Which is the best company for car insurance – Which car insurance company is the best? It’s a question every driver asks, especially when you’re looking to save some dough. Finding the perfect fit for your needs involves more than just comparing prices; it’s about understanding your coverage options and making sure you’re protected on the road. Think of it like finding your dream ride, but instead of horsepower, you’re searching for the best value and peace of mind.

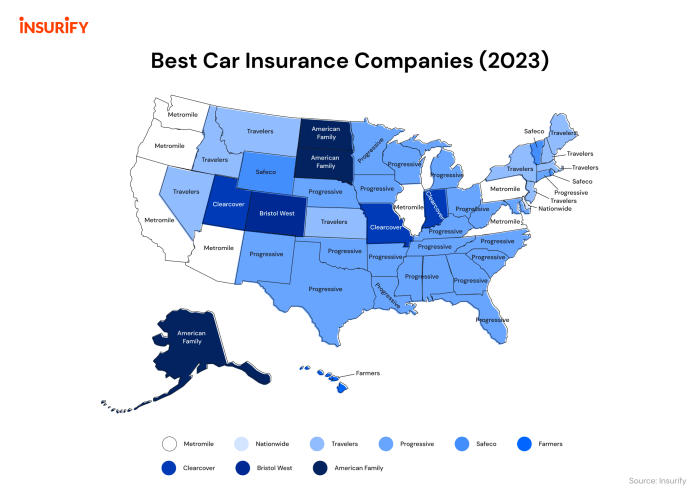

To find your perfect match, you’ll need to consider factors like your driving history, the type of car you drive, and your location. Don’t forget about your credit score, because it can impact your premiums too. It’s like a puzzle, and figuring out how these pieces fit together is key to getting the best deal.

Factors Influencing Car Insurance Costs

Car insurance premiums are not a one-size-fits-all deal. They’re calculated based on a variety of factors that assess your risk as a driver. Think of it like this: the insurance company is trying to predict how likely you are to get into an accident and how much it might cost to fix it. The more likely you are to crash and the more expensive your car is to repair, the higher your premium will be.

Driving History

Your driving history is a major factor in determining your car insurance costs. This includes things like your driving record, any accidents you’ve been in, and any traffic violations you’ve received. If you have a clean driving record, you’ll likely get a lower premium. However, if you have a history of accidents or violations, you can expect to pay more. For example, if you’ve been in an accident that was your fault, your premium will likely go up. This is because you’re considered a higher risk to the insurance company.

Comparing Car Insurance Companies: Which Is The Best Company For Car Insurance

Choosing the right car insurance company can feel like navigating a jungle of confusing policies and prices. But don’t worry, you’re not alone! This guide will help you compare the top car insurance providers, so you can find the best fit for your needs and budget.

Car Insurance Company Comparison

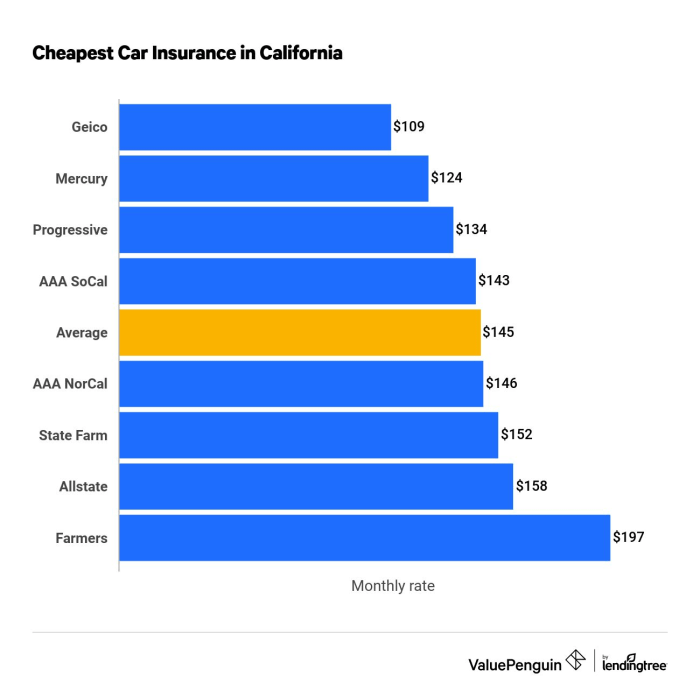

To help you make an informed decision, here’s a table comparing five major car insurance providers. We’ve included key factors like average premiums, customer satisfaction ratings, coverage options, and discounts. Remember, these are just general averages and your actual rates will vary based on your individual circumstances.

