Which insurance companies cover Omnipod 5? It’s a question many people with diabetes are asking, especially those considering switching to this innovative insulin pump system. The Omnipod 5 is a game-changer, offering a truly tubeless and discreet way to manage your blood sugar. But with its advanced technology comes the question of affordability. Knowing which insurance companies cover the Omnipod 5 is crucial for making informed decisions about your diabetes management.

Insurance coverage for diabetes supplies can be a confusing maze, with different plans, requirements, and limitations. From PPOs to HMOs, understanding the intricacies of your insurance policy is essential to determine your out-of-pocket costs. Luckily, we’ve compiled a comprehensive guide to help you navigate this process and find the information you need to make the best choice for your diabetes management.

Omnipod 5 Overview

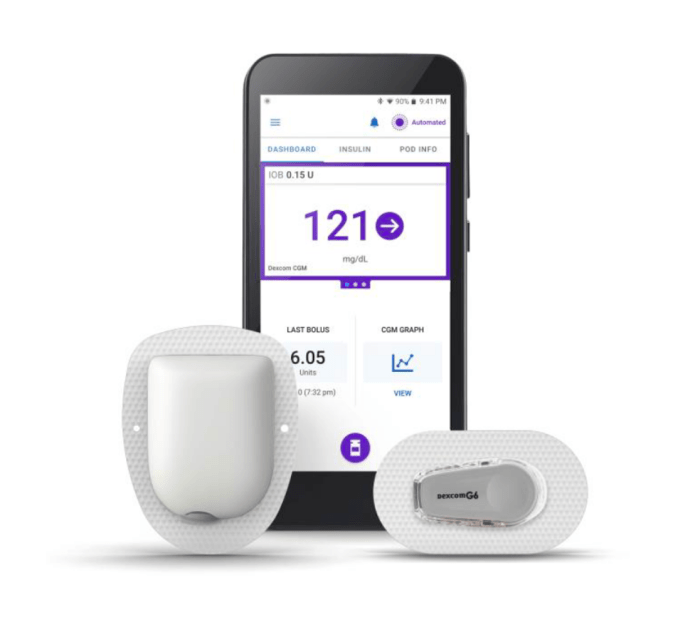

The Omnipod 5 is a revolutionary insulin pump system that offers a level of convenience and control previously unavailable for people living with diabetes. This tubeless system allows for a more discreet and flexible approach to insulin delivery, making it a game-changer for those seeking a less intrusive way to manage their condition.

Key Features and Benefits

The Omnipod 5 is a game-changer for those seeking a less intrusive way to manage their condition. It offers several key features and benefits compared to other insulin delivery methods, including:

- Tubeless Design: The Omnipod 5 system eliminates the need for traditional tubing, offering greater freedom of movement and a more discreet way to manage diabetes.

- Automatic Glucose Monitoring: The system seamlessly integrates with Dexcom G6 continuous glucose monitors (CGMs), providing real-time glucose readings directly to the pump.

- Predictive Low Glucose Management: The Omnipod 5 uses a sophisticated algorithm to predict and prevent low blood sugar events (hypoglycemia), helping users feel more secure and confident.

- Personalized Insulin Delivery: The system adjusts insulin delivery based on individual needs and glucose levels, providing more precise and tailored control over blood sugar.

- Remote Monitoring and Control: The Omnipod 5 app allows users to monitor their glucose levels, adjust insulin delivery, and receive alerts from their smartphone or tablet.

Potential Advantages and Disadvantages

The Omnipod 5 offers significant advantages for people with diabetes, but it’s essential to consider potential drawbacks before making a decision.

Advantages

- Increased Convenience and Freedom: The tubeless design provides a more discreet and comfortable way to manage diabetes, allowing users to move freely without the constraints of traditional pumps.

- Improved Blood Sugar Control: The system’s automatic glucose monitoring and predictive low glucose management features can help achieve tighter blood sugar control and reduce the risk of hypoglycemia.

- Enhanced User Experience: The intuitive app and user-friendly interface make it easier for users to manage their diabetes and stay informed about their blood sugar levels.

