Who has the best car insurance rates in Florida? It’s a question many Floridians ask, especially given the state’s unique driving environment. Florida’s weather patterns, traffic density, and demographics all contribute to higher insurance premiums compared to other states. Understanding these factors and how they impact your individual rate is essential for finding the best deal.

This guide will delve into the complexities of Florida’s car insurance market, exploring key factors that influence rates, analyzing leading providers, and offering practical tips for saving money. Whether you’re a new driver or a seasoned motorist, this comprehensive resource will empower you to make informed decisions and secure the most affordable car insurance coverage.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique and complex, shaped by a variety of factors that influence the cost of coverage. Understanding these factors is crucial for consumers seeking the best rates.

Florida’s Unique Factors

Florida’s car insurance rates are influenced by a number of unique factors, including:

- Weather Patterns: Florida’s frequent hurricanes and severe storms increase the risk of car damage, driving up insurance premiums.

- Traffic Density: Florida’s bustling cities and high population density lead to increased traffic accidents, which also contribute to higher insurance costs.

- Demographics: Florida has a large elderly population, and older drivers are statistically more likely to be involved in accidents. Additionally, the state has a high concentration of tourists and visitors, who may be unfamiliar with local roads and driving conditions.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a critical role in regulating the state’s insurance market. The DFS:

- Licenses and Supervises Insurance Companies: The DFS ensures that insurance companies operating in Florida meet specific financial and operational standards.

- Protects Consumers: The DFS investigates consumer complaints against insurance companies and provides resources to help consumers understand their rights and options.

- Monitors Insurance Rates: The DFS reviews insurance rates to ensure they are fair and reasonable, and can intervene if necessary to prevent excessive rate increases.

Types of Car Insurance Coverage in Florida

Florida law requires all drivers to carry at least the following minimum coverage:

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the insured driver and passengers, regardless of fault. The minimum PIP coverage is $10,000.

- Property Damage Liability (PDL): Covers damage to the other driver’s vehicle or property in an accident that the insured driver is at fault for. The minimum PDL coverage is $10,000.

Drivers can choose to purchase additional coverage, including:

- Collision Coverage: Covers damage to the insured vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to the insured vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Provides protection if the insured driver is involved in an accident with a driver who is uninsured or underinsured.

- Rental Reimbursement Coverage: Covers the cost of renting a vehicle while the insured vehicle is being repaired after an accident.

The cost of each type of coverage varies depending on factors such as the driver’s age, driving record, vehicle type, and location.

Factors Affecting Individual Rates

While Florida’s car insurance landscape is unique, the individual rates you pay are determined by a complex set of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your car insurance rates. Insurance companies assess your risk based on past driving behavior.

- Accidents: Each accident, regardless of fault, increases your risk and leads to higher premiums. The severity of the accident, such as injuries or property damage, further impacts your rate.

- Traffic Violations: Speeding tickets, reckless driving, and DUI convictions are serious offenses that significantly raise your insurance rates. The more severe the violation, the greater the impact on your premium.

- Driving Record: A clean driving record with no accidents or violations is the most desirable for lower insurance rates. Maintaining a safe driving record is crucial for minimizing your insurance costs.

Age

Age is another crucial factor affecting car insurance rates. Insurance companies recognize that younger drivers are statistically more likely to be involved in accidents.

- Young Drivers: Drivers under the age of 25 generally pay higher premiums due to their lack of experience and higher risk of accidents.

- Mature Drivers: Drivers over the age of 65 often benefit from lower premiums. Their experience and driving habits generally contribute to a lower risk profile.

Credit Score

Surprisingly, your credit score can influence your car insurance rates. Insurance companies use credit scores as a proxy for financial responsibility and risk assessment.

- Higher Credit Score: A good credit score typically indicates a lower risk profile and can lead to lower insurance premiums.

- Lower Credit Score: A lower credit score may signal a higher risk, potentially resulting in increased insurance premiums.

Vehicle Type

The type of vehicle you drive is a significant factor in determining your car insurance rates. Insurance companies consider the vehicle’s value, safety features, and potential for damage.

- Luxury Cars: Luxury vehicles are often more expensive to repair or replace, resulting in higher insurance premiums.

- Sports Cars: Sports cars are known for their performance and speed, which can increase the risk of accidents and higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for lower insurance rates.

Driving Violations and Rate Impact

| Violation | Rate Increase (%) |

|---|---|

| Speeding Ticket | 10-25% |

| Reckless Driving | 25-50% |

| DUI | 50-100% |

| At-Fault Accident | 15-30% |

Major Car Insurance Providers in Florida

Florida’s car insurance market is highly competitive, with numerous providers vying for customers. Understanding the key players and their offerings is crucial for making informed decisions. This section delves into the major car insurance providers in Florida, analyzing their strengths and weaknesses.

