What’s the best car insurance company? It’s a question that echoes in the minds of millions of drivers, especially when you’re trying to protect your ride and your wallet. You know you need car insurance, but with so many companies out there, how do you find the one that’s right for you? It’s like trying to pick the perfect pizza topping – there are so many choices, but only one will really hit the spot.

Choosing the best car insurance company is all about finding the right balance between price, coverage, and customer service. It’s like finding the perfect pair of jeans – you want something that fits your style, budget, and needs. But don’t worry, we’re here to help you navigate this wild world of car insurance and find the perfect fit for your driving needs.

Understanding Car Insurance Needs

Choosing the right car insurance can feel like navigating a maze, but don’t worry, we’re here to help you find your way. It’s not just about finding the cheapest policy; it’s about finding the right coverage for your specific needs.

Think of car insurance like a safety net – you hope you never need it, but when you do, you want to be sure it’s there to catch you. To find the perfect fit, you need to consider your individual circumstances and risk profile.

Assessing Individual Risk Profiles

Understanding your risk profile is key to finding the right car insurance. Your risk profile is like a snapshot of your driving habits and the likelihood of you getting into an accident. It takes into account factors like:

- Your driving history: This includes your past accidents, tickets, and even the number of years you’ve been driving.

- Your age: Younger drivers often have higher premiums due to their inexperience, while older drivers might face higher premiums due to potential health concerns.

- Your location: Urban areas with heavy traffic tend to have higher accident rates, which can influence your premiums.

- Your vehicle: The type of car you drive, its value, and safety features all play a role in determining your insurance costs. A luxury sports car, for example, will likely have a higher premium than a basic sedan.

Understanding Coverage Options

Car insurance is a complex world, but it’s all about protection. Here’s a rundown of the most common coverage options:

- Liability coverage: This is the most basic type of insurance and is usually required by law. It covers damages to other people’s property or injuries to other people in case you’re at fault in an accident.

- Collision coverage: This covers damage to your own vehicle if you’re involved in an accident, regardless of who is at fault. Think of it as your car’s personal safety net.

- Comprehensive coverage: This protects you from damages to your vehicle caused by things other than accidents, like theft, vandalism, or natural disasters. Think of it as your car’s “everything else” protection.

- Uninsured/Underinsured Motorist coverage: This protects you in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. It’s like having a backup plan in case the other driver doesn’t have one.

Comparing Car Insurance Companies

Finding the right car insurance company can feel like navigating a maze of options. With so many providers out there, how do you figure out which one is the best fit for you? Don’t worry, we’re here to help you compare apples to apples (and maybe even oranges) so you can make an informed decision.

Comparing Car Insurance Companies

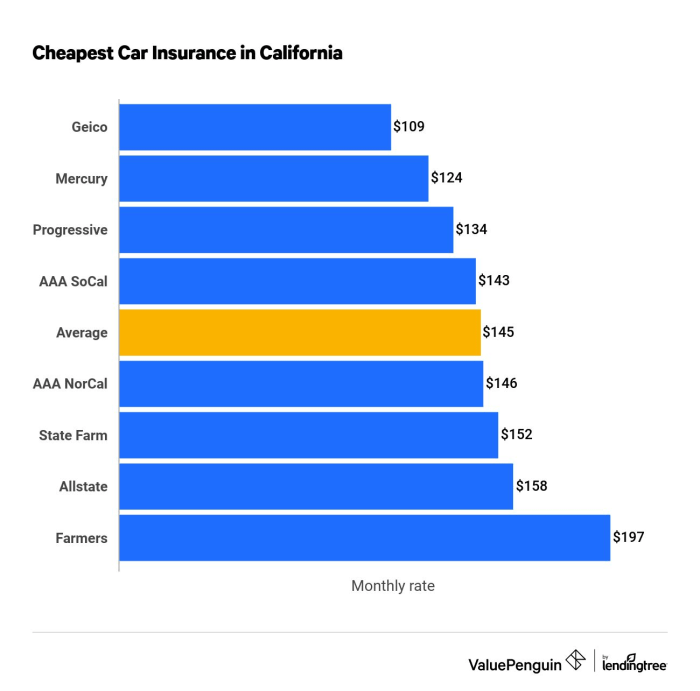

The first step in finding the best car insurance company is to compare different providers based on key factors like pricing, coverage, discounts, and customer service. Here’s a table comparing some of the major car insurance companies in the US:

