Who owns senior life insurance company – Who owns senior life insurance companies? It’s a question that might not seem as exciting as a celebrity gossip column, but it’s actually a super important one for anyone over 50. Think of it like this: when you’re buying a car, you want to know the company behind it is solid, right? The same goes for life insurance. Understanding who owns these companies can help you make the best decision for your future, because it gives you a peek into their stability, their track record, and what kind of service you can expect.

The senior life insurance market is a whole different ball game than traditional life insurance. It’s tailored to the unique needs of older folks, offering policies designed to cover final expenses, provide peace of mind for loved ones, and maybe even leave a little something extra for the grandkids. But before you dive in, it’s smart to know who’s behind these policies. Are they big-time corporations, independent agents, or something else entirely? Knowing the ownership structure can help you feel confident in your choice.

Senior Life Insurance Companies

Senior life insurance is a vital component of financial planning for individuals over 50. It provides peace of mind and financial security for loved ones, ensuring they can cover expenses like funeral costs, outstanding debts, and other final expenses.

Types of Senior Life Insurance

Senior life insurance policies are designed to meet the specific needs of older adults, offering unique features and benefits tailored to their circumstances. These policies are generally more affordable than traditional life insurance options and can be purchased with less stringent health requirements.

Here are some common types of senior life insurance products:

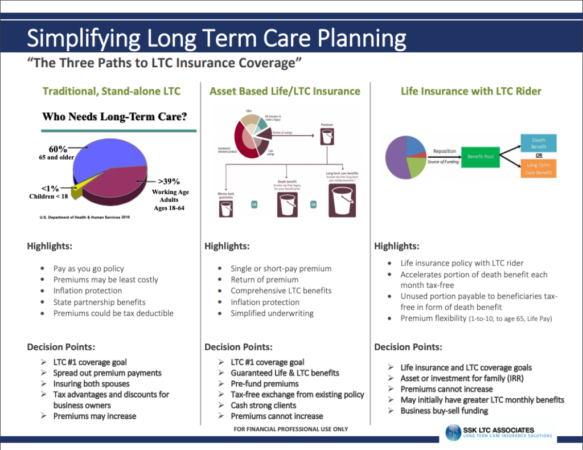

- Final expense insurance, also known as burial insurance, is a type of whole life insurance policy designed to cover funeral costs and other final expenses. It typically has a smaller death benefit and lower premiums than other whole life insurance options. Final expense insurance provides a guaranteed death benefit, ensuring that your loved ones have the funds to cover your final expenses, regardless of your health status.

