- Understanding Florida’s Car Insurance Landscape

- Key Factors Affecting Car Insurance Premiums

- Finding Affordable Car Insurance Options

- Strategies for Reducing Insurance Costs

- Importance of Comprehensive Coverage

- Navigating the Insurance Claims Process

- Last Point

- FAQ: Whats The Cheapest Car Insurance In Florida

Whats the cheapest car insurance in florida – What’s the cheapest car insurance in Florida? It’s a question many Floridians ask themselves, especially considering the state’s unique insurance landscape. Florida’s high population density, frequent weather events, and a significant number of uninsured drivers all contribute to higher insurance premiums. Navigating the complexities of car insurance in Florida can feel overwhelming, but understanding the factors that influence costs and exploring available options can help you find the most affordable coverage.

To understand what factors contribute to car insurance costs, we need to delve into the different types of coverage required in Florida. Personal Injury Protection (PIP) is mandatory, covering medical expenses for yourself and passengers in the event of an accident. Property Damage Liability covers damage to another person’s vehicle or property, while Uninsured Motorist Coverage protects you if you’re hit by an uninsured driver.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique, shaped by a combination of factors that influence the cost of coverage. These factors include a high population density, frequent weather events, and a significant number of uninsured drivers.

Factors Influencing Car Insurance Costs in Florida

Florida’s high population density contributes to a higher risk of accidents, as more vehicles are on the road. This increases the likelihood of collisions, which in turn drives up insurance premiums. Additionally, Florida’s location on the Atlantic coast makes it susceptible to hurricanes and other natural disasters, which can lead to significant property damage and insurance claims. The state also has a high number of uninsured drivers, which increases the risk for insured drivers who may be involved in accidents with uninsured motorists. This risk is factored into insurance premiums, making them higher for insured drivers.

Required Car Insurance Coverage in Florida

Florida law mandates specific types of car insurance coverage for all drivers. These coverages are designed to protect drivers and their passengers in the event of an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of who caused the accident. Florida requires a minimum PIP coverage of $10,000.

- Property Damage Liability: This coverage protects the insured driver against financial losses resulting from damage to another person’s property caused by an accident. Florida requires a minimum property damage liability coverage of $10,000.

- Uninsured Motorist Coverage: This coverage protects the insured driver and passengers in the event of an accident caused by an uninsured or hit-and-run driver. Florida requires a minimum uninsured motorist coverage of $10,000 for bodily injury and $10,000 for property damage.

Key Factors Affecting Car Insurance Premiums

Your car insurance premium is a reflection of your individual risk profile, and several factors contribute to its calculation. Understanding these factors can empower you to make informed decisions that potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your insurance premiums. A clean driving record with no accidents or violations translates to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your premiums.

- Accidents: Every accident, regardless of fault, adds to your risk profile and increases premiums. The severity of the accident, such as property damage or injuries, also plays a role.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations signal a higher risk of future accidents. These violations often lead to increased premiums for several years.

- DUI/DWI Convictions: These convictions are considered extremely serious and result in significantly higher premiums, sometimes even making insurance unaffordable.

Tips for Improving Driving Record:

* Practice defensive driving techniques.

* Avoid speeding and other traffic violations.

* Maintain your vehicle regularly for optimal performance.

* Enroll in defensive driving courses to refresh your driving skills and potentially receive discounts.

Age

Insurance companies consider age a significant factor in determining premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to lack of experience and risk-taking behavior.

- Young Drivers: Higher premiums reflect the higher risk associated with younger drivers.

- Mature Drivers: Premiums tend to decrease with age, as older drivers often have a better driving record and are considered less risky.

Credit Score

While it may seem counterintuitive, your credit score can influence your car insurance premiums. Insurance companies use credit scores as a proxy for financial responsibility.

- Good Credit: A good credit score generally indicates a lower risk of filing claims, leading to lower premiums.

- Poor Credit: A poor credit score suggests a higher risk of filing claims, resulting in higher premiums.

Tips for Maintaining Good Credit:

* Pay bills on time.

* Keep credit utilization low.

* Avoid opening too many new credit accounts.

* Monitor your credit report regularly.

Vehicle Type, Whats the cheapest car insurance in florida

The type of vehicle you drive directly impacts your insurance premiums. Some vehicles are considered riskier to insure due to factors like safety features, performance, and theft susceptibility.

- High-Performance Vehicles: Sports cars and luxury vehicles are often associated with higher speeds and accidents, resulting in higher premiums.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and electronic stability control often receive discounts.

- Theft Risk: Vehicles prone to theft, such as high-end models, are more expensive to insure due to the potential for claims.

Location

Where you live also plays a role in determining your car insurance premiums. Urban areas with higher population density and traffic congestion tend to have higher accident rates, leading to higher insurance costs.

