- Understanding Florida Car Insurance Requirements

- Factors Influencing Car Insurance Costs in Florida: What’s The Cheapest Car Insurance In Florida

- Exploring Affordable Car Insurance Options in Florida

- Tips for Lowering Car Insurance Costs in Florida

- Understanding Florida’s No-Fault Insurance System

- Closure

- Detailed FAQs

What’s the cheapest car insurance in Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance in Florida can feel like a maze, especially when you’re on a budget. With its unique no-fault system and a plethora of insurance providers, finding the most affordable option can be a challenge. This guide delves into the intricacies of Florida car insurance, exploring the factors that influence costs, highlighting affordable options, and providing practical tips for lowering your premiums.

From understanding mandatory coverage requirements to exploring available discounts, we’ll guide you through the process of securing the best car insurance deal in the Sunshine State. Whether you’re a new driver, a seasoned motorist, or simply looking for ways to save money, this comprehensive guide will equip you with the knowledge you need to make informed decisions about your car insurance.

Understanding Florida Car Insurance Requirements

Florida is known for its unique car insurance laws, which are designed to protect both drivers and pedestrians. Understanding these requirements is crucial to ensure you are adequately covered in case of an accident.

Mandatory Coverage Requirements in Florida

Florida law requires all drivers to carry a minimum amount of car insurance coverage. This mandatory coverage includes Personal Injury Protection (PIP) and Property Damage Liability (PDL). These coverages provide financial protection in the event of an accident, ensuring you can cover medical expenses and repair or replace damaged property.

Personal Injury Protection (PIP) Coverage

PIP coverage is a no-fault insurance benefit that pays for your medical expenses, lost wages, and other related costs following an accident, regardless of who is at fault. This coverage applies to you, your passengers, and even pedestrians injured in an accident involving your vehicle. It is crucial to understand the implications of PIP coverage in Florida.

- Coverage Limits: Florida law mandates a minimum PIP coverage limit of $10,000 per person. This means that PIP will pay up to $10,000 for your medical expenses and lost wages following an accident. However, you can choose to purchase higher coverage limits if you desire more financial protection. Higher limits provide more financial security in case of serious injuries or extended recovery periods.

- 80/20 Rule: Florida’s 80/20 rule dictates that PIP coverage pays 80% of your medical expenses, while you are responsible for the remaining 20%. This rule applies to most medical expenses, including doctor visits, hospital stays, and physical therapy. It is essential to understand this rule and budget accordingly, as you will be responsible for a portion of your medical costs. This rule can be waived with a higher premium, allowing PIP to cover 100% of your medical expenses.

- PIP Coverage for Passengers: PIP coverage extends to passengers in your vehicle, providing them with similar benefits for their medical expenses and lost wages. The 80/20 rule applies to passengers as well, with PIP covering 80% of their medical costs. This coverage ensures that your passengers are financially protected in the event of an accident, regardless of fault.

Property Damage Liability (PDL) Coverage

PDL coverage protects you financially if you cause damage to another person’s property in an accident. This coverage helps pay for repairs or replacement of the other driver’s vehicle, as well as any other property damage you might cause. Understanding the purpose of PDL coverage is crucial for responsible driving.

- Minimum Coverage: Florida law requires a minimum PDL coverage limit of $10,000. This means that your insurance company will pay up to $10,000 to cover the other driver’s property damage if you are at fault in an accident. However, you can choose to purchase higher PDL limits for greater financial protection. Higher limits offer more financial security in case of significant property damage, ensuring you are adequately covered.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): While PDL covers damage to the other driver’s vehicle, it does not cover your own vehicle if the other driver is uninsured or underinsured. In such situations, you would need to rely on UM/UIM coverage. This coverage protects you if you are involved in an accident with a driver who has insufficient or no insurance. It is crucial to consider adding UM/UIM coverage to your policy to ensure you are adequately protected in such scenarios. This coverage is not mandatory in Florida, but highly recommended.

Factors Influencing Car Insurance Costs in Florida: What’s The Cheapest Car Insurance In Florida

Several factors determine the cost of car insurance in Florida. Insurance companies use a complex algorithm to calculate premiums, considering various aspects of the policyholder and their vehicle. Understanding these factors can help you find the most affordable coverage for your needs.

Driving History

Your driving history is a significant factor in determining your car insurance premiums. A clean driving record with no accidents or violations can lead to lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely result in higher premiums.

Insurance companies view a clean driving record as a sign of responsible driving habits, reducing the risk of future claims.

Credit Score

In Florida, your credit score can also influence your car insurance rates. This practice is legal in many states, and insurance companies argue that a good credit score often correlates with responsible financial behavior, which may translate to responsible driving.

