What is the cheapest insurance company – What’s the cheapest insurance company? That’s a question that’s on everyone’s mind, especially when budgets are tight. But finding the cheapest option isn’t always as simple as it seems. There are a bunch of factors that can influence insurance costs, and choosing the absolute cheapest option might not always be the smartest move. It’s like trying to find the cheapest pair of sneakers – you might get a deal, but they might not be the best fit for your needs or last as long as you want.

So, let’s dive into the world of insurance costs and see what factors really matter. We’ll explore the key things insurance companies consider when setting prices, and we’ll give you some tips on how to find affordable options without sacrificing the protection you need. We’ll also talk about some common misconceptions about insurance costs and show you how to avoid getting ripped off.

Understanding “Cheapest” Insurance

You might be tempted to go for the cheapest insurance option, but hold your horses! It’s not always as simple as picking the lowest price tag. There’s a whole lot more to consider than just the initial premium.

Factors Influencing Insurance Costs

The price you pay for insurance is determined by a bunch of factors. Think of it like a personalized price tag based on your unique situation. Here’s a breakdown:

- Your Driving Record: If you’ve got a clean slate, you’ll likely get a better deal. But if you’ve got a few speeding tickets or accidents under your belt, expect to pay more.

- Your Age and Gender: Insurance companies use statistics to figure out how risky different groups are. Young drivers are often seen as higher risk, so they tend to pay more.

- Your Location: Where you live plays a role. Cities with more traffic or higher crime rates can mean higher insurance costs.

- Your Vehicle: A fancy sports car will cost more to insure than a beat-up old truck. It’s all about the value of your vehicle and the potential cost of repairs.

- Your Coverage: The more coverage you want, the more you’ll pay. Think about how much protection you really need and don’t overpay for unnecessary coverage.

- Your Credit Score: Yep, your credit score can even affect your insurance rates! A good credit score can help you get a lower premium.

Potential Trade-offs

Choosing the cheapest option might seem like a no-brainer, but it could come with some drawbacks.

- Lower Coverage: The cheapest policies often have lower coverage limits. This means you might be left footing the bill for significant repairs or losses if something happens.

- Higher Deductibles: To keep premiums low, some companies offer high deductibles. This means you’ll have to pay more out of pocket if you need to file a claim.

- Limited Customer Service: Cheaper insurance companies may not offer the same level of customer service or have as many resources available to help you in case of an issue.

Common Insurance Misconceptions

Here are a few common misconceptions about insurance costs:

- “I’m a good driver, so I should get the cheapest policy.” While good driving habits are important, other factors can also affect your rates. Don’t assume the cheapest policy is the best fit just because you think you’re a safe driver.

- “My insurance is too expensive, so I’ll just cancel it.” This is a risky move. You could face serious financial consequences if you’re in an accident without insurance. It’s better to shop around and find a policy that fits your needs and budget.

- “I’ll just get the minimum coverage required by law.” While minimum coverage is better than nothing, it might not be enough to protect you in a serious accident. Consider getting more coverage to ensure you’re fully protected.

Key Factors in Determining Cost

Insurance companies use a variety of factors to determine your premium, which is the amount you pay for your insurance policy. These factors are designed to assess your risk, meaning how likely you are to file a claim. The higher your risk, the higher your premium.

Auto Insurance

Auto insurance premiums are based on several factors, including your driving history, the type of car you drive, your location, and your age.

- Driving History: Your driving history is a major factor in determining your auto insurance premium. If you have a history of accidents or traffic violations, you’ll likely pay more for insurance.

- Type of Car: The type of car you drive also impacts your premium. Sports cars and luxury vehicles are often more expensive to insure because they are more expensive to repair and replace.

- Location: Your location can also affect your auto insurance premium. Cities with higher rates of car theft or accidents may have higher premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, so they often pay higher premiums. However, once you reach a certain age, your premium may decrease because you’re considered a more experienced driver.

