What is the minimum car insurance coverage in Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Driving in Florida comes with specific legal requirements for car insurance, ensuring that drivers are financially responsible in case of accidents. This guide will provide you with a comprehensive understanding of the minimum coverage amounts mandated by Florida law, including bodily injury liability, property damage liability, and personal injury protection (PIP).

Beyond the minimum requirements, we will delve into the various types of car insurance coverage available, offering insights into collision coverage, comprehensive coverage, and rental reimbursement coverage. We’ll explore how factors like age, driving history, vehicle type, and location influence insurance premiums, equipping you with knowledge to make informed decisions about your car insurance needs.

Florida’s Minimum Car Insurance Requirements: What Is The Minimum Car Insurance Coverage In Florida

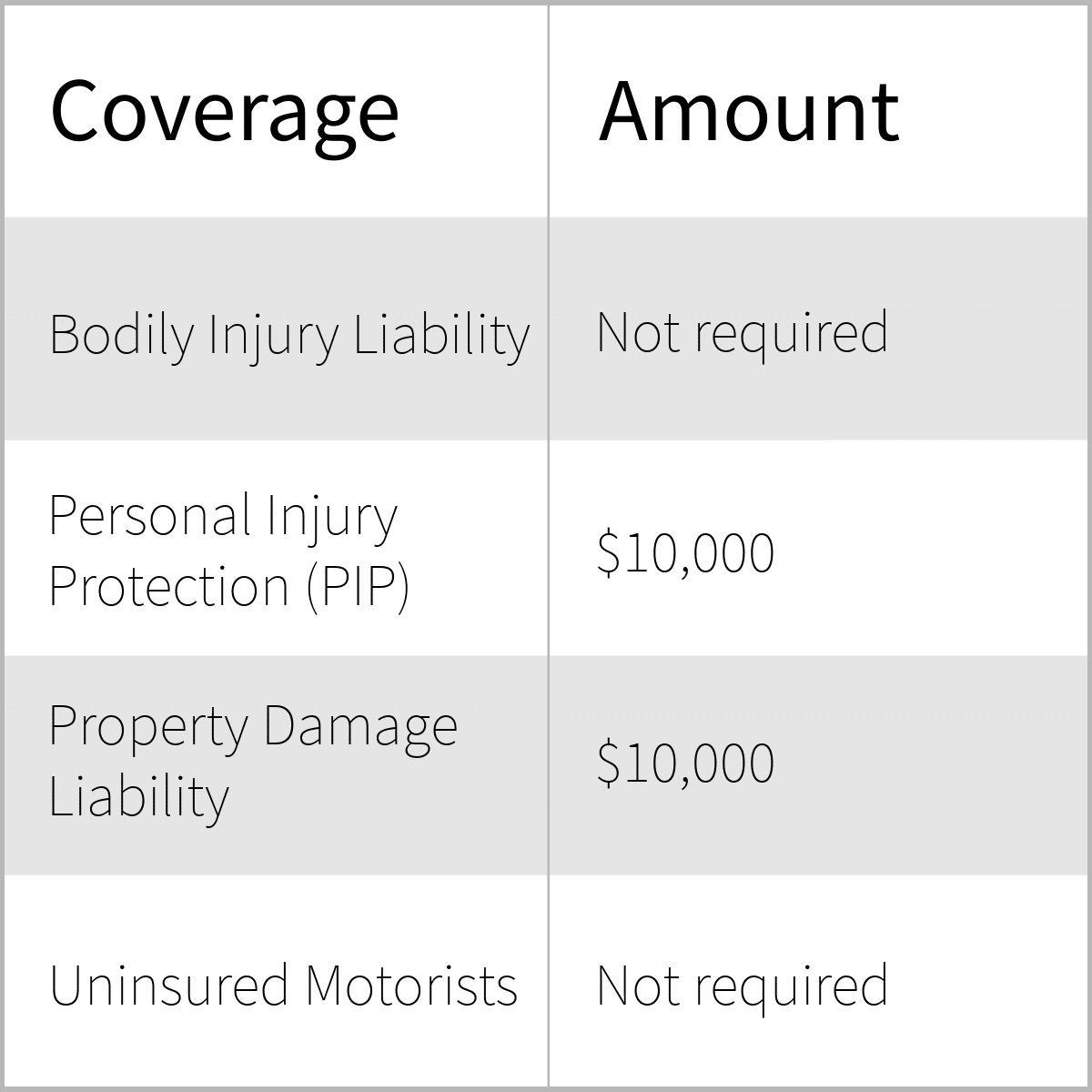

Florida law mandates that all vehicle owners carry a minimum level of car insurance to protect themselves and others in case of an accident. This ensures that those involved in accidents have access to financial compensation for injuries, damages, and other related expenses.