| Company | Average Annual Premium | Customer Satisfaction Rating | Financial Strength Rating | Discounts Offered |

|---|---|---|---|---|

| Geico | $1,526 | 4.3/5 | A+ | Good Driver, Multi-Car, Multi-Policy, Safe Driver |

| Progressive | $1,642 | 4.2/5 | A+ | Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner |

| State Farm | $1,705 | 4.4/5 | A+ | Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner |

| Allstate | $1,750 | 4.1/5 | A+ | Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner, Drive Safe & Save |

| USAA | $1,380 | 4.7/5 | A++ | Good Driver, Multi-Car, Multi-Policy, Safe Driver, Military Discounts |

It’s important to note that these are just average premiums and ratings. Your individual rate will depend on your driving history, location, vehicle, and other factors. You can use online comparison tools or contact insurance companies directly to get personalized quotes.

Comparing Pricing Models and Discounts

Each insurance company uses a different pricing model, which can affect your premium. Some companies might charge more for young drivers or those with a history of accidents, while others might offer discounts for safe driving or bundling multiple policies. Here’s a breakdown of common pricing models and discounts:

Pricing Models

- Usage-based insurance: This model uses telematics devices or smartphone apps to track your driving habits and adjust your premium based on your driving behavior. For example, if you drive safely and avoid risky maneuvers, you could earn a lower premium.

- Risk-based pricing: This model considers factors like your age, driving history, and location to determine your risk of having an accident. Drivers with a history of accidents or traffic violations might face higher premiums.

Discounts

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record and no accidents or violations.

- Multi-Car Discount: Insuring multiple vehicles with the same company can often result in a discount on your premiums.

- Multi-Policy Discount: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discount: Some companies offer discounts for drivers who complete defensive driving courses or install safety features in their vehicles.

- Homeowner Discount: Homeowners often qualify for discounts on their car insurance, as they are considered less risky drivers.

Customer Service and Claims Handling

Customer service and claims handling are crucial aspects of car insurance. You want to choose a company that has a reputation for prompt and efficient service, especially when you need it most. Here’s a look at some of the key factors to consider:

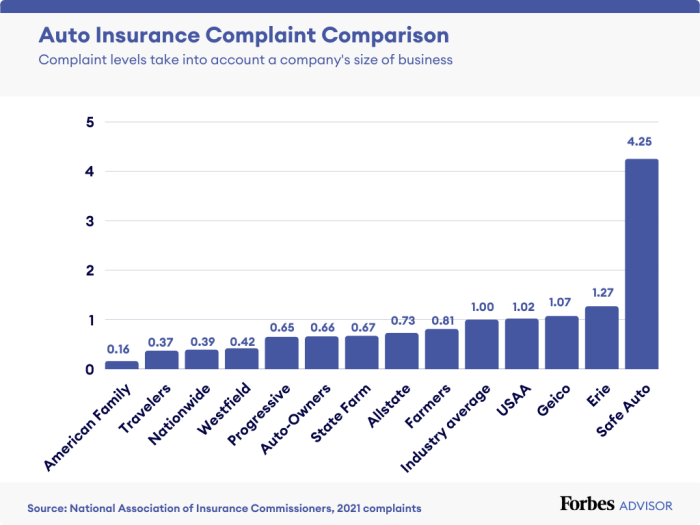

- Customer satisfaction ratings: Check online reviews and ratings from independent organizations to get an idea of how satisfied other customers are with the company’s service.

- Claims handling process: Research how the company handles claims, including the time it takes to process claims, the availability of 24/7 support, and the overall experience of filing a claim.

- Availability of resources: Look for companies that offer online tools, mobile apps, and other resources to make it easy for you to manage your policy and file claims.

Remember, the best car insurance company for you will depend on your individual needs and preferences. Take your time to compare different providers, consider your budget, and choose the company that offers the best combination of coverage, price, and customer service.

Key Features to Consider

Choosing the right car insurance company isn’t just about finding the cheapest rates; it’s about finding the right fit for your needs. Beyond the price tag, you’ll want to consider a range of features that can make a real difference in your experience. These features can be game-changers when you need to file a claim, deal with a fender bender, or even just manage your policy.