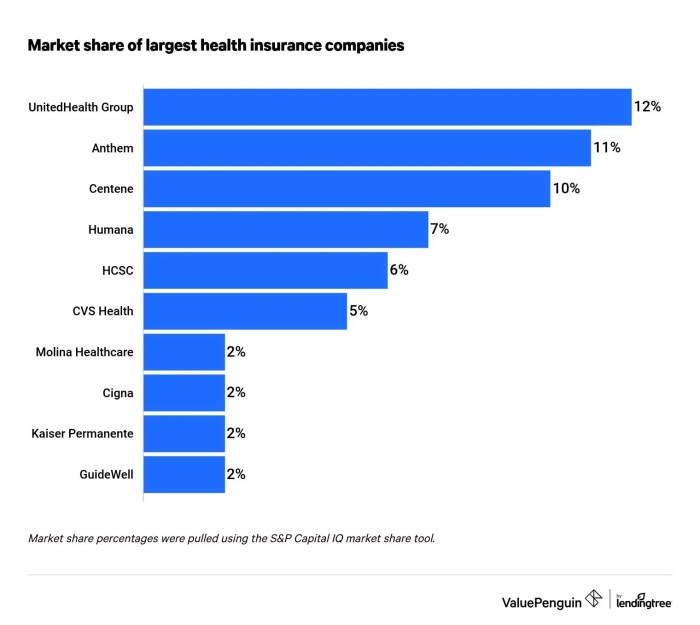

Health Insurance

Health insurance premiums are determined by a variety of factors, including your age, health status, location, and the type of plan you choose.

- Age: Older individuals typically pay higher premiums for health insurance because they tend to have higher healthcare costs.

- Health Status: If you have pre-existing health conditions, you may pay a higher premium for health insurance.

- Location: The cost of healthcare varies from region to region, so your location can affect your health insurance premium.

- Type of Plan: The type of health insurance plan you choose can also affect your premium. Plans with lower deductibles and copayments typically have higher premiums.

Homeowners Insurance

Homeowners insurance premiums are determined by factors like the value of your home, the location, and the coverage you choose.

- Value of Home: The value of your home is a major factor in determining your homeowners insurance premium. The more expensive your home, the more it will cost to insure.

- Location: Your location can also affect your homeowners insurance premium. Areas with higher rates of crime or natural disasters may have higher premiums.

- Coverage: The amount of coverage you choose for your homeowners insurance will also affect your premium. More comprehensive coverage will typically result in a higher premium.

Finding Affordable Insurance Options

Finding the cheapest insurance rates can feel like a wild goose chase, but don’t worry, we’ve got you covered! There are tools and resources available to help you navigate the insurance jungle and find the best deals.

Reputable Insurance Comparison Websites

These websites act like your personal insurance shoppers, comparing quotes from multiple companies so you don’t have to. They save you time and effort, making finding affordable options a breeze.

- NerdWallet: This site is known for its user-friendly interface and detailed breakdowns of insurance plans. They also provide helpful articles and guides on insurance topics.

- Policygenius: This website boasts a streamlined process for comparing quotes and provides personalized recommendations based on your needs.

- Insurify: This platform offers a wide range of insurance options, including car, home, and renters insurance. They also have a feature that allows you to compare your current policy to see if you can save money.

- The Zebra: This website is known for its comprehensive coverage and detailed information about each insurance company.

- Compare.com: This platform offers a wide range of insurance options, including car, home, and health insurance. They also have a feature that allows you to compare your current policy to see if you can save money.

Step-by-Step Guide for Using Comparison Websites

Using these websites is as easy as ordering pizza online. Just follow these simple steps:

- Enter your information: Start by providing basic information like your age, location, driving history, and the type of insurance you’re looking for.

- Compare quotes: The website will generate a list of quotes from different insurance companies based on your information.

- Review the details: Carefully review the quotes, including coverage details, deductibles, and premiums.

- Choose the best option: Select the policy that offers the best combination of coverage and price.

- Contact the insurance company: Once you’ve chosen a policy, contact the insurance company directly to finalize the purchase.