Bodily Injury Liability Coverage

Bodily injury liability coverage pays for the medical expenses, lost wages, and other damages incurred by the other driver or passengers if you are at fault in an accident. This coverage applies to injuries to others caused by your negligence while driving.

Florida law requires a minimum of $10,000 per person and $20,000 per accident for bodily injury liability coverage.

This means that your insurance company will pay up to $10,000 for injuries to each person involved in an accident and up to $20,000 for all injuries in a single accident, regardless of how many people are injured.

Property Damage Liability Coverage

Property damage liability coverage protects you against financial losses if your negligence causes damage to another person’s property, such as their vehicle or other possessions. This coverage is designed to cover the cost of repairs or replacement of damaged property.

Florida law mandates a minimum of $10,000 in property damage liability coverage.

This means that your insurance company will pay up to $10,000 for damages to another person’s property in a single accident.

Personal Injury Protection (PIP)

PIP coverage is a type of no-fault insurance that covers your own medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in Florida.

Florida law requires a minimum of $10,000 in PIP coverage.

This coverage is designed to pay for your medical expenses, lost wages, and other related costs, regardless of who caused the accident. However, it is important to note that PIP coverage has a 80/20 rule. This means that your insurance company will pay 80% of your eligible medical expenses, and you are responsible for the remaining 20%.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

UM/UIM coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. This coverage is optional in Florida, but it is highly recommended.

Florida law requires that UM/UIM coverage be offered to you at the same limits as your bodily injury liability coverage.

If you are involved in an accident with an uninsured or underinsured driver, your UM/UIM coverage will help cover your medical expenses, lost wages, and other damages.

Understanding Coverage Types

While Florida’s minimum car insurance requirements are designed to protect you financially in the event of an accident, they might not cover all the potential costs. You may want to consider additional coverage options beyond the minimum requirements to ensure comprehensive protection.

Collision Coverage

Collision coverage protects you against damages to your vehicle caused by an accident, regardless of fault. This means that if you hit another car, a tree, or even a pothole, your insurance will cover the repair or replacement costs.

Comprehensive Coverage

Comprehensive coverage protects you against damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. For instance, if your car is stolen or damaged by a hailstorm, comprehensive coverage will help pay for the repairs or replacement.

Rental Reimbursement Coverage

Rental reimbursement coverage helps cover the cost of renting a car while your vehicle is being repaired after an accident or other covered event. This coverage is particularly useful if you rely on your car for work or other essential activities.

Benefits and Costs

| Coverage Type | Benefits | Costs |

|---|---|---|

| Collision Coverage | Covers damages to your vehicle caused by an accident, regardless of fault. | Higher premiums than minimum requirements. |

| Comprehensive Coverage | Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | Higher premiums than minimum requirements. |

| Rental Reimbursement Coverage | Helps cover the cost of renting a car while your vehicle is being repaired. | Additional cost added to your premium. |

Factors Influencing Insurance Costs

Your car insurance premium in Florida is determined by various factors, not just the minimum coverage requirements. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Driver’s Age

The age of the driver is a significant factor in determining car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk translates to higher premiums. Conversely, older drivers, typically those over 65, may enjoy lower premiums due to their generally safer driving habits.

Driving History, What is the minimum car insurance coverage in florida

Your driving history plays a crucial role in determining your insurance costs. A clean driving record with no accidents or violations will result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates. Insurers consider these factors as indicators of your driving risk.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Luxury cars, sports cars, and vehicles with powerful engines are generally more expensive to insure. This is because these vehicles are often associated with higher repair costs and a greater risk of accidents.

Location

The location where you live can significantly impact your car insurance premiums. Urban areas with high traffic density and crime rates typically have higher insurance rates. Conversely, rural areas with lower traffic volume and fewer accidents may offer lower premiums.

Consequences of Driving Without Insurance

Driving without the minimum required car insurance in Florida is a serious offense that can lead to significant financial penalties and legal consequences. It’s crucial to understand the potential repercussions and ensure you’re adequately insured to protect yourself and others on the road.

