Who owns Cigna Insurance Company? It’s a question that sparks curiosity about the inner workings of this healthcare giant. Cigna, a household name in health insurance, has a complex ownership structure that’s been shaped by mergers, acquisitions, and market forces. Unraveling this web of ownership reveals insights into the company’s strategic direction, financial performance, and impact on the healthcare landscape.

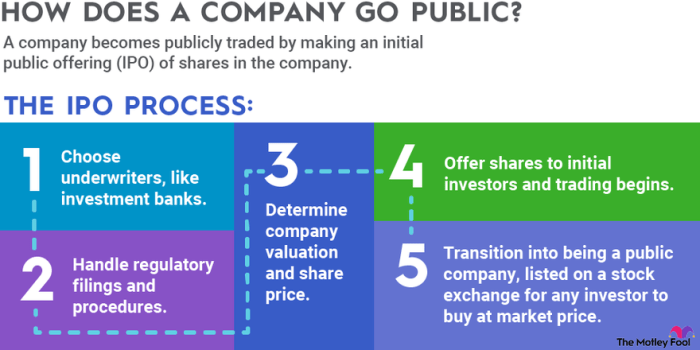

Cigna is a publicly traded company, meaning its shares are bought and sold on the open market. This public ownership structure provides transparency and allows investors to participate in the company’s success. However, it also means that Cigna’s decisions are influenced by shareholder expectations and market trends.

Cigna’s Corporate Governance

Cigna’s corporate governance practices are designed to ensure the company operates ethically, transparently, and in the best interests of its stakeholders. These practices are built upon a foundation of strong leadership, accountability, and oversight.

Cigna’s Corporate Governance Principles and Practices

Cigna’s corporate governance principles are guided by its commitment to good corporate citizenship, ethical behavior, and responsible decision-making. The company’s governance practices are designed to promote long-term value creation for shareholders, while ensuring the interests of other stakeholders are also considered.

- Board of Directors: Cigna’s Board of Directors is responsible for providing strategic direction and oversight of the company. The Board is composed of independent directors with diverse backgrounds and expertise. The Board’s responsibilities include:

- Approving the company’s strategic plan

- Overseeing the company’s financial performance

- Ensuring the company complies with all applicable laws and regulations

- Approving executive compensation

- Executive Compensation: Cigna’s executive compensation program is designed to align executive interests with shareholder interests. The program is based on a mix of base salary, annual incentives, and long-term equity awards. The compensation committee of the Board of Directors is responsible for overseeing the executive compensation program.

- Risk Management: Cigna has a robust risk management framework in place to identify, assess, and mitigate potential risks to the company. The risk management framework is overseen by the Board of Directors and the company’s executive management team.

- Corporate Social Responsibility: Cigna is committed to operating in a socially responsible manner. The company has a variety of programs and initiatives aimed at promoting community health, environmental sustainability, and diversity and inclusion.

Key Elements of Cigna’s Corporate Governance Structure

Cigna’s corporate governance structure is comprised of various key elements that contribute to its effective operation. These elements include:

- Board of Directors: As previously mentioned, the Board of Directors plays a crucial role in Cigna’s corporate governance. The Board is responsible for providing strategic direction and oversight of the company, ensuring its operations are conducted ethically and responsibly.

- Committees: The Board of Directors has several committees that provide specialized oversight and guidance on specific areas of the company’s operations. These committees include:

- Audit Committee

- Compensation Committee

- Nominating and Governance Committee

- Executive Management: Cigna’s executive management team is responsible for implementing the company’s strategic plan and ensuring its day-to-day operations are conducted efficiently and effectively.

- Internal Audit Function: Cigna has a dedicated internal audit function that provides independent assurance over the company’s financial reporting, internal controls, and compliance with laws and regulations.

Comparison of Cigna’s Corporate Governance Practices to Industry Standards

Cigna’s corporate governance practices are generally aligned with industry standards. The company has adopted many of the best practices recommended by organizations such as the National Association of Corporate Directors (NACD) and the Institute of Internal Auditors (IIA). For example, Cigna’s Board of Directors is composed of a majority of independent directors, and the company has a strong risk management framework in place.

