When does a company have to offer health insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Affordable Care Act (ACA), better known as Obamacare, throws down the gauntlet, mandating that companies with a certain number of employees must provide health insurance. This rule, like a star player on a championship team, is a game-changer for employees and employers alike. But, hold on to your hats, because the rules of the game are a bit complex. The size of the company, the cost of coverage, and the demographics of the workforce all play a role in the decision-making process. It’s a story of rules, regulations, and a dash of human resource strategy, all wrapped up in the American dream of healthcare.

The ACA’s employer mandate is like a set of guidelines, telling companies what they need to do to stay in the game. It’s a balancing act, juggling the needs of employees and the bottom line of the company. We’ll delve into the intricacies of the ACA, exploring the size thresholds that trigger the mandate and the penalties for those who don’t play by the rules. We’ll also examine the different types of health insurance plans available, like HMOs, PPOs, and EPOs, each with its own set of rules and benefits. It’s a journey through the world of health insurance, revealing the complexities and the possibilities for companies and their employees.

Legal Requirements for Offering Health Insurance

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the healthcare landscape in the United States, including the requirements for employers to offer health insurance to their employees. The ACA’s employer mandate Artikels specific obligations for businesses, ensuring that a certain portion of the workforce has access to affordable health coverage.

Employer Mandate Under the ACA

The ACA’s employer mandate requires certain employers to offer health insurance to their full-time employees. This mandate applies to businesses with 50 or more full-time equivalent (FTE) employees. An FTE is a measure that accounts for part-time employees, with one FTE representing the equivalent of one full-time employee. For example, two part-time employees working 20 hours each would equal one FTE.

Requirements for Offering Health Insurance

To comply with the ACA’s employer mandate, companies must meet several requirements:

- Offer health insurance coverage to at least 95% of their full-time employees. This means that a company must offer coverage to a significant portion of its workforce.

- The offered health insurance must meet minimum value standards. These standards ensure that the plans provide sufficient coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs.

- The employer must pay a minimum percentage of the employee’s premium. This percentage varies based on the size of the company and the average salary of its employees.

Penalties for Non-Compliance

Companies that fail to comply with the ACA’s employer mandate face penalties. These penalties are assessed based on the number of full-time employees who do not have access to affordable health insurance.

- Employer Shared Responsibility Payment: This penalty is assessed on a per-employee basis for each full-time employee who does not have access to affordable health insurance. The penalty amount varies based on the number of employees who are not offered coverage. For example, in 2023, the penalty is $2,880 per employee who is not offered coverage.

- Small Employer Penalty: This penalty applies to companies with 50-99 full-time employees who offer coverage but fail to meet the minimum value standards or the affordability requirements. The penalty is assessed on a per-employee basis and is calculated based on the number of employees who are not offered coverage that meets the minimum value and affordability standards.

Company Size and Health Insurance Offerings

The size of a company plays a significant role in determining the likelihood of offering health insurance and the types of plans available to employees. Larger companies, with more resources and a greater need to attract and retain talent, are more likely to offer comprehensive health insurance packages. In contrast, smaller companies may face budgetary constraints and administrative complexities that make offering health insurance less feasible.

Health Insurance Options by Company Size

The health insurance options offered by companies vary considerably depending on their size.

- Small Companies (Fewer than 50 Employees): Small companies often struggle to afford health insurance due to limited resources and administrative overhead. They may offer limited health insurance options, such as basic plans with high deductibles and co-pays, or may not offer health insurance at all. Some small businesses opt for alternative coverage solutions, such as individual health insurance plans or health savings accounts (HSAs).

- Medium Companies (50-200 Employees): Medium-sized companies are more likely to offer health insurance, but the plans may be less comprehensive than those offered by larger companies. They may offer a limited selection of plans, with varying levels of coverage and deductibles.

- Large Companies (Over 200 Employees): Large companies typically offer a wide range of health insurance options, including comprehensive plans with low deductibles and co-pays, as well as supplemental benefits like dental, vision, and disability coverage. They may also offer employer-sponsored retirement plans and other employee benefits.

Industry-Specific Trends in Health Insurance Offerings

The health insurance offerings of companies also vary significantly across industries.

- Technology Industry: Companies in the technology sector are known for offering generous health insurance benefits, often including comprehensive coverage, low deductibles, and a wide range of supplemental benefits. This is driven by the highly competitive nature of the industry and the need to attract and retain top talent.

- Healthcare Industry: Healthcare companies, especially those with large employee populations, often offer comprehensive health insurance plans with a focus on preventive care and wellness programs. They may also offer specialized benefits for healthcare professionals, such as malpractice insurance.

- Financial Services Industry: Financial services companies tend to offer competitive health insurance packages, including a variety of plans with different levels of coverage and deductibles. They may also offer employee assistance programs (EAPs) and other benefits to support employee well-being.

