Who rates insurance companies? It’s a question that pops up when you’re shopping for a policy, right? You want to make sure you’re getting the best coverage at the best price, but how do you know which companies are the real deal? That’s where insurance rating agencies come in, acting like the “Consumer Reports” of the insurance world. These agencies, like a squad of financial superheroes, analyze companies based on their financial strength, claims handling, and even customer satisfaction.

These ratings are like a roadmap to help you navigate the insurance landscape. They offer valuable insights into the financial stability and trustworthiness of different insurance companies. Think of it like this: Would you trust a company with your hard-earned cash if it had a bad reputation? Probably not! That’s where ratings come in – they help you avoid potential headaches and ensure you’re choosing a company you can rely on.

Who Rates Insurance Companies?

You’re probably wondering, “Who’s keeping these insurance companies in check?” Well, it’s not just your friendly neighborhood insurance agent; it’s a whole team of professional rating agencies. These agencies play a crucial role in the insurance industry by providing independent assessments of the financial strength and stability of insurance companies.

Major Rating Agencies

Rating agencies are the unsung heroes of the insurance world. They meticulously analyze insurance companies, evaluating their financial health and ability to meet their obligations to policyholders. These agencies use a standardized system of ratings, allowing consumers to quickly assess the risk associated with a particular insurer. Here are some of the major players in the insurance rating game:

- AM Best: This agency has been around since 1899, making it one of the oldest and most respected rating agencies. AM Best specializes in evaluating insurance companies and has a unique focus on the property and casualty insurance market. They assign ratings based on a comprehensive analysis of an insurer’s balance sheet, operating performance, and business profile. AM Best’s rating scale ranges from A++ (Superior) to D (Weak), with each rating representing a specific level of financial strength and ability to meet policyholder obligations.

- Standard & Poor’s (S&P): This agency is known for its comprehensive financial ratings, covering a wide range of industries, including insurance. S&P’s rating scale uses a combination of letters and numbers, with AAA being the highest rating and D being the lowest. They consider various factors, such as capital adequacy, profitability, and management quality, to assess an insurer’s financial stability.

- Moody’s Investors Service: Moody’s is another major player in the financial rating game, with a global reach. Their ratings are based on a thorough evaluation of an insurer’s financial strength, operational performance, and management effectiveness. Moody’s rating scale ranges from Aaa (Highest) to C (Lowest), with each rating reflecting the insurer’s ability to meet its financial obligations.

- Fitch Ratings: Fitch Ratings is a globally recognized credit rating agency that evaluates the financial health of companies across various sectors, including insurance. Their rating scale uses letters and numbers, with AAA being the highest and D being the lowest. Fitch takes into account factors such as capital adequacy, profitability, and risk management practices when assessing an insurer’s financial strength.

Rating Agency Methodologies

Each rating agency uses its own methodology to evaluate insurance companies, but they all share a common goal: to provide objective and transparent assessments of an insurer’s financial health and ability to meet its obligations. Here’s a closer look at the key aspects of their methodologies:

- Financial Analysis: Rating agencies meticulously analyze an insurer’s financial statements, including its balance sheet, income statement, and cash flow statement. They assess factors such as capital adequacy, profitability, and liquidity to gauge the insurer’s overall financial strength.

- Operational Performance: Rating agencies also evaluate an insurer’s operational performance, including its underwriting practices, claims handling procedures, and overall efficiency. This helps them understand the insurer’s ability to manage risk effectively and generate sustainable profits.

- Business Profile: A comprehensive assessment of an insurer’s business profile is also a key part of the rating process. Rating agencies analyze the insurer’s market position, product offerings, and distribution channels to understand its competitive landscape and growth prospects.

- Management Quality: Rating agencies also consider the quality of an insurer’s management team, including its experience, expertise, and commitment to sound business practices. This factor plays a significant role in determining an insurer’s ability to navigate challenges and make informed decisions.

