Who is the best life insurance company? That’s a question many of us ask ourselves, especially when we’re thinking about protecting our loved ones and our future. It’s a big decision, and you want to make sure you’re choosing the right company. It’s not just about finding the cheapest policy; it’s about finding a company that’s financially stable, reliable, and has a track record of excellent customer service. It’s about finding a company that will be there for you when you need them most.

Life insurance can be a complicated topic, but it doesn’t have to be. In this guide, we’ll break down the different types of life insurance policies, the factors to consider when choosing a company, and the key things to look for when evaluating their performance. We’ll also explore how to use online resources and reviews to make an informed decision. By the end of this guide, you’ll have a clear understanding of what to look for in a life insurance company and how to find the best fit for your needs.

Understanding Life Insurance Needs: Who Is The Best Life Insurance Company

Life insurance is a crucial part of financial planning, especially for individuals with dependents or outstanding debts. It provides financial security for your loved ones in case of your unexpected demise. Understanding your specific needs is key to choosing the right life insurance policy.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own features and benefits. Here are the most common types:

- Term Life Insurance: This is the most basic and affordable type of life insurance. It provides coverage for a specific period, typically 10, 20, or 30 years. If you die within the term, your beneficiaries receive a death benefit. If you outlive the term, the policy expires, and you receive nothing.

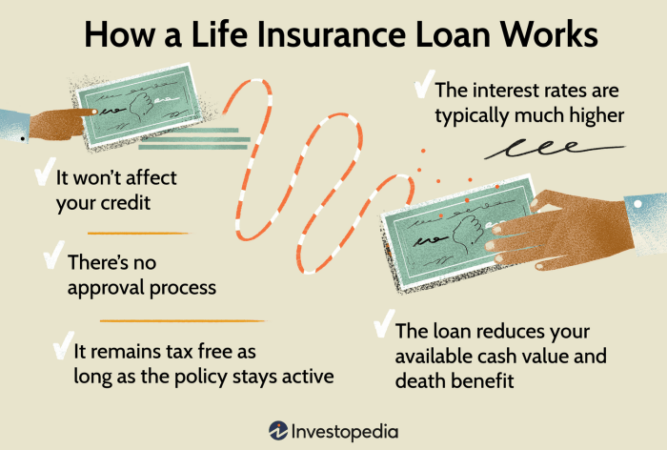

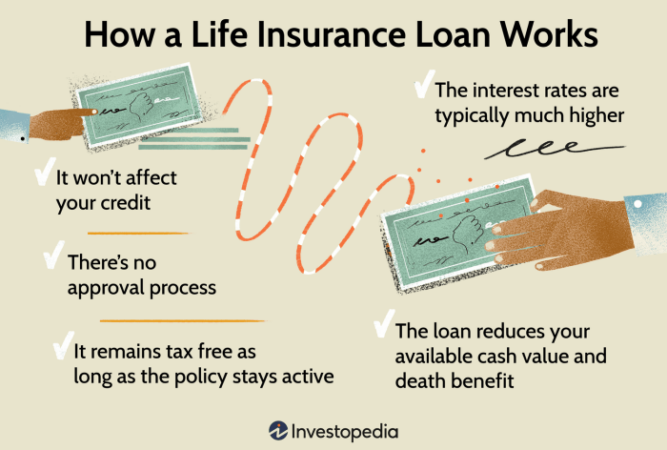

- Whole Life Insurance: This type of policy offers lifelong coverage and builds cash value. You pay a fixed premium, and a portion of your premium goes towards the death benefit, while the rest accumulates as cash value. This cash value can be borrowed against or withdrawn, but it reduces the death benefit.

- Universal Life Insurance: This policy offers flexible premiums and death benefit options. You can adjust your premium payments and death benefit amount, but the policy has a minimum death benefit guarantee. Universal life policies also accumulate cash value, but the interest rate is not guaranteed.

- Variable Life Insurance: This policy allows you to invest a portion of your premium in sub-accounts that are linked to mutual funds. The death benefit and cash value fluctuate based on the performance of your chosen investments.