- Urban Areas: Higher premiums reflect the increased risk of accidents in densely populated areas.

- Rural Areas: Lower premiums may be available in rural areas with lower accident rates and less traffic.

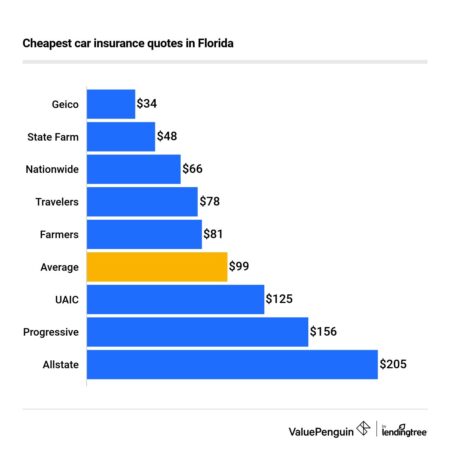

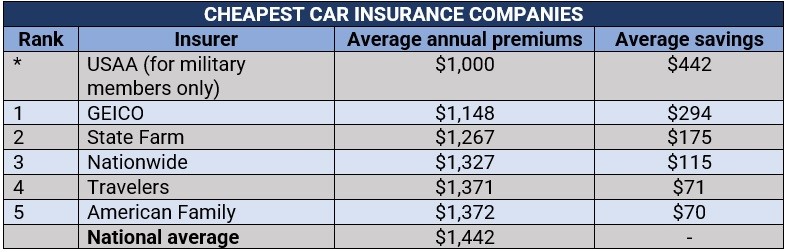

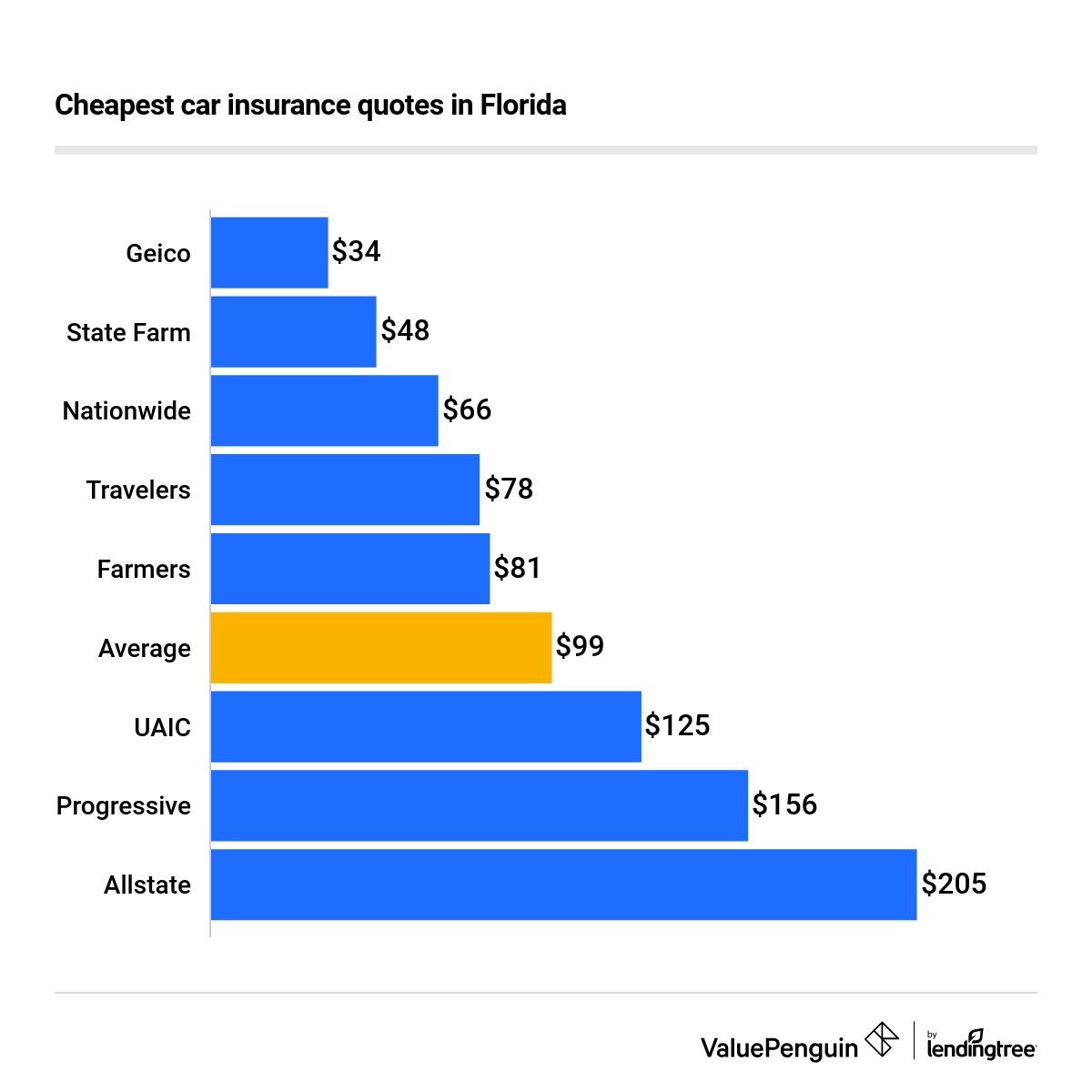

Finding Affordable Car Insurance Options

Once you understand the factors influencing your car insurance premiums, it’s time to explore the options available in Florida. This section delves into the most popular car insurance providers in the state, their key features, and average premium ranges. Additionally, it compares and contrasts the benefits and drawbacks of using online insurance brokers versus working directly with insurance companies.

Popular Car Insurance Providers in Florida

Understanding the various car insurance providers available in Florida is crucial to finding the best option for your needs. Here’s a table outlining some of the most popular providers, their key features, coverage options, and average premium ranges:

| Provider | Key Features | Coverage Options | Average Premium Range |

|---|---|---|---|

| State Farm | Wide coverage options, strong customer service, discounts for safe driving, bundling, and good student. | Liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), medical payments coverage (MedPay), and more. | $1,500 – $2,500 per year |

| Geico | Competitive rates, easy online quote process, 24/7 customer service, discounts for good drivers, bundling, and military service. | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, MedPay, and more. | $1,300 – $2,300 per year |

| Progressive | Wide range of coverage options, personalized pricing, discounts for safe driving, bundling, and good student. | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, MedPay, and more. | $1,400 – $2,400 per year |

| Allstate | Strong customer service, discounts for safe driving, bundling, and good student. | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, MedPay, and more. | $1,600 – $2,600 per year |

| USAA | Exclusive to military members and their families, excellent customer service, discounts for safe driving, bundling, and military service. | Liability, collision, comprehensive, uninsured/underinsured motorist, PIP, MedPay, and more. | $1,200 – $2,200 per year |

Comparing Online Brokers and Insurance Companies

When searching for car insurance, you can either work directly with an insurance company or utilize an online insurance broker. Both approaches have their advantages and disadvantages.

Online Insurance Brokers

- Pros:

- Convenience: Online brokers allow you to compare quotes from multiple insurance companies in one place, saving time and effort.

- Wider Selection: They often have access to a broader range of insurance providers, giving you more options to choose from.

- Potential for Lower Premiums: By comparing quotes from multiple providers, you may find a more competitive rate than you would get by working directly with a single company.

