What’s the best health insurance company? It’s a question that echoes through the halls of every American household, a quest for the holy grail of coverage that balances affordability, quality, and peace of mind. Navigating the complex world of health insurance can feel like deciphering a secret code, but fear not! We’re here to break down the jargon and empower you to make informed decisions about your health and well-being.

From understanding your individual needs to comparing plans and companies, this guide will equip you with the knowledge to choose the right health insurance for your unique situation. We’ll dive into key considerations like financial stability, customer service, and provider networks, helping you avoid common pitfalls and land a plan that fits your budget and lifestyle.

Understanding Your Needs: What’s The Best Health Insurance Company

Choosing the right health insurance plan is like picking the perfect outfit for a big event: you want something that fits your style, covers you in all the right places, and won’t break the bank. Just like your wardrobe needs change over time, your health insurance needs will evolve too.

Factors Influencing Health Insurance Needs

Your individual health insurance needs are shaped by a unique mix of factors, including your personal health history, lifestyle choices, and family medical background.

- Personal Health History: If you’ve dealt with chronic conditions like diabetes or asthma, you’ll likely need a plan that provides comprehensive coverage for your specific needs.

- Lifestyle: Are you a thrill-seeker who enjoys extreme sports? Or do you prioritize a healthy diet and regular exercise? Your lifestyle choices can influence your risk of health issues and, consequently, your insurance needs.

- Family Medical Background: A family history of certain diseases can increase your chances of developing them. Understanding your family’s medical history helps you choose a plan that offers adequate protection.

Coverage Requirements Vary

Just like a tailor adjusts a garment to fit your body, health insurance plans adapt to your unique circumstances.

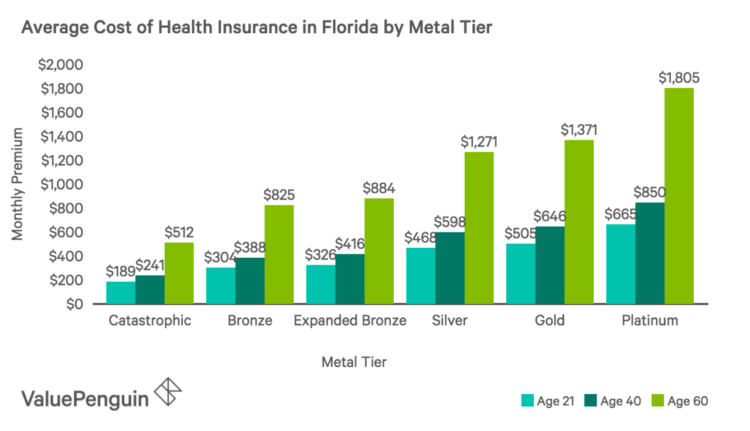

- Age: As you get older, your risk of health issues increases, so you might need more comprehensive coverage.

- Location: The cost of healthcare varies across different regions. You’ll need to consider the average healthcare costs in your area when selecting a plan.

- Pre-existing Conditions: If you have a pre-existing condition, it’s crucial to find a plan that covers it. Some plans may have limitations or exclusions for pre-existing conditions, so it’s important to read the fine print.

Comparing Health Insurance Plans

Navigating the world of health insurance plans can feel like deciphering a foreign language. Here’s a breakdown of some common plan types and their key features:

| Plan Type | Key Features | Pros | Cons |

|---|---|---|---|

| HMO (Health Maintenance Organization) | – Requires you to choose a primary care physician (PCP) within the network. – Referrals are needed to see specialists. – Usually lower premiums. |

– Typically lower monthly premiums. – Focus on preventive care. |

– Limited network of providers. – Need referrals for specialists. – May have higher out-of-pocket costs for non-network care. |

| PPO (Preferred Provider Organization) | – Allows you to see any doctor in or out of the network. – No need for referrals. – Usually higher premiums. |

