- Factors to Consider When Choosing Car Insurance

- Key Coverage Types

- Understanding Deductibles and Premiums

- Discounts and Savings

- Customer Service and Claims Process

- Financial Stability and Reputation

- Comparing Quotes and Finding the Best Fit

- Final Wrap-Up

- Query Resolution: Which Car Insurance Company Is The Best

Which car insurance company is the best? It’s a question that every driver asks, but the answer isn’t one-size-fits-all. Finding the right car insurance company is a personal journey that involves understanding your needs, driving habits, and financial situation. From coverage types and deductibles to discounts and customer service, there are many factors to consider before making a decision.

Navigating the world of car insurance can feel like a maze, but with the right information and strategies, you can find a policy that fits your lifestyle and budget. This guide will explore key aspects of car insurance, providing you with the tools and knowledge to make an informed choice.

Factors to Consider When Choosing Car Insurance

Choosing the right car insurance is like finding the perfect pair of jeans: it’s all about fit. You want a policy that fits your needs, your driving habits, and your budget. It’s not a one-size-fits-all situation, so buckle up and let’s break down the key factors to consider.

Personal Needs and Driving Habits

Your personal needs and driving habits are the foundation of your car insurance search. Think of it like choosing a car: if you’re a city dweller who only commutes short distances, a compact car might be perfect. But if you’re a family of five who loves road trips, an SUV might be a better fit. Similarly, your insurance needs will depend on factors like:

- Your age and driving experience: Younger drivers, especially those with less experience, tend to pay higher premiums due to a higher risk of accidents. But, hey, everyone starts somewhere, right? As you gain experience, your premiums may decrease.

- Your driving history: If you have a clean driving record with no accidents or tickets, you’re likely to get a better rate. However, if you’ve had some bumps in the road (literally!), you might face higher premiums. But don’t despair! There are often ways to improve your driving record and potentially lower your rates.

- The type of car you drive: Sports cars and luxury vehicles are often considered riskier to insure than more basic models. This is because they tend to be more expensive to repair or replace. But, hey, at least you’ll be driving in style!

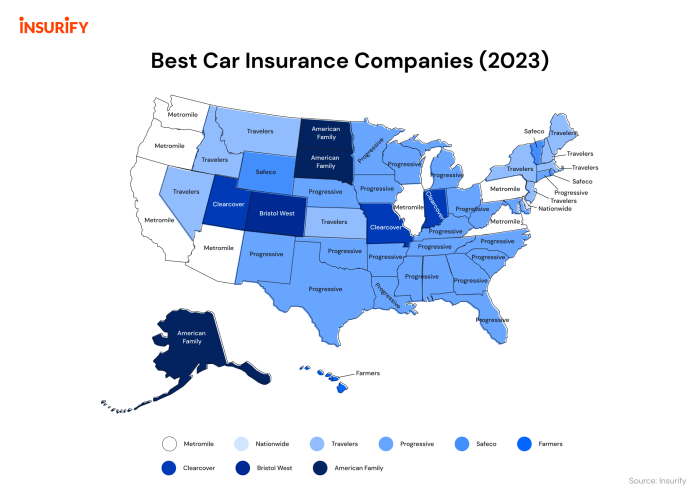

- Where you live: Insurance rates vary by location, with urban areas often having higher premiums due to increased traffic congestion and higher accident rates. Think of it as the price of living in the fast lane.

