Why would an insurance company drop you? It’s a question that might make you sweat a little, especially if you’ve been paying your premiums on time and haven’t filed any claims. But the truth is, there are a bunch of reasons why an insurance company might decide to cut ties with you. From policy violations to changes in your risk profile, it’s important to know the game to stay in the game.

Think of it like a movie where the hero is suddenly facing an unexpected betrayal. Just when you thought you had it all figured out, your insurance company throws you a curveball. It can feel like a real-life plot twist, but understanding the reasons behind these decisions can help you avoid becoming the next victim of insurance drama.

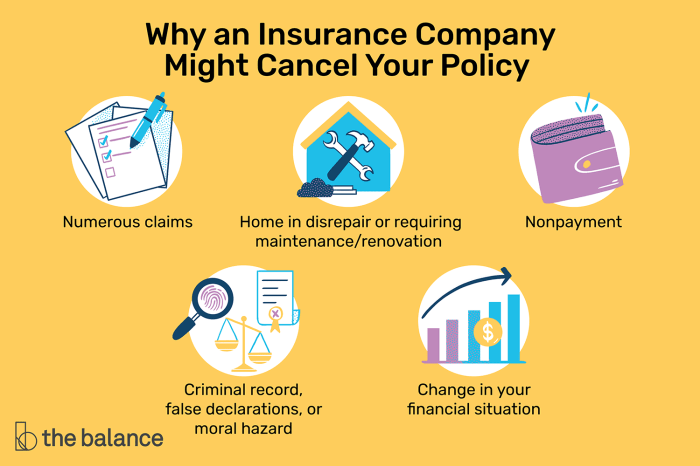

Reasons for Insurance Cancellation

It’s a nightmare scenario: you’re in a bind, need your insurance, and bam! They drop you. But why? Insurance companies are in the business of assessing risk, and sometimes, your risk profile just doesn’t fit their criteria anymore.

Let’s dive into the common reasons why insurance companies might pull the plug on your policy.

Non-Payment of Premiums

This is the most common reason for insurance cancellation. It’s pretty straightforward: you don’t pay your dues, you don’t get the coverage. Insurance companies need to collect premiums to pay out claims, and if you’re not contributing, they can’t afford to keep you on the books.

Even if you’re a good driver, have a clean record, or have been with the company for years, if you miss payments, they can drop you. This is usually a grace period before cancellation. It’s important to be aware of your payment schedule and set reminders to avoid late payments.

Fraudulent Activities

Insurance companies have a zero-tolerance policy for fraud. If you’re caught lying about your driving history, making false claims, or engaging in any other fraudulent activity, they’ll cancel your policy, and you might even face legal consequences.

- Imagine you get into a car accident and claim you were driving someone else’s car, but you were actually driving your own. This is insurance fraud, and it can get you in a whole lot of trouble.

- Another common example is claiming damage to your car that didn’t actually happen, like staging an accident or exaggerating the severity of the damage.

The bottom line is: don’t try to cheat the system. It’s not worth the risk.

Changes in Risk Profile

Your insurance company assesses your risk when you first sign up, but life changes, and your risk profile can change too. This could lead to a policy cancellation.

For example, if you get a DUI, your insurance company might consider you a higher risk and cancel your policy. They might also drop you if you move to a high-risk area or start driving a high-performance car.

Failure to Meet Policy Requirements

Every insurance policy comes with specific requirements, and if you fail to meet them, you could face cancellation. For example, your car insurance policy might require you to maintain a certain level of car maintenance.

If you don’t keep your car in good working order, your insurance company might cancel your policy. This is because a poorly maintained car is more likely to be involved in an accident, which costs the insurance company money.

Policy Violations: Why Would An Insurance Company Drop You

Insurance companies have a set of rules and regulations that policyholders must follow. Violating these rules can lead to the cancellation of your insurance policy. It’s important to understand the terms and conditions of your policy to avoid any unwanted surprises.

Common Policy Violations

Insurance companies closely monitor policyholders for potential violations. These violations can range from minor infractions to serious breaches of contract. Some common policy violations that can lead to cancellation include:

- Misrepresentation or Fraud: Providing false or misleading information during the application process or claiming benefits for a loss that didn’t actually occur. This is a serious offense that can lead to criminal charges in addition to policy cancellation.

- Failure to Pay Premiums: Non-payment of premiums is a common reason for policy cancellation. Most insurance companies provide a grace period, but failing to pay within the grace period will result in policy cancellation.