Coverage Options

Different insurance companies offer various coverage options, each tailored to specific needs and risk profiles. Understanding the different types of coverage available is crucial for making an informed decision.

- Liability Coverage: This is the most basic type of coverage, covering damages to others and their property if you’re at fault in an accident. It’s typically required by law in most states.

- Collision Coverage: This covers damages to your own vehicle if you’re involved in an accident, regardless of fault. It’s usually optional, but worth considering if you have a newer car or a loan on it.

- Comprehensive Coverage: This protects your vehicle against non-collision damages, such as theft, vandalism, or natural disasters. Like collision coverage, it’s typically optional.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver without insurance or with insufficient coverage. It’s essential, as it can help cover your medical expenses and property damage in such situations.

- Rental Car Coverage: This covers the cost of a rental car if your vehicle is damaged or stolen and you need transportation while it’s being repaired.

- Roadside Assistance: This covers services like towing, jump-starts, flat tire changes, and lockout assistance.

Customer Service and Claims Process

The best car insurance company isn’t just about the price; it’s about the support you receive when you need it most. Here’s what to look for:

- 24/7 Availability: Look for companies with 24/7 customer service availability, either through phone, email, or online chat. This ensures you can reach someone whenever you need help, even in an emergency.

- Easy Claims Filing: The claims process should be straightforward and hassle-free. Look for companies with online claim filing options, mobile app support, and dedicated claims representatives.

- Prompt Claim Resolution: A quick and efficient claims resolution process is essential. Look for companies with a reputation for timely payouts and minimal paperwork.

- Transparent Communication: Good communication is key throughout the claims process. Look for companies that keep you informed about the status of your claim and provide clear explanations of any decisions made.

Discounts and Rewards

Car insurance companies offer various discounts to lower your premiums. These can be based on your driving history, vehicle features, and other factors.

- Safe Driver Discounts: These are common and often substantial. Many companies offer discounts for clean driving records, completing defensive driving courses, and even having a good credit score.

- Multi-Policy Discounts: Bundling your car insurance with other policies, like homeowners or renters insurance, can lead to significant savings.

- Vehicle Safety Features Discounts: Companies may offer discounts for vehicles with safety features like anti-theft systems, airbags, and anti-lock brakes.

- Loyalty Discounts: Some companies reward long-term customers with discounts for staying with them for a certain period.

- Telematics Programs: These programs use technology to track your driving habits and offer discounts for safe driving behavior. Examples include:

- Progressive’s Snapshot: This program uses a small device plugged into your car’s OBD-II port to track your driving habits and offer discounts based on your driving behavior.

- State Farm’s Drive Safe & Save: This program uses a mobile app to track your driving habits and offer discounts based on factors like speed, braking, and time of day.

Technology and Innovation, What’s the best car insurance company

Car insurance companies are constantly innovating to enhance the customer experience. Here are some key technology features to look for:

- Mobile App Functionality: A user-friendly mobile app can make managing your policy, paying your premiums, and filing claims a breeze. Look for apps that allow you to access your policy information, track your driving history, get quotes, and contact customer service.

- Digital Document Management: Many companies now offer digital document management, allowing you to access and store your insurance documents online. This eliminates the need for paper copies and makes it easier to keep track of your policy information.

- Artificial Intelligence (AI) Chatbots: AI-powered chatbots can provide quick and convenient answers to common questions, saving you time and effort. Look for companies that offer 24/7 chatbot support.

- Personalized Recommendations: Some companies use AI to analyze your driving habits and provide personalized recommendations for improving your safety and potentially lowering your premiums.

Customer Reviews and Ratings

You wouldn’t buy a pair of shoes without reading reviews, would you? The same logic applies to car insurance. Customer reviews and ratings are like the Yelp of the insurance world, giving you a glimpse into the real-life experiences of policyholders. They can be your secret weapon in finding the best company for you.

Analyzing Customer Reviews and Ratings

So, where do you find these golden nuggets of information? Reputable sources like J.D. Power, Consumer Reports, and the Better Business Bureau (BBB) provide valuable insights. These organizations conduct surveys, gather feedback, and analyze data to provide objective ratings. They look at factors like customer satisfaction, claims handling, and pricing, giving you a well-rounded picture of each company’s performance.