Comparing Quotes from Multiple Insurers

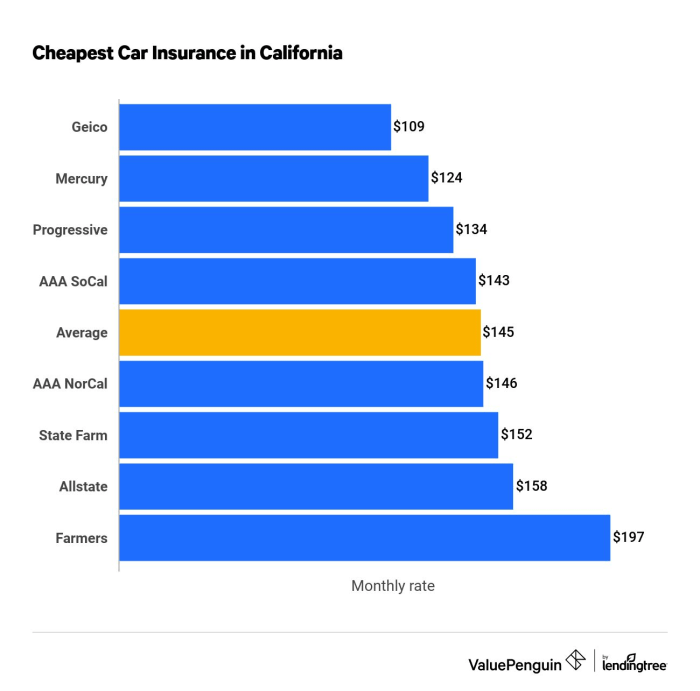

Don’t settle for the first quote you see. It’s like shopping for a new phone: you wouldn’t just grab the first one you find, right? Shop around and compare quotes from different insurers to find the best deal. You can use online comparison tools, contact insurers directly, or work with an insurance broker.

Factors to Consider When Comparing Quotes

Now that you know what to look for in a policy, it’s time to get down to the nitty-gritty details. Think of it as a checklist for your insurance search:

- Coverage Types:

- Liability Coverage: This is the most basic type of coverage and protects you if you cause an accident that injures someone or damages their property. It’s like having a safety net in case of an unexpected mishap.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of who’s at fault. It’s like having a backup plan for your car’s well-being.

- Comprehensive Coverage: This protects your car against damage from non-accident events, like theft, vandalism, or natural disasters. It’s like having peace of mind knowing your car is covered even when you’re not behind the wheel.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s like having an extra layer of protection in case someone else’s lack of insurance puts you at risk.

- Medical Payments Coverage: This covers your medical expenses if you’re injured in an accident, regardless of who’s at fault. It’s like having a safety net for your health.

- Deductibles: This is the amount you pay out of pocket before your insurance kicks in. A higher deductible means you pay less for your premium, but more in the event of a claim. It’s like a trade-off: you pay less upfront, but more in the event of an accident. A lower deductible means you pay more for your premium, but less in the event of a claim. It’s like having a little more financial cushion in case of an accident.

- Discounts: Many insurers offer discounts for things like good driving records, safety features, bundling multiple policies, and being a member of certain organizations. It’s like getting a little reward for being a responsible driver and a savvy consumer.

- Customer Service: Look for an insurer with a reputation for good customer service. You want to be able to easily contact them and get help when you need it. Think of it like having a friend in the insurance industry.

- Financial Stability: It’s important to choose an insurer that is financially sound and likely to be around when you need them. Think of it like choosing a bank: you want to be sure your money is safe and secure. You can check an insurer’s financial stability by looking at their ratings from agencies like AM Best.

Key Coverage Types

Car insurance isn’t just a legal requirement; it’s your financial safety net in case of an accident. Understanding the different types of coverage is crucial for choosing the right plan for your needs.

Liability Coverage

Liability coverage is the most important type of car insurance. It protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of:

- Medical expenses for the other driver and passengers.

- Property damage to the other driver’s vehicle and any other property involved.

- Legal fees and court costs if you are sued.

Liability coverage is expressed as a limit, typically in the form of a three-digit number, such as 100/300/100. This means that your insurance company will pay up to $100,000 per person for bodily injury, up to $300,000 per accident for bodily injury, and up to $100,000 for property damage.

The higher the limit, the more protection you have, but it also means higher premiums.

State minimum liability limits are usually the bare minimum and may not be enough to cover the costs of a serious accident.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your own vehicle from damage.

- Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive coverage covers damage to your vehicle from events other than accidents, such as theft, vandalism, fire, or natural disasters.

These coverages are optional, but they are highly recommended if you have a financed or leased vehicle. If you have an older vehicle with a low value, you may choose to forgo these coverages and only carry liability coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

UM/UIM coverage is essential because you never know if the other driver is insured or if their coverage is sufficient.

This coverage will pay for your medical expenses, lost wages, and property damage if you are injured by an uninsured or underinsured motorist.

Optional Coverage Options

In addition to the standard coverage types, there are several optional coverages that you can add to your policy.

- Rental car reimbursement: Covers the cost of renting a car while your vehicle is being repaired.

- Roadside assistance: Provides assistance with services such as towing, flat tire changes, and jump starts.

- Gap insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled.

These optional coverages can provide extra peace of mind and financial protection, but they will increase your premiums.

