What is the largest insurance company in the world? It’s a question that sparks curiosity about the financial giants shaping our global economy. The answer, however, isn’t as simple as it seems. There are different ways to measure size, and depending on the metric you use, the “largest” insurance company could be a different player altogether.

From market capitalization to total assets and premium revenue, the insurance industry boasts a diverse landscape of behemoths. This exploration dives into the world of global insurance giants, analyzing their dominance, impact, and future prospects.

Defining “Largest”

When trying to determine the “largest” insurance company, it’s crucial to understand that there’s no single, universally accepted definition. Different metrics can paint different pictures of a company’s size and influence within the industry.

Market Capitalization

Market capitalization represents the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the current share price by the number of outstanding shares. A company with a high market capitalization is generally considered to be large and influential. However, market capitalization can fluctuate significantly based on market conditions and investor sentiment.

Total Assets

Total assets represent the sum of all assets owned by a company, including cash, investments, property, and equipment. Companies with large total assets are often considered financially stable and well-positioned to weather economic downturns. This metric provides a good picture of a company’s overall financial strength.

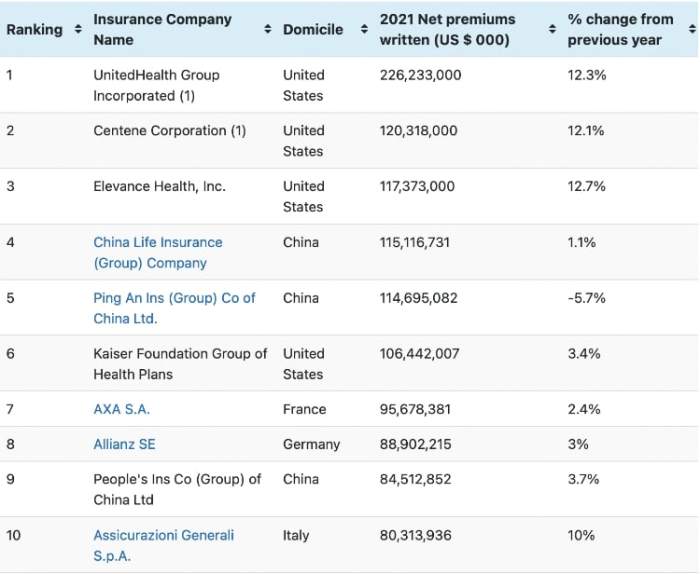

Premium Revenue

Premium revenue is the total amount of money a company receives from its policyholders in the form of premiums. A company with high premium revenue is likely to be writing a significant amount of insurance policies and is generating a substantial amount of income. This metric reflects a company’s direct impact on the insurance market.

Number of Policyholders

The number of policyholders represents the total number of individuals or businesses that have purchased insurance policies from a company. A company with a large number of policyholders may have a significant market share and a broad reach across various demographics. This metric gives a good indication of a company’s customer base and potential reach.

Global Insurance Giants

The insurance industry is a behemoth, with companies operating across borders and managing trillions of dollars in assets. Determining the “largest” insurance company can be tricky, as different metrics can lead to different rankings. This section dives into the world of global insurance giants, examining the top players based on market capitalization and total assets.

Top 5 Largest Insurance Companies by Market Capitalization

Market capitalization is a widely used metric to assess a company’s size and value. It represents the total value of all outstanding shares of a company. The top 5 largest insurance companies by market capitalization are:

- Berkshire Hathaway (United States): With a market capitalization exceeding $700 billion, Berkshire Hathaway is a titan in the insurance world. Founded by the legendary investor Warren Buffett, the company boasts a diverse portfolio, including insurance, energy, and consumer goods. Its core insurance businesses, including Geico and General Re, generate significant premiums and contribute to its financial strength. Berkshire Hathaway’s global reach extends across various industries and markets, making it a true global powerhouse.

- China Life Insurance (China): China Life Insurance is a leading player in the Chinese insurance market, with a market capitalization exceeding $200 billion. As a state-owned enterprise, it enjoys a dominant position in the country’s rapidly growing insurance sector. China Life Insurance provides a comprehensive range of products, including life insurance, health insurance, and property insurance. Its extensive network and strong brand recognition have been key drivers of its success.

