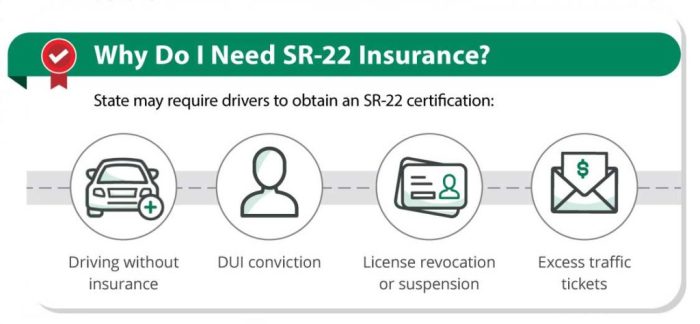

Which insurance companies offer sr22 – Ever gotten a traffic ticket or been in an accident? You might need an SR-22, which is basically a proof of insurance that shows you’re financially responsible. It’s like the insurance equivalent of a good driver’s license, but it’s usually required by the state after you’ve had some driving trouble. So, if you’re looking to get your driving privileges back on track, finding out which insurance companies offer SR-22s is key. It’s like finding the right squad for your driving journey.

Knowing which insurance companies offer SR-22s is crucial for anyone facing a driving violation. This article breaks down the basics of SR-22s, how to find the right insurance company, and what you need to know about getting, renewing, and cancelling your SR-22. It’s like your one-stop shop for SR-22 knowledge, so you can drive with confidence.

SR-22 Cost and Factors Influencing Price

The cost of an SR-22 filing can vary significantly depending on several factors. While it’s not an insurance policy itself, it’s a proof of financial responsibility that’s required in many states after certain driving violations. The cost is typically an added fee on top of your existing car insurance premium.

Several factors influence the cost of an SR-22, and understanding these factors can help you make informed decisions about your insurance.

Factors Affecting SR-22 Costs

The cost of an SR-22 filing is determined by a combination of factors, including your driving history, the state you live in, and the insurance company you choose. Here’s a breakdown of key factors:

- Driving History: Your driving record plays a significant role in determining your SR-22 cost. If you have a history of traffic violations, accidents, or DUI convictions, your SR-22 filing will likely cost more. For example, if you have multiple speeding tickets or a DUI, your insurance company might consider you a higher risk and charge you a higher premium.

- State of Residence: Each state has its own regulations and requirements for SR-22 filings, which can impact the cost. Some states have higher minimum insurance coverage requirements than others, which can influence the overall cost of your SR-22.

- Insurance Company: Different insurance companies have different pricing structures and policies for SR-22 filings. It’s crucial to compare quotes from multiple insurers to find the best rates.

- Type of Vehicle: The type of vehicle you drive can also affect the cost of your SR-22. For example, a high-performance sports car might have a higher insurance premium than a standard sedan, leading to a higher SR-22 cost.

Examples of SR-22 Cost Variations

To illustrate the impact of these factors on SR-22 costs, consider these examples:

- Driving History: A driver with a clean driving record might pay a lower SR-22 fee than someone with a DUI conviction. The DUI conviction would be seen as a higher risk factor, leading to a higher premium and SR-22 cost.

- State of Residence: An SR-22 filing in a state with high minimum insurance requirements might be more expensive than in a state with lower requirements. This is because the insurance company needs to cover higher liability limits, potentially leading to a higher SR-22 cost.

- Insurance Company: One insurance company might offer a lower SR-22 fee than another, even for the same driver and vehicle. This highlights the importance of comparing quotes from multiple insurers.

Tips for Reducing SR-22 Costs

While SR-22 costs can be substantial, there are steps you can take to potentially reduce the cost:

- Shop Around for Insurance: Compare quotes from multiple insurance companies to find the most competitive rates. Some insurers might offer discounts for good driving records or safety features in your vehicle.

- Maintain a Good Driving Record: Avoiding traffic violations and accidents can help you maintain a good driving record, which could lead to lower insurance premiums and SR-22 costs.

- Consider Defensive Driving Courses: Completing a defensive driving course can sometimes reduce your insurance premium, which could also lower your SR-22 cost.

- Pay Your Premiums on Time: Making timely payments on your insurance premiums can demonstrate financial responsibility to your insurer, which could potentially lower your SR-22 cost.

SR-22 Renewal and Cancellation

So, you’ve got your SR-22, and you’re wondering how long you’ll have to keep it and what happens when it’s time to renew or even cancel. Let’s break it down.

SR-22 Renewal

When your SR-22 expires, you’ll need to renew it. The process is pretty simple:

* Contact your insurance company. They’ll handle the renewal process, sending a new SR-22 to the DMV.

* Pay any outstanding premiums. Make sure your insurance is current to avoid any lapses in coverage.

* Maintain a clean driving record. This is crucial. If you get another violation, your SR-22 might be extended.

SR-22 Cancellation

You’re probably thinking, “When can I get rid of this thing?” Here’s the good news: Your SR-22 can be canceled when the DMV determines you’ve met the terms of your probation. This usually means:

* No further violations. No tickets, accidents, or other offenses for the duration of your probation period.

* Probation period completion. This is usually determined by the state and the severity of your offense.

What Happens If Your SR-22 Is Cancelled

Your SR-22 might be canceled under certain circumstances:

* Non-payment of premiums. If you don’t keep your insurance current, your SR-22 will be canceled, and you might face penalties.

