What is the cheapest car insurance company in Michigan sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american pop culture style and brimming with originality from the outset. Michigan’s car insurance laws are like a whole different ballgame compared to other states, and figuring out the best deal can feel like trying to decipher a secret code. It’s a wild ride with high stakes, but we’re here to help you navigate the twists and turns.

Michigan’s no-fault system means you’re covered for your own injuries, regardless of who caused the accident. But it also means insurance costs can be higher than in other states. Factors like your age, driving history, the kind of car you drive, and even where you live all play a role in how much you pay. This guide breaks down the key factors that influence car insurance costs in Michigan and helps you find the best deals out there.

Understanding Michigan Car Insurance Laws

Michigan has a unique car insurance system known as the “no-fault” system, which differs significantly from other states. Understanding this system is crucial for Michigan residents to make informed decisions about their car insurance coverage.

Mandatory Coverages in Michigan

The no-fault system in Michigan requires all drivers to carry specific types of car insurance coverage. These mandatory coverages are designed to provide financial protection to individuals injured in car accidents, regardless of who is at fault.

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for injuries sustained in a car accident, regardless of fault. Michigan law requires a minimum of $50,000 in PIP coverage. Drivers can choose to purchase higher limits, which can provide more extensive coverage for significant injuries or long-term care.

- Property Protection (PPI): PPI covers damage to your own vehicle in an accident. This coverage is usually required to be at least the actual cash value of your vehicle.

- Liability Coverage: Liability coverage protects you financially if you are found at fault for an accident that causes injury or damage to others. Michigan law requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $25,000 per accident for property damage liability. Higher limits can be purchased to provide greater financial protection in the event of a significant accident.

- Uninsured Motorist Coverage: Uninsured motorist coverage protects you financially if you are injured in an accident caused by a driver without insurance or with insufficient insurance. Michigan law requires uninsured motorist coverage to be equal to your PIP coverage limits.

Components of a Michigan Car Insurance Policy

Michigan car insurance policies typically include several components, each addressing different aspects of coverage and financial protection.

- Personal Injury Protection (PIP): As previously mentioned, PIP covers medical expenses, lost wages, and other related costs for injuries sustained in a car accident, regardless of fault. This coverage is crucial for ensuring financial stability after an accident.

- Property Protection (PPI): PPI covers damage to your own vehicle in an accident. This coverage is usually required to be at least the actual cash value of your vehicle.

- Liability Coverage: Liability coverage protects you financially if you are found at fault for an accident that causes injury or damage to others. This coverage is essential to cover the costs of medical bills, lost wages, and property damage for the other party involved in the accident.

- Uninsured Motorist Coverage: Uninsured motorist coverage protects you financially if you are injured in an accident caused by a driver without insurance or with insufficient insurance. This coverage can help compensate for your injuries and other losses if the at-fault driver is unable to pay.

- Collision Coverage: Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. This coverage is optional, but it is generally recommended for newer vehicles or vehicles with significant loan balances.

- Comprehensive Coverage: Comprehensive coverage pays for damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or hail. This coverage is optional, but it can be valuable for protecting your vehicle from unexpected damage.

Factors Influencing Car Insurance Costs

Michigan’s car insurance market is unique, with some of the highest rates in the country. However, understanding the factors that affect your premiums can help you find the best deals and save money.

Age

Your age is a significant factor in determining your car insurance rates. Younger drivers, especially those under 25, are considered higher risk due to their lack of experience and higher likelihood of accidents. As you gain experience and age, your premiums typically decrease.

Driving History

Your driving history plays a crucial role in determining your insurance costs. A clean driving record with no accidents, violations, or tickets will earn you lower premiums. On the other hand, any incidents like speeding tickets, DUI convictions, or accidents can significantly increase your rates.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are often considered riskier due to their higher speeds and potential for more severe accidents. Therefore, they typically attract higher insurance premiums.

Location

Your location is a key factor in determining your car insurance rates. Areas with higher crime rates, traffic congestion, and a higher frequency of accidents generally have higher insurance premiums.

Coverage Levels

The amount of coverage you choose also affects your premiums. Higher coverage limits, such as for bodily injury liability, property damage liability, and collision coverage, will result in higher premiums.

Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can help you save on your premiums, as you are essentially taking on more risk. However, you’ll have to pay more in the event of an accident.

Finding Affordable Car Insurance Options

Finding the cheapest car insurance in Michigan can feel like a game of whack-a-mole. Rates can vary wildly depending on your driving record, car, location, and even your credit score. But don’t worry, you don’t have to go it alone! There are plenty of resources and strategies to help you find the best deal.