Top 5 Car Insurance Providers in Florida

The following table presents the top 5 car insurance providers in Florida based on market share and customer satisfaction ratings:

| Provider | Market Share | Customer Satisfaction | Strengths | Weaknesses |

|—|—|—|—|—|

| State Farm | 22% | 80% | Extensive agent network, wide range of coverage options, competitive pricing | Limited online tools, customer service can be inconsistent |

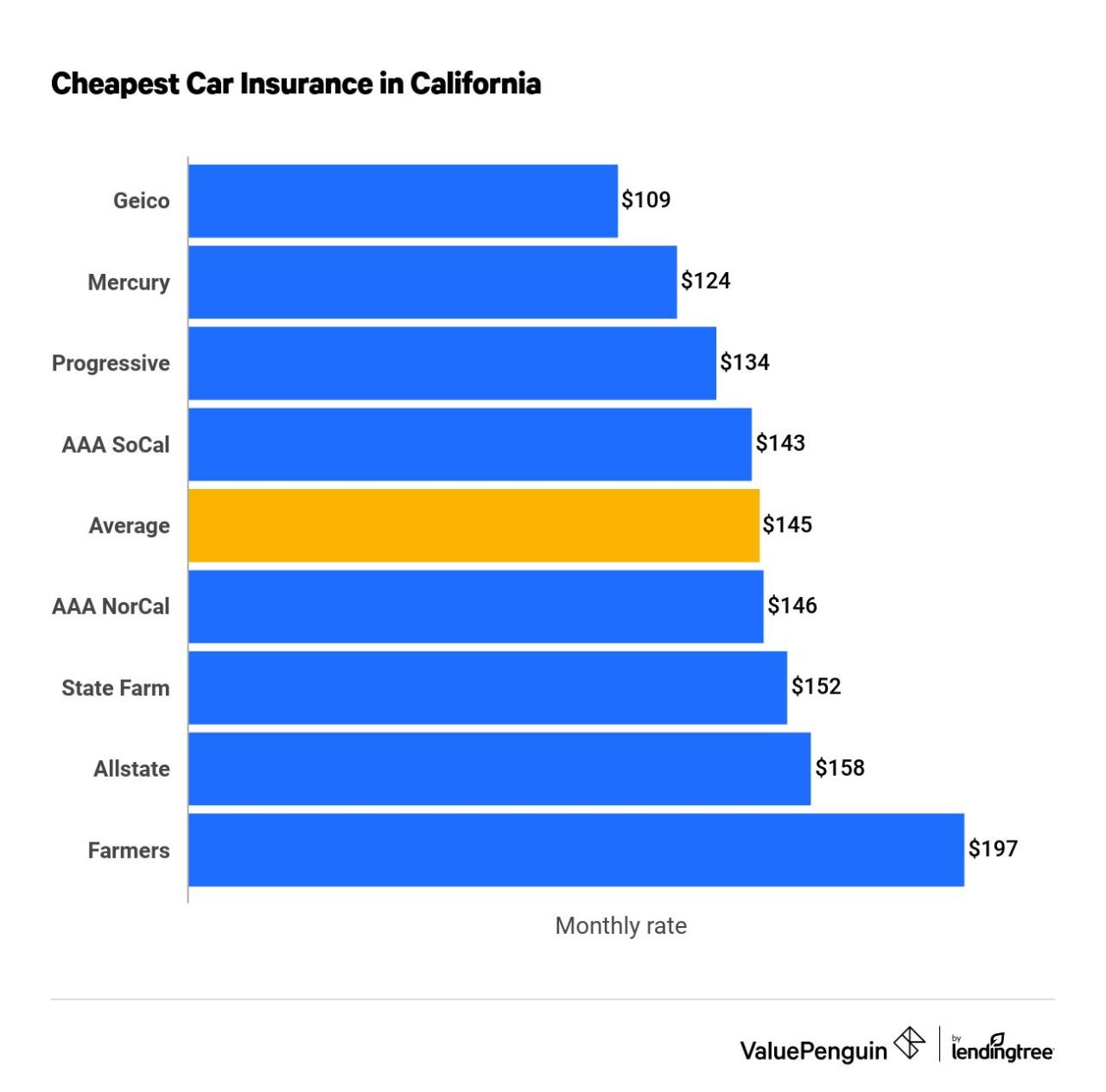

| GEICO | 15% | 78% | Affordable rates, strong online presence, 24/7 customer service | Limited coverage options, less personalized service |

| Progressive | 14% | 75% | Innovative features like Name Your Price tool, flexible payment options, strong customer service | Can be expensive for high-risk drivers, limited agent network |

| USAA | 4% | 90% | Excellent customer service, competitive rates for military members and their families, strong financial stability | Only available to military members and their families |

| Allstate | 10% | 77% | Comprehensive coverage options, strong agent network, good customer service | Can be expensive, limited online tools |

These providers offer a diverse range of features and pricing strategies. Choosing the right insurer depends on individual needs and preferences.