Rating Scales

While rating agencies share the goal of assessing insurance companies, they may use slightly different rating scales and criteria. Here’s a brief comparison of the rating scales used by some of the major agencies:

| Agency | Rating Scale | Highest Rating | Lowest Rating |

|---|---|---|---|

| AM Best | A++ to D | A++ (Superior) | D (Weak) |

| Standard & Poor’s | AAA to D | AAA (Highest) | D (Lowest) |

| Moody’s Investors Service | Aaa to C | Aaa (Highest) | C (Lowest) |

| Fitch Ratings | AAA to D | AAA (Highest) | D (Lowest) |

Why Are Insurance Company Ratings Important?

Think of insurance company ratings as the Yelp reviews for the insurance world. Just like you wouldn’t trust a restaurant with a one-star rating, you wouldn’t want to trust your financial security with an insurance company that’s got a bad reputation. These ratings provide crucial information about an insurance company’s financial stability, claims handling, and overall performance, helping you make smart decisions about your coverage.

Impact on Financial Stability and Credibility

Insurance company ratings are like a report card, showing how well a company is doing financially. They assess factors like the company’s reserves, investments, and ability to pay claims. A high rating means the company is financially sound and likely to be around to pay out claims when you need them. Conversely, a low rating can indicate financial instability, raising concerns about the company’s ability to meet its obligations. This is crucial because you don’t want to be stuck with an insurance company that goes bankrupt, leaving you high and dry when you need coverage the most.

Influence on Insurance Brokers and Agents

Insurance brokers and agents rely heavily on ratings to guide their recommendations. They know that choosing a company with a solid reputation can save them headaches in the long run. They also understand that recommending a company with a poor rating could damage their own credibility and reputation. For example, if a broker recommends an insurance company that later fails to pay claims, the broker could face lawsuits or lose their clients’ trust. This makes ratings a vital tool for brokers and agents, ensuring they recommend companies that are financially stable and reliable.

Types of Insurance Company Ratings

Insurance company ratings provide valuable insights into the financial stability, claims handling practices, and customer satisfaction levels of insurers. These ratings are essential for consumers and businesses seeking reliable and trustworthy insurance providers.

Financial Strength Ratings

Financial strength ratings assess an insurance company’s ability to meet its financial obligations to policyholders. These ratings are crucial for gauging the company’s long-term stability and its capacity to pay claims.

- A.M. Best: A.M. Best is a leading credit rating agency specializing in the insurance industry. Its financial strength ratings, ranging from A++ (Superior) to D (Weak), evaluate an insurer’s financial health, operating performance, and overall business profile.

- Standard & Poor’s (S&P): S&P Global Ratings, a well-known credit rating agency, assigns financial strength ratings to insurance companies based on their financial performance, capital adequacy, and risk management practices. Ratings range from AAA (Extremely Strong) to D (Default).

- Moody’s Investors Service: Moody’s, another prominent credit rating agency, provides financial strength ratings for insurance companies, evaluating factors such as capital adequacy, operating performance, and risk management practices. Ratings range from Aaa (Exceptional) to C (Highly Speculative).

Claims Handling Ratings

Claims handling ratings focus on an insurance company’s efficiency and fairness in processing and resolving claims. These ratings are essential for understanding how well an insurer handles claims, the timeliness of claim payments, and the overall customer experience.

- J.D. Power: J.D. Power is a well-known research and consulting firm that conducts customer satisfaction surveys, including claims satisfaction studies. Its claims satisfaction ratings assess an insurer’s performance in areas such as the ease of filing a claim, the speed of claim processing, and the overall communication with the insurer.

- National Association of Insurance Commissioners (NAIC): The NAIC, a regulatory body for insurance companies, compiles data on claims handling practices and publishes reports on insurer performance. These reports provide insights into an insurer’s claims handling efficiency, the number of complaints received, and the average time taken to resolve claims.

Customer Satisfaction Ratings

Customer satisfaction ratings measure an insurance company’s ability to meet the needs and expectations of its policyholders. These ratings are crucial for understanding an insurer’s overall customer experience, including factors such as policy transparency, communication effectiveness, and the overall customer service experience.