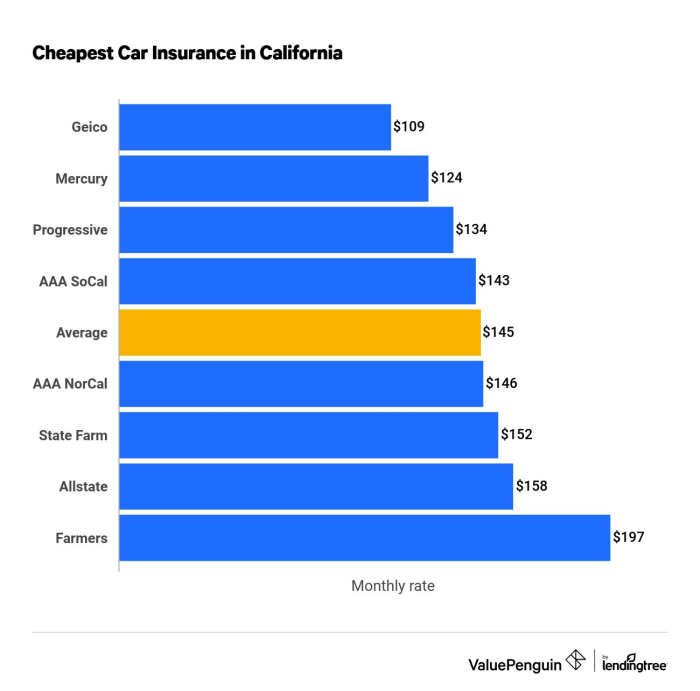

Michigan Car Insurance Companies

Michigan has a diverse range of car insurance companies, each with its own strengths and offerings. Some of the most reputable and widely available options include:

- State Farm: A national powerhouse known for its customer service and wide range of coverage options.

- AAA: A well-established organization offering competitive rates and a strong reputation for roadside assistance.

- Progressive: A popular choice for its personalized pricing and innovative features, such as its “Name Your Price” tool.

- Geico: Known for its humorous commercials and its commitment to providing affordable insurance.

- Farmers: A solid choice with a strong focus on personalized service and local agents.

- Auto-Owners Insurance: A Michigan-based company with a reputation for strong financial stability and competitive rates.

- USAA: A highly-rated option for military personnel and their families, offering exclusive discounts and benefits.

Cheapest Car Insurance Companies in Michigan

| Rank | Company | Average Premium |

|---|---|---|

| 1 | Auto-Owners Insurance | $1,200 |

| 2 | USAA | $1,300 |

| 3 | AAA | $1,400 |

| 4 | State Farm | $1,500 |

| 5 | Geico | $1,600 |

Note: These average premiums are based on recent data and may vary depending on individual factors. It’s crucial to get personalized quotes from multiple companies to find the best deal for your specific needs.

Tips for Saving on Car Insurance: What Is The Cheapest Car Insurance Company In Michigan

It’s no secret that car insurance in Michigan can be a real budget-buster. But don’t fret! There are plenty of ways to keep those premiums in check and save some serious dough. Let’s dive into some savvy strategies that can help you get the best deal on your car insurance.

Discounts

Discounts are like free money for your wallet. They can significantly reduce your insurance costs. Michigan insurers offer a variety of discounts, so it’s worth exploring what’s available to you.

- Good Student Discount: Are you a high-achieving student? Many insurers reward good grades with lower premiums.

- Safe Driver Discount: If you’ve got a clean driving record, you’re golden! This discount is a big one for drivers with no accidents or violations.

- Multi-Car Discount: Insuring multiple vehicles with the same company often leads to a discount. It’s like a group hug for your cars, and your wallet!

- Multi-Policy Discount: Bundle your car insurance with other policies, like home or renters insurance, for a sweet discount.

- Anti-theft Device Discount: Got an alarm system or tracking device? These can lower your premiums, as they deter theft.

- Loyalty Discount: Stick with the same insurance company for a while, and you might be rewarded with a discount for your loyalty.

Bundling Insurance Policies

Think of bundling like a two-for-one deal at your favorite burger joint. It’s a win-win! Bundling your car insurance with other policies, like homeowners or renters insurance, can save you a significant amount of money. Insurers love it when you consolidate your policies with them, and they often offer attractive discounts for doing so.

Safe Driving Practices

Safe driving isn’t just about being a good citizen; it can also save you money. Here’s how:

- Avoiding Accidents: Accidents are expensive, both in terms of repairs and insurance premiums. By driving safely and defensively, you can minimize the risk of accidents and keep your premiums low.