Factors to Consider When Choosing a Life Insurance Policy

Choosing the right life insurance policy depends on your individual circumstances. Here are some factors to consider:

- Age and Health: Your age and health status influence the premium you pay. Younger and healthier individuals typically pay lower premiums.

- Income: Your income determines the amount of coverage you need to replace your lost earnings.

- Dependents: If you have dependents, you need enough life insurance to cover their living expenses and education costs.

- Financial Goals: Your financial goals, such as paying off debt, funding your children’s education, or providing for your spouse’s retirement, will also affect your life insurance needs.

Scenarios Where Life Insurance Is Essential

Life insurance can be a valuable asset in various situations. Here are some examples:

- Protecting a Family’s Income: If you are the primary breadwinner in your family, life insurance can replace your lost income and provide financial security for your dependents.

- Covering Funeral Expenses: Funeral costs can be substantial, and life insurance can help your family cover these expenses.

- Paying Off Debt: Life insurance can be used to pay off outstanding debts, such as mortgages, car loans, or credit card debt.

Key Considerations for Choosing a Company

Choosing the right life insurance company is a crucial decision. It’s not just about finding the cheapest premiums; it’s about finding a company you can trust to be there for your loved ones when they need it most.

Financial Stability

Financial stability is a key factor in choosing a life insurance company. You want to be sure that the company will be around to pay out your death benefit when the time comes. Look for companies with strong financial ratings from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s. A high rating indicates that the company is financially sound and has a strong track record of paying claims.

Customer Satisfaction

Beyond financial stability, you want a company with a reputation for excellent customer service. Look for companies with high customer satisfaction ratings from organizations like J.D. Power. These ratings reflect how satisfied customers are with the company’s policies, claims process, and overall experience.

Claim Settlement Rates

The claim settlement rate is the percentage of claims that a company approves and pays out. Look for companies with high claim settlement rates, as this indicates that they are reliable and efficient in processing claims.

Features and Benefits

Life insurance companies offer a variety of features and benefits, so it’s important to compare them to find the best fit for your needs. Some key features to consider include:

- Coverage Options: Life insurance policies come in various types, such as term life, whole life, and universal life. Consider your specific needs and budget when choosing a coverage option.

- Premiums: The premium is the amount you pay for your life insurance policy. Compare premiums from different companies to find the most affordable option.

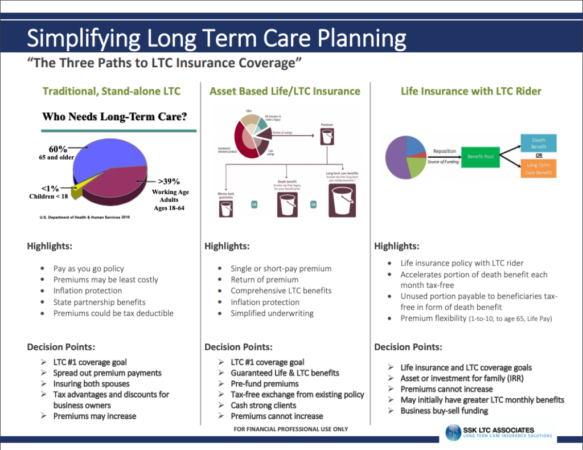

- Riders: Riders are optional additions to your life insurance policy that can provide additional coverage or benefits. Common riders include accidental death benefit, disability income, and long-term care.

Reputation and Financial Strength

It’s essential to choose a company with a good reputation and a strong financial track record. You can research a company’s reputation by reading online reviews, checking its financial ratings, and looking for any complaints filed against it.

Customer Service

Customer service is crucial when it comes to life insurance. You want to be sure that you can easily contact the company and receive prompt and helpful assistance. Look for companies that offer multiple channels of communication, such as phone, email, and online chat.

Evaluating Company Performance and Financial Strength

Choosing a life insurance company is a big decision, and it’s crucial to ensure you’re putting your trust in a financially sound and reliable company. Evaluating a company’s financial health goes beyond just checking its premiums. It’s about understanding their track record, their ability to meet their obligations, and their commitment to policyholders.

Assessing Financial Strength with Ratings

Financial rating agencies play a vital role in evaluating the financial strength of life insurance companies. These agencies analyze a company’s financial statements, investment portfolio, and overall business practices to assign ratings that reflect their perceived ability to meet their financial obligations.