- J.D. Power: J.D. Power conducts customer satisfaction surveys for various insurance products, including auto, home, and life insurance. Its customer satisfaction ratings assess an insurer’s performance in areas such as policy pricing, communication, and the overall customer service experience.

- Consumer Reports: Consumer Reports, a non-profit organization that conducts product testing and publishes consumer reviews, provides customer satisfaction ratings for insurance companies. Its ratings are based on consumer surveys and assessments of insurer performance in areas such as policy transparency, claims handling, and customer service.

Factors Influencing Insurance Company Ratings

Insurance company ratings are like the report cards for the insurance industry. They tell us how well a company is doing in terms of its financial stability, claims handling, and overall performance. Rating agencies like AM Best, Moody’s, and Standard & Poor’s (S&P) are the teachers handing out these grades. These agencies analyze a whole bunch of factors to determine a company’s rating, and these factors can influence the grades they give.

Financial Performance

The financial performance of an insurance company is a major factor in determining its rating. It’s like looking at the company’s bank account and seeing how much money they have on hand. A company with a strong financial performance is more likely to be able to pay claims and stay in business. Rating agencies look at things like:

- Capitalization: This refers to the amount of money an insurance company has available to pay claims and cover its expenses. A company with a higher capitalization is generally considered to be more financially stable.

- Profitability: This is how much money the insurance company is making. A profitable company is more likely to be able to pay claims and stay in business.

- Investment performance: Insurance companies invest a portion of their premiums. The performance of these investments can impact the company’s financial stability.

Claims History

Think of claims history as the insurance company’s track record of paying out claims. If a company has a history of paying claims quickly and fairly, it’s likely to have a good rating. This shows that the company is reliable and trustworthy. Rating agencies look at things like:

- Claims frequency: This refers to how often the insurance company is paying out claims. A company with a low claims frequency is generally considered to be a lower risk.

- Claims severity: This is the average amount of money the insurance company is paying out for each claim. A company with a high claims severity is generally considered to be a higher risk.

- Claims handling: This refers to how efficiently and effectively the insurance company handles claims. A company with a good claims handling process is generally considered to be more reliable.

Regulatory Compliance, Who rates insurance companies

Just like any business, insurance companies have to follow rules and regulations set by state and federal governments. Rating agencies want to see that insurance companies are playing by the rules and are in good standing with regulators. They look at things like:

- State licensing: An insurance company must be licensed to operate in each state where it sells insurance.

- Financial reporting: Insurance companies are required to file regular financial reports with regulators. These reports provide insight into the company’s financial health.

- Regulatory actions: Any regulatory actions taken against an insurance company, such as fines or penalties, can negatively impact its rating.

Customer Service and Innovation

While not always the biggest factors, customer service and innovation can play a role in shaping an insurance company’s rating. It’s like the “extra credit” that can help a company stand out.

- Customer satisfaction: A company with high customer satisfaction is likely to be more successful in the long run. Rating agencies may consider customer satisfaction surveys and reviews when assessing a company’s rating.

- Innovation: Insurance companies that are constantly innovating and developing new products and services are more likely to be seen as forward-thinking and adaptable. This can positively impact their rating.

Using Insurance Company Ratings to Make Informed Decisions

Insurance company ratings can be your secret weapon in navigating the world of insurance. They’re like a trusty guide, helping you make smart choices and avoid potential pitfalls.

How to Use Ratings Effectively

Insurance company ratings provide valuable insights, but it’s crucial to know how to use them effectively. Here’s a step-by-step guide to help you make the most of these ratings:

- Identify your needs: Before diving into ratings, determine your specific insurance needs. Are you looking for car insurance, homeowners insurance, or something else? Understanding your needs will help you narrow down your search and focus on relevant ratings.

- Choose reputable rating agencies: Not all rating agencies are created equal. Look for agencies with a solid reputation, such as A.M. Best, Moody’s, Standard & Poor’s, and Fitch Ratings. These agencies have a proven track record of providing reliable and comprehensive assessments.

