- Factors Influencing Car Insurance Costs

- Types of Car Insurance Coverage

- Choosing the Right Car Insurance Company

- Tips for Saving on Car Insurance

- Understanding Car Insurance Policies

- Filing a Car Insurance Claim

- Car Insurance Resources: Which Car Insurance Company Is Best

- Ending Remarks

- FAQ Compilation

Which car insurance company is best? That’s a question every driver asks themselves at some point. Navigating the world of car insurance can feel like a maze of confusing jargon and hidden fees. But don’t worry, we’re here to help you unlock the secrets of getting the best coverage at the best price. Think of it like a game of “Deal or No Deal” for your car, where you want to choose the right company to protect your ride from life’s little bumps (and big crashes!).

We’ll break down the key factors that influence car insurance costs, explore different coverage options, and reveal tips for saving money. We’ll also introduce you to some of the top-rated car insurance companies, helping you find the perfect match for your needs and budget. So buckle up, it’s time to hit the road and find the best car insurance deal out there!

Factors Influencing Car Insurance Costs

Car insurance is a necessity for most car owners, and the cost of premiums can vary significantly depending on several factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Driving History

Your driving history is one of the most significant factors influencing your car insurance costs. Insurance companies assess your risk based on your past driving record, and a clean driving record typically results in lower premiums. A history of accidents, traffic violations, or driving under the influence (DUI) can lead to higher premiums.

Vehicle Type

The type of vehicle you drive also plays a crucial role in determining your insurance premiums. Luxury cars, high-performance vehicles, and SUVs often have higher insurance costs due to their higher repair costs and increased risk of accidents.

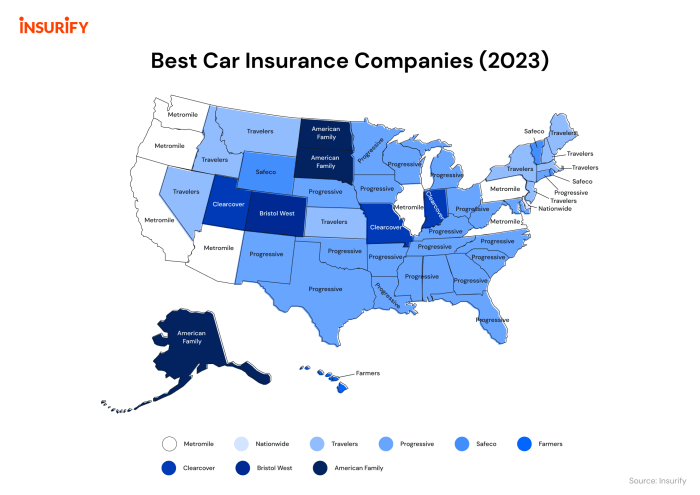

Location

The location where you live can also affect your car insurance premiums. Urban areas with high traffic density and crime rates tend to have higher insurance costs due to the increased risk of accidents and theft. Rural areas, with lower traffic and crime rates, may have lower premiums.

Age

Your age is another factor considered by insurance companies. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums typically decrease.

Average Insurance Premiums for Different Vehicle Types

Here’s a table comparing the average annual insurance premiums for different vehicle types:

| Vehicle Type | Average Annual Premium |

|—|—|

| Compact Car | $1,000 |

| Mid-Size Sedan | $1,200 |

| SUV | $1,500 |

| Truck | $1,800 |

| Luxury Car | $2,000 |

Note: These are just average premiums, and your actual premium will depend on your individual circumstances.

Types of Car Insurance Coverage

Car insurance is a necessity for most drivers. It provides financial protection in case of an accident or other incidents involving your vehicle. Understanding the different types of coverage is crucial to choosing the right policy for your needs and budget.

Liability Coverage

Liability coverage is the most basic type of car insurance. It protects you financially if you cause an accident that injures someone or damages their property. This coverage typically includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages for injuries you cause to others in an accident.

- Property Damage Liability: Covers repairs or replacement costs for damage you cause to another person’s vehicle or property.

Liability coverage is usually required by law, and the minimum amounts vary by state. It’s essential to have sufficient liability coverage to protect yourself from significant financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault. This coverage is optional but highly recommended, especially if you have a newer or financed vehicle.

Collision coverage will pay for repairs to your vehicle even if you are at fault for the accident.