Factors Influencing Health Insurance Decisions: When Does A Company Have To Offer Health Insurance

Offering health insurance is a significant financial commitment for any company. It’s not just about ticking a box on the employee benefits list; it’s a strategic decision with far-reaching implications. Companies weigh various factors before deciding whether to offer health insurance and, if so, what type of plan to provide.

Cost

The cost of health insurance is a major factor in a company’s decision. Companies need to consider the premium costs, the potential for rising healthcare costs, and the impact on their bottom line. Smaller companies, in particular, might find the cost of offering health insurance to be a significant burden.

“The cost of healthcare is a major concern for many companies, especially small businesses. In fact, a 2023 study by the National Federation of Independent Business (NFIB) found that 45% of small businesses cited healthcare costs as their top concern.”

Employee Demographics

Companies also consider the demographics of their workforce when making health insurance decisions. Factors such as age, health status, and family size can all influence the cost of health insurance. For example, a company with a workforce that is predominantly young and healthy might be able to offer a less expensive plan than a company with a workforce that is older and has more health issues.

Industry Competition

The level of competition within an industry can also play a role in a company’s decision to offer health insurance. In industries where attracting and retaining top talent is critical, companies may be more likely to offer competitive health insurance plans to stand out from the competition. This is especially true in industries with a high turnover rate.

Advantages and Disadvantages of Offering Health Insurance

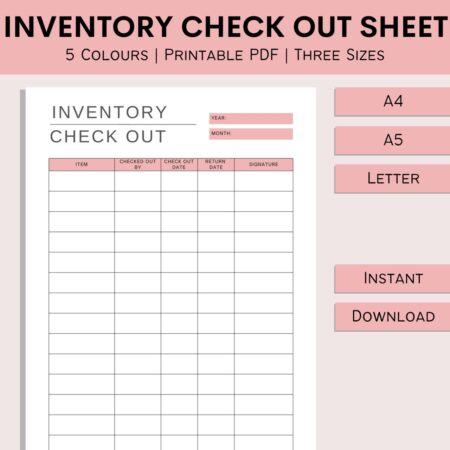

| Company Type | Advantages of Offering Health Insurance | Disadvantages of Offering Health Insurance |

|—|—|—|

| Small Business | * Increased employee satisfaction and loyalty * Improved employee health and productivity * Ability to attract and retain top talent * Tax benefits | * High costs * Administrative burden * Potential for rising healthcare costs |

| Large Corporation | * Increased employee satisfaction and loyalty * Improved employee health and productivity * Ability to attract and retain top talent * Tax benefits * Ability to negotiate lower premiums with insurers | * High costs * Administrative burden * Potential for rising healthcare costs |

| Non-Profit Organization | * Increased employee satisfaction and loyalty * Improved employee health and productivity * Ability to attract and retain top talent * Tax benefits * Ability to provide a valuable benefit to employees | * High costs * Administrative burden * Potential for rising healthcare costs * May need to rely on donations or grants to fund the program |

Employee Benefits and Health Insurance

Employee benefits are a critical part of attracting and retaining top talent in today’s competitive job market. Health insurance is a key component of a comprehensive benefits package, and its impact on employee well-being and overall satisfaction cannot be overstated.

The Relationship Between Health Insurance and Other Employee Benefits

Health insurance often goes hand-in-hand with other employee benefits, creating a holistic package that addresses various aspects of employee well-being.

- Retirement Plans: Offering both health insurance and retirement plans demonstrates a company’s commitment to employees’ long-term financial security and overall well-being. Employees are more likely to stay with companies that offer a comprehensive package, including both health insurance and retirement savings options.

- Paid Time Off: Paid time off, in conjunction with health insurance, helps employees maintain a healthy work-life balance. Employees can take time off for personal reasons, medical appointments, or simply to recharge, knowing that their health insurance coverage will continue.

- Other Benefits: Companies often offer a range of other benefits, such as disability insurance, life insurance, and employee assistance programs (EAPs), which complement health insurance and further contribute to employee well-being.

The Impact of Health Insurance on Employee Satisfaction, Retention, and Overall Well-being

Offering health insurance can significantly contribute to employee satisfaction, retention, and overall well-being.

- Employee Satisfaction: Health insurance is a major concern for many employees, and providing this benefit can boost satisfaction levels. Knowing that they have access to quality healthcare can reduce stress and anxiety, leading to a more positive work environment.

- Employee Retention: Offering health insurance can help companies retain valuable employees. Employees are more likely to stay with companies that provide comprehensive benefits, including health insurance.

- Employee Well-being: Health insurance can improve employees’ overall well-being. Access to healthcare allows employees to address health concerns proactively, preventing potential health issues from escalating and leading to missed work time or reduced productivity.