- Ping An Insurance (China): Ping An Insurance is another prominent Chinese insurance company, with a market capitalization exceeding $150 billion. It offers a wide range of insurance products, including life insurance, property insurance, and health insurance. Ping An Insurance has also expanded into other financial services, such as banking and asset management. Its focus on innovation and technology has enabled it to capture a significant share of the Chinese insurance market.

- Allianz (Germany): Allianz is a global insurance giant with a market capitalization exceeding $100 billion. Founded in 1890, the company has a long history of providing insurance and financial services. Allianz operates in over 70 countries, offering a comprehensive range of products, including life insurance, property insurance, and health insurance. Its strong brand recognition and global reach have contributed to its success.

- AXA (France): AXA is another leading global insurance company with a market capitalization exceeding $100 billion. It operates in over 60 countries, offering a wide range of insurance products, including life insurance, property insurance, and health insurance. AXA has a strong presence in Europe and Asia, and its focus on digital transformation has enabled it to adapt to changing customer needs.

Top 5 Largest Insurance Companies by Total Assets

Total assets represent the value of all assets owned by a company. This metric provides insight into a company’s overall financial strength and its ability to meet its obligations. The top 5 largest insurance companies by total assets are:

- Berkshire Hathaway (United States): Berkshire Hathaway remains at the top with total assets exceeding $1 trillion. Its vast portfolio of investments and insurance businesses contributes to its impressive asset base. Its strong investment returns and diverse operations have been key drivers of its financial strength.

- China Life Insurance (China): China Life Insurance follows closely with total assets exceeding $700 billion. Its dominance in the Chinese insurance market and its focus on growth have resulted in a significant asset base. The company’s extensive network and strong brand recognition have enabled it to attract a large customer base.

- Ping An Insurance (China): Ping An Insurance holds a significant position with total assets exceeding $500 billion. Its expansion into various financial services, including banking and asset management, has contributed to its asset growth. The company’s focus on innovation and technology has enabled it to capture a significant share of the Chinese financial market.

- Allianz (Germany): Allianz is another major player with total assets exceeding $1 trillion. Its global reach and diverse product offerings have resulted in a substantial asset base. The company’s focus on risk management and its strong brand recognition have contributed to its financial stability.

- MetLife (United States): MetLife is a prominent US-based insurance company with total assets exceeding $500 billion. It offers a wide range of insurance products, including life insurance, property insurance, and health insurance. MetLife has a strong presence in the US and international markets, and its focus on customer service and innovation has been key to its success.

Factors Contributing to Success

Several factors contribute to the success and dominance of these global insurance giants:

- Strong Financial Strength: These companies have a robust financial foundation, characterized by significant capital reserves, high credit ratings, and strong investment returns. This financial strength enables them to weather economic downturns, meet their obligations, and invest in growth opportunities.

- Global Reach: Operating across borders allows these companies to diversify their revenue streams and mitigate risks. Their global presence enables them to tap into emerging markets and capture a larger share of the global insurance market.

- Diverse Product Offerings: These companies offer a wide range of insurance products, catering to the diverse needs of individuals and businesses. This diversification allows them to capture a broader customer base and generate more revenue streams.

- Technological Innovation: These companies are investing heavily in technology to enhance customer experience, improve operational efficiency, and develop new products and services. They are leveraging data analytics, artificial intelligence, and digital platforms to stay ahead of the competition.

- Strong Brand Recognition: These companies have built strong brand recognition and reputations for reliability, trust, and financial stability. Their established brands enable them to attract customers and maintain a competitive advantage.

Key Players by Region

The global insurance industry is a vast and diverse landscape, with major players operating across different regions. Understanding the key players in each region is crucial for gaining insights into the competitive landscape and identifying emerging trends.