However, there is usually a deductible, which is the amount you pay out of pocket before the insurance company covers the rest.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages from events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Natural disasters

- Animal collisions

Like collision coverage, comprehensive coverage is optional and has a deductible. It’s beneficial for protecting your vehicle from unexpected events that could cause significant damage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

This coverage can help pay for your medical expenses, lost wages, and vehicle repairs.

UM/UIM coverage is optional in most states, but it’s highly recommended to have it, as you never know when you might encounter an uninsured driver.

Coverage Options and Costs

Here’s a table showcasing common coverage options and their typical costs:

| Coverage Type | Typical Cost |

|---|---|

| Liability Coverage | $500-$1,000 per year |

| Collision Coverage | $200-$500 per year |

| Comprehensive Coverage | $100-$300 per year |

| Uninsured/Underinsured Motorist Coverage | $50-$150 per year |

Note: These costs are estimates and can vary significantly based on factors such as your driving record, age, location, vehicle type, and coverage limits.

Choosing the Right Car Insurance Company

So you’ve decided to get car insurance, but with so many companies out there, how do you choose the right one? It’s like trying to pick the perfect outfit for a big night out – you want something that fits your style, looks good, and won’t break the bank.

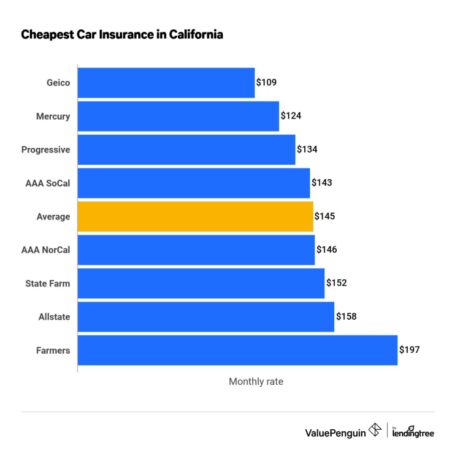

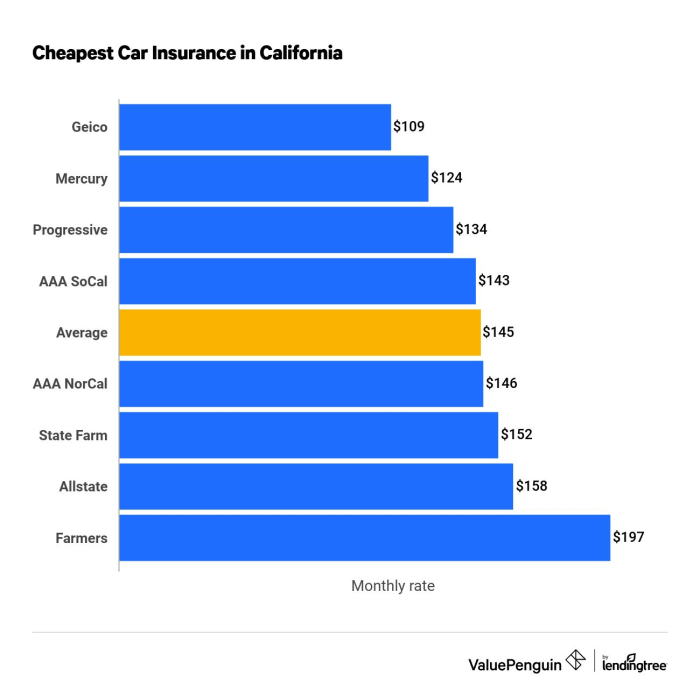

Comparing Features, Pricing, and Customer Service

To find your perfect insurance match, you need to compare apples to apples. Look at what each company offers in terms of coverage, pricing, and customer service. Think of it like a dating app, but for insurance – you’re swiping right on the features that matter most to you.

- Coverage: Do they offer the types of coverage you need? Think comprehensive, collision, liability, and uninsured/underinsured motorist coverage.

- Pricing: Get quotes from multiple companies to see who offers the best rates for your specific needs. Remember, the cheapest option isn’t always the best.

- Customer Service: Look for companies with a solid reputation for customer service. Check out online reviews and ratings to see how other customers have fared.

