What is the best Medigap insurance company? It’s a question that many seniors and individuals with pre-existing conditions are asking. Medigap insurance is a great way to help cover the costs of healthcare that Original Medicare doesn’t cover. It can be confusing to figure out which company is the best fit for your needs, but it doesn’t have to be. We’re going to break down everything you need to know to find the best Medigap insurance company for you.

First, you need to understand what Medigap insurance is and how it works. Medigap plans are supplemental insurance policies that help pay for out-of-pocket costs associated with Original Medicare. They can cover things like copayments, coinsurance, deductibles, and even some services that aren’t covered by Medicare. There are 10 different Medigap plans, each with different levels of coverage. You’ll need to decide which plan is right for you based on your individual needs and budget.

Understanding Medigap Insurance: What Is The Best Medigap Insurance Company

Medigap insurance is a supplemental insurance policy that helps cover the out-of-pocket costs associated with Medicare. It’s designed to fill the gaps in Original Medicare coverage, providing financial protection against potentially expensive medical bills.

Purpose and Benefits of Medigap Insurance

Medigap insurance is a crucial supplement to Original Medicare, offering significant benefits for seniors and individuals with pre-existing conditions. It helps minimize out-of-pocket expenses by covering copayments, coinsurance, deductibles, and other costs not covered by Original Medicare.

Overview of Medigap Plans and Their Coverage Differences

There are ten standardized Medigap plans, each with its own set of coverage benefits.

- Plan A is the most basic plan, offering the minimum required coverage. It covers most of the costs not covered by Original Medicare, including hospital coinsurance, deductibles, and 80% of the cost of skilled nursing facility care.

- Plan F, which is no longer available to new enrollees, provides the most comprehensive coverage. It covers all the costs not covered by Original Medicare, including deductibles, copayments, and coinsurance.

- Plan G is similar to Plan F, but it does not cover the Medicare Part B deductible.

- Plan K and Plan L offer a combination of coverage and cost-sharing, with higher deductibles and lower premiums than Plan F or Plan G.

Importance of Medigap Insurance for Seniors and Individuals with Pre-existing Conditions

Medigap insurance is particularly important for seniors and individuals with pre-existing conditions because it provides financial protection against potentially expensive medical bills.

- Seniors are more likely to experience health problems that require expensive medical care.

- Individuals with pre-existing conditions may have difficulty finding affordable health insurance outside of Medicare.

Factors to Consider When Choosing a Medigap Company

Choosing the right Medigap insurance company is a big decision. You want to make sure you’re getting the best coverage at the best price, but you also want to choose a company that’s financially stable and has a good reputation for customer service. There are a few key factors to consider when making your choice.

Financial Stability

It’s important to choose a Medigap insurance company that’s financially stable. This means that the company has enough money to pay its claims and is unlikely to go out of business. You can check a company’s financial stability by looking at its ratings from independent organizations like A.M. Best and Standard & Poor’s. These ratings are based on a variety of factors, including the company’s financial strength, claims-paying ability, and overall management.

Customer Service

You’ll want to choose a Medigap insurance company that has a good reputation for customer service. This means that the company should be easy to work with, responsive to your needs, and helpful in resolving any issues you may have. You can get an idea of a company’s customer service by reading reviews from other customers. You can find these reviews on websites like Consumer Reports and the Better Business Bureau.

Plan Availability

Not all Medigap insurance companies offer the same plans. Some companies may offer a wider range of plans than others. It’s important to choose a company that offers the plan that best meets your needs. You should also consider the availability of plans in your area. Some companies may not offer all of their plans in every state.