Impact of Cigna’s Corporate Governance on its Financial Performance and Reputation

Cigna’s commitment to strong corporate governance has had a positive impact on its financial performance and reputation. The company’s governance practices have helped to build investor confidence and attract and retain top talent. These practices have also helped to mitigate risk and ensure the company operates in a sustainable and ethical manner.

Cigna’s Financial Performance

Cigna, a leading health insurance company, has a strong track record of financial performance, consistently delivering robust revenue growth and profitability. The company’s financial performance is driven by a combination of factors, including its diverse product offerings, strong brand recognition, and efficient operations. This section examines Cigna’s recent financial performance, identifying key drivers and comparing it to its competitors. It also explores the potential impact of its ownership structure on its financial performance.

Revenue Growth and Profitability

Cigna’s revenue has consistently grown in recent years, driven by factors such as increased healthcare spending, expansion into new markets, and acquisitions. The company’s profitability has also been strong, with net income consistently exceeding expectations.

Key Drivers of Financial Performance

Several key drivers contribute to Cigna’s financial performance:

- Diversified Product Offerings: Cigna offers a wide range of health insurance products, including individual, family, and group plans, as well as specialty products like dental and vision insurance. This diversification helps to mitigate risk and ensure steady revenue streams.

- Strong Brand Recognition: Cigna has a strong brand reputation, known for its quality products and services. This brand recognition helps attract and retain customers, contributing to revenue growth.

- Efficient Operations: Cigna has a highly efficient operating model, with a focus on cost control and process optimization. This efficiency helps to improve profitability and maintain a competitive advantage.

- Strategic Acquisitions: Cigna has made several strategic acquisitions in recent years, expanding its product offerings and market reach. These acquisitions have contributed to revenue growth and market share expansion.

Comparison to Competitors

Cigna’s financial performance compares favorably to its major competitors in the health insurance industry, such as UnitedHealth Group, Anthem, and Humana. The company has consistently ranked among the top performers in terms of revenue, profitability, and market share.

Impact of Ownership Structure

Cigna is a publicly traded company, with its shares listed on the New York Stock Exchange. This ownership structure can have both positive and negative impacts on financial performance.

- Positive Impact: Public ownership provides access to capital markets, allowing Cigna to raise funds for growth and expansion. It also creates shareholder pressure for strong financial performance, encouraging management to focus on profitability and shareholder value.

- Negative Impact: Short-term pressures from investors can sometimes lead to decisions that may not be in the long-term best interests of the company. For example, cost-cutting measures may negatively impact customer service or product quality.

Cigna’s Business Model

Cigna is a global health service company with a diversified business model that focuses on providing health insurance, health services, and related products. The company’s core business model revolves around managing healthcare costs and improving health outcomes for individuals and employers.

Cigna’s primary revenue streams are generated through the sale of health insurance products and the provision of healthcare services. The company offers a wide range of products and services to individuals, families, and employers, including:

Key Products and Services Offered by Cigna, Who owns cigna insurance company

Cigna’s key products and services include:

- Health Insurance: Cigna offers a variety of health insurance plans, including individual, family, and group plans. These plans cover a range of medical expenses, including hospitalization, surgery, prescription drugs, and preventive care.

- Dental Insurance: Cigna also offers dental insurance plans, which cover the cost of dental care, including cleanings, fillings, and extractions.

- Vision Insurance: Cigna’s vision insurance plans cover the cost of eye exams, eyeglasses, and contact lenses.

- Pharmacy Benefits Management (PBM): Cigna’s PBM services manage the prescription drug benefits for employers and health plans. This includes negotiating drug prices, processing prescriptions, and managing pharmacy networks.

- Healthcare Services: Cigna offers a range of healthcare services, including:

- Health Management: Cigna provides health management programs that focus on preventing disease, promoting wellness, and managing chronic conditions.

- Care Management: Cigna offers care management services to help individuals with complex medical needs navigate their healthcare journey.

- Behavioral Health: Cigna provides behavioral health services, including counseling, therapy, and medication management.

Competitive Advantages and Challenges in the Healthcare Industry

Cigna’s competitive advantages in the healthcare industry include:

- Strong Brand Recognition: Cigna is a well-known and respected brand in the healthcare industry, which gives it an advantage in attracting customers.