– More flexibility in choosing providers. – No need for referrals. |

– Higher monthly premiums. – Higher out-of-pocket costs for non-network care. |

| POS (Point-of-Service) | – Combines features of HMO and PPO plans. – Requires you to choose a PCP within the network. – Offers some flexibility in seeing out-of-network providers. |

– More flexibility than HMOs. – Lower premiums than PPOs. |

– Can be confusing to navigate. – May have higher out-of-pocket costs for out-of-network care. |

| EPO (Exclusive Provider Organization) | – Similar to HMOs but with a wider network of providers. – Usually no coverage for out-of-network care. |

– Lower premiums. – Wider network than HMOs. |

– Limited out-of-network coverage. – May have higher out-of-pocket costs for non-network care. |

Key Considerations for Choosing a Health Insurance Company

Choosing the right health insurance company is like finding the perfect pair of jeans: you want something that fits your needs, is comfortable, and looks good (financially, that is). You wouldn’t just grab the first pair you see, right? The same goes for health insurance. There are a bunch of factors to consider, and making the right choice can save you a ton of stress and money in the long run.

Financial Stability and Claims Processing Efficiency

Think of your health insurance company like a friend you call when you’re in a pinch. You want someone reliable, who’s got your back, and who won’t ghost you when you need them most. That’s where financial stability and claims processing efficiency come in.

- Financial Stability: A financially stable company is less likely to go belly up, leaving you scrambling for new coverage. Look for companies with strong ratings from agencies like A.M. Best or Standard & Poor’s. These ratings are like a report card for insurance companies, letting you know how financially sound they are.

- Claims Processing Efficiency: When you need to file a claim, you don’t want to be stuck in a bureaucratic nightmare. Look for companies with a reputation for processing claims quickly and fairly. Check online reviews and ask around to see what others say about their claims experience.

Customer Service and Provider Network Size

You wouldn’t want to be stuck with a health insurance company that makes you feel like you’re dealing with a robot, right? Good customer service is a must. You also want a company with a network of providers that meets your needs.

- Customer Service: A good health insurance company will have a customer service team that’s responsive, helpful, and easy to work with. Check online reviews and see what others say about their experience with the company’s customer service. Look for companies with 24/7 customer service options, like online chat or phone support.

- Provider Network Size: You want a company with a wide network of doctors, hospitals, and other healthcare providers in your area. This means you’ll have more choices when it comes to finding a doctor you like and trust. Check the company’s website or call their customer service line to see which providers are in their network.

Reputation and Policy Terms and Conditions

Before you sign on the dotted line, it’s important to do your homework and understand the company’s reputation and the details of their policies.

- Reputation: Read online reviews and see what others say about the company. Look for independent sources, like Consumer Reports or the Better Business Bureau, to get an unbiased perspective. Check for any complaints or lawsuits filed against the company.

- Policy Terms and Conditions: Don’t just skim over the fine print! Read the policy carefully and make sure you understand everything. Pay attention to things like deductibles, co-pays, and coverage limits. If you have any questions, don’t hesitate to call the company’s customer service line.

Key Factors to Consider

| Factor | Description | Importance |

|---|---|---|

| Financial Stability | The company’s ability to meet its financial obligations. | Essential for ensuring you have coverage in the long run. |

| Claims Processing Efficiency | How quickly and efficiently the company processes claims. | Important for ensuring you get paid for your healthcare expenses. |

| Customer Service | The quality of the company’s customer service. | Crucial for resolving issues and getting the help you need. |

| Provider Network Size | The number of doctors, hospitals, and other healthcare providers in the company’s network. | Important for ensuring you have access to the care you need. |

| Reputation | The company’s track record and public perception. | Provides insights into the company’s reliability and trustworthiness. |

| Policy Terms and Conditions | The details of the company’s insurance policy. | Essential for understanding your coverage and costs. |

Researching and Comparing Options

Okay, so you’ve got a good handle on what you need in a health insurance plan. Now it’s time to dive into the world of insurance companies and find the best fit for you. Think of it like choosing your favorite restaurant – you want to find the one with the best menu (coverage), the best service (customer support), and the best price (premiums).

