What is the cheapest car insurance in Florida? Finding affordable car insurance in the Sunshine State can be a challenge, especially considering the unique factors that influence pricing. From Florida’s no-fault system to the impact of driving history and vehicle type, numerous variables contribute to the cost of car insurance. This guide delves into the intricacies of car insurance in Florida, providing valuable insights and practical tips to help you find the most cost-effective coverage for your needs.

Understanding the factors that affect insurance premiums is crucial. Driving history, age, vehicle type, location, and coverage levels all play a significant role. Florida’s no-fault system, which requires drivers to carry Personal Injury Protection (PIP) coverage, also influences pricing. Understanding these dynamics empowers you to make informed decisions and negotiate favorable rates.

Factors Affecting Car Insurance Costs in Florida

Several factors influence the cost of car insurance in Florida, including your driving history, age, the type of vehicle you drive, where you live, and the coverage levels you choose. Florida’s unique laws and regulations also play a significant role in shaping car insurance premiums.

Driving History, What is the cheapest car insurance in florida

Your driving history is a major factor in determining your car insurance premiums. Insurance companies use your driving record to assess your risk of getting into an accident.

- Accidents: Having a history of accidents, especially at-fault accidents, will increase your premiums. The number and severity of accidents are considered.

- Traffic Violations: Receiving traffic tickets, such as speeding tickets or driving under the influence (DUI), can also raise your premiums. The more serious the violation, the higher the impact on your rates.

- Driving Record Cleanliness: Maintaining a clean driving record with no accidents or violations will significantly reduce your insurance costs.

Age

Your age is another factor that insurance companies consider when calculating your premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents.

- Young Drivers: Insurance companies may charge higher premiums for young drivers due to their lack of experience and higher risk profile.

- Mature Drivers: Older drivers, typically those over 65, may also see higher premiums due to factors like declining eyesight or slower reaction times. However, some insurers offer discounts for older drivers with good driving records.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums.

- High-Performance Vehicles: Sports cars and luxury vehicles are more expensive to repair and replace, making them more costly to insure.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts due to their reduced risk of accidents and injuries.

- Vehicle Age: Older vehicles may be less expensive to insure due to their lower value and potential for depreciation. However, older vehicles may not have modern safety features, potentially increasing your risk and premiums.

Location

Your location in Florida plays a role in your insurance rates.

- Urban Areas: Car insurance rates tend to be higher in urban areas due to increased traffic congestion, higher crime rates, and a greater likelihood of accidents.

- Rural Areas: Insurance rates in rural areas are generally lower due to lower traffic density and fewer potential risks.

Coverage Levels

The level of coverage you choose significantly impacts your insurance premiums.

- Liability Coverage: Liability coverage pays for damages to other people’s property or injuries caused by an accident you are at fault for. Higher liability limits mean higher premiums.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if it is involved in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage from non-accident events like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Florida law requires all drivers to have PIP coverage, which pays for medical expenses and lost wages in the event of an accident, regardless of fault.

Florida’s No-Fault System

Florida operates under a no-fault insurance system. This means that if you are involved in an accident, your own insurance company will cover your medical expenses and lost wages, regardless of who is at fault. This system aims to reduce the number of lawsuits related to car accidents. However, it can also lead to higher insurance premiums, as drivers are responsible for paying for their own injuries and damages.

Impact of Florida’s Laws and Regulations

Florida’s no-fault system and the requirement for PIP coverage are major factors influencing car insurance premiums. These regulations can lead to higher costs, especially for drivers with high medical expenses or those who frequently use their insurance benefits.

- PIP Coverage: Florida’s PIP coverage is often considered expensive, especially for drivers who choose higher coverage limits. This is because PIP benefits are not capped and can be used for a wide range of medical expenses.

- No-Fault System: While the no-fault system aims to reduce lawsuits, it can also lead to higher insurance premiums due to the increased cost of covering medical expenses and lost wages.

Demographics and Insurance Pricing

Certain demographics, such as young drivers and those with poor credit scores, are often impacted by higher insurance premiums.

- Young Drivers: Young drivers, especially those under 25, are considered higher risk due to their lack of experience and higher likelihood of accidents. This leads to higher premiums for young drivers.

- Credit Score: Insurance companies may use your credit score to assess your risk profile. Drivers with poor credit scores may be charged higher premiums because they are considered more likely to file claims.

Types of Car Insurance Coverage in Florida: What Is The Cheapest Car Insurance In Florida

Understanding the different types of car insurance coverage available in Florida is crucial for drivers to make informed decisions about their insurance needs and ensure they have adequate protection in case of an accident. Florida law mandates certain minimum coverage requirements, and drivers can choose to purchase additional coverage based on their individual circumstances and risk tolerance.

