Which is the best insurance company? That’s a question that’s been buzzing around the water cooler for ages, and trust me, it’s a real head-scratcher. Finding the right insurance is like finding the perfect pair of jeans – you want something that fits your needs, looks good, and doesn’t break the bank. Whether you’re a seasoned pro or just starting out, navigating the world of insurance can feel like a maze. But fear not, my friends! We’re diving deep into the insurance jungle to find the best fit for your unique situation.

This guide will cover everything from understanding your insurance needs to comparing different companies and finding the perfect policy for your lifestyle. We’ll break down the jargon, reveal the secrets, and give you the power to make informed decisions about your insurance. Buckle up, it’s gonna be a wild ride!

Understanding Insurance Needs

Insurance is like that safety net you hope you never need, but you’re glad you have when you do. It’s about protecting yourself and your loved ones from unexpected life events. But with so many different types of insurance out there, figuring out what you need can feel like a game of “who wants to be a millionaire” with your future on the line. Don’t worry, we’re here to help you navigate the insurance jungle.

Types of Insurance

Insurance is like a diverse menu of options, each designed to protect a different part of your life. Here are some of the most common types:

- Health Insurance: This covers medical expenses like doctor visits, hospital stays, and prescriptions. It’s like a superhero cape for your health, protecting you from financial ruin in case of an unexpected illness or injury.

- Auto Insurance: This protects you from financial loss in case of an accident involving your car. It’s like a bodyguard for your ride, covering damages to your vehicle and even injuries to others.

- Home Insurance: This protects your home from damage due to fire, theft, or natural disasters. It’s like a security system for your castle, providing peace of mind and financial assistance if something unfortunate happens.

- Life Insurance: This provides a financial safety net for your loved ones in case of your death. It’s like a legacy plan, ensuring your family is taken care of when you’re gone.

Factors Influencing Insurance Needs

Your insurance needs are as unique as your fingerprint. Several factors come into play, shaping the kind of coverage you need. Think of it as a personalized insurance recipe, tailored to your specific situation:

- Age: As you age, your health needs change, and your risk of certain events increases. For example, older adults may need more comprehensive health insurance or long-term care coverage.

- Health: Your current health status plays a major role in determining your insurance needs. For instance, someone with pre-existing conditions might need a more robust health insurance plan.

- Location: Where you live affects your insurance needs. For example, homeowners in areas prone to hurricanes or earthquakes may require additional coverage.

- Lifestyle: Your daily activities and hobbies can also influence your insurance needs. If you’re a thrill-seeker with a penchant for extreme sports, you might need specialized coverage.

Personalized Insurance Assessments

Just like you wouldn’t buy a pair of shoes without trying them on, you shouldn’t choose insurance without a personalized assessment. This involves talking to an insurance professional who can help you:

- Identify your specific needs: They’ll ask you questions about your health, finances, lifestyle, and future goals to determine what kind of coverage is right for you.

- Compare different options: They’ll present you with a range of insurance plans from different companies, explaining the pros and cons of each.

- Choose the best plan: They’ll help you select the plan that provides the right level of coverage at an affordable price.

Key Factors to Consider

Choosing the right insurance company is like picking the perfect outfit for a big event – you want something that fits your needs, looks good, and protects you from any unexpected spills or mishaps. To find your perfect insurance match, you need to consider some key factors.

Financial Stability

Financial stability is the foundation of a reliable insurance company. It’s like having a strong bank account – you want to make sure your insurer can pay out when you need them most. You can assess financial stability by looking at a company’s financial ratings, which are assigned by independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings evaluate a company’s financial health, including its ability to pay claims, manage risk, and stay solvent. A company with a high rating is considered financially strong and trustworthy.

Customer Service

You’re not just buying insurance; you’re buying a relationship. Customer service is essential for a smooth and positive experience. When you have a question, need to file a claim, or just want to understand your policy, you want a company that responds quickly, efficiently, and with empathy. You can gauge customer service by reading online reviews, checking customer satisfaction scores, and asking friends and family for their experiences.