Large National Providers vs. Smaller Regional Insurers

Florida’s car insurance market offers a diverse range of providers, from large national companies to smaller regional insurers. Choosing between these two types involves considering several factors.

- Large National Providers: These providers typically offer a wide range of coverage options, extensive agent networks, and strong financial stability. They often have robust online platforms and customer service resources. However, their pricing can be less competitive, and they may have less flexibility in tailoring policies to individual needs.

- Smaller Regional Insurers: Regional insurers may offer more personalized service and competitive pricing, particularly for drivers with good driving records. They often have a strong local presence and are more responsive to community needs. However, they may have fewer coverage options and limited resources compared to national providers.

Finding the Best Rates

Finding the most competitive car insurance rates in Florida is crucial to saving money. While the cost of car insurance can vary significantly, comparing quotes from multiple insurers is a vital step in securing the best possible deal.

Comparing Quotes

Comparing quotes from multiple insurers is essential because rates can vary considerably, even for individuals with similar profiles. Each insurer utilizes its own proprietary algorithms to calculate premiums, taking into account factors like driving history, vehicle type, and coverage options. This means that what might be a great deal with one insurer could be significantly more expensive with another.

Methods for Obtaining Quotes

- Online Comparison Tools: Websites like Insurance.com, The Zebra, and NerdWallet allow you to enter your information once and receive quotes from multiple insurers simultaneously. These tools streamline the process, making it easy to compare rates side-by-side.

- Phone Calls: You can call insurance companies directly to request quotes. This allows you to ask questions and receive personalized advice from agents.

- In-Person Visits: Visiting an insurance agent’s office allows for face-to-face interaction, where you can discuss your specific needs and get detailed explanations about coverage options.

Getting the Most Competitive Rates

- Gather Your Information: Before requesting quotes, have your driver’s license, vehicle information (make, model, year), and details about your driving history readily available. This will expedite the quoting process.

- Explore Different Coverage Options: Consider your needs and risk tolerance when selecting coverage options. While higher coverage levels may cost more, they can provide greater protection in case of an accident.

- Compare Quotes Thoroughly: Once you receive quotes, analyze them carefully, comparing not only the premium but also the coverage provided. Look for any discounts or additional benefits offered by each insurer.

- Consider Bundling Policies: If you have multiple insurance needs, such as homeowners or renters insurance, bundling policies with the same insurer can often result in significant discounts.

- Shop Around Regularly: Insurance rates can fluctuate over time. It’s a good practice to compare quotes from different insurers every year or two to ensure you’re still getting the best deal.

Tips for Saving on Car Insurance

In Florida, car insurance is a necessity, but it doesn’t have to break the bank. By understanding the factors that influence your rates and implementing smart strategies, you can significantly reduce your insurance costs. This section will explore practical tips and techniques to help you find the best car insurance rates and save money.

Improving Driving Habits

Maintaining a safe driving record is crucial for securing affordable car insurance. Insurance companies reward drivers with clean records by offering lower premiums. Here are some ways to improve your driving habits:

- Avoid Traffic Violations: Traffic tickets, such as speeding or reckless driving, can significantly increase your insurance rates.

- Maintain a Safe Driving Speed: Speeding is a common cause of accidents and can lead to higher premiums.

- Avoid Distracted Driving: Distracted driving, including texting or using your phone while driving, can be dangerous and costly.

- Practice Defensive Driving: Defensive driving techniques can help you anticipate potential hazards and avoid accidents.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premiums. However, consider your financial situation and the potential risk of having to pay a higher deductible in case of an accident.

Bundling Insurance Policies, Who has the best car insurance rates in florida

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant discounts. Insurance companies reward customers who bundle their policies by offering lower premiums.

Enrolling in Defensive Driving Courses

Enrolling in a defensive driving course can demonstrate to insurance companies that you are committed to safe driving practices. Completing a course can often qualify you for discounts on your car insurance premiums.

Installing Safety Features

Modern vehicles are equipped with advanced safety features that can reduce the risk of accidents and injuries. Installing safety features such as anti-theft devices, airbags, and anti-lock brakes can lead to lower insurance rates.

Last Recap: Who Has The Best Car Insurance Rates In Florida

Navigating the Florida car insurance landscape can be overwhelming, but with careful planning and a bit of research, you can find the best rates and coverage for your needs. By comparing quotes from multiple insurers, understanding the factors that influence your premium, and implementing cost-saving strategies, you can secure affordable car insurance while protecting yourself and your loved ones on the road.

FAQ Resource

How often should I review my car insurance rates?

It’s a good idea to review your car insurance rates at least annually, or even more frequently if you experience significant life changes, such as a change in driving history, vehicle, or address.

What are some common discounts available for car insurance in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, multi-policy discounts, and discounts for safety features like anti-theft devices or airbags.

What should I do if I’m unhappy with my current car insurance provider?

If you’re unhappy with your current provider, you can shop around for a new one and switch. Be sure to compare quotes from multiple insurers to find the best rates and coverage for your needs.