Florida’s Minimum Coverage Requirements

Florida law requires all drivers to carry a minimum amount of liability insurance, which covers damages to other people and their property in case of an accident. This minimum coverage is known as the “Financial Responsibility Law” and includes:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault. It has a limit of $10,000 per person and $20,000 per accident.

- Property Damage Liability (PDL): This coverage pays for damages to other people’s property, such as their vehicles, in case of an accident. The minimum required coverage is $10,000.

While these minimum requirements are mandatory, they may not be enough to cover all potential expenses in a serious accident. It’s essential to consider your individual needs and choose coverage that provides adequate protection.

Liability Insurance

Liability insurance protects you financially if you cause an accident that results in injuries or property damage to others. It covers:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and other damages to people injured in an accident caused by you.

- Property Damage Liability: Pays for damages to other people’s property, such as their vehicles, in case of an accident caused by you.

The amount of liability coverage you choose determines the maximum amount your insurance company will pay for damages. It’s crucial to choose coverage that meets your individual needs and financial responsibilities.

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, minus any deductible you choose.

- This coverage is optional in Florida, but it can be beneficial if you have a newer car or a car loan.

- If you choose not to have collision coverage, you will be responsible for paying for any repairs or replacement costs yourself.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses if your vehicle is damaged by something other than an accident, such as theft, vandalism, fire, or natural disasters. It covers the cost of repairs or replacement of your vehicle, minus any deductible you choose.

- This coverage is also optional in Florida, but it can be beneficial if you have a newer car or a car loan.

- If you choose not to have comprehensive coverage, you will be responsible for paying for any repairs or replacement costs yourself.

Personal Injury Protection (PIP)

PIP coverage, as mentioned earlier, is mandatory in Florida and pays for medical expenses and lost wages for you and your passengers, regardless of fault. It has a limit of $10,000 per person and $20,000 per accident.

- PIP coverage is a valuable benefit, as it helps cover your medical expenses even if you are at fault in an accident.

- You can choose to reduce your PIP coverage to $5,000 per person, but this is not recommended unless you have other health insurance that covers medical expenses.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers damages to you and your vehicle, as well as medical expenses and lost wages.

- This coverage is optional in Florida, but it is highly recommended.

- It can help protect you from significant financial losses if you are involved in an accident with a driver who does not have adequate insurance.