Coverage Options

Every insurance need is different, just like every person is unique. You need to find a company that offers the coverage options that best fit your specific needs and circumstances. Consider factors like the amount of coverage you need, the types of risks you want to protect yourself against, and the specific features and benefits that are important to you.

Claims Process

When you need to file a claim, you want a company that makes the process as simple and hassle-free as possible. Look for a company with a transparent and straightforward claims process, clear communication, and a history of handling claims fairly and efficiently.

Independent Ratings and Reviews

Think of independent ratings and reviews as the Yelp of insurance companies. These sources provide valuable insights into a company’s performance and customer satisfaction. Websites like J.D. Power, Consumer Reports, and the National Association of Insurance Commissioners (NAIC) offer independent ratings and reviews based on various factors, including financial stability, customer satisfaction, claims handling, and complaint resolution.

Comparing Insurance Companies

Here’s a table that compares the pros and cons of different insurance companies based on the key factors we’ve discussed:

| Insurance Company | Financial Stability | Customer Service | Coverage Options | Claims Process | Overall Rating |

|---|---|---|---|---|---|

| Company A | A+ | Excellent | Wide range | Fast and efficient | 4.5 stars |

| Company B | A | Good | Limited options | Average | 3.5 stars |

| Company C | B+ | Fair | Limited options | Slow and complex | 2.5 stars |

Specific Insurance Types

Choosing the right insurance can feel like navigating a maze of confusing terms and options. But don’t worry, we’re here to break it down for you, one type at a time.

Auto Insurance

Auto insurance is a must-have for anyone who owns or drives a vehicle. It protects you financially in case of an accident, theft, or other damage to your car. Here’s a breakdown of some of the leading companies and their key features:

Top 5 Auto Insurance Companies

| Company | Coverage Options | Pricing | Customer Satisfaction |

|—|—|—|—|

| Geico | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist | Competitive pricing, discounts for good driving records, bundling | High customer satisfaction ratings, known for its ease of use and online services |

| Progressive | Similar coverage options to Geico, also offers unique features like “Name Your Price” tool | Competitive pricing, discounts for safe driving, bundling | High customer satisfaction ratings, known for its innovative features and personalized pricing |

| State Farm | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist | Competitive pricing, discounts for good driving records, bundling | High customer satisfaction ratings, known for its strong reputation and local agent network |

| USAA | Similar coverage options to State Farm, but only available to military members and their families | Highly competitive pricing, discounts for military service, bundling | Excellent customer satisfaction ratings, known for its dedicated service and benefits for military personnel |

| Liberty Mutual | Comprehensive, collision, liability, personal injury protection, uninsured/underinsured motorist | Competitive pricing, discounts for good driving records, bundling | High customer satisfaction ratings, known for its personalized service and strong financial stability |

Homeowners Insurance

Homeowners insurance protects your home and belongings from a variety of risks, such as fire, theft, and natural disasters.

Top 5 Homeowners Insurance Companies

| Company | Coverage Options | Pricing | Customer Satisfaction |

|—|—|—|—|

| State Farm | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses | Competitive pricing, discounts for home safety features, bundling | High customer satisfaction ratings, known for its strong reputation and local agent network |

| Allstate | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses | Competitive pricing, discounts for good credit scores, bundling | High customer satisfaction ratings, known for its innovative features and personalized service |

| Farmers | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses | Competitive pricing, discounts for bundling, and good driving records | High customer satisfaction ratings, known for its strong reputation and financial stability |

| USAA | Similar coverage options to Farmers, but only available to military members and their families | Highly competitive pricing, discounts for military service, bundling | Excellent customer satisfaction ratings, known for its dedicated service and benefits for military personnel |

| Liberty Mutual | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses | Competitive pricing, discounts for good credit scores, bundling | High customer satisfaction ratings, known for its personalized service and strong financial stability |

