Which insurance company is best for life insurance – Choosing the right life insurance company can be a daunting task, especially with so many options available. It’s like trying to pick the perfect pizza topping – everyone has their own preferences, and what works for one person might not work for another. But just like finding the perfect pepperoni-to-cheese ratio, finding the right life insurance company can give you peace of mind knowing your loved ones will be taken care of.

To make the process easier, we’ll break down the essential factors to consider, including different types of life insurance, coverage needs, financial stability, and comparing quotes. We’ll also discuss the role of professional advisors and highlight resources for finding the best fit for your unique situation.

Understanding Life Insurance Needs

Life insurance is a crucial financial tool that can provide peace of mind for you and your loved ones. It acts as a safety net, ensuring that your family is financially secure in the event of your untimely demise. However, choosing the right life insurance policy can be a daunting task. This guide will help you navigate the complexities of life insurance and determine the best policy for your specific needs.

Types of Life Insurance Policies

Understanding the different types of life insurance policies is essential to making an informed decision. Each type comes with its own unique features, benefits, and drawbacks.

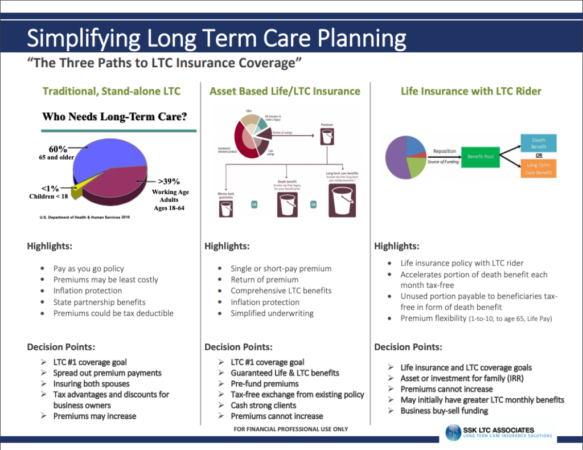

- Term Life Insurance: This is the most basic and affordable type of life insurance. It provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you receive nothing. Term life insurance is ideal for individuals with temporary financial obligations, such as a mortgage or young children. It is typically more affordable than other types of life insurance.

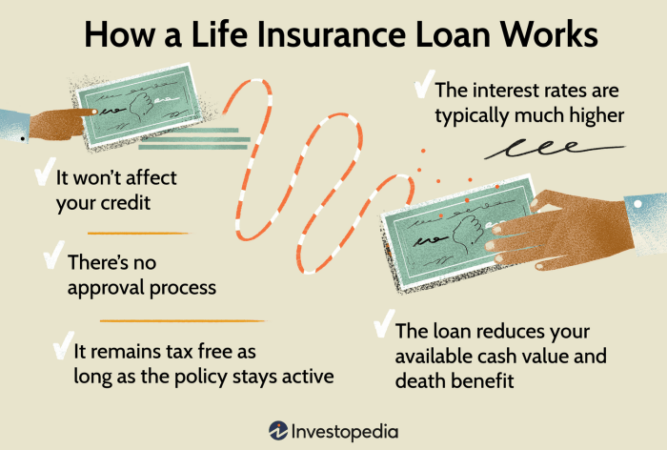

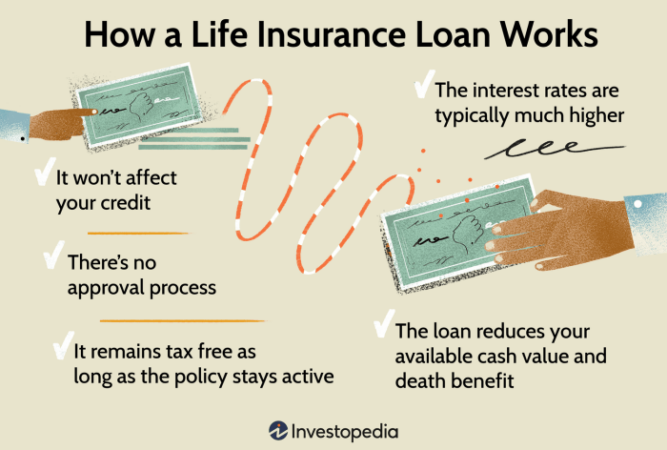

- Whole Life Insurance: This type of life insurance provides permanent coverage for your entire life, as long as you continue paying the premiums. It builds cash value that you can borrow against or withdraw from. Whole life insurance is more expensive than term life insurance, but it offers lifetime coverage and investment potential. It can be a good option for individuals who want a long-term financial safety net and are willing to pay a higher premium.