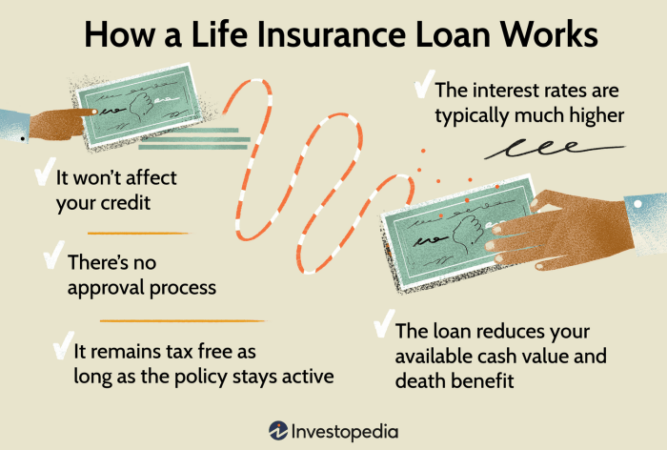

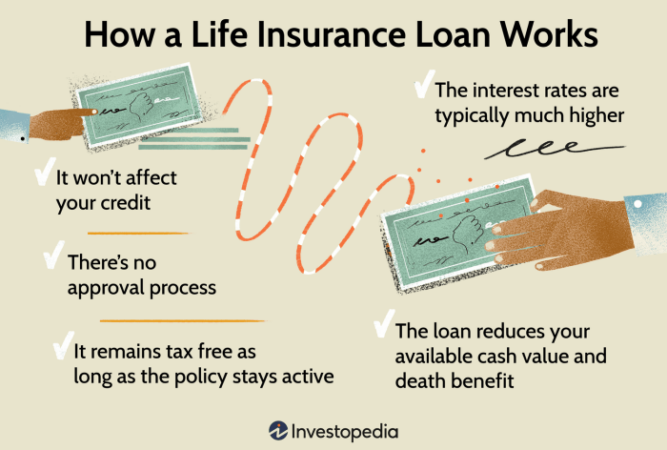

- Whole life insurance offers a fixed death benefit and guaranteed premiums throughout your lifetime. This type of policy builds cash value that you can borrow against or withdraw from. Whole life insurance provides lifelong coverage and can serve as a valuable asset for retirement planning.

- Universal life insurance provides flexible premiums and a death benefit that can be adjusted to meet your changing needs. It also accumulates cash value that earns interest, allowing you to customize your coverage and financial planning. Universal life insurance offers greater flexibility and control over your policy, making it a suitable option for those who prefer a more customized approach to life insurance.

Ownership Structure and Key Players

The senior life insurance industry is a dynamic and complex landscape, with a diverse range of players and ownership structures. Understanding the key players and their ownership models is crucial to grasping the industry’s dynamics and its impact on consumers.

The senior life insurance industry is dominated by large insurance companies, independent agents, and brokers. These players operate within various ownership structures, each with its unique characteristics and implications for the market.

Publicly Traded Companies

Publicly traded companies are listed on stock exchanges, allowing investors to buy and sell shares in the company. These companies are subject to greater regulatory scrutiny and transparency, as they are required to disclose their financial performance and operations publicly.

Examples of publicly traded senior life insurance companies include:

- AIG (American International Group)

- MetLife

- Prudential Financial

- Transamerica

Mutual Insurance Companies

Mutual insurance companies are owned by their policyholders, who share in the company’s profits and losses. These companies are typically not listed on stock exchanges and are governed by a board of directors elected by their policyholders.

Examples of mutual senior life insurance companies include:

- MassMutual

- New York Life

- Northwestern Mutual

Privately Held Firms

Privately held firms are not publicly traded and are owned by a limited number of individuals or families. These companies have more flexibility in their operations and decision-making, but they also face challenges in accessing capital.

Examples of privately held senior life insurance companies include:

- John Hancock

- Lincoln National

- Principal Financial

Financial Performance and Market Share

The financial performance of senior life insurance companies is influenced by factors such as interest rates, mortality rates, and the overall economic climate. Leading companies have consistently demonstrated strong financial performance and market share, indicating their ability to navigate industry challenges and meet consumer needs.

Examples of leading senior life insurance companies with strong financial performance and market share include:

- AIG (American International Group)

- MetLife

- Prudential Financial

- Transamerica

Factors Influencing Ownership and Operations

The ownership structure of senior life insurance companies is dynamic and influenced by various factors, including regulatory changes, industry trends, and market forces. These factors shape the landscape of the senior life insurance market, impacting the strategies of companies and their ability to navigate the evolving needs of an aging population.

Regulatory Changes and Industry Trends, Who owns senior life insurance company

Regulatory changes and industry trends play a significant role in shaping the ownership structure of senior life insurance companies. The senior life insurance market is subject to a complex web of regulations at both the state and federal levels, with ongoing developments and modifications impacting how companies operate and structure their ownership.

- Increased Scrutiny and Regulation: Regulatory bodies have intensified their scrutiny of the senior life insurance industry in recent years, focusing on issues such as transparency, consumer protection, and financial stability. This increased oversight has led to stricter regulations governing product design, marketing practices, and financial reporting, prompting companies to adapt their operations and ownership structures to comply with these evolving requirements.