Pricing

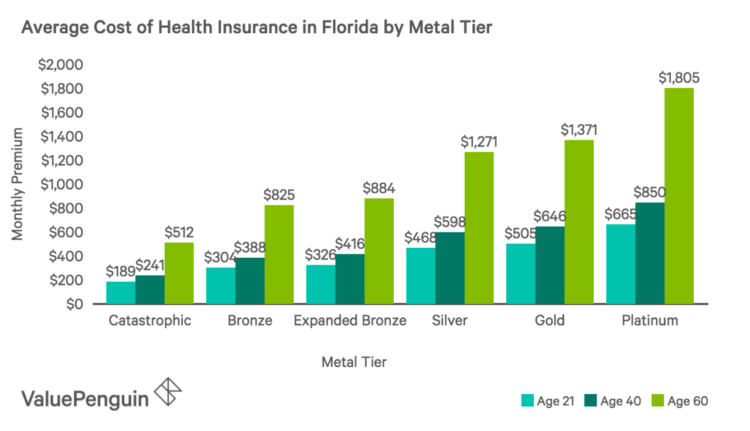

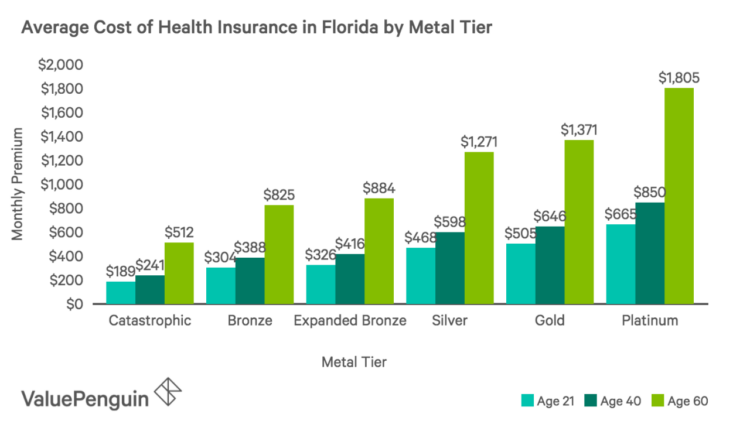

Medigap insurance premiums can vary significantly from company to company. It’s important to compare prices from several companies before making a decision. You should also consider the deductibles and copayments associated with each plan. A lower premium may mean a higher deductible or copayment, and vice versa.

Ratings and Reviews

Independent organizations, such as A.M. Best and Standard & Poor’s, provide ratings for Medigap insurance companies. These ratings reflect the company’s financial stability and overall strength. You can also find customer reviews on websites like Consumer Reports and the Better Business Bureau. These reviews can give you insights into a company’s customer service and reputation.

Comparing Medigap Plan Options

Medigap plans are standardized, meaning that each plan has the same coverage, regardless of the insurance company. However, premiums and deductibles can vary significantly. Here’s a comparison of different Medigap plan options from various companies:

| Plan | Company A | Company B | Company C |

|---|---|---|---|

| Plan F | $150/month | $175/month | $160/month |

| Plan G | $125/month | $140/month | $130/month |

| Plan N | $90/month | $105/month | $95/month |

This table shows that Company A has the lowest premiums for all three plans. However, it’s important to consider the deductibles and copayments associated with each plan before making a decision.

“It’s important to remember that the best Medigap insurance company for you will depend on your individual needs and circumstances.”

Top Medigap Insurance Companies

Finding the right Medigap insurance company can feel like navigating a maze of confusing options. But don’t worry, we’re here to help you find the perfect fit for your needs! We’ve compiled a list of top-rated Medigap insurance companies, taking into account factors like financial strength, customer satisfaction, and unique features.

Top Medigap Insurance Companies, What is the best medigap insurance company

This table showcases some of the top-rated Medigap insurance companies, including their plan options, coverage details, and average premiums. It’s important to remember that premiums can vary based on your age, location, and health status.