Disadvantages

- Cost: The Omnipod 5 system can be expensive, and not all insurance plans cover it. It’s important to consult with your insurance provider to determine coverage and potential out-of-pocket costs.

- Technical Issues: As with any complex medical device, there is a possibility of technical issues or malfunctions. It’s important to be prepared for potential problems and have a backup plan in place.

- Limited Availability: The Omnipod 5 system may not be available in all regions or may require a prescription from a healthcare provider.

Insurance Coverage for Diabetes Supplies

Navigating the world of insurance coverage for diabetes supplies can feel like a maze, especially when it comes to expensive technology like the Omnipod 5. But, like a good detective, we’re here to help you uncover the clues and understand the process.

Factors Affecting Coverage

Insurance companies consider a variety of factors when determining coverage for diabetes supplies. Think of it like a multi-step verification process, where each factor acts as a gatekeeper. Here are some of the key considerations:

- Medical Necessity: This is the cornerstone of coverage. Insurance companies want to ensure the supplies are medically necessary for your specific needs. This means your doctor needs to provide documentation justifying why you need the supplies, like the Omnipod 5, for proper diabetes management.

- Prior Authorization: This is like a pre-approval process. Your doctor will need to submit a request to your insurance company, outlining why you need the Omnipod 5 and providing supporting medical evidence. This process can take time, so be patient.

- Formulary: This is like a list of approved medications and supplies. Insurance companies have a formulary that Artikels which supplies they cover. The Omnipod 5 may be covered under your plan’s formulary, but it’s important to double-check. You might need to request a prior authorization or appeal if it’s not listed.

- Benefit Limits: Insurance plans often have limits on how much they’ll cover for certain supplies. For example, they might have a yearly cap on the amount they’ll pay for insulin pumps. It’s important to understand your plan’s limitations so you’re not caught off guard.

- Co-pays and Deductibles: Even if your plan covers the Omnipod 5, you might still be responsible for co-pays or deductibles. These costs vary depending on your plan and can be significant. Be sure to factor these expenses into your budget.

Insurance Plan Types

Different insurance plans can impact coverage. Think of it like choosing the right vehicle for your journey. Here are some common types of insurance plans and how they might affect your coverage:

- PPO (Preferred Provider Organization): PPO plans offer more flexibility in choosing healthcare providers, but they might have higher premiums. They often have a broader network of providers and may cover a wider range of diabetes supplies.

- HMO (Health Maintenance Organization): HMO plans usually have lower premiums but offer less flexibility. They require you to choose a primary care physician (PCP) within their network. Coverage for diabetes supplies may be more limited, and you might need a referral from your PCP to access specialists or supplies.

- EPO (Exclusive Provider Organization): EPO plans are similar to HMOs, but they generally have a narrower network of providers. They might offer lower premiums than PPOs, but coverage for diabetes supplies could be more limited. You’ll likely need a referral from your PCP to access specialists or supplies.

Common Requirements and Limitations

Insurance companies often impose requirements and limitations on insulin pump coverage. These are like the fine print you need to read carefully. Here are some common requirements:

- Documentation: Your doctor needs to provide detailed medical documentation justifying the need for an insulin pump. This might include your medical history, blood sugar readings, and any complications you’ve experienced.

- Training: Some insurance plans require you to complete a training program on how to use the insulin pump. This is to ensure you’re comfortable and competent in managing the device.

- Coverage Period: Insurance companies might have a set coverage period for insulin pumps. After this period, you might need to reapply for coverage or pay out-of-pocket.

- Pre-approval: You might need to obtain pre-approval from your insurance company before purchasing an insulin pump. This can involve submitting a prior authorization request and providing supporting documentation.

- Limited Coverage for Supplies: Some insurance plans might have limited coverage for supplies related to the insulin pump, such as infusion sets, cartridges, or other accessories. You might need to pay out-of-pocket for these items.

Specific Insurance Company Policies: Which Insurance Companies Cover Omnipod 5

Navigating the world of insurance coverage for the Omnipod 5 can feel like deciphering a secret code. But don’t worry, we’re here to break it down and help you understand the specifics of what major insurance companies cover.

It’s important to remember that insurance policies can vary greatly depending on your specific plan and state. This information is intended as a general overview, and you should always contact your insurance provider directly for the most accurate and up-to-date information.