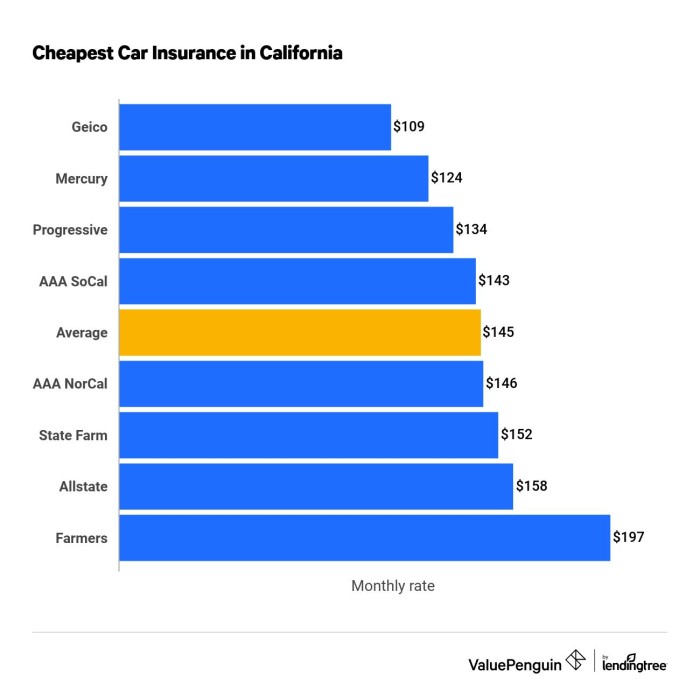

Top 5 Insurance Companies Known for Affordable Premiums

Remember, prices can vary depending on your individual circumstances, but these companies are generally known for offering competitive rates.

| Company | Type of Insurance | Known For |

|---|---|---|

| Geico | Car, Home, Renters | Low premiums, easy-to-use website and mobile app |

| USAA | Car, Home, Renters | Excellent customer service, discounts for military members |

| State Farm | Car, Home, Renters, Life | Wide range of coverage options, strong reputation for customer service |

| Progressive | Car, Home, Renters, Life | Innovative features, like “Name Your Price” tool, and discounts |

| Liberty Mutual | Car, Home, Renters, Life | Competitive rates, strong financial stability |

Considerations Beyond Price

You’ve probably heard the saying, “You get what you pay for.” This is especially true when it comes to insurance. While the cheapest option might seem tempting, it’s crucial to consider the bigger picture and understand the potential consequences of choosing solely based on price.

The Importance of Coverage, What is the cheapest insurance company

Insurance is designed to protect you from financial hardship in the event of an unexpected event. It acts as a safety net, helping you manage the costs associated with accidents, illnesses, or disasters. When you choose an insurance policy, you’re essentially making a contract with the insurance company, agreeing to pay premiums in exchange for their promise to cover specific risks.

Choosing the cheapest option might mean you’re sacrificing crucial coverage. This could leave you vulnerable and financially exposed if an unforeseen event occurs.

Risks Associated with Choosing the Cheapest Option

Choosing the cheapest insurance policy without carefully evaluating your needs and potential risks can lead to several negative consequences.

- Insufficient Coverage: The cheapest policy might have lower coverage limits, leaving you responsible for a significant portion of the costs in case of a claim. For example, a cheap car insurance policy might have a low liability limit, which could leave you personally liable for damages exceeding that limit in an accident.

- High Deductibles: Lower premiums often come with higher deductibles, meaning you’ll need to pay more out-of-pocket before your insurance kicks in. A high deductible can be a significant financial burden, especially if you experience multiple claims.

- Limited Benefits: Cheaper policies may offer fewer benefits or have restrictive exclusions. For instance, a cheap health insurance plan might not cover certain medical procedures or medications.

- Financial Strain: If you choose the cheapest option and end up facing a large, uncovered expense, you could be left financially strained. This can lead to debt, stress, and even bankruptcy in extreme cases.

- Lack of Support: Cheaper insurance companies may have limited customer service or a less responsive claims process. This could make it challenging to get the help you need when you need it most.

Real-World Examples

Let’s consider a few real-world examples to illustrate the potential pitfalls of choosing the cheapest insurance option:

- Sarah’s Car Accident: Sarah chose the cheapest car insurance policy, only to find out later that it had a low liability limit. After getting into an accident, she was held responsible for damages exceeding her policy’s limit, leaving her with a substantial debt.