Finding Reputable Health Insurance Companies

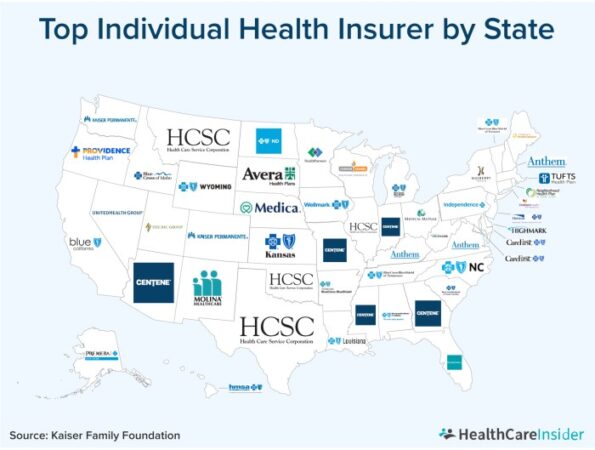

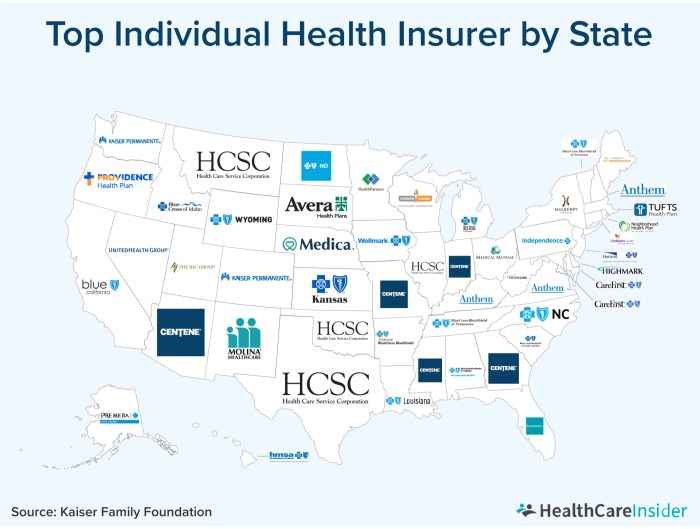

The health insurance market is a big one, with a bunch of different players. It can feel overwhelming, but don’t worry! We’ll break it down for you. Here are some of the most reputable companies that you can check out:

- Anthem

- Aetna

- Blue Cross Blue Shield

- Cigna

- Humana

- UnitedHealthcare

Obtaining Quotes and Comparing Plans

Once you’ve got a list of companies you want to explore, it’s time to get some quotes. This is like window shopping for health insurance. You’ll need to give each company some basic info about yourself, like your age, location, and whether you’re part of a family plan. Then, they’ll give you a quote for different plans.

Using Online Resources and Independent Review Websites

The internet is your best friend when it comes to researching health insurance. There are tons of online resources and independent review websites that can help you compare plans, read customer reviews, and find information about different companies. Some of the most popular resources include:

- Healthcare.gov: This is the official website for the Affordable Care Act, and it’s a great place to start your research.

- eHealthInsurance: This website allows you to compare quotes from multiple companies side-by-side.

- Healthgrades: This website provides ratings and reviews of hospitals and doctors.

- Consumer Reports: This website provides independent reviews of products and services, including health insurance.

Comparing Key Features and Pricing, What’s the best health insurance company

Now, let’s get down to the nitty-gritty and compare some of the key features and pricing of different health insurance plans. Here’s a sample table to give you an idea of what to look for:

| Company | Plan Type | Monthly Premium | Deductible | Co-pay | Out-of-Pocket Maximum |

|---|---|---|---|---|---|

| Anthem | Bronze | $250 | $5,000 | $20 | $6,000 |

| Aetna | Silver | $350 | $3,000 | $30 | $5,000 |

| Blue Cross Blue Shield | Gold | $450 | $1,000 | $40 | $4,000 |

Remember, these are just examples, and the actual prices and features of plans can vary depending on your individual needs and location. Don’t be afraid to ask questions and get clarification from the insurance companies. You want to make sure you’re getting the best deal possible.