Understanding Deductibles and Premiums

Think of your car insurance as a safety net, but it’s not free. You pay a monthly premium for that protection, and you also have to agree to pay a deductible if you have to make a claim. Understanding the relationship between deductibles and premiums is crucial for finding the right car insurance plan for your needs and budget.

Deductible and Premium Relationship

Your deductible is the amount you pay out of pocket before your insurance kicks in. The higher your deductible, the lower your premium will be. This is because you’re essentially taking on more risk, and the insurance company is willing to offer you a lower rate in return.

Here’s a simple way to visualize this:

Higher Deductible = Lower Premium

Lower Deductible = Higher Premium

Let’s say you have a $500 deductible and get into an accident that costs $2,000 to repair. You’ll pay the first $500, and your insurance company will cover the remaining $1,500. If you had a $1,000 deductible, you’d pay more upfront, but your monthly premium would be lower.

Factors Influencing Deductibles and Premiums

Several factors influence the relationship between your deductible and premium, including:

- Your driving history: A clean driving record with no accidents or tickets will generally lead to lower premiums. This is because insurance companies see you as a lower risk.

- Your age and gender: Younger drivers are statistically more likely to be involved in accidents, so they often pay higher premiums. Similarly, gender can also play a role in insurance rates, though this is becoming less common.

- Your location: Insurance rates are often higher in urban areas where there’s more traffic and a higher risk of accidents.

- The type of car you drive: More expensive cars are generally more expensive to insure because repairs are more costly.

Choosing the Right Balance

Finding the right balance between your deductible and premium depends on your individual circumstances and risk tolerance. If you’re comfortable taking on more risk, you can choose a higher deductible and enjoy lower premiums. However, if you want the most financial protection, you might opt for a lower deductible, even if it means paying a higher premium.

Here are some tips for choosing the right balance:

- Consider your financial situation: If you’re on a tight budget, you might want to choose a higher deductible to save money on premiums. However, make sure you can afford to pay the deductible if you need to file a claim.

- Think about your risk tolerance: How comfortable are you with taking on risk? If you’re risk-averse, you might want to choose a lower deductible to minimize your out-of-pocket costs.

- Compare quotes from different insurance companies: Don’t settle for the first quote you get. Shop around and compare rates from several different insurers to find the best deal.

Discounts and Savings

You’ve done your research, compared quotes, and are ready to choose the right car insurance policy. But before you hit that “purchase” button, let’s talk about how to score some sweet discounts and save some serious cash.

Insurance companies are all about the Benjamins, and they love to reward good behavior. That’s where discounts come in – they’re like secret weapons to help you pay less for the same great coverage.

Discounts Available

Discounts can significantly reduce your premium, and knowing which ones you qualify for can be a game-changer. Here’s a breakdown of common discounts:

- Safe Driver Discount: If you’ve got a clean driving record, you’re a rockstar in the insurance world. Companies love drivers who haven’t been in any fender benders, so you can expect a hefty discount for your driving prowess.

- Good Student Discount: Brains over brawn! If you’re crushing it in school with good grades, insurance companies recognize your commitment to excellence and reward you with a discount.

- Multi-Car Discount: Have multiple vehicles in your household? Insurance companies are all about family love and offer a discount when you insure multiple cars under the same policy. It’s like a “buy one, get one half off” deal, but for your insurance!

- Multi-Policy Discount: Bundle your insurance policies like a pro. Insurance companies love when you combine your car insurance with other policies, like homeowners or renters insurance. It’s like a loyalty program, and you get a discount for being a good customer.

- Anti-theft Device Discount: Installing an anti-theft device in your car is like adding an extra layer of security. Insurance companies appreciate the extra effort you’re making to keep your car safe and reward you with a discount.

- Loyalty Discount: Sticking with the same insurance company for years? They recognize your commitment and may reward you with a loyalty discount.

Qualifying for Discounts, Which car insurance company is the best

It’s like unlocking a secret level in a video game – you need to meet certain criteria to unlock these awesome discounts. Here’s how you can qualify:

- Provide Proof: Be ready to show your insurance company your good driving record, student transcripts, or any other documents they may require to verify your eligibility for a discount.

- Contact Your Insurance Company: Don’t be shy! Contact your insurance company and ask about the discounts you qualify for. They’re the experts, and they can guide you through the process.