- Universal Life Insurance: This type of life insurance offers flexibility in premium payments and death benefit amounts. It allows you to adjust your coverage and premiums based on your changing needs. Universal life insurance typically has higher premiums than term life insurance, but it offers more flexibility and investment options. It can be a good option for individuals who want a more customized policy.

Factors to Consider

Several factors can influence your life insurance needs, including:

- Age and Health: Your age and health status play a significant role in determining your life insurance premiums. Younger and healthier individuals typically qualify for lower premiums.

- Dependents: The number and ages of your dependents will influence your life insurance needs. If you have young children or a spouse who relies on your income, you may need more coverage than someone without dependents.

- Financial Obligations: Your financial obligations, such as a mortgage, student loans, or business debts, should be considered when determining your life insurance coverage needs. Your life insurance policy should be sufficient to cover these obligations in the event of your death.

- Income: Your income level can also impact your life insurance needs. If you have a high income, you may need more coverage to ensure your family’s financial security.

Advantages and Disadvantages

Each type of life insurance policy has its own advantages and disadvantages:

- Term Life Insurance:

- Advantages: Affordable, provides temporary coverage for a specific period, good for temporary financial obligations.

- Disadvantages: No cash value, coverage expires after the term, premiums may increase with age.

- Whole Life Insurance:

- Advantages: Permanent coverage, builds cash value, can be used as a savings tool.

- Disadvantages: More expensive than term life insurance, premiums can be fixed or variable, investment returns may be lower than other options.

- Universal Life Insurance:

- Advantages: Flexible premiums and death benefit amounts, allows for customization based on changing needs, investment options available.

- Disadvantages: Higher premiums than term life insurance, complex policies can be difficult to understand, investment returns may vary.

Key Factors to Evaluate Insurance Companies

Choosing the right life insurance company is a big decision, especially when you’re considering a policy that will protect your loved ones for years to come. Just like you wouldn’t buy a car without researching its safety features and reliability, you shouldn’t choose a life insurance company without carefully evaluating its track record and reputation. Let’s dive into some key factors that can help you make an informed decision.

Financial Stability and Ratings

Financial stability is crucial for any insurance company, but it’s especially important when it comes to life insurance. You want to be sure that the company will be around to pay out your death benefit when the time comes. Think of it like this: if you invest in a company that goes bankrupt, you lose your money. The same principle applies to life insurance – you want to make sure your beneficiaries will receive the promised payout.

Several organizations rate insurance companies based on their financial strength and stability. These ratings are based on a company’s financial reserves, investment performance, and overall business practices. Look for companies with high ratings from reputable organizations like:

- A.M. Best

- Standard & Poor’s

- Moody’s

- Fitch Ratings

A high rating from these organizations indicates that the company is financially sound and has a strong track record of meeting its obligations.

Key Factors for Comparison, Which insurance company is best for life insurance

When comparing life insurance companies, it’s important to consider factors beyond just the premium price. Here are some key aspects to evaluate:

- Premiums: Premiums are the monthly payments you make for your life insurance policy. It’s important to compare premiums from different companies, but remember that the lowest premium isn’t always the best deal. Consider the coverage you’re getting and the financial stability of the company before making a decision.

- Coverage: Coverage refers to the amount of money your beneficiaries will receive upon your death. The amount of coverage you need will depend on your individual circumstances, such as your income, dependents, and debts. Make sure you understand the different types of coverage available and choose a policy that meets your specific needs.

- Customer Service: A good life insurance company should have excellent customer service. Look for companies that are responsive to your questions and concerns, and that have a proven track record of resolving customer issues quickly and efficiently.

- Claims Processing: The claims process can be complex and stressful, so you want to choose a company that makes it as easy as possible. Look for companies with a streamlined claims process and a history of paying claims promptly and fairly.

Role of Independent Financial Advisors and Consumer Reviews

Independent financial advisors can provide valuable guidance in choosing the right life insurance company. They can help you understand your needs, compare different policies, and find the best fit for your situation. You can find a certified financial planner (CFP) through the Financial Planning Association.