Coverage Policies of Major Insurance Companies

Here’s a table comparing the coverage policies of some major insurance companies for the Omnipod 5:

| Company Name | Plan Type | Coverage Details | Specific Requirements/Limitations |

|---|---|---|---|

| UnitedHealthcare | Medicare Advantage | Typically covers the Omnipod 5 with pre-authorization. | May require prior authorization and documentation of medical necessity. |

| Anthem | Commercial PPO | Generally covers the Omnipod 5 with pre-authorization. | May have co-pay or co-insurance requirements. |

| Cigna | Individual Health Insurance | Often covers the Omnipod 5 with pre-authorization. | May have coverage limits on the number of pods per month. |

| Aetna | Employer-Sponsored Plan | Coverage for the Omnipod 5 can vary widely depending on the plan. | May require pre-authorization and documentation of medical necessity. |

Pre-Authorization Procedures

Pre-authorization is a common requirement for insurance coverage of the Omnipod 5. This process involves getting approval from your insurance company before you can receive the device and supplies.

Here’s what you can expect:

- Your doctor will need to submit a pre-authorization request to your insurance company, including supporting documentation such as medical records and a prescription.

- The insurance company will review the request and may require additional information or documentation.

- Once the pre-authorization is approved, you will be able to receive the Omnipod 5 and supplies.

Co-Pays or Co-Insurance Requirements

Most insurance plans will have some form of co-pay or co-insurance for the Omnipod 5. This means you will be responsible for a portion of the cost of the device and supplies.

Here’s a breakdown:

- Co-pay: A fixed amount you pay for each service or supply.

- Co-insurance: A percentage of the cost you pay after meeting your deductible.

The specific co-pay or co-insurance amounts will vary depending on your insurance plan.

Coverage Limits or Restrictions

Some insurance plans may have coverage limits or restrictions on the Omnipod 5, such as:

- Number of pods per month: Your plan may limit the number of pods you can receive each month.

- Total cost coverage: Your plan may have an annual limit on the amount they will cover for diabetes supplies.

- Specific requirements for medical necessity: Your plan may have specific criteria that must be met for coverage of the Omnipod 5.

It’s important to understand any coverage limits or restrictions before you start using the Omnipod 5.

Specific Documentation or Medical Necessity Criteria

Insurance companies may require specific documentation or medical necessity criteria to approve coverage for the Omnipod 5.

Here’s a general overview:

- Medical records: Your doctor will need to provide your insurance company with your medical records, including your diagnosis, treatment history, and current blood sugar control.

- Prescription: Your doctor will need to provide a prescription for the Omnipod 5.

- Other documentation: Your insurance company may require additional documentation, such as a letter of medical necessity from your doctor or a detailed explanation of why the Omnipod 5 is the best option for your specific needs.

It’s important to work closely with your doctor and insurance company to ensure that you have all the necessary documentation to support your claim.

Factors Influencing Coverage Decisions

Getting your hands on the Omnipod 5 can feel like a quest, but knowing the factors that influence coverage decisions can help you navigate the process.

Individual Factors

Your age, medical history, and prescription needs can all play a role in how your insurance company views your request for the Omnipod 5.

- Age: Insurance companies may consider your age when determining coverage for diabetes supplies. Younger patients may have different coverage options compared to adults. For example, some insurance plans may offer coverage for continuous glucose monitors (CGMs) for children and adolescents, while coverage for adults may be more limited.

- Medical History: Your medical history, including the severity and management of your diabetes, can influence coverage decisions. For example, individuals with Type 1 diabetes may have more access to coverage for insulin pumps like the Omnipod 5 compared to those with Type 2 diabetes.

- Prescription Needs: The specific prescription your doctor writes for the Omnipod 5 will also be considered. Some insurance plans may have specific criteria or prior authorization requirements for certain types of insulin pumps.

Role of Healthcare Providers

Your healthcare provider is your champion in the fight for Omnipod 5 coverage. They can help you navigate the process and advocate for your needs.

- Prescription: Your doctor will need to write a prescription for the Omnipod 5, outlining the medical necessity for this specific device.