- Be Proactive: Don’t wait for them to reach out – be proactive and ask about discounts! You could be missing out on some serious savings.

Maximizing Savings

Saving money is like a marathon – you need to strategize and stay focused. Here are some tips to maximize your savings:

- Shop Around: Don’t settle for the first quote you get. Compare quotes from different insurance companies to find the best deals.

- Bundle Your Policies: Combine your car insurance with other policies, like homeowners or renters insurance, to unlock the power of multi-policy discounts.

- Improve Your Credit Score: A good credit score can make a big difference in your insurance premiums. Work on improving your credit score to potentially get lower rates.

- Maintain a Clean Driving Record: Avoid getting tickets or being involved in accidents to keep your safe driver discount.

- Take Advantage of Discounts: Make sure you’re taking advantage of all the discounts you qualify for. Don’t leave money on the table!

Leveraging Technology

We’re living in the digital age, and insurance companies are embracing technology. Here’s how you can leverage technology to find discounts:

- Online Tools: Use online tools and comparison websites to quickly compare quotes and find discounts from multiple insurance companies.

- Insurance Company Apps: Many insurance companies offer mobile apps that allow you to manage your policy, track discounts, and even get quotes on the go.

- Automated Discounts: Some insurance companies use technology to automatically identify and apply discounts based on your driving behavior or other factors.

Customer Service and Claims Process

You’ve chosen your coverage, figured out your deductible, and are ready to hit the road. But what happens when you actually need to use your car insurance? That’s where customer service and the claims process come in. These aspects are crucial for a smooth and hassle-free experience when you’re dealing with an accident or other insured event.

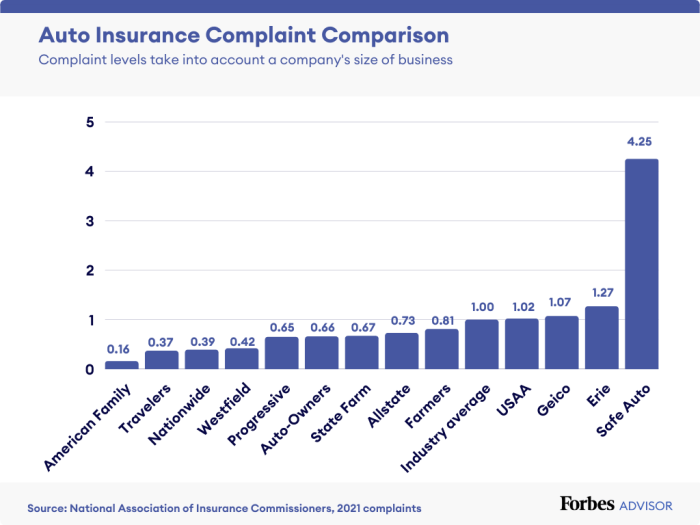

Customer Service Ratings and Reviews

Before you commit to a car insurance company, it’s wise to check out what others have to say about their customer service. Researching customer service ratings and reviews can give you a good idea of how responsive, helpful, and efficient an insurer is. Online platforms like J.D. Power, Consumer Reports, and the Better Business Bureau provide valuable insights from real customers who have interacted with the company.

Understanding the Claims Process

When you’re involved in an accident, the claims process is how you get your car fixed or receive compensation for damages. Each insurance company has its own procedures, but the general steps usually involve:

- Reporting the accident: This is usually done by phone or online, and you’ll need to provide details about the accident, such as the date, time, location, and any injuries involved.

- Filing a claim: Once you’ve reported the accident, you’ll need to file a formal claim with your insurer. This may involve providing additional documentation, such as a police report or photos of the damage.

- Investigation and assessment: The insurance company will investigate the claim and assess the damage to your car. They may also review the police report and speak with witnesses.

- Negotiation and settlement: Once the investigation is complete, the insurance company will negotiate a settlement with you. This will involve determining the amount of money you’ll receive for repairs or other damages.

- Payment and repair: After you’ve agreed to the settlement, the insurance company will pay you for the repairs or other damages. You may be able to choose your own repair shop, or the insurance company may have a preferred network of repair shops.

Comparing Claim Handling Procedures

Different insurers have different approaches to handling claims. Some insurers are known for their speed and efficiency, while others may be more bureaucratic and time-consuming.

