- Factors to Consider When Choosing Car Insurance

- Types of Car Insurance Coverage

- Top Car Insurance Companies

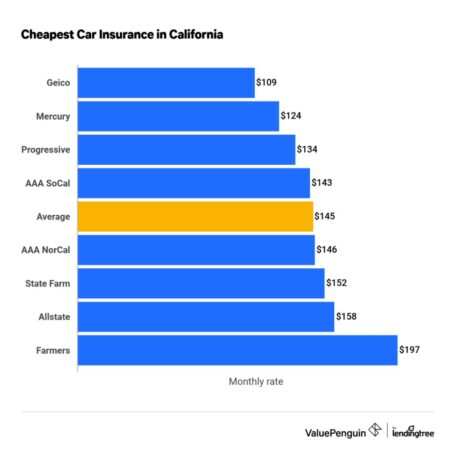

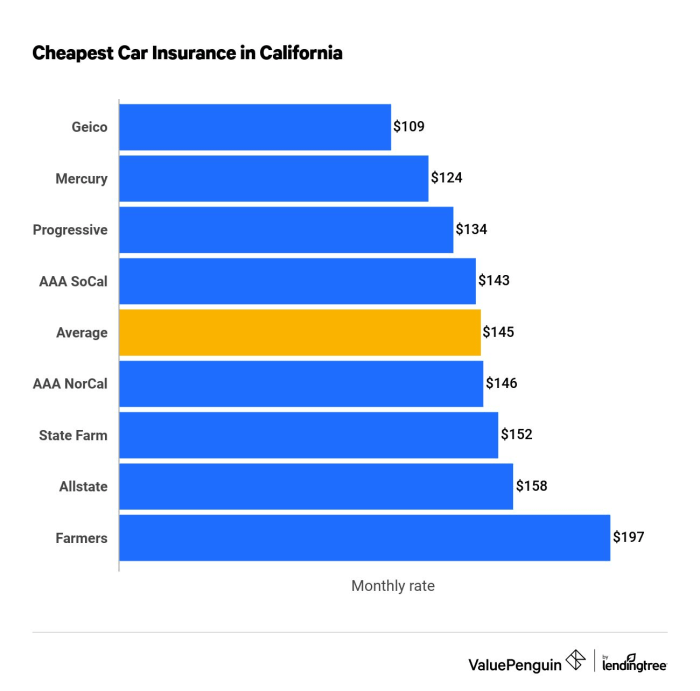

- Getting Quotes and Comparing Prices

- Understanding Your Policy and Making Claims

- Car Insurance Discounts and Savings

- Tips for Maintaining a Good Driving Record

- Ultimate Conclusion: Which Company Is Good For Car Insurance

- Answers to Common Questions

Which company is good for car insurance – Choosing the right car insurance can feel like navigating a maze of confusing policies and confusing jargon. But, don’t worry! We’re here to help you find the best car insurance company for your needs. Whether you’re a seasoned driver or a new one, understanding the factors that matter most can save you money and give you peace of mind. Let’s break it down, and find the perfect insurance fit for you.

We’ll explore different coverage options, explain key terms like deductibles and premiums, and help you compare top companies based on customer satisfaction, financial stability, and claims handling. We’ll also give you tips on getting the best possible rates, and how to understand your policy and file a claim if you need to. So, buckle up, it’s time to find the car insurance that’s right for you.

Factors to Consider When Choosing Car Insurance

Choosing the right car insurance is like picking the perfect outfit for a big event – you want it to fit your needs, protect you, and look good (or at least not make you cringe!). Just like your style, your car insurance needs are unique to you, your car, and your driving habits.

Coverage Options

Different car insurance policies offer various levels of coverage. It’s important to understand what each type of coverage provides and choose the options that best suit your individual needs and budget.

- Liability Coverage: This is the most basic type of car insurance, and it protects you financially if you cause an accident that results in injuries or property damage to others. Liability coverage typically includes bodily injury liability and property damage liability. Think of it as your “get-out-of-jail-free” card in case you accidentally cause a fender bender or something more serious.

- Collision Coverage: This coverage pays for repairs to your car if you’re involved in an accident, regardless of who’s at fault. This is a good option if you drive an older car or have a loan on your vehicle, as it helps cover repair costs. It’s like having a safety net in case you hit a pothole or someone rear-ends you.