- Diversified Business Model: Cigna’s diversified business model allows it to generate revenue from multiple sources, which makes it less vulnerable to economic fluctuations.

- Focus on Innovation: Cigna is committed to innovation, and it invests heavily in developing new products and services to meet the evolving needs of its customers.

- Strong Financial Performance: Cigna has a strong track record of financial performance, which gives it the resources to invest in its business and grow.

Cigna faces several challenges in the healthcare industry, including:

- Rising Healthcare Costs: The cost of healthcare is rising steadily, which puts pressure on Cigna to manage its expenses and keep premiums affordable.

- Increased Competition: The healthcare industry is becoming increasingly competitive, with new entrants and existing players expanding their offerings.

- Regulatory Changes: The healthcare industry is subject to frequent regulatory changes, which can create uncertainty and increase costs.

Relationship between Cigna’s Ownership Structure and Its Business Model

Cigna is a publicly traded company, which means that its shares are traded on the stock market. This ownership structure has a significant impact on Cigna’s business model.

Publicly traded companies are typically focused on maximizing shareholder value. This means that Cigna’s management team is under pressure to deliver strong financial performance, which can influence its decisions regarding product development, pricing, and investment.

The company’s ownership structure also influences its corporate governance practices. As a publicly traded company, Cigna is subject to a range of regulations and oversight from investors and regulators. This helps to ensure that the company is run in a responsible and ethical manner.

Cigna’s Impact on the Healthcare Industry

Cigna, a major player in the healthcare industry, wields significant influence through its insurance products, administrative services, and healthcare delivery network. The company’s operations have a tangible impact on healthcare costs, access, and the overall landscape of the healthcare market.

Cigna’s Role in Shaping Healthcare Costs

Cigna’s role in managing healthcare costs is multifaceted. As a health insurer, Cigna negotiates contracts with healthcare providers to secure discounted rates for its policyholders. This practice, known as managed care, aims to control costs by influencing provider behavior and incentivizing efficient healthcare delivery. Cigna also employs various strategies to manage utilization, such as pre-authorization requirements for certain procedures and promoting preventive care initiatives.

Cigna’s Influence on Healthcare Access

Cigna’s extensive network of healthcare providers provides its members with access to a wide range of medical services. The company’s provider network encompasses hospitals, physicians, and other healthcare professionals, ensuring that its members have choices when seeking medical care. However, the size and scope of Cigna’s network can also influence access to specific healthcare services, particularly in rural areas or for specialized treatments.

Future Trends and Challenges Facing Cigna

The healthcare industry is constantly evolving, presenting both opportunities and challenges for Cigna. The rising cost of healthcare, the increasing adoption of technology, and the growing emphasis on value-based care are some of the key trends shaping the future of the industry. Cigna is actively adapting to these trends by investing in digital health solutions, expanding its provider network, and developing new programs that promote preventive care and health management.

Cigna’s Ownership Structure and its Impact on the Healthcare Industry

Cigna’s ownership structure is a publicly traded company, meaning its shares are available for purchase on the stock market. This structure has implications for the company’s decision-making processes and its overall impact on the healthcare industry. As a publicly traded entity, Cigna is subject to shareholder pressure to deliver strong financial performance, which can influence its strategic priorities and its approach to managing healthcare costs.

Ending Remarks

Understanding who owns Cigna Insurance Company sheds light on the forces that shape its operations and its role in the healthcare industry. From its major shareholders to its board of directors, the ownership structure influences Cigna’s strategic direction, financial performance, and impact on healthcare access and costs. As the healthcare landscape continues to evolve, Cigna’s ownership structure will play a crucial role in its ability to adapt and navigate the challenges and opportunities ahead.

Top FAQs: Who Owns Cigna Insurance Company

Is Cigna a publicly traded company?

Yes, Cigna is a publicly traded company, meaning its shares are bought and sold on the open market.

What is Cigna’s stock symbol?

Cigna’s stock symbol is CI.

How can I find out more about Cigna’s ownership structure?

You can find detailed information about Cigna’s ownership structure in its annual reports and SEC filings, which are available on the company’s website and the SEC’s EDGAR database.