Penalties and Fines

Driving without insurance in Florida can result in a range of penalties and fines, including:

- A minimum fine of $150 for the first offense.

- An additional fine of up to $500 for subsequent offenses.

- Possible suspension of your driver’s license.

- Potential vehicle impoundment until proof of insurance is provided.

- Court costs and administrative fees.

Impact on Driving Privileges

Driving without insurance can have a significant impact on your driving privileges in Florida.

- Your driver’s license may be suspended, preventing you from legally operating a vehicle.

- The suspension period can vary depending on the severity of the offense and your driving history.

- Even after the suspension is lifted, you may be required to pay reinstatement fees and provide proof of insurance.

Impact on Vehicle Registration

Driving without insurance can also affect your ability to register your vehicle in Florida.

- You may be unable to renew your vehicle registration until you provide proof of insurance.

- This can lead to delays in driving your vehicle and potential fines for driving an unregistered vehicle.

Financial Consequences

Driving without insurance can lead to substantial financial consequences, especially in the event of an accident.

- If you cause an accident without insurance, you could be held personally liable for all damages and injuries, potentially leading to significant financial losses.

- This can include medical bills, property damage, legal fees, and potential lawsuits.

- The lack of insurance coverage can severely impact your financial stability and create significant financial burdens.

Obtaining Car Insurance in Florida

Navigating the process of obtaining car insurance in Florida can feel overwhelming, but it’s essential for responsible drivers. Understanding the steps involved, available options, and key considerations will help you find the best insurance coverage for your needs.

Finding Affordable Insurance Options

Finding affordable car insurance options in Florida requires careful research and comparison. Several strategies can help you secure competitive rates.

- Shop around: Obtain quotes from multiple insurance providers to compare rates and coverage options. Online comparison websites and insurance brokers can streamline this process.

- Bundle your policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, as many providers offer discounts for multiple policies.

- Maintain a good driving record: A clean driving record with no accidents or traffic violations significantly reduces insurance premiums. Safe driving habits can lead to lower rates.

- Consider increasing your deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Carefully assess your risk tolerance and financial situation before increasing your deductible.

- Explore discounts: Ask about available discounts, such as good student, safe driver, or anti-theft device discounts. These can significantly impact your overall premium.

Comparing Quotes from Different Providers

Comparing quotes from different providers is crucial for securing the best insurance rates. Utilize the following methods for an effective comparison:

- Online comparison websites: These websites allow you to enter your information once and receive quotes from multiple insurers. This saves time and effort while providing a comprehensive overview of available options.

- Insurance brokers: Brokers represent multiple insurance companies and can help you find the best coverage at competitive rates. They can negotiate on your behalf and provide personalized recommendations based on your needs.

- Directly contacting insurers: Contacting insurers directly allows you to discuss specific coverage options and ask questions about their policies. This can provide a more in-depth understanding of each provider’s offerings.

Understanding Policy Terms and Conditions

Before purchasing insurance, thoroughly understanding the policy terms and conditions is vital. This ensures you are aware of your coverage limits, deductibles, exclusions, and other important details.

- Review the policy document: Carefully read through the entire policy document, paying attention to the specific coverage details, exclusions, and limitations.

- Ask questions: Don’t hesitate to ask your insurance agent or provider any questions you have about the policy terms and conditions. Ensure you fully understand all aspects of the coverage before making a decision.

- Compare different policies: Compare the terms and conditions of different policies before choosing one. This allows you to identify the best coverage for your specific needs and budget.

Final Review

Navigating the world of car insurance in Florida can be a complex endeavor, but understanding the minimum coverage requirements, available options, and factors influencing costs is crucial for responsible driving. By following the steps Artikeld in this guide, you can ensure you have the right coverage to protect yourself, your passengers, and your vehicle. Remember, driving without the minimum required insurance comes with serious consequences, so prioritize obtaining the necessary coverage to avoid potential penalties and legal ramifications.

Helpful Answers

What happens if I get into an accident and don’t have the minimum car insurance coverage?

You could face serious financial consequences, including fines, suspension of your driving privileges, and difficulty registering your vehicle. You could also be held personally liable for any damages or injuries caused to other parties involved in the accident.

Can I get a discount on my car insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records. This can significantly reduce your premiums over time.

Is there a way to lower my car insurance premiums?

There are several ways to lower your premiums, including maintaining a good driving record, taking defensive driving courses, bundling your car insurance with other policies, and choosing a vehicle with safety features.