Evaluating Coverage and Benefits

Choosing the right health insurance plan involves more than just picking the cheapest option. You need to understand the nitty-gritty details of coverage and benefits to ensure you’re getting the protection you need. This is where the real “choosing wisely” comes in, like picking the perfect power move in a video game.

Understanding Coverage Limits, Deductibles, and Co-pays

It’s like navigating the world of “health insurance lingo.” You need to know what these terms mean to make an informed decision.

- Coverage Limits: These are the maximum amounts your insurance company will pay for specific services or treatments. It’s like a “health insurance cap” – think of it as the maximum amount you can spend on a single health service before you’re on your own.

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in. Think of it as your “health insurance entrance fee” – the amount you have to pay before your insurance starts paying for your healthcare.

- Co-pays: These are fixed amounts you pay for specific services, like doctor’s visits or prescriptions. Imagine it like your “health insurance tip” – a small amount you pay for each service you use.

These terms are important because they directly affect how much you’ll pay for your healthcare. Think of it like a “health insurance budget” – you need to know how much you’ll be spending before you sign up.

Different Types of Benefits Offered

Insurance plans offer a variety of benefits, like a “health insurance buffet.” Here are some of the key benefits to consider:

- Preventive Care: This includes things like check-ups, screenings, and vaccinations. Think of it as your “health insurance preventative care” – keeping you healthy before things get serious.

- Prescription Drugs: This covers the cost of prescription medications. Think of it as your “health insurance medicine cabinet” – ensuring you have access to the drugs you need.

- Hospitalization: This covers the cost of inpatient care, including room and board, surgery, and other medical services. Think of it as your “health insurance safety net” – protecting you if you need to stay in the hospital.

It’s important to compare the benefits offered by different plans to see which ones best fit your needs. Think of it like “health insurance shopping” – you want to make sure you’re getting the best deal.

Comparing Coverage for Specific Health Conditions or Treatments

If you have a specific health condition or need regular treatment, you’ll want to make sure your plan covers it. Think of it like “health insurance customization” – you need a plan that fits your unique needs.

- Pre-existing Conditions: Some plans may have limitations on coverage for pre-existing conditions. It’s like a “health insurance pre-existing condition clause” – you need to make sure you’re covered for any health conditions you already have.

- Specific Treatments: Certain plans may have limitations on coverage for specific treatments, like surgery or therapy. Think of it like “health insurance treatment limits” – you need to make sure your plan covers the treatments you need.

You can use the insurance company’s website or contact them directly to get more information about coverage for specific conditions or treatments. Think of it as “health insurance research” – you need to do your homework to make sure you’re getting the right coverage.

Key Benefits and Coverage Details

To make it easier to compare plans, here’s a table summarizing the key benefits and coverage details of different health insurance plans:

| Plan Type | Deductible | Co-pay | Coverage Limits | Benefits |

|---|---|---|---|---|

| High Deductible Health Plan (HDHP) | High | Low | High | Preventive care, prescription drugs, hospitalization |

| Preferred Provider Organization (PPO) | Moderate | Moderate | Moderate | Preventive care, prescription drugs, hospitalization, out-of-network coverage |

| Health Maintenance Organization (HMO) | Low | Low | Low | Preventive care, prescription drugs, hospitalization, limited out-of-network coverage |

Think of it like a “health insurance cheat sheet” – this table can help you quickly compare the key features of different plans.

Enrolling and Managing Your Plan

Once you’ve chosen the health insurance plan that’s right for you, it’s time to enroll and get your coverage rolling. This process might seem like navigating a maze, but with the right info, you’ll be cruising in no time.

Enrolling in Your Plan

To enroll in your chosen health insurance plan, you’ll need to provide some key information and documentation. Think of it like filling out an application for your health insurance “membership.” This usually involves providing personal details, employment information, and any relevant medical history.