Top Insurance Companies by Region

The following table highlights the top 10 insurance companies in North America, Europe, and Asia, based on market capitalization as of 2023:

| Company Name | Region | Market Capitalization (USD Billion) | Key Products | Notable Features |

|---|---|---|---|---|

| Berkshire Hathaway | North America | 650 | Property & Casualty, Life Insurance, Reinsurance | Warren Buffett’s legendary investment firm with a diverse portfolio. |

| UnitedHealth Group | North America | 450 | Health Insurance, Managed Care | Largest health insurer in the US, offering a wide range of healthcare services. |

| Cigna | North America | 80 | Health Insurance, Life Insurance, Disability Insurance | Known for its global reach and focus on innovative healthcare solutions. |

| Aetna | North America | 70 | Health Insurance, Dental Insurance, Vision Insurance | Acquired by CVS Health in 2018, offering integrated healthcare services. |

| Prudential Financial | North America | 60 | Life Insurance, Retirement Planning, Investment Management | Long-standing provider of financial products and services. |

| Allianz | Europe | 80 | Property & Casualty, Life Insurance, Asset Management | Germany’s largest insurer with a strong global presence. |

| AXA | Europe | 70 | Property & Casualty, Life Insurance, Health Insurance | France-based insurer with a focus on international expansion. |

| ING Groep | Europe | 50 | Life Insurance, Investment Management, Banking | Dutch financial services conglomerate with a strong presence in Europe. |

| Zurich Insurance Group | Europe | 40 | Property & Casualty, Life Insurance, General Insurance | Swiss multinational insurer with a global network. |

| Legal & General | Europe | 35 | Life Insurance, Pensions, Investment Management | UK-based insurer with a focus on retirement and investment products. |

| Ping An Insurance | Asia | 150 | Life Insurance, Property & Casualty, Health Insurance | China’s largest insurer, known for its diverse product offerings. |

| China Life Insurance | Asia | 120 | Life Insurance, Annuity Products, Investment Management | State-owned insurer with a dominant market share in China. |

| HDFC Life Insurance | Asia | 50 | Life Insurance, Health Insurance, Retirement Planning | India’s largest private life insurer, known for its innovative products. |

| AIA Group | Asia | 45 | Life Insurance, Health Insurance, Retirement Planning | Hong Kong-based insurer with a strong presence in Asia. |

| Samsung Life Insurance | Asia | 40 | Life Insurance, Health Insurance, Annuity Products | South Korea’s largest life insurer, known for its strong brand recognition. |

Regional Trends and Patterns, What is the largest insurance company

The insurance landscape in each region is characterized by unique trends and patterns:

North America:

* Health Insurance Dominance: The US healthcare system is highly complex and expensive, leading to the dominance of health insurance companies.

* Consolidation and Integration: The industry is witnessing consolidation and integration, with large players acquiring smaller companies and expanding their product offerings.

* Technological Advancements: Insurers are embracing technology to improve customer experience, streamline operations, and develop new products.

Europe:

* Regulatory Landscape: The European Union’s Solvency II regulations have significantly impacted the insurance industry, leading to increased capital requirements and stricter oversight.

* International Expansion: European insurers are increasingly looking to expand their operations beyond their home markets, particularly in emerging economies.

* Digital Transformation: Insurers are investing heavily in digital technologies to enhance their operations and provide customers with more personalized services.

Asia:

* Rapid Growth: The Asian insurance market is experiencing rapid growth, driven by rising incomes, increasing urbanization, and a growing middle class.

* Competition from Local Players: Local insurers are gaining market share, challenging the dominance of international players.

* Focus on Life Insurance: Life insurance is a key product category in Asia, driven by cultural factors and a growing need for financial protection.

Impact of Largest Companies: What Is The Largest Insurance Company

Think of the insurance industry as a massive game of Risk, and the biggest insurance companies are the players with the most armies. Their size and influence are undeniable, and they leave a big footprint on the entire game. These giants aren’t just selling policies; they’re shaping the entire industry landscape.

Industry Influence

Large insurance companies wield significant power, influencing industry trends, setting standards, and driving innovation. Their decisions ripple through the market, impacting smaller players, consumers, and even the way insurance is regulated.

- Setting the Pace: They set the pace for innovation by investing in new technologies, developing cutting-edge products, and pushing the boundaries of risk management. This can inspire smaller companies to follow suit, leading to overall industry advancements.