- Changes in Risk: If you make significant changes to your property or lifestyle that increase the risk of a claim, such as adding a pool to your backyard or starting a dangerous hobby, you must notify your insurance company. Failure to do so can lead to policy cancellation.

- Material Changes in Circumstances: Failing to inform your insurance company about changes in your situation, like a change of address or a new driver added to your policy, can also lead to policy cancellation. It’s important to keep your insurance company updated about any changes.

- Driving Record: For auto insurance, a poor driving record with multiple accidents or traffic violations can lead to policy cancellation. It’s important to drive safely and maintain a clean driving record.

- Breach of Contract: Violating any specific terms and conditions Artikeld in your policy, such as using your car for commercial purposes without notifying your insurer, can lead to policy cancellation.

Terms and Conditions Often Overlooked

Many policyholders don’t thoroughly read the terms and conditions of their insurance policies. Some common terms and conditions that are often overlooked include:

- Exclusions: Insurance policies often have exclusions, which are specific events or circumstances that are not covered by the policy. For example, many homeowners insurance policies exclude coverage for damage caused by earthquakes or floods.

- Deductibles: Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. It’s important to understand your deductible amount and how it affects your claims.

- Limits: Insurance policies have limits on the amount of coverage they provide. It’s crucial to ensure your policy limits are sufficient for your needs.

- Cancellation Clause: This clause Artikels the conditions under which the insurance company can cancel your policy. It’s essential to understand these conditions to avoid any surprises.

Insurance Company Investigations

When an insurance company suspects a policy violation, they will conduct an investigation. This investigation may involve:

- Reviewing Policy Documents: The insurance company will carefully review your policy documents to determine if you have violated any terms or conditions.

- Gathering Information: The insurance company may gather information from various sources, such as police reports, medical records, and witness statements.

- Contacting You: The insurance company may contact you to request information or clarification about a suspected violation.

Consequences of Policy Violations

The consequences of a policy violation can vary depending on the severity of the violation. Some common consequences include:

| Policy Violation | Consequences |

|---|---|

| Misrepresentation or Fraud | Policy cancellation, denial of claims, potential criminal charges |

| Failure to Pay Premiums | Policy cancellation, late fees, potential damage to credit score |

| Changes in Risk | Policy cancellation, higher premiums |

| Material Changes in Circumstances | Policy cancellation, denial of claims |

| Driving Record | Policy cancellation, higher premiums |

| Breach of Contract | Policy cancellation, denial of claims |

Risk Assessment and Underwriting

Insurance companies are like detectives, constantly analyzing your life to figure out how risky you are. This is called risk assessment, and it’s the foundation of how they decide whether to insure you and how much you’ll pay.

Factors Influencing Risk Assessment

Risk assessment is all about predicting the likelihood of you needing to file a claim. The higher the risk, the higher the premium you’ll pay. Here’s a breakdown of some key factors:

- Demographics: Age, gender, location, and even your credit score can impact your risk. For example, young drivers are statistically more likely to get into accidents, so they’ll pay more for car insurance.

- Lifestyle: Your hobbies, driving habits, and even your job can affect your risk profile. For example, a skydiving enthusiast might face higher premiums for life insurance than a librarian.

- Health History: For health insurance, your medical records are crucial. Pre-existing conditions or a history of smoking can lead to higher premiums.

- Property Details: For home or auto insurance, the condition of your property, its location, and even security features play a role in determining your risk.

Changes in Risk Profile

Life is unpredictable, and so are your risk factors. Here are some situations that could lead to a change in your risk profile and potentially affect your insurance:

- Moving to a New Location: A move to a high-crime area might lead to increased home insurance premiums.

- Changing Jobs: A job with higher risk factors, like construction, might increase your life insurance premiums.

- Getting Married or Divorced: Marital status can affect your risk profile for some types of insurance.

- Adding a Driver to Your Policy: Adding a young or inexperienced driver to your car insurance policy will likely increase your premiums.

Underwriting Process

Underwriting is the process where insurance companies evaluate your risk profile and decide whether to offer you insurance. It’s a complex process that involves:

- Gathering Information: This involves reviewing your application, credit history, driving record, and medical records (for health insurance).

- Assessing Risk: Using algorithms and statistical models, insurance companies analyze your information to determine your likelihood of filing a claim.

- Setting Premiums: Based on your risk profile, they calculate the premium you’ll pay.

Underwriting for Different Insurance Types, Why would an insurance company drop you

The underwriting process can vary depending on the type of insurance:

- Life Insurance: Underwriters focus on your health, lifestyle, and financial history. They may require medical exams and financial statements.