- Cons:

- Limited Personalization: Online brokers may not be able to tailor your policy to your specific needs as effectively as an insurance agent.

- Potential for Confusion: Comparing quotes from multiple providers can be overwhelming, and it may be challenging to understand the nuances of each policy.

- Limited Customer Service: Online brokers may not offer the same level of personalized customer service as a traditional insurance agent.

Insurance Companies

- Pros:

- Personalized Service: Insurance agents can provide personalized advice and help you understand your coverage options.

- Stronger Relationships: Working directly with an insurance company can lead to a stronger relationship, making it easier to resolve issues or adjust your policy in the future.

- More Comprehensive Coverage: Some insurance companies may offer more comprehensive coverage options than online brokers.

- Cons:

- Limited Options: You are limited to the coverage options offered by that specific company.

- Less Convenient: You may need to schedule an appointment or visit an office to get a quote or make changes to your policy.

- Potentially Higher Premiums: You may not get the most competitive rate if you don’t compare quotes from multiple providers.

Strategies for Reducing Insurance Costs

In Florida, where car insurance premiums can be significantly higher than in other states, finding ways to lower your costs is crucial. Several strategies can help you save money on your car insurance premiums, from making simple adjustments to your driving habits to exploring various discounts offered by insurance companies.

Increasing Your Deductible

A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lead to lower premiums. This is because you’re essentially taking on more risk, which insurers reward with lower rates. When deciding on a deductible, consider your financial situation and how much you can afford to pay in the event of an accident.

Bundling Insurance Policies

Insurance companies often offer discounts for bundling multiple policies, such as your car insurance, homeowners insurance, and renters insurance. This is a straightforward way to save money, as insurance companies often offer discounts for having multiple policies with them.

Taking Advantage of Discounts

Insurance companies offer a wide range of discounts that can significantly reduce your premiums.

Common Car Insurance Discounts

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically those without accidents or traffic violations within a specific period.

- Safe Driver Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and qualify you for a discount.

- Multi-Car Discount: Insuring multiple vehicles with the same company often results in a discount on your premiums.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can deter theft and earn you a discount.

- Good Student Discount: Students with good grades may qualify for a discount, reflecting their responsible nature.