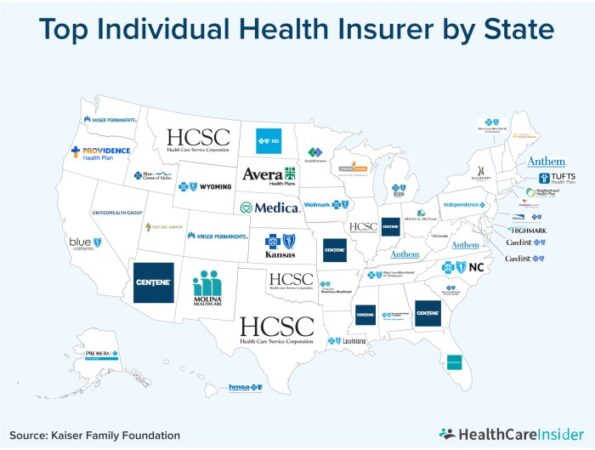

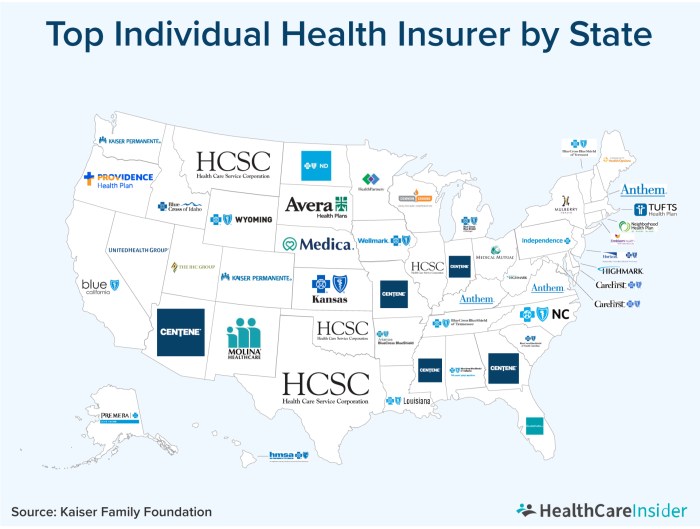

Health Insurance

Health insurance is essential for covering the costs of medical care, including doctor’s visits, hospital stays, and prescription drugs.

Top 5 Health Insurance Companies

| Company | Coverage Options | Pricing | Customer Satisfaction |

|—|—|—|—|

| UnitedHealthcare | Wide range of plans, including HMO, PPO, and POS | Competitive pricing, discounts for group plans, bundling | High customer satisfaction ratings, known for its extensive network and coverage options |

| Anthem | Wide range of plans, including HMO, PPO, and POS | Competitive pricing, discounts for group plans, bundling | High customer satisfaction ratings, known for its strong reputation and customer service |

| Cigna | Wide range of plans, including HMO, PPO, and POS | Competitive pricing, discounts for group plans, bundling | High customer satisfaction ratings, known for its innovative features and personalized service |

| Aetna | Wide range of plans, including HMO, PPO, and POS | Competitive pricing, discounts for group plans, bundling | High customer satisfaction ratings, known for its strong reputation and financial stability |

| Kaiser Permanente | Integrated health system offering HMO plans with emphasis on preventive care | Competitive pricing, discounts for group plans, bundling | High customer satisfaction ratings, known for its comprehensive care and focus on preventive health |

Life Insurance, Which is the best insurance company

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover expenses such as funeral costs, mortgage payments, and living expenses.