Consumer reviews can also be a helpful resource when choosing a life insurance company. Websites like Trustpilot and Consumer Reports provide reviews from real customers who have experience with different companies. While reviews can be subjective, they can give you a sense of a company’s overall reputation and customer satisfaction.

Comparing Life Insurance Quotes

Finding the right life insurance policy involves more than just picking the first option you come across. It’s about comparing apples to apples, or in this case, policies to policies. Getting quotes from multiple companies and carefully evaluating them is crucial to ensure you’re getting the best coverage at the best price.

Obtaining Life Insurance Quotes

To get started, you’ll need to gather some basic information about yourself and your needs. This includes your age, health, desired coverage amount, and any other relevant factors like smoking status or family history. Once you have this information, you can start obtaining quotes. Here’s a step-by-step guide:

- Online Quote Tools: Many insurance companies offer online quote tools that allow you to quickly and easily get a preliminary estimate. These tools are usually free and require only basic information to provide a quote. However, keep in mind that these quotes may not be finalized until a more comprehensive application process is completed.

- Insurance Broker: Working with an insurance broker can be a great way to compare quotes from multiple companies. Brokers have access to a wide range of insurance companies and can help you navigate the process of finding the best policy for your needs. While they may charge a fee for their services, their expertise can save you time and effort in the long run.

- Contact Insurance Companies Directly: You can also contact insurance companies directly to request a quote. This allows you to speak with a representative and get more personalized guidance. Be sure to have all the necessary information ready, including your personal details and desired coverage amount.

Comparing Life Insurance Quotes

Once you have quotes from multiple companies, it’s time to compare them side-by-side. Don’t just focus on the premium; look at the overall value of the policy. Here are some key factors to consider:

- Coverage Amount: Make sure the coverage amount is sufficient to meet your family’s needs in case of your death. Consider factors like outstanding debts, funeral expenses, and income replacement for your dependents.

- Premium: The premium is the monthly payment you’ll make for the life insurance policy. Compare premiums from different companies and ensure they fit within your budget. Look for policies with competitive premiums and coverage that aligns with your needs.

- Policy Type: Different types of life insurance policies offer varying levels of coverage and premiums. Term life insurance is typically more affordable but provides coverage for a specific period. Permanent life insurance offers lifelong coverage but comes with higher premiums. Choose the type of policy that best suits your financial situation and long-term goals.

- Riders: Riders are optional additions to your life insurance policy that can provide extra benefits, such as accidental death coverage or disability income protection. Evaluate whether these riders are necessary for your specific needs and weigh their costs against their potential benefits.

- Company Reputation: Before committing to a policy, research the insurance company’s financial stability and reputation. Look for companies with strong ratings from independent agencies like A.M. Best and Standard & Poor’s. A financially sound company is more likely to be able to pay out claims when needed.

Comparing Key Features and Costs

To help you visualize the comparison process, here’s a sample table comparing key features and costs of different life insurance policies from various companies:

| Company | Policy Type | Coverage Amount | Premium (Monthly) | Riders | Company Rating |

|---|---|---|---|---|---|

| Company A | Term Life | $500,000 | $50 | Accidental Death, Disability Income | A+ |

| Company B | Whole Life | $250,000 | $100 | None | A |

| Company C | Universal Life | $300,000 | $75 | Waiver of Premium | A- |

Understanding Policy Terms and Conditions: Which Insurance Company Is Best For Life Insurance

You’ve compared quotes, considered your needs, and even weighed the pros and cons of different insurance companies. But before you sign on the dotted line, you need to understand the fine print! This is where understanding the policy terms and conditions comes into play, and it’s not as boring as it sounds. Think of it like reading the back of a cereal box – you might not always be interested, but it’s important to know what you’re getting into.

Policy Terms and Conditions: What’s in it for you?

The policy terms and conditions are the legal document that lays out the agreement between you and the insurance company. It’s your roadmap for navigating the world of life insurance. It defines everything from the benefits you’ll receive to the obligations you’ll have. It’s like the “rule book” of your life insurance policy, and you’ll want to make sure you understand the rules.

Common Policy Terms

It’s like learning a new language, but don’t worry, we’re here to translate. Here’s a breakdown of some key terms:

- Death Benefit: This is the main event, folks. This is the amount of money your beneficiaries will receive upon your death. Think of it as the “grand prize” of your life insurance policy.