- Comprehensive Coverage: This coverage protects your car from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This can be a good option if you live in an area with high crime rates or if you drive a newer car. It’s like having a bodyguard for your car, protecting it from all sorts of unexpected situations.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s like having a backup plan in case you encounter a “phantom driver” who disappears after an accident.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of who’s at fault. It’s like having a personal doctor on call in case you need medical attention after an accident.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your monthly premium will be, but you’ll have to pay more if you need to file a claim. Think of it like a co-pay at the doctor’s office – the higher your deductible, the less you pay each month, but you’ll have to pay more out of pocket if you need to see the doctor.

It’s important to choose a deductible that you can afford to pay in case you need to file a claim.

Premiums

Your car insurance premium is the amount you pay monthly or annually for your coverage. Your premium is based on several factors, including your age, driving history, location, the type of car you drive, and your coverage options. It’s like your monthly subscription fee for peace of mind.

Discounts

Many insurance companies offer discounts to lower your premiums. These discounts can be based on factors like your driving record, your age, your occupation, your credit score, or the safety features of your car. It’s like earning rewards for being a good driver and taking care of your car.

- Good Driver Discount: If you have a clean driving record, you may be eligible for a good driver discount. This is like getting a bonus for being a safe driver.

- Safe Driver Discount: If you’ve taken a defensive driving course, you may qualify for a safe driver discount. This is like getting a reward for learning how to be a better driver.

- Multi-Car Discount: If you insure multiple cars with the same company, you may qualify for a multi-car discount. This is like getting a family discount for your car insurance.

- Anti-theft Device Discount: If your car has anti-theft devices, you may qualify for a discount. This is like getting a discount for having a security system in your car.

Customer Service

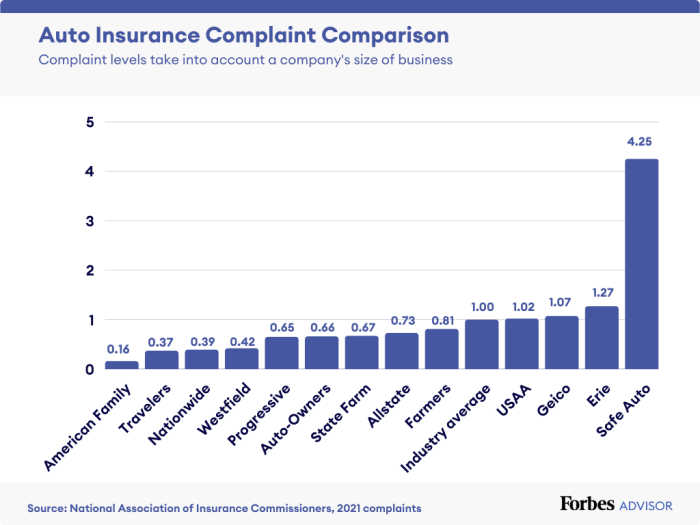

Customer service is an important factor to consider when choosing car insurance. You want to make sure you can easily reach your insurance company if you need to file a claim or have a question. It’s like having a reliable friend who’s always there to help you out.

- Availability: Check the company’s hours of operation and how many ways you can contact them (phone, email, online chat).

- Responsiveness: See how quickly the company responds to your inquiries.

- Friendliness: Look for a company with friendly and helpful customer service representatives.

Types of Car Insurance Coverage

Choosing the right car insurance coverage can be a daunting task, especially with all the different options available. But don’t worry, it’s not as complicated as it seems. Understanding the basics of car insurance coverage can help you make informed decisions and ensure you have the protection you need.

Types of Car Insurance Coverage, Which company is good for car insurance

Car insurance policies typically offer a variety of coverage options, each designed to protect you in different situations. Understanding these different coverages and their benefits is crucial to making the right decision for your needs. Here’s a breakdown of the most common types of car insurance coverage:

| Coverage Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Liability Coverage | This coverage protects you financially if you’re at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of medical bills, lost wages, and property damage. | It protects you from financial ruin if you’re responsible for an accident. | It doesn’t cover your own vehicle’s damage. |

| Collision Coverage | This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. | It covers your vehicle’s damage, even if you’re at fault. | It has a deductible, which you pay before the insurance company covers the rest. |

| Comprehensive Coverage | This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | It covers your vehicle’s damage from non-collision events. | It also has a deductible, which you pay before the insurance company covers the rest. |

| Uninsured/Underinsured Motorist Coverage | This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. | It covers your medical bills and property damage if the other driver is uninsured or underinsured. | It doesn’t cover your own vehicle’s damage if the other driver is at fault. |