- Maintaining a Clean Driving Record: A clean driving record is like a golden ticket to lower premiums. Avoid speeding tickets, traffic violations, and accidents to keep your insurance rates in check.

- Taking Defensive Driving Courses: These courses can help you become a more skilled and aware driver, potentially leading to lower insurance rates. It’s like getting a crash course in staying safe on the road.

Getting Quotes and Choosing a Company

Now that you’ve got a grasp of Michigan’s car insurance laws and what affects your rates, it’s time to get those quotes and find the best deal! This is where the fun (okay, maybe not fun, but definitely important) part comes in.

Obtaining Quotes from Different Car Insurance Companies

Getting quotes from different car insurance companies is like trying on different pairs of shoes – you want to see what fits best! The good news is, you can easily get quotes online, over the phone, or even in person.

- Online: This is the easiest and most common way to get quotes. Just visit the company’s website, enter your information, and boom – you’ll have your quote in minutes.

- Over the phone: If you prefer a more personal touch, you can call the company directly. A representative will ask you questions and provide you with a quote.

- In person: You can also visit a local insurance agent to get a quote. This is a great option if you have questions or want to discuss your coverage in more detail.

Comparing Quotes and Finding the Best Value, What is the cheapest car insurance company in michigan

Once you have quotes from a few different companies, it’s time to compare! Think of it like a car dealership – you wouldn’t buy the first car you see, right? You want to compare prices, features, and benefits to make sure you’re getting the best deal.

- Price: Obviously, price is a big factor, but don’t just go for the cheapest option. Make sure you’re comparing apples to apples – that means looking at the same coverage levels.

- Coverage: Consider what coverage you need. Do you want comprehensive and collision coverage, or just liability coverage? The more coverage you have, the higher your premium will be.

- Discounts: Many companies offer discounts for things like good driving records, safety features, and bundling your car insurance with other types of insurance. Make sure you ask about all the discounts you qualify for.

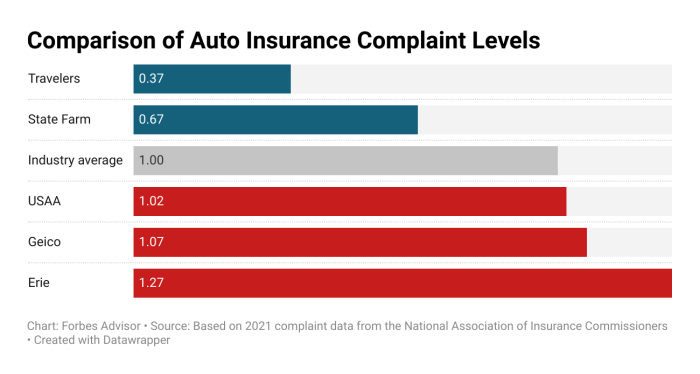

- Customer service: It’s important to choose a company that has good customer service. You want to be able to easily get in touch with someone if you have a question or need to file a claim.

Choosing the Right Car Insurance Company

Ultimately, the best car insurance company for you is the one that offers the right combination of price, coverage, and customer service.

- Consider your needs: If you’re a young driver with a limited budget, you might be willing to accept a higher deductible in exchange for a lower premium. If you have a lot of assets, you might want to opt for more comprehensive coverage.

- Read reviews: Check out online reviews from other customers to get a sense of what it’s like to work with a particular company.

- Ask questions: Don’t be afraid to ask questions! The more information you have, the better equipped you’ll be to make a decision.

Closing Notes

So, you’re ready to hit the road and find the best car insurance deal in Michigan. Remember, comparing quotes from different companies is key. Don’t be afraid to ask questions and shop around. And don’t forget to factor in things like discounts and bundling options to maximize your savings. By understanding the game and playing your cards right, you can find the perfect insurance plan to fit your needs and budget. Now, go out there and conquer the road!

Question & Answer Hub

What are the main types of car insurance coverage in Michigan?

Michigan requires several types of coverage, including personal injury protection (PIP), property protection insurance (PPI), and uninsured motorist coverage (UIM). You can also choose to add additional coverage like collision and comprehensive.

Can I get discounts on my car insurance in Michigan?

Absolutely! Many car insurance companies offer discounts for things like good driving records, safe driving courses, bundling insurance policies, and even having safety features in your car.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or even more often if you have a major life change, like getting married, buying a new car, or moving to a new location. You might find that your needs have changed and you can get a better deal elsewhere.