Understanding the Significance of Reviews

Think of customer reviews as a giant focus group. They tell you what other people think about a company’s service, responsiveness, and overall value. They can reveal potential red flags like slow claims processing or difficult customer service. Remember, not all reviews are created equal. Pay attention to patterns and consistency in the feedback. Are there recurring issues or positive trends? This will give you a better understanding of the company’s strengths and weaknesses.

Examining Trends in Customer Feedback

Take a look at the big picture. Are certain companies consistently receiving praise for their claims handling process? Are others known for their competitive pricing? By understanding these trends, you can identify companies that align with your priorities. For example, if you value prompt claims service, you might look for companies that consistently score high in that area.

Choosing the Best Fit

You’ve done the research, compared prices, and considered features. Now it’s time to make the big decision: choosing the car insurance company that’s right for you. Think of it like picking the perfect playlist for your road trip – you want tunes that match your vibe and keep you rolling.

Evaluating Individual Needs and Preferences

Everyone has their own unique set of needs and preferences when it comes to car insurance. It’s not just about finding the cheapest option. You need to find a policy that provides the right level of coverage and support for your specific situation. To do this, consider these factors:

- Driving History: If you’ve got a clean driving record, you might qualify for discounts and better rates. But if you’ve got a few fender benders under your belt, you’ll want to focus on companies that offer good coverage and potentially higher limits.

- Vehicle Value: A brand new Tesla needs a different level of coverage than a 1998 Honda Civic. Consider the value of your vehicle and choose a policy that provides adequate protection in case of an accident.

- Personal Preferences: Some people prefer the convenience of online tools and digital communication, while others prefer the personal touch of a local agent. Think about your communication style and choose a company that aligns with your preferences.

Selecting the Most Suitable Car Insurance Company

Finding the perfect insurance match is like finding the perfect pair of jeans – it takes a little effort and a few tries. Here’s a step-by-step guide to help you find your ideal fit:

- Make a Shortlist: Based on your research and the factors we discussed, narrow down your options to a few top contenders. Think of it like a bracket tournament – you’re whittling down the competition to find your champion.

- Get Personalized Quotes: Once you have your shortlist, contact each company and get a personalized quote. This will give you a clear picture of what they offer and how much it will cost.

- Compare Apples to Apples: When comparing quotes, make sure you’re comparing the same coverage levels. Don’t be fooled by low prices if the policy doesn’t offer the protection you need.

- Check the Fine Print: Read through the policy documents carefully, paying attention to things like deductibles, coverage limits, and exclusions. You don’t want any surprises down the road.

- Consider Customer Service: Check out online reviews and ratings to get an idea of how responsive and helpful each company is. You want a company that’s there for you when you need them.

Negotiating Rates and Securing the Best Coverage

You’ve found the right company, but you want to make sure you’re getting the best deal. Here are some tips for negotiating rates and securing the best possible coverage:

“Don’t be afraid to ask for a better deal. Insurance companies are often willing to negotiate, especially if you’re a loyal customer or have a clean driving record.”

- Bundle Your Policies: If you have other insurance policies, like homeowners or renters insurance, consider bundling them with your car insurance. Many companies offer discounts for bundling.

- Shop Around Regularly: Don’t be afraid to compare quotes from other companies every year or two. The insurance market is constantly changing, and you might find a better deal elsewhere.

- Take Advantage of Discounts: Many insurance companies offer discounts for things like safe driving, good grades, and anti-theft devices. Ask your insurer about any discounts you may be eligible for.

- Consider Increasing Your Deductible: A higher deductible means lower premiums. But make sure you can afford to pay the deductible if you need to file a claim.

Conclusive Thoughts

So, whether you’re a seasoned driver or a newbie hitting the road for the first time, finding the right car insurance company is a crucial step in your driving journey. Don’t just settle for the first policy you see – do your research, compare options, and find the company that gives you the peace of mind you deserve. And remember, a little bit of effort now can save you a whole lot of stress and money down the road.

Frequently Asked Questions: What’s The Best Car Insurance Company

What are the different types of car insurance coverage?

There are several types of car insurance coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each type of coverage protects you in different situations, so it’s important to understand what you need and what’s available.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or even more frequently if your life circumstances change. You might need to adjust your coverage or find a better deal based on your driving history, vehicle changes, or other factors.