Top 5 Life Insurance Companies

| Company | Coverage Options | Pricing | Customer Satisfaction |

|—|—|—|—|

| Northwestern Mutual | Wide range of term and permanent life insurance plans | Competitive pricing, discounts for good health, bundling | High customer satisfaction ratings, known for its financial stability and strong reputation |

| New York Life | Wide range of term and permanent life insurance plans | Competitive pricing, discounts for good health, bundling | High customer satisfaction ratings, known for its financial stability and strong reputation |

| Prudential | Wide range of term and permanent life insurance plans | Competitive pricing, discounts for good health, bundling | High customer satisfaction ratings, known for its financial stability and strong reputation |

| MassMutual | Wide range of term and permanent life insurance plans | Competitive pricing, discounts for good health, bundling | High customer satisfaction ratings, known for its financial stability and strong reputation |

| Guardian | Wide range of term and permanent life insurance plans | Competitive pricing, discounts for good health, bundling | High customer satisfaction ratings, known for its financial stability and strong reputation |

Tips for Choosing the Right Company

Finding the best insurance company for your needs is like finding the perfect pair of jeans – it takes a little effort and a lot of comparison. You don’t want to end up with a policy that’s too tight (limited coverage) or too loose (too expensive). So, buckle up and let’s dive into some tips for finding the right fit for you.

Requesting Quotes and Comparing Offers

Getting quotes from multiple insurance companies is like trying on different pairs of jeans – you want to see what fits best. Don’t settle for the first offer you get; shop around! Most insurance companies have online quote tools, making it super easy to get an idea of their prices.

- Gather your information: Before you start requesting quotes, have your policy details handy, like your current coverage limits, deductibles, and any discounts you’re eligible for. This will help you compare apples to apples.

- Be specific with your needs: Don’t just say “I need car insurance.” Tell them what type of coverage you’re looking for (liability, collision, comprehensive), your driving history, and the vehicle you’re insuring. This will give you a more accurate quote.

- Compare features and benefits: Once you have a few quotes, compare the coverage offered, deductibles, and premiums. Don’t just go for the cheapest option – make sure the coverage is sufficient for your needs.

- Read the fine print: Don’t just skim the quotes; read the policy terms and conditions carefully. This will help you understand what’s covered and what’s not, as well as any exclusions or limitations.

Understanding Policy Terms and Conditions

Reading policy terms and conditions can be like reading a legal document, but it’s crucial for understanding what you’re signing up for. Think of it like reading the fine print on a pair of jeans – you want to know what’s included (like pockets or a certain type of fabric) and what’s not (like a special wash or a limited warranty).

- Coverage: This defines what the insurance company will cover in case of an accident or loss. It’s important to understand the different types of coverage available and what each one covers. For example, collision coverage covers damage to your vehicle in an accident, while comprehensive coverage covers damage from things like theft or vandalism.

- Deductibles: This is the amount you’ll pay out of pocket before your insurance kicks in. A higher deductible typically means a lower premium, but you’ll pay more in the event of a claim.

- Exclusions: These are specific events or circumstances that are not covered by the policy. For example, a policy might exclude coverage for certain types of vehicles, like motorcycles or antique cars.

- Limitations: These are restrictions on the coverage provided. For example, a policy might limit the amount of coverage for certain types of claims or have a specific time limit for filing a claim.

Insurance Trends and Innovations

The insurance industry is constantly evolving, driven by technological advancements and changing customer expectations. Insurance companies are embracing innovative solutions to improve efficiency, enhance customer experiences, and develop new products that cater to evolving needs.

Telematics and Usage-Based Insurance

Telematics, the use of technology to collect and analyze data from vehicles, has revolutionized the way insurance is priced and managed. Usage-based insurance (UBI) programs utilize telematics devices or smartphone apps to track driving behavior, such as speed, braking, and mileage. This data allows insurers to offer personalized premiums based on actual driving habits, rewarding safer drivers with lower rates.

For example, a driver who consistently maintains a safe driving record and drives fewer miles may receive a significant discount on their insurance premiums.

Digital Insurance Platforms

Digital insurance platforms are transforming the customer experience, providing convenient and personalized insurance solutions. These platforms offer online quotes, policy management, claims filing, and customer support, all accessible through a user-friendly interface.

- Enhanced User Experience: Digital platforms streamline the insurance process, allowing customers to compare quotes, purchase policies, and manage their accounts online.

- Personalized Recommendations: Utilizing data analytics, these platforms can tailor insurance recommendations to individual customer needs and risk profiles.