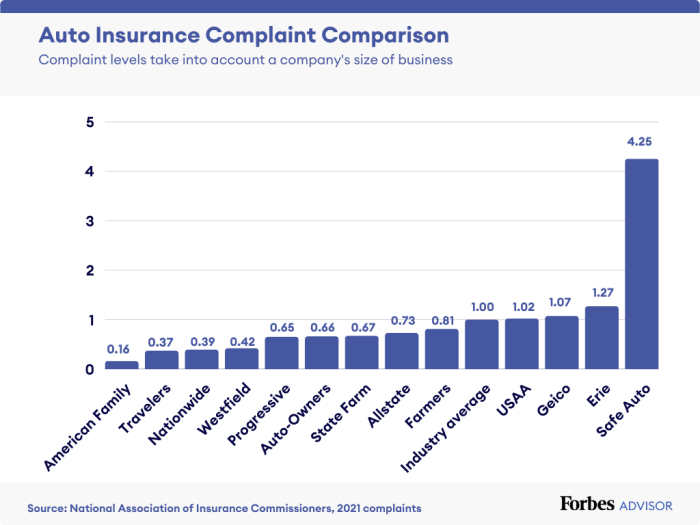

Evaluating Company Strengths and Weaknesses

Just like your favorite celebrity has their strengths and weaknesses, so do insurance companies. It’s important to understand what each company does well and where they might fall short.

- Financial Stability: A company’s financial strength is important, especially when you need to file a claim. Look for companies with high ratings from organizations like A.M. Best.

- Claims Handling: How easy is it to file a claim and get it processed? Read customer reviews to see how companies handle claims and how quickly they resolve issues.

- Customer Satisfaction: Check out customer satisfaction ratings from organizations like J.D. Power. These ratings can give you a good idea of how happy customers are with the company’s overall service.

Top-Rated Car Insurance Companies

Ready for the big reveal? Here’s a table comparing some of the top-rated car insurance companies based on factors like financial stability, claims handling, and customer satisfaction.

| Company | Financial Stability | Claims Handling | Customer Satisfaction |

|---|---|---|---|

| Geico | A+ (A.M. Best) | Excellent | High |

| State Farm | A+ (A.M. Best) | Very Good | High |

| Progressive | A+ (A.M. Best) | Good | Above Average |

| Allstate | A+ (A.M. Best) | Good | Above Average |

Tips for Saving on Car Insurance

Paying for car insurance is a necessity, but it doesn’t have to break the bank. With a little effort, you can significantly lower your premiums and keep more money in your pocket.

Maintaining a Good Driving Record

A clean driving record is your golden ticket to lower insurance rates. Insurance companies view drivers with a history of accidents or violations as higher risks, leading to higher premiums.

- Drive Safely: This might sound obvious, but it’s crucial. Avoid speeding, reckless driving, and distractions like texting while driving. Every time you get behind the wheel, remember you’re not just driving a car, you’re driving your insurance rates.

- Defensive Driving Course: Taking a defensive driving course can not only improve your driving skills but also earn you a discount on your insurance. Think of it as an investment in your driving and your wallet.

- Check Your Record: Regularly check your driving record for any errors. Mistakes happen, and it’s your responsibility to ensure your record is accurate.

Bundling Insurance Policies

Insurance companies love it when you’re a loyal customer. Bundling your car insurance with other policies, like homeowners or renters insurance, can often lead to significant discounts.

- One-Stop Shop: By bundling your policies, you’re essentially saying, “Hey, I’m a loyal customer and I trust you to protect all my stuff.” This can make you more attractive to insurance companies, leading to better rates.

- Comparison Shopping: Don’t just assume your current insurer offers the best bundled rates. Shop around and compare quotes from different companies to see if you can get a better deal.

Exploring Discounts

Insurance companies offer a wide range of discounts, some of which you might not even know about.

- Good Student Discount: If you’re a high-achieving student, your good grades could translate into a lower insurance premium. Think of it as a reward for your hard work in the classroom, but also a reminder to stay focused on your studies.

- Safe Driver Discount: This is a classic, and it’s well-deserved. If you have a clean driving record, you’re less likely to be involved in accidents, which translates to lower insurance rates.

- Anti-theft Device Discount: Installing anti-theft devices like alarms or GPS trackers can deter car theft and lower your insurance costs. It’s like a double win: you’re protecting your car and saving money.

- Multi-Car Discount: If you have multiple cars in your household, you might be eligible for a discount. Think of it as a “family discount” for your automotive family.

- Loyalty Discount: Staying with the same insurance company for a long time can sometimes earn you a loyalty discount. It’s like a thank-you for your commitment, and it can save you some serious cash.

Shopping Around for the Best Rates

Don’t settle for the first quote you get.

- Online Comparison Tools: Several websites allow you to compare quotes from multiple insurance companies in minutes. It’s like having a car insurance shopping spree, but without leaving your couch.

- Direct Quotes: Contact insurance companies directly to get personalized quotes. This allows you to ask specific questions and discuss your individual needs.