Top Car Insurance Companies

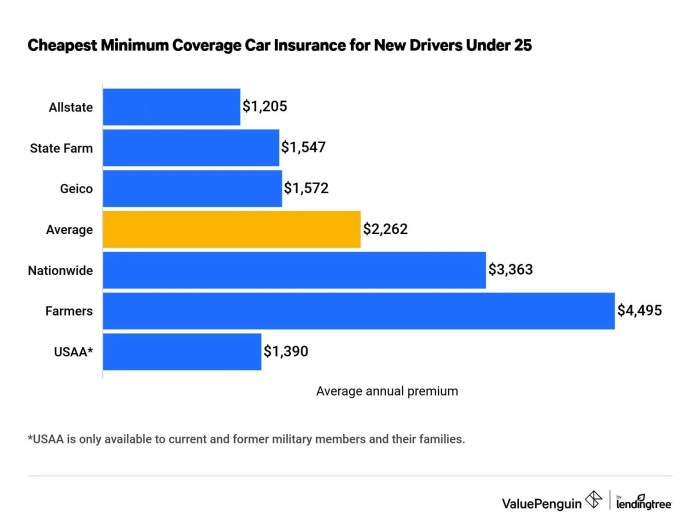

Choosing the right car insurance company can be a daunting task, especially with so many options available. It’s important to do your research and compare quotes from different companies before making a decision. We’ve compiled a list of some of the top car insurance companies based on factors like financial stability, customer satisfaction, and claims handling.

Top Car Insurance Companies

To help you make an informed decision, we’ve ranked some of the top car insurance companies based on their overall performance, customer satisfaction, and financial strength.

| Company Name | Rating | Coverage Options | Pricing | Customer Reviews |

|---|---|---|---|---|

| USAA | A++ | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Highly competitive, especially for military members and their families | Excellent customer service, fast claims processing |

| State Farm | A++ | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Competitive rates, discounts for good drivers and multiple policies | Generally positive reviews, but some complaints about claims handling |

| Geico | A++ | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Known for low rates, particularly for younger drivers | Mixed reviews, some praise for their online tools and mobile app, while others report difficulties with claims processing |

| Progressive | A+ | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Offers a wide range of coverage options, including name-your-own price and usage-based insurance | Mixed reviews, some praise for their innovative features, while others report issues with customer service |

| Liberty Mutual | A+ | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection | Offers competitive rates and a variety of discounts | Generally positive reviews, with praise for their customer service and claims handling |

Getting Quotes and Comparing Prices

You’re ready to shop for car insurance, but where do you even start? Don’t worry, it’s easier than you think! The key is to get quotes from multiple companies and compare prices. That’s how you find the best deal for your specific needs.

Using Online Comparison Tools

Online comparison tools are a lifesaver when it comes to car insurance shopping. Think of them like a super-powered search engine for insurance quotes. You enter your info once, and boom! You get quotes from a bunch of different companies side-by-side. This lets you compare prices, coverage options, and even discounts without having to contact each company individually. It’s like having a personal insurance shopper at your fingertips!

Contacting Insurance Agents Directly

Sometimes, you want to talk to a real person. That’s where insurance agents come in. They can walk you through your options, explain different coverage types, and help you find the best policy for your situation. You can find agents through online directories, recommendations from friends or family, or even through the insurance companies themselves.

Negotiating Car Insurance Premiums

Remember, you’re not stuck with the first quote you get. You can try to negotiate a lower premium. Here’s the deal:

* Ask about discounts: Insurance companies offer all sorts of discounts, like good driver discounts, safe driver discounts, and even discounts for having multiple policies with them.

* Shop around: Don’t be afraid to compare quotes from multiple companies, even if you’ve already gotten a quote you like. You might find a better deal somewhere else.

* Consider increasing your deductible: A higher deductible means you pay more out of pocket if you have an accident, but it can also lower your premium.

* Be polite but firm: When negotiating, be polite but firm. Explain your situation and why you’re looking for a lower rate.

Understanding Your Policy and Making Claims

Your car insurance policy is a contract between you and your insurance company, outlining the terms of your coverage. It’s essential to read and understand your policy thoroughly to ensure you’re adequately protected in case of an accident or other covered event.

Understanding Your Policy

Before you sign on the dotted line, take some time to carefully review your car insurance policy. It’s like reading the fine print of a contract, but for your car. You want to make sure you know exactly what you’re covered for and what the limits of your coverage are. Think of it like reading the menu before ordering at your favorite restaurant – you want to make sure you’re getting what you want!

- Coverage Limits: Your policy will specify the maximum amount your insurance company will pay for different types of claims, such as bodily injury liability, property damage liability, collision, and comprehensive coverage. This is your “coverage ceiling,” so it’s crucial to know what it is.