- Compare ratings across multiple agencies: Don’t rely on just one rating agency. Comparing ratings from different sources can provide a more balanced and comprehensive picture of an insurance company’s financial strength and stability.

- Understand the rating scale: Each rating agency has its own rating scale, so it’s essential to understand what each rating means. Generally, higher ratings indicate better financial stability and a lower risk of the company failing to meet its obligations.

- Consider other factors: While ratings are important, they’re not the only factor to consider. You should also look at customer service, claims handling, and the company’s overall reputation.

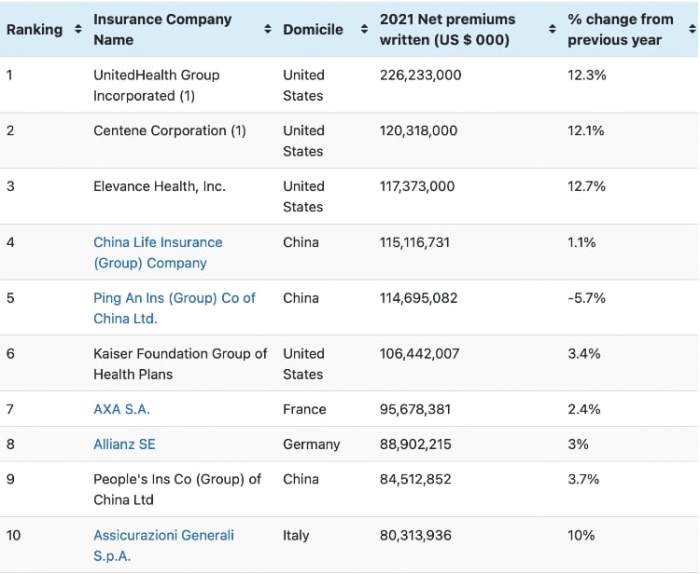

Top-Rated Insurance Companies

Here’s a table comparing the top-rated insurance companies in different categories, based on ratings from A.M. Best, Moody’s, Standard & Poor’s, and Fitch Ratings:

| Category | Top-Rated Companies | Rating |

|---|---|---|

| Car Insurance | USAA, Geico, State Farm | A++ |

| Homeowners Insurance | USAA, State Farm, Liberty Mutual | A+ |

| Life Insurance | Northwestern Mutual, New York Life, MassMutual | A++ |

Interpreting Ratings and Their Limitations

While insurance company ratings offer valuable insights, it’s crucial to understand their limitations:

- Past performance is not a guarantee of future results: Ratings are based on historical data, and past performance is not always a reliable indicator of future performance.

- Ratings are not a substitute for thorough research: Ratings should be used as a starting point for your research, not as the sole basis for your decision.

- Ratings can vary across different agencies: Different rating agencies may have different methodologies and criteria, leading to variations in ratings.

Closing Notes

So, the next time you’re searching for insurance, remember that ratings are your secret weapon. They’re like the insider scoop on the insurance world, giving you the intel you need to make smart decisions. Whether you’re looking for car insurance, home insurance, or anything else, understanding insurance company ratings is like having a cheat code to unlock the best coverage at the best price. So, go ahead and level up your insurance game with the power of ratings!

Questions and Answers: Who Rates Insurance Companies

What are the major insurance rating agencies?

Some of the big names in insurance ratings include A.M. Best, Standard & Poor’s, Moody’s, and Fitch Ratings. These agencies are like the experts in the insurance world, providing insights into the financial health and stability of companies.

How do I use insurance company ratings?

Think of ratings like a report card for insurance companies. Look for companies with strong financial strength ratings, good claims handling records, and positive customer reviews. You can find these ratings on the websites of the rating agencies or on insurance comparison websites.

Do all insurance rating agencies use the same scale?

While the overall concept of ratings is similar, different agencies may use slightly different scales and criteria. It’s important to familiarize yourself with the specific scale used by each agency you’re looking at.