| Company | Plan Options | Coverage Details | Average Premium | Financial Strength | Customer Satisfaction | Unique Features |

|---|---|---|---|---|---|---|

| AARP (UnitedHealthcare) | Plans A, B, C, D, F, G, K, L, M, N | Covers a wide range of medical expenses, including hospital stays, doctor visits, and skilled nursing care. | $150-$300 per month | A+ (Superior) | 4.5 out of 5 stars | Discounts for AARP members |

| Humana | Plans A, B, C, D, F, G, K, L, M, N | Comprehensive coverage for medical expenses, including preventive care and prescription drugs. | $140-$320 per month | A+ (Superior) | 4 out of 5 stars | Wide network of healthcare providers |

| Mutual of Omaha | Plans A, B, C, D, F, G, K, L, M, N | Offers a range of plan options to suit different needs and budgets. | $130-$300 per month | A+ (Superior) | 4.2 out of 5 stars | Dedicated customer service team |

| UnitedHealthcare | Plans A, B, C, D, F, G, K, L, M, N | Large network of healthcare providers and a variety of plan options. | $160-$350 per month | A+ (Superior) | 3.8 out of 5 stars | Online tools for managing your health and benefits |

| Cigna | Plans A, B, C, D, F, G, K, L, M, N | Offers comprehensive coverage and a focus on preventive care. | $150-$330 per month | A+ (Superior) | 4.1 out of 5 stars | Telehealth services and wellness programs |

Additional Considerations

Choosing the right Medigap insurance company isn’t just about finding the cheapest plan; you need to consider your individual circumstances and how those might impact your eligibility and premiums. Here are some additional factors to think about before making your decision.

Pre-existing Conditions

Your health history plays a significant role in Medigap insurance. If you have pre-existing conditions, you might face limitations or higher premiums. It’s important to understand how pre-existing conditions affect your Medigap options.

- Eligibility: Medigap plans are generally required to cover you regardless of your health status, but they might not cover pre-existing conditions right away. There’s a waiting period, typically six months, during which pre-existing conditions may not be covered. After this waiting period, the plan will cover all your medical expenses, including those related to pre-existing conditions.

- Premiums: While you can’t be denied coverage based on pre-existing conditions, your premiums might be higher. This is because insurance companies are essentially pricing in the increased risk associated with covering pre-existing conditions. However, it’s important to note that premiums can vary significantly between companies, so it’s worth comparing quotes from multiple providers.

Open Enrollment Period

The Open Enrollment period for Medigap insurance is a critical time for those turning 65 and becoming eligible for Medicare. It’s a 6-month window during which you can enroll in any Medigap plan offered in your state, regardless of your health status. This is a crucial advantage for individuals with pre-existing conditions, as they can’t be denied coverage or charged higher premiums.

Guaranteed Issue

The concept of “Guaranteed Issue” is a significant benefit for those with pre-existing conditions. This means that during the Open Enrollment period, insurance companies are legally obligated to sell you any Medigap plan you choose, regardless of your health status. You won’t be subject to underwriting or health questions.

Ultimate Conclusion

Finding the best Medigap insurance company can seem like a daunting task, but it doesn’t have to be. By taking the time to understand your needs and compare different companies, you can find a plan that fits your budget and provides the coverage you need. Remember to consider factors like financial stability, customer service, plan availability, and pricing. Don’t be afraid to ask questions and get quotes from multiple companies. With a little research, you can find the best Medigap insurance company to protect your health and your wallet.

Commonly Asked Questions

What are the most common Medigap plans?

The most common Medigap plans are Plan F, Plan G, and Plan N. Plan F offers the most comprehensive coverage, but it’s also the most expensive. Plan G is similar to Plan F, but it doesn’t cover the Medicare Part B deductible. Plan N is a more affordable option, but it has a higher copayment for doctor visits and a deductible for emergency room visits.

What are the benefits of Medigap insurance?

Medigap insurance can help you save money on healthcare costs, protect you from unexpected medical bills, and provide peace of mind. It can also help you avoid having to pay for healthcare out of your own pocket, which can be a big financial burden for seniors and individuals with pre-existing conditions.

How much does Medigap insurance cost?

The cost of Medigap insurance varies depending on your age, health, location, and the plan you choose. You can get a quote from different companies to compare prices and find the best deal.

What are the eligibility requirements for Medigap insurance?

To be eligible for Medigap insurance, you must have Medicare Part A and Part B. You must also be a U.S. citizen or permanent resident. There are no waiting periods or health requirements to enroll in Medigap insurance.