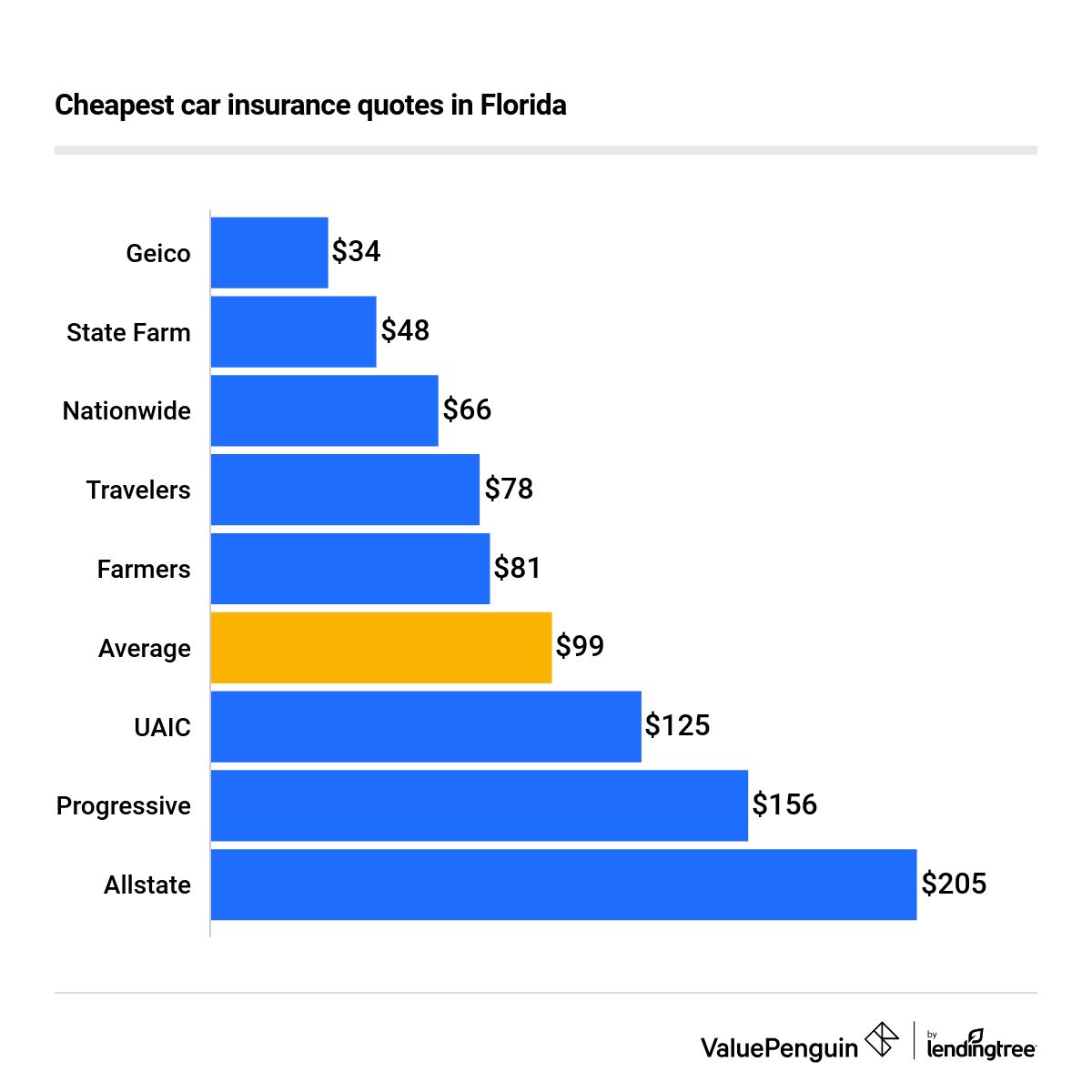

Finding the Cheapest Car Insurance in Florida

Finding the most affordable car insurance in Florida involves a comprehensive approach, encompassing multiple steps and strategies. By meticulously comparing quotes, exploring discounts, and negotiating rates, you can significantly reduce your insurance premiums.

Comparing Quotes from Multiple Insurers

Obtaining quotes from various insurance companies is crucial to identify the most competitive rates. This process allows you to compare coverage options, premiums, and deductibles across different providers.

- Utilize online comparison websites: Websites like Insurance.com, Policygenius, and The Zebra provide a convenient platform for comparing quotes from multiple insurers simultaneously.

- Contact insurance companies directly: Reach out to insurance companies directly to request personalized quotes based on your specific needs and vehicle details.

- Consider local and regional insurers: Explore smaller regional insurers that may offer competitive rates tailored to the Florida market.

Exploring Available Discounts

Insurance companies offer various discounts to reduce premiums. By taking advantage of these discounts, you can significantly lower your insurance costs.

- Good driving record: Maintaining a clean driving record with no accidents or traffic violations can earn you substantial discounts.

- Safe driving courses: Completing defensive driving courses can demonstrate your commitment to safe driving practices, leading to reduced premiums.

- Bundling policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

- Vehicle safety features: Cars equipped with anti-theft devices, airbags, and other safety features often qualify for discounts.

- Payment frequency: Opting for annual or semi-annual payments instead of monthly installments can sometimes lead to lower premiums.

Negotiating Insurance Premiums

Once you have identified a few competitive quotes, you can negotiate with insurers to potentially secure even lower rates.

- Highlight your positive driving history: Emphasize your clean driving record and any relevant safe driving certifications or courses.

- Inquire about additional discounts: Explore all available discounts, including those related to your profession, membership organizations, or vehicle usage.

- Consider increasing your deductible: Raising your deductible can lower your monthly premiums, but ensure you can afford the higher out-of-pocket expense in case of an accident.

- Shop around periodically: It’s advisable to re-evaluate your insurance coverage and compare quotes from other insurers at least once a year to ensure you’re getting the best possible rates.

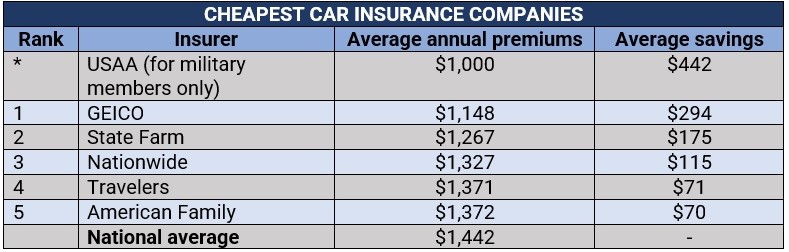

Reputable Insurance Companies in Florida

- National Providers:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Regional Providers:

- Florida Peninsula Insurance Company

- Southern Fidelity Insurance Company

- United Property & Casualty Insurance Company

- First Protective Insurance Company

- Auto-Owners Insurance

Tips for Saving on Car Insurance in Florida

Lowering your car insurance costs in Florida can be achieved through various strategies, including bundling policies, improving driving habits, and taking advantage of discounts offered by insurance companies.