- Deductibles: Your deductible is the amount you’ll pay out-of-pocket before your insurance kicks in. It’s like your “personal contribution” to the cost of repairs or replacement. The higher your deductible, the lower your monthly premium will be, but you’ll pay more if you need to file a claim.

- Exclusions: Your policy will list situations or events that are not covered by your insurance. Think of these as “exceptions to the rule.” For example, your insurance may not cover damage caused by driving under the influence or while racing.

- Premium Payment Options: You can choose to pay your premiums monthly, quarterly, semi-annually, or annually. The more frequently you pay, the less you’ll pay in interest, but you’ll have smaller payments.

Filing a Claim

If you need to file a claim, you’ll want to know the process so you can get the ball rolling quickly and efficiently. It’s like calling for backup when you’re in a pinch.

- Contact Your Insurance Company: The first step is to report the accident or incident to your insurance company as soon as possible. They’ll likely ask for details about the event, such as the date, time, location, and any injuries or damage.

- Gather Documentation: You’ll need to provide your insurance company with specific documentation to support your claim. This might include:

- A police report (if applicable)

- Photos or videos of the damage

- Estimates from repair shops

- Medical bills (if applicable)

- Submit Your Claim: Once you have gathered all the necessary documentation, you can submit your claim to your insurance company. They will review your claim and make a decision on whether or not to approve it.

Navigating Insurance Claims

Navigating insurance claims can be a bit of a rollercoaster, but it doesn’t have to be a stressful experience. Just like a good friend, your insurance company should be there to help you through the process.

- Keep Records: It’s essential to keep detailed records of all communications and interactions with your insurance company. This will help you track the progress of your claim and ensure you’re not missing any important information.

- Be Patient: Insurance claims can take time to process. Don’t be discouraged if you don’t hear back from your insurance company right away. Be patient and persistent, and they will get back to you.

- Dispute Resolutions: If you disagree with your insurance company’s decision on your claim, you have the right to dispute it. You can contact your insurance company directly to appeal their decision, or you can contact your state’s insurance department for assistance.

Car Insurance Discounts and Savings

You want to save money on car insurance, right? Who doesn’t? Luckily, there are a ton of ways to score discounts and lower your premiums. Think of it like a scavenger hunt for savings, but instead of finding hidden treasure, you’re finding ways to make your insurance more affordable.

Common Car Insurance Discounts

Car insurance companies offer a variety of discounts to help you save money. These discounts can be a real game-changer, and knowing what’s available can make a big difference in your bottom line. Here are some common car insurance discounts you should look out for:

- Safe Driving Discount: This is one of the most common discounts, and it’s a no-brainer. If you have a clean driving record, you’re less likely to get into an accident, so insurance companies reward you for being a good driver. This discount can be significant, especially if you’ve been accident-free for a long time.

- Good Student Discount: This discount is often available to students who maintain a certain GPA. Insurance companies see good students as responsible individuals, and they’re more likely to be safe drivers. This discount can be a great way for students to save money, especially if they’re just starting out and need affordable car insurance.

- Multi-Car Discount: If you insure multiple cars with the same company, you can often get a multi-car discount. This discount is a simple way to save money on all your vehicles. Think of it as a bulk discount for your car insurance needs.

- Anti-theft Device Discount: If you have anti-theft devices installed in your car, such as an alarm system or GPS tracking, you might be eligible for a discount. This is because these devices make your car less appealing to thieves, which reduces the risk for the insurance company.

- Loyalty Discount: Some insurance companies offer discounts to customers who have been with them for a certain amount of time. This is a way for them to reward loyal customers and encourage them to stay with the company.

- Bundling Discount: This is where things get really interesting. If you bundle your car insurance with other types of insurance, like homeowners or renters insurance, you can often get a significant discount. This is because insurance companies like to keep all your insurance business in one place. It’s like a one-stop shop for all your insurance needs, and it’s a great way to save money.

Maximizing Discounts and Lowering Premiums

So, how can you maximize your discounts and lower your premiums? It’s like a game of strategy, and the more you know, the better you’ll play. Here are some tips to help you win at the car insurance game:

- Shop Around: Don’t settle for the first quote you get. Get quotes from multiple insurance companies and compare prices. This is like comparing apples to apples, and it can help you find the best deal.

- Consider Your Coverage: Do you really need all that coverage? If you have an older car, you might not need as much collision or comprehensive coverage. This is like decluttering your insurance policy and only keeping what you need.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lower your premium. This is like a trade-off, but if you’re comfortable with a higher deductible, you can save money.