Benefits of Offering Health Insurance

Offering health insurance can benefit both employees and employers. Here’s a table summarizing the potential benefits:

| Benefit | Employees | Employers |

|---|---|---|

| Improved Health and Well-being | Access to quality healthcare, preventive care, and treatment for illnesses and injuries. | Reduced healthcare costs due to a healthier workforce, fewer sick days, and lower claims. |

| Increased Employee Satisfaction and Morale | Peace of mind knowing they have access to healthcare and financial protection. | Higher employee engagement, productivity, and loyalty. |

| Reduced Absenteeism and Turnover | Less time missed from work due to health issues. | Lower recruitment and training costs associated with employee turnover. |

| Enhanced Company Reputation and Attractiveness | Improved perception of the company as an employer of choice. | Easier to attract and retain top talent in a competitive job market. |

Trends in Health Insurance Offerings

The healthcare landscape is constantly evolving, and employers are adapting their health insurance offerings to meet the changing needs of their workforce. These trends are driven by factors such as rising healthcare costs, an increasingly diverse workforce, and a growing focus on employee well-being.

Telehealth

Telehealth, the delivery of healthcare services remotely using technology, has become increasingly popular in recent years. This trend is driven by several factors, including the convenience and accessibility of virtual care, the growing adoption of technology in healthcare, and the desire to reduce healthcare costs.

Many companies are now offering telehealth services as part of their health insurance plans. This can include virtual doctor visits, mental health counseling, and even prescription refills.

Telehealth has proven to be a valuable tool for employers to improve access to care, reduce healthcare costs, and enhance employee satisfaction.

Wellness Programs

Employers are increasingly investing in wellness programs to promote employee health and well-being. These programs can include a variety of initiatives, such as:

- Fitness center memberships

- On-site health screenings

- Nutritional counseling

- Smoking cessation programs

- Stress management workshops

Wellness programs have been shown to improve employee health, reduce healthcare costs, and boost productivity.

Flexible Benefit Options, When does a company have to offer health insurance

Flexible benefit options, also known as cafeteria plans, allow employees to choose from a variety of health insurance options and other benefits. This can include different levels of coverage, deductibles, and copayments.

Employers are increasingly offering flexible benefit options to give employees more control over their healthcare spending. This can help employees choose plans that best meet their individual needs and budgets.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. Employers often contribute to HSAs, and employees can make tax-deductible contributions.

HSAs are becoming increasingly popular, as they can help employees save money on healthcare costs and build up a nest egg for future medical expenses.

High-Deductible Health Plans (HDHPs)

HDHPs are health insurance plans with high deductibles and low premiums. They are often paired with HSAs, which can help offset the cost of the high deductible.

HDHPs have become more popular in recent years, as they can help employers control healthcare costs. However, it is important to note that HDHPs may not be suitable for everyone, as they can require employees to pay a significant amount out-of-pocket for healthcare services.

Value-Based Care

Value-based care is a healthcare delivery model that focuses on providing high-quality care at a lower cost. This model encourages providers to focus on preventive care, early detection, and patient education.

Employers are increasingly adopting value-based care models to improve the quality of care for their employees while controlling healthcare costs. This can involve partnering with providers who have a proven track record of delivering value-based care.

Data-Driven Decision-Making

Employers are using data to make more informed decisions about their health insurance offerings. This can include tracking healthcare utilization patterns, analyzing claims data, and identifying areas where they can improve their health insurance plans.

Data-driven decision-making can help employers tailor their health insurance offerings to the specific needs of their workforce.

Conclusion

The trends discussed above are transforming the landscape of health insurance in the workplace. Employers are embracing these trends to provide their employees with better access to healthcare, improve employee well-being, and control healthcare costs.

Closing Notes

So, as the final buzzer sounds on our journey through the world of company-provided health insurance, we’re left with a clear understanding of the rules of the game. The ACA’s employer mandate is a force to be reckoned with, impacting companies and employees alike. From the size of the company to the cost of coverage, there are many factors that influence the decision to offer health insurance. But, the bottom line is this: companies that offer health insurance are not just playing by the rules, they’re playing for a bigger prize – a healthier, happier, and more productive workforce. And, in the game of business, that’s a winning strategy.

Quick FAQs

What are the penalties for not offering health insurance?

Companies that don’t comply with the ACA’s employer mandate may face penalties in the form of fines. The amount of the penalty depends on the number of full-time equivalent employees and the number of employees who go without coverage.

Does a company have to offer the same health insurance plan to all employees?

No, companies can offer different health insurance plans to different groups of employees, such as full-time versus part-time employees.

Can a company offer health insurance to only a portion of its employees?

Yes, but the company must offer health insurance to at least 95% of its full-time equivalent employees. If the company offers health insurance to less than 95% of its employees, it may be subject to penalties.

How does the ACA affect small businesses?

The ACA provides tax credits to small businesses that offer health insurance to their employees. These tax credits can help offset the cost of providing health insurance.