A higher credit score can lead to lower insurance premiums, while a lower score may result in higher rates.

Age

Age is another significant factor in determining car insurance rates. Younger drivers, particularly those under 25, generally have higher premiums due to their higher risk of accidents. As drivers gain experience and age, their rates typically decrease.

Insurance companies consider younger drivers less experienced and therefore more prone to accidents.

Gender

Historically, insurance companies have considered gender when calculating rates, with men often paying higher premiums than women. However, this practice is becoming increasingly regulated, and some states have banned gender-based pricing altogether.

While gender may still be a factor in some cases, its influence is diminishing in many areas.

Vehicle Type

The type of vehicle you drive significantly impacts your car insurance premiums. High-performance cars, luxury vehicles, and SUVs tend to have higher rates due to their higher repair costs and potential for greater damage in accidents.

Sports cars and SUVs are often associated with higher accident rates, leading to higher insurance premiums.

Location

Your location in Florida also plays a role in determining your car insurance rates. Areas with higher crime rates or traffic congestion may have higher premiums due to the increased risk of accidents and theft.

Urban areas with high population density often have higher insurance rates due to increased traffic and risk of accidents.

Driving Habits, What’s the cheapest car insurance in florida

Your driving habits, such as the number of miles you drive annually and your commuting patterns, can influence your car insurance rates. Drivers who commute long distances or frequently drive in high-traffic areas may face higher premiums.

Insurance companies may offer discounts for drivers who maintain a low annual mileage or drive primarily in less congested areas.

Exploring Affordable Car Insurance Options in Florida

Navigating the world of car insurance in Florida can be daunting, especially when seeking the most affordable option. This section delves into the various types of car insurance policies available in Florida, compares their key features, and highlights popular insurance providers, emphasizing potential discounts.

Types of Car Insurance Policies in Florida

Understanding the different types of car insurance policies available is crucial for making informed decisions. Here’s a breakdown of the most common types:

- Liability Insurance: This is the most basic type of car insurance required by law in Florida. It covers damages to other people’s property and injuries caused by an accident for which you are at fault.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