Here’s a checklist of what you’ll typically need:

- Personal Information: Your name, address, date of birth, Social Security number, and contact information.

- Employment Information: If you’re getting coverage through your employer, you’ll need your employer’s name and contact information.

- Proof of Identity: This might include a driver’s license, passport, or other government-issued ID.

- Proof of Residency: A utility bill, bank statement, or lease agreement can be used to verify your address.

- Medical Information: You might be asked to provide information about your medical history, including any pre-existing conditions.

You’ll usually be able to enroll in your plan online, over the phone, or by mail. Some insurers might offer a combination of these options. Just make sure to read the enrollment materials carefully and ask any questions you have.

Accessing Your Benefits

Now that you’re enrolled, it’s time to reap the rewards of your health insurance plan. Your plan will provide you with a variety of benefits, such as coverage for doctor visits, hospital stays, prescription drugs, and more. To access these benefits, you’ll need to understand how your plan works.

Here are some key things to keep in mind:

- Network: Your health insurance plan will likely have a network of doctors, hospitals, and other healthcare providers that it covers. This means that you’ll generally get the best rates and coverage when you use providers within your network.

- Co-pays and Deductibles: Your plan might require you to pay a co-pay for certain services, such as doctor visits. You might also have a deductible, which is the amount you need to pay out-of-pocket before your insurance starts covering your costs.

- Pre-authorization: For certain procedures or treatments, you might need to get pre-authorization from your insurance company. This means getting their approval before you receive the service.

Managing Your Account

Once you’re enrolled, you’ll need to manage your health insurance account. This includes things like making payments, filing claims, and updating your personal information.

Here are some tips for keeping your account in tip-top shape:

- Set Up Automatic Payments: This can help you avoid late fees and ensure that your premiums are paid on time.

- Keep Your Contact Information Updated: Make sure your insurance company has your current address, phone number, and email address.

- Review Your Explanation of Benefits (EOB): After you receive medical services, you’ll get an EOB that explains what your insurance company paid and what you’re responsible for. Review this document carefully to make sure everything is accurate.

- File Claims Promptly: If you need to file a claim, do so as soon as possible. Most insurers have a time limit for filing claims, so don’t wait too long.

- Ask Questions: If you have any questions about your plan or how to manage your account, don’t hesitate to contact your insurance company. They’re there to help!

Checklist After Enrollment

Once you’ve enrolled in your health insurance plan, there are a few things you should do to ensure a smooth sailing experience:

- Read Your Plan Materials: Take some time to review your plan documents carefully. This will help you understand your coverage and benefits.

- Keep Your ID Card Handy: Your insurance ID card contains important information, such as your policy number and group number. Make sure to keep it in a safe place and carry it with you when you visit a doctor or hospital.

- Contact Your Doctor: If you have any health concerns, schedule an appointment with your doctor to discuss your healthcare needs.

- Keep Track of Your Coverage: Make sure you understand your plan’s coverage periods and renewal dates.

Wrap-Up

Choosing the right health insurance company is a journey, not a destination. It’s about finding the perfect balance between coverage, cost, and peace of mind. By taking the time to understand your needs, researching options, and comparing plans, you can make a smart and informed decision that will protect your health and financial well-being for years to come. Remember, knowledge is power, and armed with the right information, you can navigate the world of health insurance with confidence and clarity.

FAQ Overview

What if I have a pre-existing condition?

Don’t worry! The Affordable Care Act (ACA) protects individuals with pre-existing conditions from being denied coverage or charged higher premiums. Make sure to disclose your conditions to the insurance company during the application process.

How often can I change my health insurance plan?

You can usually change your health insurance plan during the annual open enrollment period, which typically runs from November 1st to January 15th. You may also be able to change your plan outside of open enrollment if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

What are some common health insurance terms I should know?

Some common terms include: Deductible (the amount you pay before your insurance kicks in), Co-pay (a fixed amount you pay for a service), Co-insurance (a percentage of the cost you pay after your deductible is met), and Premium (the monthly cost of your insurance plan).