- Pay Your Premium in Full: If you can afford it, pay your premium in full. This can sometimes save you money on interest charges. Think of it as a lump sum payment to avoid extra costs.

- Take a Defensive Driving Course: A defensive driving course can not only make you a safer driver, but it can also qualify you for a discount. This is like getting a certification for safe driving and saving money at the same time.

- Ask About Discounts: Don’t be afraid to ask your insurance agent about all the discounts you qualify for. They might have some hidden gems that you didn’t know about. It’s like asking for a treasure map to find all the discounts you deserve.

Bundling Car Insurance

Bundling your car insurance with other types of insurance, like homeowners or renters insurance, is a great way to save money. It’s like a team effort, and when you bundle your insurance, you get a discount because you’re essentially becoming a loyal customer to the insurance company.

- Lower Premiums: Bundling can significantly lower your premiums on both your car insurance and your other insurance policies. This is like getting a double discount for being a loyal customer.

- Convenience: Having all your insurance policies with one company can make things much easier. You only have one place to call for claims, payments, and customer service. This is like having a one-stop shop for all your insurance needs.

- Better Customer Service: Insurance companies often give better customer service to customers who have multiple policies with them. This is like being a VIP customer and getting special treatment.

Tips for Maintaining a Good Driving Record

Your driving record is a critical factor in determining your car insurance premiums. A clean driving record can save you a significant amount of money, while a history of accidents or violations can lead to higher rates.

Safe Driving Habits

Safe driving habits are crucial for maintaining a clean driving record and keeping your insurance premiums low. Here are some tips to help you avoid accidents and stay safe on the road:

- Always wear your seatbelt. Seatbelts are designed to protect you in the event of an accident and can significantly reduce the risk of serious injury or death.

- Avoid distractions. Distracted driving, such as texting, talking on the phone, or eating while driving, is a major cause of accidents. Make sure to put your phone away and focus on the road.

- Don’t drive under the influence of alcohol or drugs. Driving impaired is extremely dangerous and can lead to serious consequences. Always have a designated driver or use a ride-sharing service if you plan to drink.

- Be aware of your surroundings. Pay attention to other vehicles, pedestrians, and road conditions. Be prepared to react quickly in case of an emergency.

- Maintain a safe following distance. Allow yourself enough space to stop safely if the vehicle in front of you suddenly brakes.

- Obey traffic laws. Always follow the speed limit, stop at red lights, and yield to pedestrians.

- Get enough sleep. Drowsy driving is as dangerous as driving under the influence. If you’re tired, pull over and rest.

- Be a defensive driver. Anticipate potential hazards and be prepared to react accordingly.

Handling Traffic Violations

Traffic violations can have a significant impact on your car insurance premiums. Even a minor violation, such as a speeding ticket, can increase your rates. Here’s how to handle traffic violations:

- Understand the consequences. Know the potential impact of a traffic violation on your insurance rates and driving record.

- Contest the violation if you believe it’s unfair. You may be able to get the violation dismissed or reduced if you have a strong case.

- Take a defensive driving course. Completing a defensive driving course can help you avoid future violations and may even reduce your insurance premiums.

- Pay the fine promptly. Ignoring a traffic violation can lead to additional penalties and a negative impact on your driving record.

Maintaining a Good Credit Score

You might be surprised to learn that your credit score can affect your car insurance premiums. Insurance companies use credit scores to assess your risk as a driver. Here’s how to maintain a good credit score:

- Pay your bills on time. Late payments can negatively impact your credit score.

- Keep your credit utilization low. Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Aim to keep this ratio below 30%.

- Don’t apply for too much credit at once. Multiple credit inquiries can lower your credit score.

- Check your credit report regularly. Make sure there are no errors or fraudulent activity on your report.

Ultimate Conclusion: Which Company Is Good For Car Insurance

Finding the best car insurance is a crucial step in being a responsible driver. By understanding your needs, comparing options, and taking advantage of discounts, you can secure the best possible coverage at a price that fits your budget. Remember, driving safely and maintaining a good driving record are the best ways to ensure you have affordable car insurance and keep your premiums low. So, get out there, shop around, and find the perfect car insurance policy for your peace of mind.

Answers to Common Questions

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of who is at fault.

How can I get a free car insurance quote?

You can get a free car insurance quote online, over the phone, or by visiting an insurance agent in person.

What factors influence my car insurance premium?

Factors that influence your car insurance premium include your age, driving history, credit score, location, type of car, and coverage options.

What is a deductible?

A deductible is the amount you pay out of pocket for repairs or replacement before your insurance coverage kicks in.