- Premium: This is the monthly (or annual) payment you make to the insurance company. It’s like your “investment” in your life insurance policy.

- Beneficiary: This is the person or people who will receive the death benefit. It’s like choosing your “lucky recipients” to inherit the “grand prize.”

- Grace Period: This is the time you have to pay your premium after it’s due. Think of it as a “buffer” for those occasional slip-ups.

Importance of Reading and Understanding

It’s not just about checking a box, it’s about making sure you’re getting the best deal and ensuring your loved ones are protected. Here’s why:

- Avoid Surprises: You don’t want to find out about hidden clauses or exclusions after something happens. Reading the policy terms and conditions is like avoiding a “gotcha” moment.

- Make Informed Decisions: Knowing the terms allows you to compare different policies and choose the one that best fits your needs. Think of it like making a smart “shopping” decision.

- Protect Your Beneficiaries: Understanding the policy ensures your loved ones receive the benefits they deserve, without any unexpected complications. It’s like making sure your legacy is “on point.”

Negotiating Policy Terms and Conditions

You don’t have to take everything as is. You can negotiate with the insurance company to get the best deal for your specific needs.

- Ask Questions: Don’t be afraid to ask for clarification on any terms you don’t understand. Think of it like getting a “second opinion” before making a big decision.

- Compare Offers: Get quotes from multiple insurance companies and compare the terms and conditions. It’s like “price-checking” before making a purchase.

- Negotiate Exclusions: If there are specific exclusions that don’t make sense for your situation, try to negotiate them out. Think of it like “haggling” for a better deal.

Seeking Professional Advice

Choosing the right life insurance policy can be a complex and overwhelming process. There are many factors to consider, and it’s easy to get lost in the details. This is where a financial advisor can be a valuable asset.

Financial advisors are trained professionals who can help you navigate the world of life insurance. They can assess your individual needs, provide personalized recommendations, and help you choose the policy that best fits your budget and goals.

Benefits of Seeking Professional Advice

Financial advisors can offer several benefits when it comes to choosing life insurance:

- Objectivity: Financial advisors provide an unbiased perspective. They are not tied to any particular insurance company and can recommend the best policy based on your needs, not their own commission.

- Expertise: Financial advisors have extensive knowledge of the life insurance market. They can explain complex concepts, compare different policies, and help you understand the fine print.

- Customization: Financial advisors can create a personalized life insurance plan that meets your unique circumstances. They will consider your income, dependents, financial goals, and risk tolerance.

- Long-term Planning: Financial advisors can help you integrate life insurance into your overall financial plan. They can advise you on how much coverage you need, how to pay for premiums, and how to manage your policy over time.

Finding Qualified and Reputable Financial Advisors

Finding a qualified and reputable financial advisor is crucial. Here are some resources you can use:

- Professional Associations: Organizations like the Certified Financial Planner Board of Standards (CFP Board) and the National Association of Personal Financial Advisors (NAPFA) have strict requirements for membership. Look for advisors who are certified by these organizations.

- Referrals: Ask your friends, family, and colleagues for recommendations. You can also ask your accountant, lawyer, or other trusted professionals for referrals.

- Online Directories: Websites like the CFP Board’s website and NAPFA’s website offer directories of certified financial advisors in your area. You can search for advisors based on their experience, specialties, and fees.

Ending Remarks

Ultimately, finding the best life insurance company is about finding the right balance between coverage, affordability, and peace of mind. It’s like finding the perfect pair of jeans – you want something that fits well, looks good, and makes you feel confident. By considering all the factors and taking the time to compare options, you can find a life insurance policy that meets your needs and protects your loved ones for years to come.

FAQ Compilation

What are the main types of life insurance policies?

The most common types of life insurance are term life, whole life, and universal life. Term life provides coverage for a specific period, while whole life offers permanent coverage with a cash value component. Universal life combines features of both, offering flexibility in premiums and death benefit.

How do I know how much life insurance coverage I need?

To determine your coverage needs, consider factors like your age, health, dependents, and financial obligations. A financial advisor can help you calculate your specific needs based on your individual circumstances.

What are the benefits of using a financial advisor?

Financial advisors can provide expert guidance on choosing the right life insurance policy, understanding your coverage needs, and navigating the complex world of insurance companies. They can also help you compare quotes and negotiate policy terms.