Why are auto insurance companies leaving California? It’s a question that’s been buzzing around the Golden State, leaving drivers wondering what’s going on. The answer, it turns out, isn’t just one thing but a complex mix of factors. Think of it like a car crash – a perfect storm of high insurance costs, strict regulations, and a driving environment that’s a bit of a wild ride. It’s like a scene straight out of a Hollywood movie, with drivers caught in the middle of a financial drama.

From soaring insurance premiums to California’s unique driving environment, there are a lot of factors at play. Imagine you’re trying to navigate a freeway during rush hour, with a chance of an earthquake or wildfire popping up anytime. That’s kind of what it’s like for insurance companies in California. They’re dealing with a lot of risks, which is why they’re rethinking their approach.

Rising Insurance Costs in California

California drivers are facing a perfect storm of factors driving up their auto insurance premiums. From skyrocketing repair costs to a complex legal environment, the Golden State is becoming increasingly expensive to insure.

Factors Contributing to Rising Premiums

Several factors contribute to the increase in auto insurance premiums in California. These factors are interconnected and often reinforce one another, making it challenging to address the issue without comprehensive solutions.

- Increased Repair Costs: The cost of vehicle repairs has risen dramatically in recent years. This is due to a combination of factors, including the use of more advanced technology in cars, the rising cost of materials, and the increased complexity of modern vehicles. For example, the average cost of repairing a damaged bumper has increased by over 50% in the past decade.

- Higher Healthcare Costs: California’s healthcare system is one of the most expensive in the nation. This translates into higher costs for auto insurers, who are responsible for covering medical expenses for drivers and passengers involved in accidents.

- Increased Litigation: California has a “no-fault” insurance system, which means that drivers are required to file claims with their own insurance companies, regardless of who is at fault in an accident. This system has led to an increase in litigation, as drivers often seek to maximize their settlements.

- Fraudulent Claims: Insurance fraud is a significant problem in California. This includes staged accidents, fake injuries, and inflated repair costs. Insurance companies are forced to factor in the cost of fraud when setting premiums.

Impact of California’s “No-Fault” System

California’s “no-fault” insurance system, also known as “personal injury protection” (PIP), is designed to simplify the claims process and provide prompt medical benefits to injured parties. However, it has also contributed to higher premiums in several ways.

- Increased Claims: The “no-fault” system encourages drivers to file claims, even for minor injuries. This increases the number of claims processed by insurers, leading to higher administrative costs and ultimately higher premiums.

- Higher Settlements: Since drivers are not required to prove fault in a “no-fault” system, they can argue for higher settlements, even for relatively minor injuries. This increases the amount of money insurers must pay out, which is reflected in higher premiums.

- Limited Control over Costs: Insurers have less control over medical costs in a “no-fault” system. This is because drivers are free to choose their own healthcare providers, and insurers are obligated to cover their expenses.

Comparison to Other States

California’s average auto insurance premium is significantly higher than in many other states. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for car insurance in California in 2022 was $2,044. This is well above the national average of $1,543.

- Factors Contributing to the Difference: Several factors contribute to California’s higher premiums, including:

- The high cost of living in California, which translates into higher costs for vehicle repairs, medical care, and other expenses.

- The state’s dense population and high traffic volume, which increase the likelihood of accidents.

- California’s unique legal environment, which is more favorable to plaintiffs in personal injury lawsuits.

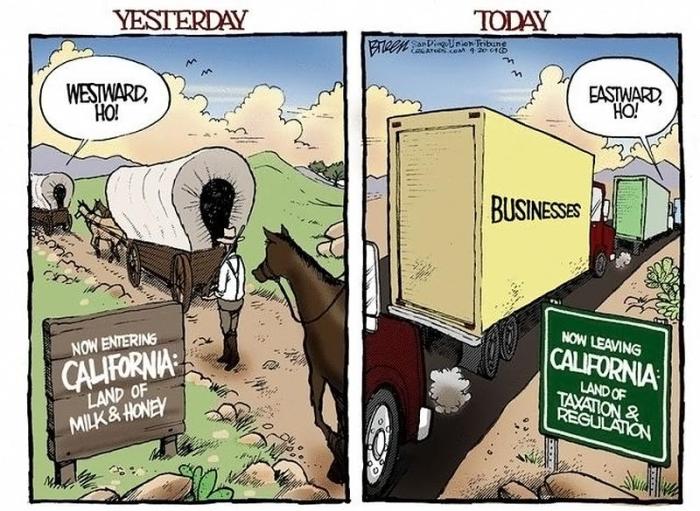

California’s Legal and Regulatory Environment

California’s unique legal and regulatory landscape has a significant impact on the auto insurance industry, influencing how companies operate and ultimately affecting the cost of coverage for consumers. This section delves into the complexities of California’s regulatory environment and its impact on auto insurance companies.

Environmental Regulations

California’s strict environmental regulations, aimed at reducing greenhouse gas emissions and promoting clean air, have indirectly affected auto insurance companies. The state’s Zero Emission Vehicle (ZEV) mandate, for instance, has driven the adoption of electric vehicles (EVs). While EVs are generally considered safer due to their advanced safety features, their repair costs can be significantly higher, impacting insurance premiums. Additionally, the cost of replacing damaged EV batteries can be substantial, adding to the financial burden for insurers.