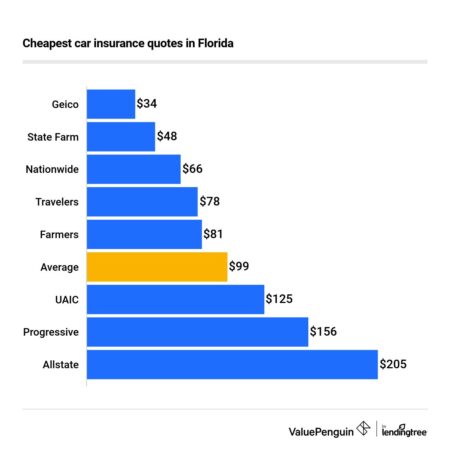

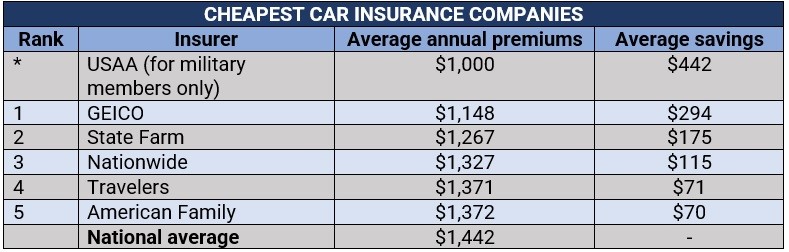

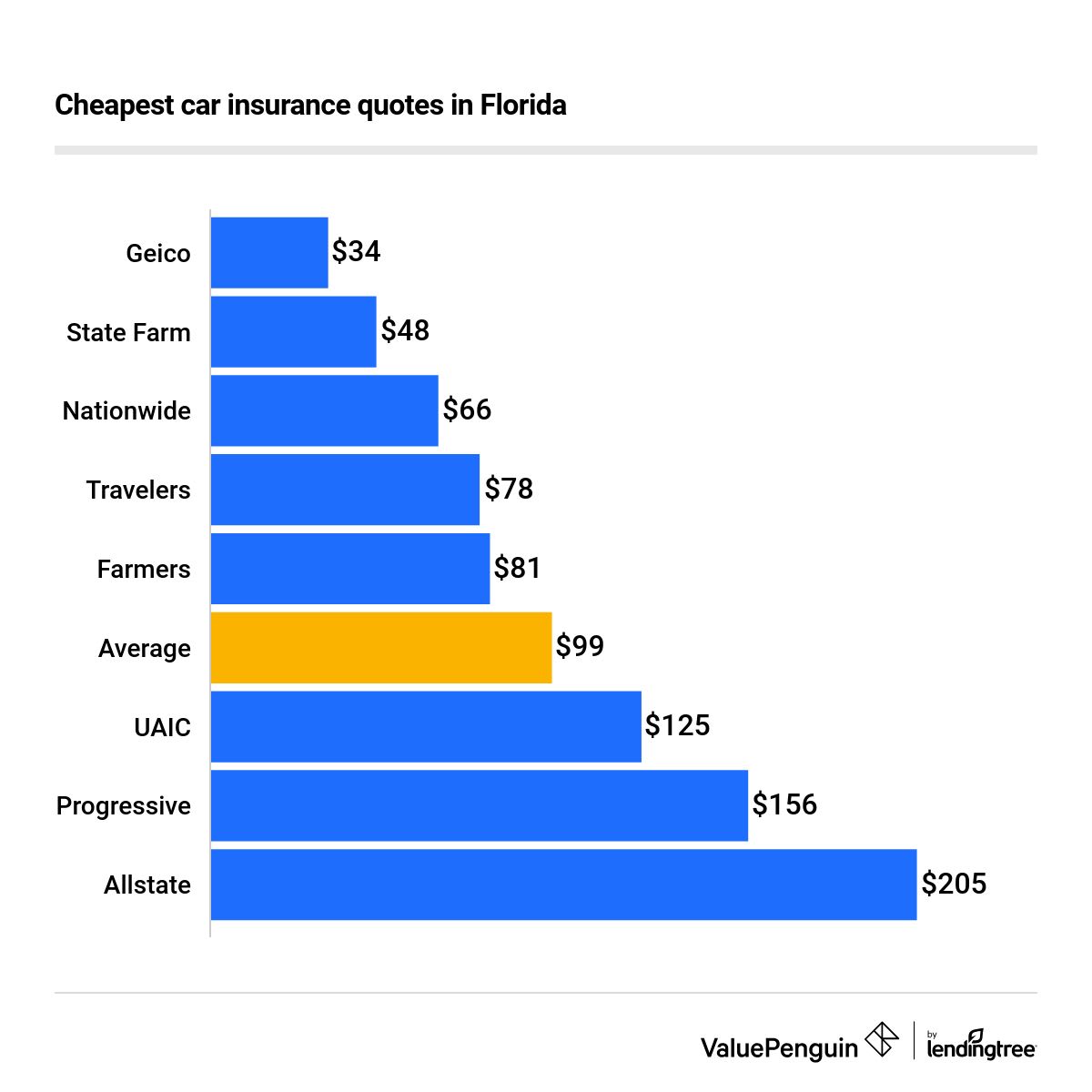

Popular Car Insurance Companies in Florida

Choosing the right car insurance company is crucial for securing affordable coverage. Here’s a table comparing some popular car insurance companies in Florida, highlighting their key features:

| Company | Key Features |

|---|---|

| State Farm | Wide range of coverage options, discounts, and strong customer service. |

| Geico | Known for its competitive pricing and convenient online tools. |

| Progressive | Offers a variety of discounts and flexible payment options. |

| USAA | Exclusive coverage for military members and their families. |

| Allstate | Provides comprehensive coverage options and a strong reputation. |

Potential Discounts Offered by Insurance Providers

Car insurance companies often offer various discounts to lower your premiums. Understanding these discounts can help you significantly reduce your overall costs. Here’s a list of common discounts:

- Good Driver Discount: This discount is typically awarded to drivers with a clean driving record.

- Safe Driver Discount: This discount is often offered to drivers who have completed a defensive driving course.

- Multi-Car Discount: This discount is available if you insure multiple vehicles with the same company.

- Multi-Policy Discount: This discount is offered if you bundle your car insurance with other insurance products, such as homeowners or renters insurance.

- Good Student Discount: This discount is available to students who maintain a certain GPA.

- Anti-theft Device Discount: This discount is offered to drivers who have installed anti-theft devices in their vehicles.

- Low Mileage Discount: This discount is available to drivers who drive fewer miles annually.

Tips for Lowering Car Insurance Costs in Florida

Finding affordable car insurance in Florida is essential, but it can feel like an uphill battle. Fortunately, several strategies can help you lower your premiums and keep your wallet happy. By understanding these strategies and implementing them effectively, you can significantly reduce your car insurance costs and save money.

Safe Driving Practices

Safe driving is not only essential for your own well-being but also plays a significant role in lowering your car insurance premiums. Insurance companies reward safe drivers with lower rates.