- John’s Medical Emergency: John opted for the cheapest health insurance plan, thinking it would save him money. However, when he needed emergency surgery, he discovered that his plan didn’t cover the procedure, leaving him with a massive medical bill.

- Mary’s Home Fire: Mary saved money by choosing the cheapest homeowners insurance policy. However, when a fire destroyed her home, she realized her policy had a low coverage limit, leaving her with significant financial losses.

Strategies for Reducing Insurance Costs

You’ve got your insurance needs covered, but now it’s time to get those premiums down! Just like a pro-level gamer mastering a new level, you can learn the moves to save some serious cash on your insurance. Let’s break down the strategies and show you how to become a budget-savvy insurance ninja.

Bundling Policies

Bundling your insurance policies, like your home and auto, can be a game-changer for your wallet. Insurance companies often offer discounts for having multiple policies with them, so you can save big by combining your coverage. Imagine getting a sweet discount on your car insurance just for having your home insurance with the same company!

Improving Credit Score

You might be thinking, “Wait, my credit score impacts my insurance?,” but it’s true! Insurance companies often use your credit score as a measure of risk, so a higher credit score can translate to lower premiums. It’s like having a good credit score unlocks secret levels of savings!

Shop Around

Just like you wouldn’t buy the first pair of sneakers you see, don’t settle for the first insurance quote. Get quotes from multiple insurance companies to compare prices and find the best deal. You might be surprised by the savings you can uncover by doing a little comparison shopping.

Negotiating with Your Insurance Company

Don’t be afraid to negotiate with your insurance company! They might be willing to offer you a better rate if you’re a loyal customer or have a good driving record. It’s like haggling at a flea market, but instead of getting a cool vintage record, you’re getting lower insurance premiums!

Taking Defensive Driving Courses

Want to show your insurance company you’re a safe driver? Take a defensive driving course! Not only will you learn valuable driving skills, but you can also qualify for discounts on your car insurance. It’s a win-win!

Increasing Deductibles

Raising your deductible, the amount you pay out of pocket before insurance kicks in, can lower your premiums. It’s like investing in yourself! You’re taking on a little more risk, but it can save you money in the long run.

Maintaining a Good Driving Record

Driving safely and avoiding accidents is key to keeping your insurance costs low. Insurance companies reward good drivers with lower premiums, so keep those driving skills sharp!

Paying Your Premiums on Time

Paying your premiums on time is crucial for maintaining a good insurance record. Just like paying your rent on time keeps you in your apartment, paying your insurance premiums on time keeps you covered and can even qualify you for discounts!

Making Your Home Safer

For homeowners insurance, making your home safer can lower your premiums. This might involve installing security systems, smoke detectors, or fire sprinklers. It’s like giving your home a safety makeover!

Keeping Your Car Well-Maintained

For car insurance, keeping your car in good shape can also help reduce your premiums. Regularly servicing your car and making sure it’s safe to drive can make a difference. It’s like giving your car a spa day!

Taking Advantage of Discounts

Many insurance companies offer discounts for things like being a good student, having a good driving record, or belonging to certain organizations. Take advantage of these discounts to save even more on your insurance. It’s like unlocking secret codes for savings!

Conclusion

Finding the cheapest insurance company isn’t just about hunting for the lowest price. It’s about finding the right balance between affordability and coverage. You want to make sure you’re getting the protection you need without breaking the bank. By understanding the factors that influence insurance costs, comparing different options, and taking advantage of strategies to reduce your premiums, you can find an insurance plan that fits your budget and your needs. Remember, insurance is like a safety net – you don’t want to find out it’s not strong enough when you need it most.

Query Resolution: What Is The Cheapest Insurance Company

What’s the best way to find cheap car insurance?

Use online comparison websites, get multiple quotes, and consider factors like your driving record and car model.

Do credit scores affect insurance premiums?

Yes, in many cases, a higher credit score can lead to lower insurance premiums.

Is it better to bundle my car and home insurance?

Bundling policies with the same insurer can often lead to discounts.

What’s the difference between a deductible and a premium?

A deductible is the amount you pay out of pocket before your insurance kicks in, while a premium is the regular payment you make for your insurance policy.