Consumer Protection Laws

California has a robust set of consumer protection laws that significantly impact the auto insurance industry. These laws, designed to safeguard consumers from unfair or deceptive practices, have led to increased regulatory scrutiny and compliance requirements for insurance companies. For example, California’s “Unfair Competition Law” prohibits insurers from engaging in practices that are unfair or deceptive, such as using misleading advertising or denying claims without proper justification. This legislation has forced insurance companies to operate with transparency and fairness, contributing to a more regulated and consumer-friendly market.

Proposition 103

California’s Proposition 103, a landmark initiative passed in 1988, revolutionized the state’s auto insurance industry. This proposition established the California Department of Insurance (CDI) as the primary regulator of the auto insurance market and introduced a system of rate regulation that allows the CDI to review and approve insurance rates. Proposition 103 also established the “Good Driver Discount,” which rewards safe drivers with lower premiums, and implemented other consumer protections. While these reforms have been credited with lowering insurance costs for some consumers, they have also increased the regulatory burden on insurance companies, adding to their operating expenses.

California’s Driving Environment

California’s unique driving environment, with its dense population, heavy traffic, and diverse landscapes, poses distinct challenges for auto insurance companies. These factors contribute to a higher frequency and severity of accidents, leading to increased insurance premiums.

Impact of California’s Dense Population and Traffic Congestion

California’s dense population and heavy traffic congestion create a higher risk of accidents. With more vehicles on the road, the likelihood of collisions increases. Additionally, traffic congestion can lead to aggressive driving behaviors, such as tailgating and speeding, further escalating the risk of accidents.

Impact of California’s High Rate of Car Theft

California’s high rate of car theft presents a significant challenge for auto insurance companies. The state consistently ranks among the top for car theft, with cities like Los Angeles and San Francisco experiencing particularly high rates. Auto insurance companies must factor in the risk of theft when setting premiums, which can lead to higher costs for California drivers.

Influence of California’s Diverse Driving Conditions

California’s diverse driving conditions, ranging from mountainous roads to urban areas, contribute to the complexity of the state’s auto insurance market. Mountainous roads often present challenging conditions with steep inclines, sharp curves, and unpredictable weather. Urban areas, on the other hand, feature heavy traffic, congested streets, and a higher density of pedestrians and cyclists. These diverse driving environments increase the risk of accidents and require auto insurance companies to adjust their pricing accordingly.

Impact of Natural Disasters

California’s natural beauty comes with a price, and auto insurance companies are feeling the heat. Frequent wildfires, earthquakes, and rising sea levels are driving up insurance costs and making California a riskier place to insure. The state’s unique geographic and environmental challenges are impacting auto insurance companies’ bottom line.

Wildfires and Earthquakes

Wildfires are a major concern for auto insurance companies in California. They cause significant damage to vehicles, homes, and infrastructure.

The frequency and intensity of wildfires have increased in recent years, driven by climate change and human activity. This has led to increased insurance claims and higher premiums. The state’s drought conditions, coupled with strong winds, have made California particularly susceptible to wildfires.

“In 2020 alone, California experienced over 8,000 wildfires that burned more than 4 million acres. The cost of these wildfires to insurers was estimated at over $12 billion.” – California Department of Forestry and Fire Protection

Earthquakes also pose a significant risk to auto insurance companies in California. The state is located on the San Andreas Fault, which is known for its high seismic activity.

A major earthquake could cause widespread damage to vehicles and infrastructure, leading to a surge in insurance claims.

“The average earthquake claim in California is estimated at $10,000, and a major earthquake could result in billions of dollars in insurance claims.” – Insurance Information Institute

Coastal Vulnerability to Rising Sea Levels

California’s extensive coastline is vulnerable to rising sea levels. The state is already experiencing higher tides and more frequent coastal flooding.

As sea levels continue to rise, coastal areas will be at greater risk of flooding and erosion, which could damage vehicles and property.

“By 2100, sea levels are projected to rise by as much as 6.6 feet, which could lead to significant flooding in coastal areas of California.” – National Oceanic and Atmospheric Administration

California’s Drought Conditions, Why are auto insurance companies leaving california

California’s ongoing drought is another factor that is impacting auto insurance companies. The drought has led to a decline in water levels, which has made it more difficult to fight wildfires. This has resulted in more extensive wildfire damage and higher insurance claims.

Additionally, the drought has led to increased dust and debris on roads, which can increase the risk of accidents and vehicle damage.

“The California drought has caused over $10 billion in damages to the state’s economy, including agricultural losses and increased wildfire costs.” – California Department of Water Resources

Epilogue

So, what’s the future for drivers in California? Well, it’s a bit of a mystery, but there are some possible solutions on the horizon. It’s like a game of chess, with everyone trying to make the best move. Maybe there’s room for public-private partnerships to help ease the pressure on insurance companies, or maybe some regulatory changes could smooth out the road. Whatever the answer, it’s clear that the insurance landscape in California is about to get a makeover.

Q&A: Why Are Auto Insurance Companies Leaving California

Why are insurance premiums so high in California?

California has a unique combination of factors that contribute to high insurance premiums, including a high rate of car theft, traffic congestion, and a “no-fault” insurance system.

Are insurance companies really leaving California?

While some insurance companies have reduced their presence in California, many are still operating in the state. However, they are adapting their strategies to manage the risks associated with the California market.

What can I do to lower my insurance premiums in California?

You can explore options like increasing your deductible, improving your driving record, and comparing quotes from different insurance providers.

What are the long-term implications of insurance companies leaving California?

If insurance companies continue to leave California, it could lead to higher premiums for drivers who remain, limited choices for insurance providers, and potentially less access to coverage.