- Claims processing time: Some companies boast quick turnaround times, while others might take weeks or even months to settle a claim.

- Communication and transparency: A good insurer will keep you informed throughout the claims process, providing updates on the status of your claim and answering any questions you may have.

- Customer satisfaction: Look for insurers that have a history of high customer satisfaction when it comes to their claims handling procedures.

Financial Stability and Reputation

You wouldn’t want to trust your car to a mechanic who’s about to go under, right? The same goes for car insurance. Choosing a financially stable company is crucial because they’re the ones who’ll be there to pay out when you need them most.

Financial Ratings

It’s important to choose an insurance company that’s financially sound and has a good track record. You can find this information by checking their financial ratings, which are assigned by independent rating agencies like AM Best, Standard & Poor’s, Moody’s, and Fitch Ratings.

- AM Best is a leading credit rating agency that specializes in the insurance industry. They provide financial strength ratings for insurance companies, which are based on a variety of factors, including financial performance, operating performance, and balance sheet strength.

- Standard & Poor’s (S&P) is another well-known credit rating agency that assigns financial ratings to insurance companies. S&P’s ratings are based on a similar set of factors as AM Best’s ratings.

- Moody’s is a global credit rating agency that provides ratings for insurance companies, as well as other financial institutions and corporations. Moody’s ratings are based on a similar set of factors as AM Best’s and S&P’s ratings.

- Fitch Ratings is a global credit rating agency that assigns financial ratings to insurance companies. Fitch’s ratings are based on a similar set of factors as AM Best’s, S&P’s, and Moody’s ratings.

Researching an Insurer’s Financial History

- Check the company’s website: Most insurance companies will display their financial ratings on their website. This is a good place to start your research.

- Visit a financial rating agency’s website: You can find detailed information about an insurance company’s financial history and ratings on the websites of AM Best, S&P, Moody’s, and Fitch Ratings.

- Read industry publications: Magazines and websites that focus on the insurance industry often publish articles about the financial stability of insurance companies.

- Talk to your insurance agent: Your insurance agent can provide you with information about the financial stability of the companies they represent.

Comparing Quotes and Finding the Best Fit

Finding the best car insurance policy involves comparing quotes from different insurers. This allows you to see what’s available and choose the plan that fits your needs and budget.

Using Online Comparison Tools and Insurance Brokers

Online comparison tools and insurance brokers can be helpful resources when searching for car insurance. They can save you time and effort by providing quotes from multiple insurers in one place.

- Online Comparison Tools: These websites allow you to enter your information once and receive quotes from various insurers. They typically have user-friendly interfaces and allow you to filter quotes based on your specific requirements. Popular examples include sites like NerdWallet, Policygenius, and The Zebra.

- Insurance Brokers: These professionals act as intermediaries between you and insurance companies. They can help you understand different policy options and find the best fit for your needs. They may have access to quotes from insurers that are not available online.

Carefully Reviewing Quotes and Comparing Coverage Details

Once you have a few quotes, it’s important to review them carefully and compare the coverage details. Don’t just focus on the price; ensure the policy offers the protection you need.

- Coverage Limits: Compare the coverage limits for liability, collision, comprehensive, and other types of insurance.

- Deductibles: Consider your deductible amount and how it impacts your premium.

- Exclusions and Limitations: Read the fine print to understand any exclusions or limitations in the policy.

- Discounts: Check if the insurer offers discounts for good driving records, safety features, or other factors.

- Customer Service and Claims Process: Research the insurer’s reputation for customer service and claims handling. Look for online reviews and ratings.

Final Wrap-Up

Ultimately, the best car insurance company for you depends on your individual circumstances. By understanding your needs, comparing quotes from multiple insurers, and carefully reviewing coverage details, you can find a policy that provides the protection you need at a price you can afford. Remember, your car insurance is an investment in your peace of mind, so don’t settle for anything less than the best.

Query Resolution: Which Car Insurance Company Is The Best

What are some common car insurance discounts?

Many car insurance companies offer discounts for safe driving, good student records, multi-car policies, and other factors. Be sure to ask about available discounts when you’re getting quotes.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or even more frequently if your circumstances change (like getting a new car, moving to a new location, or adding a driver to your policy).

What are some tips for filing a car insurance claim?

Document the accident with photos and witness information. Contact your insurer as soon as possible to report the claim and follow their instructions carefully.