- Maintain a Clean Driving Record: A spotless driving record is your best friend when it comes to car insurance. Avoid traffic violations, such as speeding tickets, reckless driving, and DUI convictions, as these can significantly increase your premiums.

- Take Defensive Driving Courses: Enrolling in a defensive driving course demonstrates your commitment to safe driving and can earn you discounts. These courses teach you valuable techniques for avoiding accidents and navigating challenging driving situations.

- Avoid Distractions: Distracted driving is a major cause of accidents. Put your phone away, avoid eating while driving, and ensure passengers are not distracting you.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance kicks in. Increasing your deductible can lead to lower premiums.

- Understand the Trade-Off: A higher deductible means you pay more upfront in case of an accident, but your monthly premiums will be lower.

- Assess Your Risk Tolerance: Consider your financial situation and how much you can afford to pay out of pocket in case of an accident.

- Set Realistic Deductibles: Don’t increase your deductible to a level that would be financially burdensome if you need to make a claim.

Exploring Alternative Coverage Options

Sometimes, reducing your coverage can also reduce your premium.

- Evaluate Your Needs: Do you really need collision and comprehensive coverage for an older car? If your car has a low value, you might consider dropping these coverages, which can significantly lower your premiums.

- Consider Liability Coverage: Liability coverage is typically required by law and covers damages to others in case of an accident. You can adjust the limits to fit your needs and budget.

- Shop Around for Discounts: Many insurance companies offer discounts for good students, safe drivers, homeowners, and other factors.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- Combine Policies: Insurance companies often offer discounts for bundling multiple policies with them.

- Compare Quotes: Get quotes from different insurers to see which offers the best bundle discounts.

- Review Coverage: Make sure you understand the coverage included in your bundled policies and that it meets your needs.

Comparing Quotes

Shopping around for quotes from multiple insurers is crucial for finding the best rates.

- Use Online Comparison Tools: Many websites and apps allow you to compare quotes from various insurers quickly and easily.

- Contact Insurers Directly: Don’t hesitate to contact insurers directly to get personalized quotes and discuss your specific needs.

- Negotiate: Once you have quotes from multiple insurers, don’t be afraid to negotiate with them to see if you can get a better rate.

Understanding Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who caused it. This system aims to reduce lawsuits and expedite the claims process.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault system relies heavily on Personal Injury Protection (PIP) coverage, a mandatory component of car insurance policies. PIP coverage provides financial assistance to policyholders for medical expenses, lost wages, and other related costs following an accident.

- Medical Expenses: PIP covers up to 80% of reasonable and necessary medical expenses incurred within the first three years after an accident, with a maximum benefit of $10,000. This includes hospital bills, doctor’s visits, and other related medical treatments.

- Lost Wages: PIP coverage also provides compensation for lost wages, up to 80% of the insured’s average weekly earnings, with a maximum benefit of $2,000 per week. This helps cover income lost due to the inability to work after an accident.

- Other Expenses: In addition to medical expenses and lost wages, PIP coverage may also cover other related expenses, such as funeral costs, rehabilitation services, and essential household services.

Limitations and Exceptions of Florida’s No-Fault System

While Florida’s no-fault system simplifies the claims process, it also has certain limitations and exceptions.

- Threshold for Filing a Lawsuit: Florida law allows drivers to file a lawsuit against the at-fault driver only if they meet certain thresholds, such as exceeding the $10,000 PIP limit or suffering a serious injury, including death, permanent disability, or significant disfigurement.

- Limited Coverage for Pain and Suffering: PIP coverage does not typically cover pain and suffering, emotional distress, or other non-economic damages.

- “No-Fault” Doesn’t Mean “No Liability”: While PIP coverage handles your own expenses, the at-fault driver can still be held liable for damages beyond your PIP coverage limits.

Closure

Finding the cheapest car insurance in Florida requires a strategic approach. By understanding the intricacies of Florida’s insurance landscape, comparing quotes, and implementing smart strategies, you can significantly reduce your premiums. Remember, being informed is key to navigating this complex world and securing the best possible car insurance deal. So, take your time, explore your options, and drive with confidence knowing you’ve made the right choice for your needs and budget.

Detailed FAQs

What are the minimum car insurance requirements in Florida?

Florida requires all drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

Can I get car insurance without a credit check in Florida?

While some insurance companies may offer policies without a credit check, most use credit scores as a factor in determining your rates. It’s advisable to check with individual insurers to see their specific requirements.

What are some common discounts offered by Florida car insurance providers?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining auto and home insurance.