- Negotiate: Once you’ve found a good rate, don’t be afraid to negotiate. You might be surprised how much you can save with a little friendly persuasion.

Understanding Car Insurance Policies

It’s like a contract between you and your insurance company, outlining the coverage you’ll receive in case of an accident or other covered event. Think of it as a safety net, providing financial protection and peace of mind. But before you sign on the dotted line, it’s crucial to understand the terms and conditions of your policy.

Key Terms and Conditions

Car insurance policies are full of jargon, but don’t worry, we’re here to break it down. Understanding these terms is crucial to making informed decisions about your coverage:

- Premium: This is the amount you pay for your car insurance policy, typically on a monthly or annual basis. It’s like a membership fee for the protection your policy provides.

- Deductible: This is the amount you’re responsible for paying out-of-pocket in case of an accident or claim before your insurance kicks in. Think of it as a “co-pay” for your coverage. A higher deductible typically means a lower premium, but you’ll have to pay more out of pocket if you need to file a claim.

- Coverage Limits: These limits determine the maximum amount your insurance company will pay for a covered event, such as an accident or theft. It’s like a cap on the financial assistance you can receive.

- Exclusions: These are specific situations or events that your insurance policy doesn’t cover. It’s like a list of “no-go” zones where your policy won’t provide protection.

- Policy Period: This is the duration of your insurance coverage, typically a year. It’s like a subscription to your safety net.

Importance of Reading the Policy

Reading your policy might seem like a chore, but it’s a must. It’s like reading the fine print on a product you’re buying – you want to know exactly what you’re getting. Here’s why it’s important:

- Avoid surprises: You’ll be aware of what’s covered and what’s not, preventing any unexpected financial burdens in case of an accident.

- Understand your rights: You’ll know what to expect from your insurance company in case of a claim.

- Make informed decisions: You’ll be able to compare different policies and choose the one that best suits your needs and budget.

Common Policy Exclusions and Limitations

Not everything is covered by car insurance. There are specific exclusions and limitations to keep in mind. Think of them as “gray areas” where your policy might not provide full protection:

- Driving without a valid license: If you’re driving without a valid license, your insurance might not cover you. It’s like breaking the rules of the game, and your policy won’t protect you in that case.

- Driving under the influence: Driving under the influence of alcohol or drugs is illegal and can void your coverage. It’s like playing with fire – your policy won’t protect you from the consequences.

- Driving a car not listed on the policy: If you’re driving a car that isn’t listed on your policy, your insurance might not cover you. It’s like borrowing someone else’s safety net without their permission.

- Intentional damage: If you intentionally damage your car or cause an accident, your insurance won’t cover you. It’s like sabotaging your own safety net.

- Certain types of accidents: Some accidents, such as those caused by natural disasters or acts of war, might not be covered. It’s like being caught in a storm that’s beyond the scope of your safety net.

Filing a Car Insurance Claim

It’s a stressful situation, but it’s important to stay calm and organized when filing a car insurance claim. Your insurance company is there to help you navigate the process, and they’ll want to ensure you get back on the road as quickly and smoothly as possible.

Steps Involved in Filing a Car Insurance Claim

- Report the Accident to Your Insurance Company: The first step is to contact your insurance company and report the accident. You’ll need to provide them with the details of the accident, including the date, time, location, and any injuries involved. They’ll guide you through the next steps and provide you with a claim number.

- File a Claim: Your insurance company will provide you with the necessary forms to file a claim. Make sure to fill out the forms accurately and completely. Be sure to include all relevant information, such as the names and contact information of all parties involved, the damage to your vehicle, and any injuries you sustained. Remember, this is your opportunity to explain the details of the accident from your perspective.

- Cooperate with the Insurance Adjuster: After you file your claim, an insurance adjuster will be assigned to your case. The insurance adjuster will investigate the accident, assess the damage to your vehicle, and determine the amount of coverage you’re eligible for. They will likely ask you to provide additional documentation, such as police reports, medical bills, and repair estimates. Be honest and open with the adjuster and be sure to provide all the information they need to properly evaluate your claim.

- Negotiate a Settlement: Once the insurance adjuster has completed their investigation, they will make a settlement offer. You have the right to negotiate the settlement offer if you believe it is too low. Your insurance company will have your best interests in mind and want to ensure you are fairly compensated for your losses.