| Company Name | Average Premium | J.D. Power Customer Satisfaction Rating | Coverage Options | Discounts |

|---|---|---|---|---|

| Geico | $1,400 | 4 out of 5 | Comprehensive, Collision, Liability, Uninsured Motorist, Medical Payments | Good Student, Safe Driver, Multi-Car, Multi-Policy |

| State Farm | $1,500 | 4 out of 5 | Comprehensive, Collision, Liability, Uninsured Motorist, Medical Payments | Good Student, Safe Driver, Multi-Car, Multi-Policy |

| Progressive | $1,300 | 3 out of 5 | Comprehensive, Collision, Liability, Uninsured Motorist, Medical Payments | Good Student, Safe Driver, Multi-Car, Multi-Policy |

| Allstate | $1,600 | 3 out of 5 | Comprehensive, Collision, Liability, Uninsured Motorist, Medical Payments | Good Student, Safe Driver, Multi-Car, Multi-Policy |

| USAA | $1,200 | 5 out of 5 | Comprehensive, Collision, Liability, Uninsured Motorist, Medical Payments | Good Student, Safe Driver, Multi-Car, Multi-Policy |

Understanding Coverage Options

Car insurance coverage is a complex topic with many options to consider. To choose the right coverage for you, it’s important to understand the different types of coverage available and how they work.

Liability Coverage

Liability coverage is the most common type of car insurance. It protects you financially if you cause an accident that injures someone or damages their property. Liability coverage pays for:

* Medical expenses: If you cause an accident that injures someone, liability coverage will pay for their medical bills.

* Property damage: If you cause an accident that damages someone’s car or other property, liability coverage will pay for the repairs.

* Legal defense costs: If you are sued as a result of an accident, liability coverage will pay for your legal defense costs.

Liability coverage is typically expressed in two numbers:

* Bodily injury liability: This covers medical expenses and other damages for injuries caused to other people.

* Property damage liability: This covers damages to another person’s property.

Liability coverage is required by law in most states. The amount of liability coverage you need will depend on your individual circumstances.

Collision Coverage

Collision coverage pays for repairs to your car if it’s damaged in an accident, regardless of who is at fault. It will pay for:

* Repairs to your car: Collision coverage will pay for repairs to your car, up to the actual cash value (ACV) of the vehicle.

* Deductible: You’ll need to pay a deductible before your insurance company will cover the rest of the repairs.

Collision coverage is optional, but it’s a good idea to have it if you have a loan or lease on your car. If you have an older car, you may want to consider dropping collision coverage, as the cost of repairs may exceed the value of the car.

Comprehensive Coverage

Comprehensive coverage pays for damage to your car caused by events other than an accident. This includes:

* Theft: If your car is stolen, comprehensive coverage will pay for the replacement value of the car, minus your deductible.

* Vandalism: If your car is vandalized, comprehensive coverage will pay for repairs, minus your deductible.

* Natural disasters: If your car is damaged by a natural disaster, such as a flood or earthquake, comprehensive coverage will pay for repairs, minus your deductible.

Comprehensive coverage is optional, but it’s a good idea to have it if you have a new car or a car with a high value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage will pay for:

* Medical expenses: If you are injured in an accident with an uninsured or underinsured driver, UM/UIM coverage will pay for your medical bills.

* Property damage: If your car is damaged in an accident with an uninsured or underinsured driver, UM/UIM coverage will pay for repairs.

UM/UIM coverage is optional in most states, but it’s a good idea to have it.

It’s important to note that the amount of coverage you need will depend on your individual circumstances. You should talk to an insurance agent to determine the best coverage options for you.

Finding the Best Deal

Finding the best car insurance deal can feel like a game of “Who Wants to Be a Millionaire,” but don’t worry, you don’t need a lifeline for this one. We’ll walk you through the process, step by step, so you can find the perfect coverage at a price that fits your budget.

Getting Quotes

Obtaining quotes from multiple providers is essential for comparing prices and finding the best deal. It’s like shopping around for a new pair of sneakers – you wouldn’t buy the first pair you see, would you? Here’s how to get those quotes rolling:

- Start with Online Quotes: Most insurance companies have user-friendly websites where you can get a quick quote. Just enter your information, including your driving history, car details, and desired coverage, and voila! You’ll have a quote in minutes.

- Contact Insurance Agents: If you prefer a more personalized approach, reach out to insurance agents. They can help you understand different coverage options and find policies that best suit your needs. Think of them as your personal insurance gurus.