- Loyalty Discount: Insurers often reward long-term customers with discounts for their continued business.

- Payment Discount: Paying your premiums in full or opting for automatic payments may qualify you for a discount.

- Military Discount: Active military personnel and veterans may be eligible for discounts.

- Occupation Discount: Certain professions, like teachers or nurses, may qualify for discounts.

Importance of Comprehensive Coverage

Comprehensive coverage is an essential component of car insurance in Florida, offering protection against a wide range of unforeseen events that could significantly impact your finances. This coverage goes beyond the standard liability coverage, safeguarding you against financial burdens arising from incidents like theft, vandalism, and natural disasters.

While Florida is known for its sunshine and beaches, it also experiences its share of severe weather events, particularly hurricanes. The potential for these events makes comprehensive coverage even more critical in this state.

Financial Implications of Driving Without Comprehensive Coverage

Driving without comprehensive coverage in Florida can expose you to substantial financial risks, particularly in the face of natural disasters. Here are some potential financial implications:

- Hurricane Damage: A hurricane can cause extensive damage to your vehicle, even if it’s parked in your garage. Without comprehensive coverage, you’ll be responsible for the entire repair cost, which can be significant. For example, a hurricane can cause flooding, wind damage, or debris impact, leading to costly repairs or even a total loss of your vehicle.

- Theft and Vandalism: Florida is prone to vehicle theft and vandalism. Without comprehensive coverage, you’ll be responsible for replacing your vehicle or paying for repairs if it’s stolen or vandalized. This can be a significant financial burden, especially if you’re unable to afford a replacement vehicle.

- Other Natural Disasters: Florida is also susceptible to other natural disasters, such as tornadoes, floods, and wildfires. These events can cause damage to your vehicle, leaving you financially responsible for repairs or replacement without comprehensive coverage.

Navigating the Insurance Claims Process

Filing a car insurance claim in Florida can be a stressful experience, but understanding the process and having the necessary documentation can make it smoother. This section will guide you through the steps involved and provide tips for ensuring a successful claim.

Understanding Your Policy

It’s crucial to understand your car insurance policy before you need to file a claim. This includes knowing your coverage limits, deductibles, and any exclusions. Carefully review your policy documents and contact your insurance agent if you have any questions.

Reporting the Accident

After an accident, the first step is to report it to your insurance company. This should be done as soon as possible, ideally within 24 hours of the incident. You can typically report an accident online, over the phone, or through your insurance company’s mobile app.

Gathering Information

After reporting the accident, you need to gather the following information:

- The names, addresses, and contact information of all parties involved in the accident.

- The license plate numbers and insurance information of all vehicles involved.

- A description of the accident, including the date, time, and location.

- Details of any injuries sustained.

- Photographs or videos of the accident scene and any damage to your vehicle.

Filing a Claim

Once you have gathered the necessary information, you can file a claim with your insurance company. This can usually be done online, over the phone, or in person.

Working with Your Insurance Company

After filing your claim, you will be assigned a claims adjuster who will investigate the accident and determine the amount of coverage you are entitled to. It’s important to cooperate with your insurance company and provide them with all the necessary information.

Negotiating a Settlement

If you disagree with the amount of coverage offered by your insurance company, you have the right to negotiate a settlement. You can consult with an attorney or an independent insurance adjuster to help you with this process.

Understanding Your Rights

It’s important to understand your rights as a policyholder in Florida. The Florida Department of Financial Services (DFS) has a website with information about car insurance claims and your rights as a consumer.

“Policyholders have the right to file a claim with their insurance company and to receive fair and prompt payment for covered losses.” – Florida Department of Financial Services

Last Point

Finding the cheapest car insurance in Florida involves a combination of understanding your needs, exploring various options, and implementing strategies to reduce your premiums. Remember, while affordability is essential, don’t compromise on coverage. Ensure you have adequate protection against potential risks, especially considering Florida’s vulnerability to hurricanes and other natural disasters. By taking a proactive approach and comparing options, you can secure affordable car insurance that provides peace of mind on the road.

FAQ: Whats The Cheapest Car Insurance In Florida

What are some common discounts offered by car insurance companies in Florida?

Insurance companies in Florida offer a variety of discounts, including good driver discounts, safe driver courses, multi-car discounts, and discounts for anti-theft devices, safety features, and good student records.

How can I improve my driving record to potentially lower my insurance premiums?

Avoid traffic violations, such as speeding tickets and reckless driving. Maintain a clean driving record by following traffic laws and driving defensively. Consider taking a defensive driving course to enhance your driving skills and potentially earn a discount.

Is it cheaper to buy car insurance online or through an insurance agent?

Online insurance brokers often offer competitive rates and convenience, while working directly with insurance companies can provide personalized service and tailored coverage options. It’s recommended to compare quotes from both online and traditional sources to find the best deal.