Here are some of the key rating agencies and their significance:

- A.M. Best: A.M. Best is a leading independent rating agency specializing in the insurance industry. They assign ratings based on a company’s balance sheet strength, operating performance, and business profile. A.M. Best ratings are widely recognized and considered a crucial indicator of financial stability.

- Moody’s: Moody’s is a global credit rating agency that provides ratings for a wide range of financial instruments, including life insurance companies. Their ratings reflect the likelihood of a company meeting its financial obligations. A high Moody’s rating indicates a strong financial position.

- Standard & Poor’s (S&P): S&P is another major credit rating agency that provides ratings for life insurance companies. Their ratings are based on a comprehensive analysis of the company’s financial performance, risk profile, and overall business strategy.

The higher the rating from these agencies, the stronger the company’s financial standing. A rating of “A” or above generally indicates a company with a solid track record and a high capacity to meet its obligations.

Understanding Company History and Claims Experience

Beyond ratings, it’s important to delve deeper into a company’s history and claims experience. This information can provide valuable insights into their commitment to policyholders and their ability to handle claims efficiently.

- Company History: A long and reputable history is a positive sign. Look for companies that have been in business for several decades and have a consistent track record of financial stability.

- Claims Experience: A company’s claims experience reflects how effectively they handle claims and their commitment to providing fair and timely payouts. Research their claims handling process, customer satisfaction ratings, and any notable incidents or disputes.

Examining Solvency Ratios

Solvency ratios are crucial metrics that indicate a company’s ability to meet its long-term financial obligations. They measure the company’s assets against its liabilities, providing insights into their financial stability and capacity to handle unexpected events.

Solvency ratios are calculated by dividing a company’s assets by its liabilities. A higher solvency ratio generally indicates a stronger financial position.

- Risk-Based Capital (RBC): RBC is a measure of a company’s capital adequacy, reflecting their ability to absorb potential losses. Regulators set minimum RBC requirements, and companies with higher RBC ratios are considered more financially secure.

- Combined Ratio: The combined ratio measures a company’s underwriting profitability. It compares the company’s incurred losses and expenses to its earned premiums. A combined ratio below 100% indicates profitability, while a ratio above 100% suggests losses.

Impact of Financial Stability on Policyholder Benefits

A financially stable life insurance company provides greater assurance to policyholders. It means:

- Guaranteed Benefits: A strong company is more likely to fulfill its obligations and pay out policy benefits as promised, even in challenging economic times.

- Claims Payment: A financially sound company has the resources to handle claims promptly and fairly, ensuring policyholders receive the benefits they are entitled to.

- Long-Term Security: A financially stable company provides peace of mind, knowing your policy is backed by a reliable and trustworthy entity.

Customer Service and Claims Handling

You’ve carefully considered your life insurance needs and chosen a company that seems like a good fit. But what happens when you need to contact them? A smooth and responsive customer service experience is crucial, especially when dealing with something as important as life insurance.

Customer Service Experience, Who is the best life insurance company

Customer service quality is a key indicator of a life insurance company’s trustworthiness and commitment to its policyholders. Here’s what to look for:

- Response Times: How quickly does the company respond to inquiries? Do they offer 24/7 support or have convenient online chat options? A company that prioritizes quick responses demonstrates a commitment to customer satisfaction.

- Communication Channels: Do they offer multiple ways to contact them, such as phone, email, online chat, or a dedicated mobile app? Having multiple options makes it easier for customers to choose the communication method they prefer.

- Complaint Resolution: How does the company handle complaints? Do they have a clear process for resolving issues? Are they transparent about their complaint resolution process and timelines? A company with a well-defined and efficient complaint resolution process shows a commitment to fairness and customer satisfaction.

Claims Handling Process

When the time comes to file a claim, you want a company that makes the process as smooth and hassle-free as possible. Here’s what to consider:

- Turnaround Time: How long does it take for the company to process and approve a claim? A company with a quick turnaround time demonstrates efficiency and a commitment to helping policyholders in their time of need.