- Use Comparison Websites: Websites like [website name] and [website name] aggregate quotes from multiple insurers, allowing you to compare side-by-side. It’s like having a car insurance showdown, with you as the champion picking the best deal.

Comparing Quotes and Understanding Policy Terms

Now that you’ve got your quotes, it’s time to put on your detective hat and compare them carefully. Don’t just focus on the bottom line; delve into the details of each policy. You’re looking for the best value, not just the cheapest price.

- Coverage Amounts: Make sure the coverage amounts (liability limits, collision and comprehensive deductibles) are adequate for your needs. You don’t want to be caught short if you’re ever in an accident.

- Deductibles: Higher deductibles generally mean lower premiums. Think about how much you’re willing to pay out of pocket if you have an accident. If you’re comfortable with a higher deductible, you could save on your premiums.

- Exclusions: Read the fine print! Pay attention to any exclusions in the policy, such as coverage limitations for certain types of accidents or specific car parts.

Negotiating Discounts and Saving Money

Once you’ve found a policy you like, don’t be afraid to negotiate. Insurance companies are often willing to work with you to find ways to lower your premium. Here are some tips:

- Ask About Discounts: Most insurance companies offer a variety of discounts, such as safe driver discounts, good student discounts, multi-car discounts, and more. Ask your insurance agent about all the discounts you qualify for.

- Bundle Your Policies: If you have multiple insurance policies (home, renters, life), you may be able to bundle them together for a discount. This is a great way to save on your overall insurance costs.

- Improve Your Credit Score: Believe it or not, your credit score can impact your car insurance rates. Improving your credit score can lead to lower premiums. Think of it as a financial superpower that can save you money on insurance.

- Shop Around Regularly: Don’t get complacent. Shop around for car insurance quotes at least once a year to make sure you’re still getting the best deal. Remember, the insurance landscape is constantly changing, so staying informed is key.

Tips for Saving on Car Insurance

Car insurance is a necessity for most drivers, but it can be a significant expense. Fortunately, there are several strategies you can employ to reduce your premiums and keep more money in your pocket.

Bundling Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Insurance companies often offer discounts for combining multiple policies, as they see you as a more valuable customer.

Bundling can often save you 10-15% or more on your premiums.

By bundling your policies, you streamline your insurance needs and simplify your financial management.

Maintaining a Good Driving Record, Which is the best company for car insurance

A clean driving record is a gold mine when it comes to car insurance. Avoiding accidents, traffic violations, and DUI charges can significantly lower your premiums. Insurance companies view drivers with a good driving history as lower risk, translating into more favorable rates.

Every accident or violation can lead to an increase in your premiums.

Maintaining a safe driving record not only saves you money but also contributes to safer roads for everyone.

Exploring Discounts

Car insurance companies offer a variety of discounts to attract and retain customers. These discounts can be based on various factors, such as:

- Good student discounts for students with high GPAs.

- Safe driver discounts for drivers who haven’t had any accidents or violations.

- Multi-car discounts for insuring multiple vehicles with the same company.

- Loyalty discounts for long-term customers.

- Discounts for safety features, such as anti-theft devices or airbags.

Taking the time to explore these discounts can result in significant savings.

Increasing Safety Features

Investing in safety features for your car can make a difference in your insurance premiums.

Cars with advanced safety features like anti-lock brakes, airbags, and stability control are often considered safer by insurance companies.

These features can reduce the likelihood of accidents and injuries, leading to lower insurance rates.

Reducing Risk Factors

Certain factors can increase your car insurance premiums.

Factors like your age, location, and driving history can all influence your rates.

To minimize these risk factors, consider:

- Choosing a safe neighborhood to live in.

- Parking your car in a secure garage or driveway.

- Limiting your driving distance and avoiding high-risk areas.

By taking steps to reduce your risk, you can lower your insurance premiums and keep your costs under control.

Ultimate Conclusion

So, how do you navigate this car insurance jungle? The key is to do your research, compare quotes from different companies, and don’t be afraid to negotiate. Remember, the right car insurance company can be your wingman, protecting you on the road and giving you peace of mind. Just like a good playlist, finding the perfect car insurance is about finding the right mix of coverage, price, and customer service.

FAQ Corner

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of who is at fault.

How can I get a discount on my car insurance?

Many companies offer discounts for good driving records, bundling policies, safety features, and more. Ask about available discounts when you get a quote.

What is a deductible, and how does it affect my insurance costs?

A deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually means lower premiums.

What are the best car insurance companies for young drivers?

Some companies offer special discounts or programs for young drivers. It’s best to compare quotes from multiple companies to find the best deal.