Bundling Policies

Bundling your car insurance with other types of insurance, such as homeowners, renters, or life insurance, can lead to significant savings. Insurance companies often offer discounts for bundling multiple policies together, as it simplifies their administrative processes and reduces the risk associated with insuring multiple assets for a single customer.

Improving Driving Habits

Maintaining a clean driving record is crucial for lowering your car insurance premiums. Avoiding accidents, traffic violations, and speeding tickets can significantly impact your insurance rates. Insurance companies consider your driving history a key indicator of your risk profile.

Discounts Offered by Insurance Companies

Insurance companies in Florida offer various discounts to their policyholders. These discounts can significantly reduce your premiums, making it essential to explore all available options.

Types of Discounts

| Discount Type | Description |

|---|---|

| Safe Driver Discount | This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits. |

| Good Student Discount | This discount is available to students who maintain a high GPA or excellent academic standing. |

| Multi-Car Discount | Insurance companies offer this discount when you insure multiple vehicles under the same policy. |

| Anti-theft Device Discount | Installing anti-theft devices, such as alarm systems or GPS trackers, can qualify you for this discount, as it reduces the risk of vehicle theft. |

| Defensive Driving Course Discount | Completing a defensive driving course can lower your premiums, demonstrating your commitment to safe driving practices. |

Impact of Safety Features and Anti-theft Devices

Modern vehicles are equipped with advanced safety features that can significantly reduce the severity of accidents and lower insurance premiums. Features like anti-lock brakes (ABS), electronic stability control (ESC), and airbags are highly valued by insurance companies. Similarly, installing anti-theft devices can deter theft and reduce the risk of claims, leading to lower premiums.

“Installing safety features and anti-theft devices can make a significant difference in your car insurance premiums. Insurance companies recognize the value of these features in reducing accidents and theft, leading to lower risk profiles for policyholders.”

Understanding Florida’s No-Fault System

Florida’s no-fault insurance system is a unique approach to handling car accidents, designed to streamline the claims process and reduce litigation. Unlike traditional fault-based systems, where drivers must prove fault to receive compensation, Florida’s no-fault system requires drivers to file claims with their own insurance companies, regardless of who caused the accident. This system has significant implications for car insurance claims and coverage in Florida.

The No-Fault System’s Impact on Claims and Coverage

Under Florida’s no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages for the policyholder and passengers in their vehicle, regardless of fault. This means that even if you are involved in an accident where you are not at fault, you will still file a claim with your own insurance company for your medical expenses and lost wages. This can expedite the claims process and ensure you receive compensation for your injuries more quickly.

Filing a Claim Under the No-Fault System

The process of filing a claim under Florida’s no-fault system is relatively straightforward. If you are involved in an accident, you should:

- Contact your insurance company as soon as possible to report the accident.

- Seek medical attention if necessary.

- Provide your insurance company with the necessary documentation, such as police reports and medical bills.

Your insurance company will then review your claim and process your benefits according to your PIP coverage.

Limitations and Complexities of Florida’s No-Fault System

While Florida’s no-fault system aims to simplify the claims process, it does have some limitations and complexities:

- Limited PIP Coverage: Florida’s PIP coverage is capped at $10,000 per person, which may not be sufficient to cover all medical expenses and lost wages in serious accidents.

- Threshold for Fault-Based Claims: If your injuries exceed the “threshold” of $10,000 in medical expenses or permanent injuries, you may be able to file a fault-based claim against the other driver’s insurance company. However, this process can be more complex and time-consuming.

- Limited Coverage for Non-Economic Damages: Florida’s no-fault system generally does not cover non-economic damages, such as pain and suffering, unless the threshold for fault-based claims is met.

Final Review

Navigating the complexities of Florida’s car insurance market requires a comprehensive understanding of the factors that impact pricing. By taking a proactive approach, exploring available coverage options, and leveraging strategies for cost reduction, you can secure affordable and reliable car insurance that meets your specific needs. Remember, it’s not just about finding the cheapest policy; it’s about finding the best value for your money, ensuring adequate coverage while minimizing your out-of-pocket expenses.

FAQ Resource

What is the average cost of car insurance in Florida?

The average cost of car insurance in Florida varies depending on several factors, but it’s generally higher than the national average. You can expect to pay around $2,000-$2,500 per year for full coverage.

Can I get a discount on my car insurance in Florida?

Yes, many insurance companies offer discounts for good driving records, safe driving courses, bundling policies, and other factors. Be sure to ask your insurer about available discounts.

What is the minimum car insurance coverage required in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident. However, it’s recommended to have higher limits for better protection.