* Driving violations. If you get another ticket or have an accident, your SR-22 could be extended, and you might have to start the probation period over.

Important: It’s crucial to stay on top of your SR-22. If it lapses, you’ll need to file a new one, which can be a hassle.

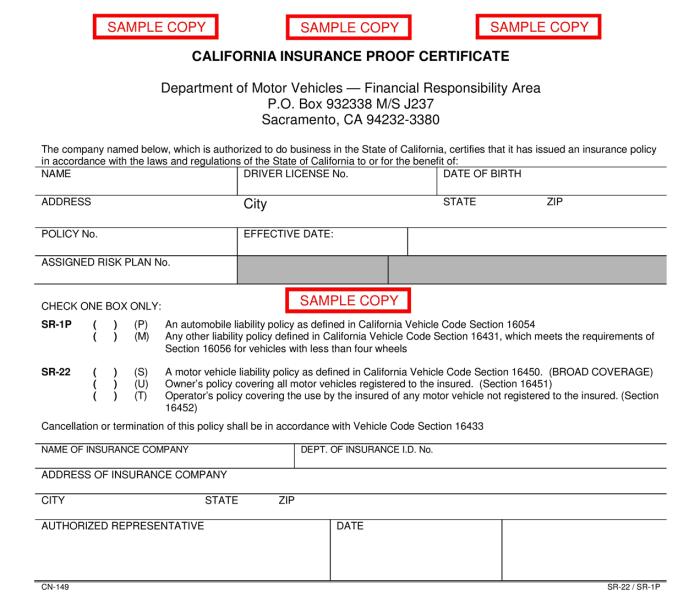

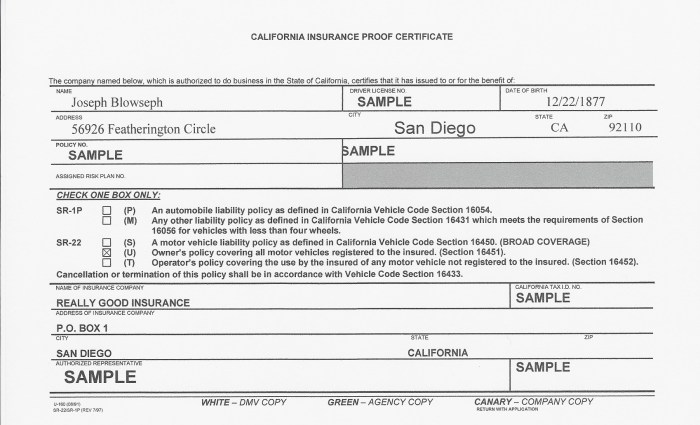

Legal and Regulatory Considerations

SR-22 forms are not just a piece of paper; they’re a legal document that shows you’re meeting your state’s requirements after a serious driving violation. Think of it as a “proof of insurance” on steroids, with extra rules and consequences if you mess up.

SR-22 Legal Requirements, Which insurance companies offer sr22

SR-22 forms are issued by your insurance company and sent to your state’s Department of Motor Vehicles (DMV) to prove you have the minimum required liability insurance coverage. This is a big deal because states have laws in place to make sure drivers are financially responsible for any accidents they cause. If you’re in a situation that requires an SR-22, it’s crucial to understand the specific requirements in your state, as they can vary.

Penalties for Non-Compliance

Failing to comply with SR-22 regulations is like playing with fire. You’re not just risking a hefty fine; you’re also risking losing your driver’s license, getting your car impounded, and even facing jail time. States take SR-22s seriously, and if you don’t keep your insurance active and file the necessary paperwork, they’ll come down on you hard.

Resources for Legal Advice

If you’re facing an SR-22 requirement, it’s always best to consult with a legal professional. They can explain your specific situation, the rules in your state, and your legal options. Here are some resources to help you find legal advice:

- State Bar Associations: Each state has a bar association that can provide referrals to lawyers in your area. You can find their websites by searching for “State Bar Association” followed by your state’s name.

- Legal Aid Organizations: If you can’t afford a lawyer, legal aid organizations offer free or low-cost legal services to low-income individuals. You can find a local legal aid organization by searching online or contacting your local courthouse.

Ultimate Conclusion

Navigating the world of SR-22s can feel like driving through a maze, but by understanding the basics and finding the right insurance company, you can get back on the road and keep your driving privileges. Remember, an SR-22 is more than just a piece of paper – it’s a sign of your commitment to being a responsible driver. So, keep your cool, do your research, and get the coverage you need. You’ve got this!

Clarifying Questions: Which Insurance Companies Offer Sr22

What happens if I don’t get an SR-22?

If you don’t get an SR-22 when required, you could face serious consequences, like losing your driver’s license or even facing legal penalties. It’s best to get one ASAP to avoid any potential problems.

How long do I have to keep an SR-22?

The length of time you need to keep an SR-22 depends on your state and the specific violation you’re dealing with. It could be anywhere from a few months to a few years. Your insurance company can provide you with the specific timeframe for your situation.

Can I get an SR-22 even if I have a bad driving record?

While some insurance companies might be hesitant to provide an SR-22 to drivers with a bad driving record, there are still options available. It’s best to contact a few different companies and compare their rates and coverage options. Remember, persistence is key!