- Improved Customer Service: Digital platforms offer 24/7 access to customer support, enabling faster response times and improved communication.

Artificial Intelligence (AI) in Insurance

AI is playing an increasingly significant role in the insurance industry, automating processes, improving risk assessment, and personalizing customer interactions.

- Claims Processing: AI-powered systems can automate claims processing, reducing processing times and improving accuracy.

- Fraud Detection: AI algorithms can analyze large datasets to identify patterns and anomalies that indicate potential fraud.

- Personalized Pricing: AI can help insurers develop more accurate and personalized pricing models based on individual risk factors.

Insurtech Startups

Insurtech startups are disrupting the traditional insurance industry by offering innovative products and services that leverage technology to improve efficiency, accessibility, and customer satisfaction.

- Micro-Insurance: Insurtech startups are developing micro-insurance products that provide affordable coverage for specific risks, such as mobile phone damage or travel insurance.

- On-Demand Insurance: Some startups offer on-demand insurance policies that provide coverage for specific events or activities, such as short-term rental insurance or event liability insurance.

- Peer-to-Peer Insurance: These platforms allow individuals to share risk and provide insurance coverage to each other, potentially reducing costs and increasing transparency.

Resources and Additional Information: Which Is The Best Insurance Company

You’ve learned a lot about insurance, but there’s always more to discover. Here are some resources to help you dive deeper and find the best insurance solutions for your needs.

Reputable Resources for Further Research

- Insurance Information Institute (III): This non-profit organization provides comprehensive information on various insurance topics, including insurance types, industry trends, and consumer tips. They offer resources like articles, infographics, and reports that can help you make informed decisions.

- National Association of Insurance Commissioners (NAIC): The NAIC is a regulatory body that oversees insurance companies and promotes consumer protection. Their website provides valuable information about insurance regulations, consumer rights, and resources for filing complaints.

- Consumer Reports: This reputable consumer advocacy group provides independent reviews and ratings of insurance companies, helping you compare coverage and pricing. They also offer advice on navigating the insurance industry and protecting your rights as a consumer.

Official Insurance Company Websites and Regulatory Bodies

- Insurance Company Websites: Each insurance company has its own website where you can find detailed information about their policies, coverage options, pricing, and customer service. You can also often access online tools for getting quotes, managing your policy, and filing claims.

- State Insurance Departments: Each state has a dedicated insurance department that regulates insurance companies within its jurisdiction. These departments can provide information about insurance laws, licensing requirements, and consumer protection resources. You can usually find their contact information on the NAIC website.

Accessing Financial and Insurance Advice from Professionals

- Insurance Agents and Brokers: Insurance agents and brokers can provide personalized advice and help you find the right insurance policies for your needs. They can compare quotes from different companies, explain coverage options, and answer your questions.

- Financial Advisors: Financial advisors can help you develop a comprehensive financial plan that includes insurance as part of your overall risk management strategy. They can help you determine your insurance needs, choose the right policies, and ensure your coverage aligns with your financial goals.

Outcome Summary

So, remember, finding the best insurance company is a personal journey. Take the time to explore your options, ask questions, and don’t be afraid to shop around. By following the tips and advice in this guide, you’ll be well on your way to finding the insurance coverage that gives you peace of mind and keeps you protected.

FAQs

What are the most important factors to consider when choosing an insurance company?

When choosing an insurance company, consider factors like financial stability, customer service, coverage options, claims process, and independent ratings. It’s also essential to evaluate whether the company’s values align with your own.

How can I get a free insurance quote?

Most insurance companies offer free online quotes. You can also contact an insurance agent or broker to get quotes from multiple companies.

What are some tips for saving money on insurance?

You can save money on insurance by maintaining a good driving record, improving your credit score, and making your home more secure. Some insurance companies also offer discounts for bundling policies, being a loyal customer, or being a member of certain organizations.

What are some common insurance scams?

Be wary of insurance scams, such as fake insurance companies, fraudulent claims, and identity theft. Always do your research and be cautious when sharing personal information.