Which auto insurance company is cheapest sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Finding the best auto insurance deal can feel like searching for a needle in a haystack, but don’t worry, we’re here to help you navigate this maze of premiums and coverage options. We’ll break down the key factors that influence auto insurance costs, compare quotes from top insurers, and explore ways to unlock hidden savings. Get ready to unlock the secrets of finding the cheapest auto insurance company, because you’re about to become a master of the insurance game!

From driving history and vehicle type to location and coverage options, there’s a whole world of factors that can impact your insurance rates. We’ll dive into these factors, showing you how to understand the ins and outs of auto insurance pricing. We’ll also uncover the role of credit score in determining your premium, a factor that might surprise you. This is your chance to learn how to play the insurance game and score the best deal possible.

Understanding Auto Insurance Pricing Factors: Which Auto Insurance Company Is Cheapest

Getting the best car insurance deal isn’t just about finding the cheapest company. It’s about understanding how the pricing works and what factors can make your premiums go up or down. Think of it like a game of car insurance bingo, where you can win by knowing how to play the game.

Factors That Influence Auto Insurance Costs, Which auto insurance company is cheapest

Auto insurance companies use a bunch of factors to calculate your rates, like your driving history, the car you drive, where you live, and the coverage you choose. Here’s a rundown of the key players in the pricing game:

- Driving History: If you’ve got a clean driving record, you’re in the clear. But if you’ve got tickets or accidents, your rates will likely go up. Think of it like a “driving report card” – the better your record, the better your rates.

- Vehicle Type: Sports cars and luxury vehicles are more expensive to repair, so they’ll cost more to insure. On the other hand, a reliable, basic car will typically have lower premiums. It’s like picking your team in a car insurance race – the pricier the car, the higher the stakes.

- Location: If you live in a big city with lots of traffic and accidents, your insurance rates will probably be higher than someone living in a rural area. It’s like playing car insurance in a high-stakes zone – the more risk, the higher the cost.

- Coverage Options: The more coverage you choose, the more you’ll pay. It’s like adding more layers of protection – the more layers, the higher the price.

Common Factors That Contribute to Higher Insurance Premiums

There are certain factors that can make your insurance rates skyrocket. It’s like hitting the “expensive” button on the car insurance machine.

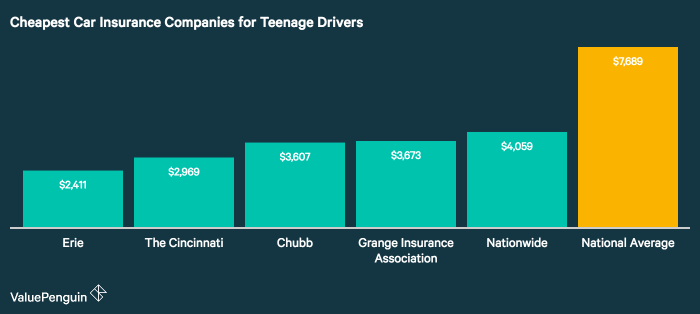

- Young Drivers: Insurance companies see young drivers as a higher risk, so they often charge higher premiums. It’s like being a “newbie” in the car insurance game – you gotta pay your dues.

- Poor Credit Score: Believe it or not, your credit score can impact your insurance rates. Insurance companies use it as a way to assess your financial responsibility. It’s like your “financial credit card” for car insurance – the better your score, the better your rates.

- Multiple Drivers: Having multiple drivers on your policy can increase your rates. It’s like having a “carpool” for your insurance – the more people, the higher the price.

- Driving a High-Performance Vehicle: If you drive a sports car or a luxury vehicle, you’ll likely pay higher premiums. It’s like having a “high-performance” car insurance tag – the more powerful the car, the higher the cost.

- Living in a High-Risk Area: If you live in a city with lots of traffic and accidents, your insurance rates will be higher. It’s like playing car insurance in a “high-risk” zone – the more danger, the higher the cost.

- Frequent Claims: If you file a lot of claims, your insurance rates will go up. It’s like having a “claim-happy” insurance record – the more claims, the higher the cost.

Last Recap

So, you’ve armed yourself with knowledge, compared quotes, and explored ways to save. Now, you’re ready to take control of your auto insurance and choose the policy that’s perfect for you. Remember, finding the cheapest auto insurance company isn’t just about the bottom line; it’s about getting the right coverage to protect yourself and your loved ones on the road. Armed with the insights from this guide, you’re ready to hit the road with confidence, knowing you’ve secured the best possible auto insurance protection at the most affordable price.

Query Resolution

What are some common discounts offered by auto insurance companies?

Auto insurance companies offer a variety of discounts, including safe driver discounts, good student discounts, multi-car discounts, and discounts for safety features like anti-theft devices.

How can I compare auto insurance quotes from different companies?

You can compare quotes from different companies by using online comparison websites or by contacting insurance companies directly. Be sure to provide accurate information about your vehicle, driving history, and coverage needs to ensure you get the most accurate quotes.

What is the role of credit score in auto insurance rates?

Credit score can play a role in determining auto insurance rates in some states. Insurers believe that people with good credit are more likely to be responsible drivers, so they may offer lower rates to those with good credit scores.

What is a deductible and how does it affect my premiums?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but you’ll pay more if you need to file a claim.