- Shifting Demographics and Consumer Preferences: The aging population and changing consumer preferences are driving significant changes in the senior life insurance market. As the population ages, demand for products tailored to the unique needs of seniors is growing, prompting companies to develop innovative products and distribution channels to meet these evolving demands. These shifts in consumer behavior have also led to a greater focus on transparency and customer service, influencing ownership structures as companies strive to adapt to these evolving needs.

- Technological Advancements: Technological advancements have revolutionized the senior life insurance market, impacting how companies operate and interact with their customers. The rise of online platforms, mobile applications, and data analytics has enabled companies to streamline their operations, reach wider audiences, and personalize their offerings. These advancements have also led to increased competition and innovation, influencing the ownership structure as companies seek to leverage technology to gain a competitive edge.

Mergers and Acquisitions

Mergers and acquisitions (M&A) have played a significant role in shaping the senior life insurance landscape, driving consolidation and reshaping the competitive landscape. These strategic transactions allow companies to expand their market reach, enhance their product offerings, and optimize their operations.

- Consolidation and Market Dominance: M&A activity has resulted in consolidation within the senior life insurance market, with larger companies acquiring smaller players to gain market share and expand their distribution networks. This consolidation has led to a more concentrated market, with a smaller number of companies dominating the landscape.

- Product Diversification and Innovation: M&A transactions allow companies to diversify their product offerings and gain access to new technologies and distribution channels. By combining their strengths and resources, companies can create more comprehensive solutions for seniors, meeting a wider range of needs.

- Operational Efficiency and Cost Savings: Mergers and acquisitions can lead to operational efficiencies and cost savings through the elimination of redundancies, streamlining of processes, and leveraging of economies of scale. These benefits can improve profitability and enhance competitiveness.

Challenges and Opportunities

The senior life insurance market faces both challenges and opportunities as it navigates an evolving landscape. Companies must adapt to changing demographics, regulatory requirements, and technological advancements to remain competitive and meet the needs of an aging population.

- Meeting the Needs of a Growing Senior Population: The aging population presents both challenges and opportunities for senior life insurance companies. Companies must develop products and services tailored to the unique needs of seniors, including those with complex health conditions or limited financial resources.

- Maintaining Financial Stability and Solvency: Senior life insurance companies face the challenge of maintaining financial stability and solvency in a low-interest-rate environment and a market with increasing longevity. Companies must carefully manage their assets and liabilities to ensure they can meet their long-term obligations.

- Navigating Regulatory Changes: The senior life insurance industry is subject to ongoing regulatory changes, requiring companies to adapt their operations and products to comply with evolving requirements. Companies must invest in compliance resources and stay abreast of regulatory developments to avoid potential penalties.

- Leveraging Technology for Growth and Innovation: Technological advancements offer significant opportunities for senior life insurance companies to improve their operations, enhance customer service, and develop innovative products. Companies must invest in technology and data analytics to gain a competitive edge and meet the evolving needs of consumers.

Final Summary

So, who owns senior life insurance companies? The answer is a mix of big names, smaller players, and everything in between. It’s a dynamic market that’s always changing, but one thing’s for sure: doing your research and understanding the ownership structure is a key move in making sure you get the best possible policy for your needs. Think of it like choosing the right team for your financial game plan. With a little investigation, you can find a company that’s got your back and your future covered.

FAQ Resource: Who Owns Senior Life Insurance Company

What are the main types of senior life insurance?

Senior life insurance comes in a few different flavors, like final expense insurance (covers funeral costs and other final expenses), whole life insurance (builds cash value and can be borrowed against), and universal life insurance (offers flexibility in premium payments and death benefit).

How do I find out if a senior life insurance company is reputable?

You can check with the Better Business Bureau (BBB), look for an A.M. Best rating (a financial strength rating for insurance companies), and read reviews from other customers.

Can I get senior life insurance if I have health problems?

It’s definitely possible, but you might need to look for a specialized insurer that caters to individuals with pre-existing conditions. Some companies offer guaranteed acceptance policies that don’t require a medical exam.