- Pre-authorization: Some insurance plans require pre-authorization for insulin pumps. Your doctor can help you with the necessary paperwork and documentation to support your request.

- Appeals: If your initial coverage request is denied, your doctor can help you appeal the decision. They can provide additional medical information to support your case.

Strategies for Navigating Coverage

Don’t let the complexities of insurance coverage discourage you. Here are some strategies to help you navigate the process:

- Understand Your Coverage: Review your insurance plan to understand your benefits and any limitations for diabetes supplies.

- Contact Your Insurance Company: Reach out to your insurance company directly to ask specific questions about coverage for the Omnipod 5.

- Explore Patient Assistance Programs: Some pharmaceutical companies offer patient assistance programs that can help cover the cost of diabetes supplies.

Alternative Options for Affordability

Navigating the cost of diabetes management, especially with the Omnipod 5, can be a real struggle. But don’t fret! There are ways to make this tech-savvy insulin pump more accessible. We’re talking about programs and strategies that can help you keep those out-of-pocket costs in check.

Patient Assistance Programs

Patient assistance programs (PAPs) are lifesavers for folks with high out-of-pocket costs for medications and medical supplies. These programs are often offered by pharmaceutical companies or non-profit organizations. Think of them as a helping hand to ensure access to essential care, regardless of your financial situation.

- The Omnipod 5 manufacturer, Insulet, offers a patient assistance program. To find out if you qualify, you can visit their website or contact their customer service department. You’ll need to provide information about your income, insurance coverage, and other relevant details.

- Other organizations, such as the Diabetes Patient Assistance Foundation (DPAF), can also provide financial assistance for diabetes supplies. The DPAF offers grants and other resources to help individuals with diabetes afford their medications and supplies.

Eligibility Criteria for Patient Assistance Programs, Which insurance companies cover omnipod 5

Each PAP has its own set of eligibility criteria. These criteria usually include:

- Income level: Programs typically have income limits to determine eligibility. You’ll need to provide documentation of your income, such as tax returns or pay stubs.

- Insurance coverage: Many PAPs require that you have insurance, but your insurance may not cover the full cost of the Omnipod 5. This is where the PAP can help bridge the gap.

- Other factors: Some programs may also consider factors like your age, medical history, and other medications you’re taking.

Cost-Saving Strategies

Even if you don’t qualify for a PAP, there are still ways to manage the cost of the Omnipod 5:

- Negotiate with your insurance company: You might be able to negotiate a lower copay or coinsurance for the Omnipod 5. Be prepared to provide information about your medical needs and the benefits of using the Omnipod 5.

- Explore alternative supply options: Look for generic or less expensive alternatives to the Omnipod 5 supplies, such as insulin cartridges or infusion sets. While the Omnipod 5 offers unique benefits, exploring options can help you save money in the long run.

- Join a diabetes support group: Connecting with others who use the Omnipod 5 or other diabetes supplies can provide valuable insights into cost-saving strategies and resources.

Ending Remarks

Navigating insurance coverage for the Omnipod 5 can feel like a wild ride, but remember, you’re not alone. By understanding the factors influencing coverage decisions, exploring alternative options, and reaching out to the right resources, you can gain clarity and find the best path forward. Ultimately, managing diabetes is a personal journey, and having the right tools and support can make a world of difference. So, take the reins, research your options, and empower yourself to make the best choices for your health and well-being.

FAQ

How do I know if my insurance plan covers the Omnipod 5?

The best way to find out is to contact your insurance provider directly. They can provide specific details about your plan’s coverage for diabetes supplies, including insulin pumps.

What if my insurance doesn’t cover the Omnipod 5?

There are a few options to consider: You might be able to appeal the decision, explore patient assistance programs, or consider alternative insulin delivery methods.

Can I use my HSA or FSA to pay for the Omnipod 5?

In many cases, yes! You can usually use funds from your Health Savings Account (HSA) or Flexible Spending Account (FSA) to cover eligible medical expenses, including diabetes supplies like insulin pumps.

How often do I need to get pre-authorization for the Omnipod 5?

Pre-authorization requirements vary by insurance company. Some require it every time you need supplies, while others might have a longer timeframe. Check with your insurer for specific details.