Documenting the Accident

- Take Photos and Videos: It’s crucial to document the accident scene as thoroughly as possible. Take pictures of the damage to your vehicle, the other vehicles involved, and the surrounding area, including any road signs, traffic lights, or other relevant details. A video can also be helpful to capture the scene from different angles and perspectives.

- Gather Information: Exchange contact and insurance information with the other drivers involved. If possible, get the names and contact information of any witnesses. Note the time and location of the accident, as well as any weather conditions.

- File a Police Report: If the accident involved injuries or significant damage, you should file a police report. This report will be helpful in documenting the accident and can be used to support your insurance claim.

The Claim Process and the Role of the Insurance Adjuster, Which car insurance company is best

- Understanding the Claim Process: The insurance claim process can be complex and time-consuming. Your insurance company will provide you with updates throughout the process, and you should be prepared to provide any necessary documentation or information.

- The Role of the Insurance Adjuster: The insurance adjuster is responsible for investigating the accident, assessing the damage, and determining the amount of coverage you are eligible for. They will work with you to gather information and documentation, and they will be your main point of contact throughout the claim process.

Car Insurance Resources: Which Car Insurance Company Is Best

You’re ready to dive into the world of car insurance, but you need a roadmap to navigate the ins and outs. Don’t worry, you’re not alone! This section is your guide to the best resources available to help you make informed decisions about your car insurance.

Government Agencies

Government agencies play a vital role in ensuring fair and transparent car insurance practices. They provide valuable information and resources for consumers, including:

- National Association of Insurance Commissioners (NAIC): The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry. It provides consumer information, including tips for finding the best car insurance rates and filing complaints.

- Your State Insurance Department: Each state has its own insurance department that regulates insurance companies and protects consumers. You can find contact information for your state’s insurance department on the NAIC website.

Consumer Protection Organizations

These organizations are dedicated to protecting consumers’ rights and providing information about car insurance:

- Consumer Reports: Consumer Reports provides unbiased reviews and ratings of car insurance companies, based on factors like customer satisfaction, claims handling, and financial stability.

- Better Business Bureau (BBB): The BBB provides information about businesses, including car insurance companies. You can check a company’s BBB rating to see if it has a history of complaints.

Industry Associations

Industry associations represent car insurance companies and advocate for their interests. They also provide valuable information about the industry:

- Insurance Information Institute (III): The III is a non-profit organization that provides information about insurance, including car insurance. It offers resources for consumers, such as tips for buying car insurance and understanding insurance policies.

- American Insurance Association (AIA): The AIA represents property and casualty insurance companies. It provides information about insurance issues, including car insurance.

Contacting Car Insurance Companies

Once you’ve gathered information about different car insurance companies, you’ll likely want to contact them directly to get quotes and ask questions. Here’s how to connect:

- Company Websites: Most car insurance companies have websites where you can get quotes, manage your policy, and find contact information.

- Phone Numbers: You can find phone numbers for car insurance companies on their websites or in online directories.

- Customer Service Representatives: Most car insurance companies have customer service representatives available by phone, email, or chat.

Helpful Resources

Here’s a table listing some of the best resources for car insurance-related questions and concerns:

| Resource | Description |

|---|---|

| NAIC | National Association of Insurance Commissioners: Provides consumer information and resources for insurance, including car insurance. |

| Your State Insurance Department | Regulates insurance companies and protects consumers in your state. |

| Consumer Reports | Provides unbiased reviews and ratings of car insurance companies. |

| Better Business Bureau (BBB) | Provides information about businesses, including car insurance companies. |

| Insurance Information Institute (III) | Non-profit organization that provides information about insurance, including car insurance. |

| American Insurance Association (AIA) | Represents property and casualty insurance companies and provides information about insurance issues. |

Ending Remarks

Choosing the right car insurance company is a big decision, but with the right information and a little bit of research, you can find a policy that fits your needs and budget perfectly. Remember, car insurance is about peace of mind, knowing you’re protected on the road. So, take your time, compare quotes, and don’t settle for anything less than the best! And remember, if you have any questions, don’t hesitate to reach out to an insurance expert for guidance.

FAQ Compilation

What are some common car insurance discounts?

There are many discounts available, including good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining car and home insurance. You can also get discounts for safety features like anti-theft devices or airbags.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or even more often if your driving habits or circumstances change. You might be eligible for new discounts or find that your current policy no longer meets your needs.

What should I do if I’m involved in an accident?

Stay calm, prioritize safety, and document the accident. Exchange information with the other driver(s) involved, take pictures of the damage, and contact your insurance company to report the accident as soon as possible.