- Transparency: Is the claims process clear and transparent? Does the company provide regular updates on the status of the claim? A company that keeps policyholders informed throughout the claims process builds trust and confidence.

- Customer Satisfaction: How satisfied are other policyholders with the company’s claims handling process? Look for reviews and testimonials that provide insights into real-life experiences.

Examples of Customer Experiences

- Positive Experience: Imagine you need to file a claim for a death benefit. A company with excellent customer service might provide you with a dedicated claims representative who guides you through the process, answers your questions, and keeps you informed every step of the way. The claim is processed quickly and efficiently, and you receive the benefit within a reasonable timeframe. This positive experience leaves you feeling confident and satisfied with the company’s services.

- Negative Experience: Now, imagine you need to contact the company about a policy change. You call their customer service line and are put on hold for an extended period. When you finally reach a representative, they are unhelpful and dismissive of your concerns. This negative experience leaves you feeling frustrated and dissatisfied with the company’s service.

Exploring Online Resources and Reviews

In today’s digital age, the internet is a treasure trove of information, and life insurance is no exception. It’s a great place to research and compare life insurance companies to find the best fit for your needs.

Reputable Online Resources

Before diving into the vast ocean of online information, it’s essential to stick to reliable sources. These resources provide unbiased and accurate information, allowing you to make informed decisions.

- Consumer Reports: This non-profit organization provides independent and unbiased reviews of various products and services, including life insurance companies.

- NerdWallet: A personal finance website that offers comprehensive reviews and comparisons of life insurance companies, making it easier to find the best options.

- Investopedia: A financial education website that provides in-depth information about life insurance, including articles, guides, and comparisons of different companies.

- The National Association of Insurance Commissioners (NAIC): This organization regulates the insurance industry and provides information about insurance companies, including their financial stability and consumer complaints.

Customer Reviews and Testimonials

Reading what other customers have to say about a company can provide valuable insights into its performance and customer satisfaction. These reviews can shed light on aspects like the claims process, customer service, and overall experience.

- Google Reviews: This widely used platform allows users to rate and review businesses, including life insurance companies.

- Trustpilot: A review website that focuses on providing unbiased feedback from customers, offering a diverse perspective on various companies.

- Yelp: A popular platform for finding local businesses, Yelp also includes reviews for insurance companies, allowing you to see what others have experienced.

- Company Websites: Many life insurance companies have their own review sections on their websites, offering insights into customer feedback.

Interpreting and Evaluating Online Reviews

While online reviews can be helpful, it’s important to approach them with a critical eye.

Pay attention to the overall rating, the number of reviews, and the consistency of feedback.

- Look for specific details: Instead of just relying on star ratings, read through the actual reviews to understand the reasons behind the feedback.

- Consider the context: Understand the reviewer’s situation and perspective to determine if their experience is relevant to your needs.

- Be wary of fake reviews: Some companies might try to manipulate reviews, so be cautious of overly positive or negative reviews that seem suspicious.

- Focus on common themes: Identify recurring patterns or issues raised in multiple reviews to gain a comprehensive understanding of the company’s strengths and weaknesses.

Closing Summary

So, who is the best life insurance company? It’s not a one-size-fits-all answer. The best company for you will depend on your individual circumstances and needs. But by following the tips and advice in this guide, you can narrow down your choices and find a company that meets your requirements. It’s a big decision, but it’s one that can give you peace of mind knowing that your loved ones are protected.

Answers to Common Questions

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your income, dependents, and outstanding debts. It’s a good idea to consult with a financial advisor to determine the right amount of coverage for you.

What is a life insurance premium?

A life insurance premium is the regular payment you make to maintain your policy. The premium amount is determined by factors such as your age, health, and the amount of coverage you choose.

What are the benefits of having life insurance?

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover funeral expenses, outstanding debts, and provide income replacement for your family.

Can I get life insurance if I have a pre-existing medical condition?

Yes, you can still get life insurance if you have a pre-existing medical condition. However, your premium may be higher than someone with a good health history. You’ll need to disclose your medical condition during the application process.

How do I file a life insurance claim?

The process for filing a life insurance claim varies by company. You’ll typically need to provide documentation of the death, such as a death certificate, and complete a claim form. Your life insurance company will guide you through the process.