- Shaping Standards: These companies often establish industry standards and best practices. Their policies and procedures can influence regulatory bodies and become benchmarks for others to follow. This can lead to greater consistency and reliability across the industry.

- Market Power: Their sheer size allows them to negotiate favorable terms with suppliers, invest heavily in research and development, and attract top talent. This can create a competitive advantage, leading to lower costs, better products, and more efficient operations.

Future of Large Insurance Companies

The world of insurance is changing faster than ever before. The largest insurance companies are facing a perfect storm of challenges and opportunities. From the rise of InsurTech to the evolving needs of customers, these companies must adapt to stay ahead of the curve.

Technological Advancements

Technological advancements are revolutionizing the insurance industry, creating both opportunities and challenges for large insurance companies. The rise of artificial intelligence (AI), blockchain, and big data analytics is transforming how insurance is underwritten, priced, and delivered.

- AI-Powered Underwriting: AI algorithms can analyze vast amounts of data to assess risk more accurately and efficiently, leading to more personalized pricing and improved customer experiences. For example, AI can analyze driving data from telematics devices to assess risk for auto insurance, resulting in lower premiums for safer drivers.

- Blockchain for Transparency: Blockchain technology can improve transparency and security in insurance transactions, reducing fraud and streamlining claims processing. Blockchain can create a secure and immutable record of insurance policies, claims, and payments, making it easier to track and verify information.

- Big Data Analytics for Personalized Products: Big data analytics allows insurance companies to gather and analyze customer data to develop personalized products and services. This data-driven approach can help companies identify emerging risks and tailor coverage to individual needs.

Changing Customer Preferences

Customer preferences are shifting towards digital experiences, personalized services, and faster claims processing. Large insurance companies need to embrace these changes to remain competitive and meet the expectations of modern consumers.

- Digital-First Approach: Customers increasingly prefer to interact with insurance companies online or through mobile apps. Companies need to invest in user-friendly digital platforms that offer seamless customer experiences, including online policy purchases, claims reporting, and account management.

- Personalized Insurance: Customers want insurance products that are tailored to their specific needs and risk profiles. Large insurance companies can leverage data analytics to offer personalized pricing, coverage options, and services.

- Faster Claims Processing: Customers expect quick and efficient claims processing. Insurance companies need to implement streamlined processes and leverage technology to expedite claims handling, reducing wait times and improving customer satisfaction.

Regulatory Shifts

The insurance industry is subject to evolving regulations that can impact the operations and profitability of large insurance companies. Companies need to stay informed about regulatory changes and adapt their business practices accordingly.

- Cybersecurity Regulations: As cyber threats become more sophisticated, regulatory bodies are imposing stricter cybersecurity requirements on insurance companies. Companies need to invest in robust cybersecurity measures to protect customer data and comply with regulations.

- Data Privacy Regulations: Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) place limitations on how companies collect, use, and share customer data. Insurance companies need to ensure they are compliant with these regulations to avoid penalties and maintain customer trust.

- Climate Change Regulations: The increasing impact of climate change is leading to more frequent and severe weather events, increasing insurance risks. Insurance companies need to adapt their pricing models and risk assessments to account for these changing conditions.

Summary

The insurance industry is a dynamic landscape, and the largest companies play a pivotal role in shaping its trajectory. Understanding their influence, strategies, and future challenges is crucial for navigating this complex world. As the industry evolves, these giants will continue to adapt, innovate, and shape the future of risk management and financial security.

FAQs

How do insurance companies make money?

Insurance companies make money by collecting premiums from policyholders and investing those funds. They aim to earn a profit by carefully assessing risk, setting premiums accordingly, and investing wisely.

What is the difference between life insurance and health insurance?

Life insurance provides financial protection to beneficiaries upon the death of the insured, while health insurance covers medical expenses and healthcare costs.

What are some of the biggest risks facing insurance companies?

Insurance companies face risks like natural disasters, pandemics, economic downturns, and changes in regulations. They also have to contend with fraud and evolving customer needs.

What is reinsurance?

Reinsurance is a form of insurance that insurance companies purchase to protect themselves against large losses. It essentially transfers a portion of the risk to another company.