- Health Insurance: Underwriters carefully review your medical history, pre-existing conditions, and medications. They may require a physical exam or additional medical information.

- Auto Insurance: Underwriters assess your driving record, age, vehicle type, and location. They may also consider factors like safety features and driving habits.

- Home Insurance: Underwriters consider your property’s location, age, condition, and security features. They may require an inspection of your home.

Key Risk Factors Considered by Insurance Companies

| Insurance Type | Key Risk Factors |

|---|---|

| Life Insurance | Age, health, lifestyle, financial history |

| Health Insurance | Medical history, pre-existing conditions, medications |

| Auto Insurance | Driving record, age, vehicle type, location, driving habits |

| Home Insurance | Property location, age, condition, security features |

Communication and Transparency

Clear and open communication is the cornerstone of a healthy relationship between you and your insurance company. Just like any relationship, it’s essential to understand each other’s expectations and communicate effectively to prevent misunderstandings and ensure a smooth sailing experience.

Understanding Policy Terms and Conditions

It’s crucial to fully understand the terms and conditions of your insurance policy. This includes knowing your coverage limits, deductibles, exclusions, and any specific requirements you need to meet. Think of it like reading the fine print of a contract, but for your insurance policy. The more you understand, the better you can navigate your policy and avoid potential issues.

“Read your insurance policy carefully, and ask questions if you don’t understand anything. It’s your responsibility to know what your policy covers and what it doesn’t.” – Financial Expert,

The Role of Clear Communication in Preventing Policy Cancellation

Open communication with your insurance company can be a proactive way to prevent policy cancellation. This means:

- Keeping your insurer updated on any changes in your circumstances, such as a change of address, a new vehicle, or a change in your driving habits.

- Promptly reporting any incidents or claims, no matter how small.

- Being transparent about any potential risk factors that could affect your policy, such as a recent DUI.

By keeping your insurer informed, you build trust and demonstrate that you’re a responsible policyholder, which can significantly reduce the chances of your policy being cancelled.

Addressing Concerns or Disputes with Insurers

Disagreements with insurance companies are a common occurrence. When facing a dispute, it’s important to stay calm and approach the situation strategically:

- Document everything. Keep records of all correspondence, including emails, letters, and phone calls. This will be helpful if you need to escalate the issue.

- Be polite but firm in your communication. Clearly state your concerns and the resolution you seek.

- If you’re not satisfied with the insurer’s response, consider seeking assistance from a consumer protection agency or an insurance mediator.

Remember, effective communication is key to resolving any disputes and achieving a fair outcome.

Legal Considerations

Insurance companies and policyholders both have legal rights and obligations. These are crucial for understanding why an insurance company might drop you, and what your options are. This section delves into the legal framework surrounding policy cancellations and explores the consequences of insurance fraud.

Policyholder Rights and Obligations

Policyholders have the right to expect their insurance company to uphold the terms of their policy agreement. This includes fair treatment, timely processing of claims, and clear communication. In turn, policyholders are obligated to provide accurate information, pay premiums on time, and abide by the policy’s terms and conditions.

Challenging Policy Cancellation

If you believe your policy was unfairly canceled, you have legal options. You can dispute the cancellation by contacting your insurance company and presenting your case. If this fails, you can file a complaint with your state’s insurance commissioner or seek legal counsel to challenge the cancellation in court.

Insurance Fraud

Insurance fraud is a serious crime that can have severe legal consequences. This includes fines, imprisonment, and even the loss of your insurance coverage. Examples of insurance fraud include:

- Falsely claiming a loss.

- Exaggerating the extent of a loss.

- Concealing relevant information.

- Providing false information on an insurance application.

Relevant Laws and Regulations

Various federal and state laws regulate insurance policies and practices. Some examples include:

- The Fair Credit Reporting Act (FCRA): This law governs how insurance companies can use your credit history in underwriting decisions.

- The Gramm-Leach-Bliley Act (GLBA): This law requires insurance companies to protect your personal financial information.

- State insurance regulations: Each state has its own laws governing insurance practices, including policy cancellations.

Ending Remarks

So, the next time you’re dealing with your insurance company, remember to play it smart. Know your policy inside and out, communicate clearly, and don’t be afraid to ask questions. By staying informed and proactive, you can avoid becoming the next casualty in the insurance game. Remember, knowledge is power, and understanding the ins and outs of your policy can help you stay in the game and avoid getting dropped.

Question Bank

What happens if I get dropped by my insurance company?

It can be tough to find a new insurance company after being dropped, especially if you have a history of claims or violations. You might have to pay higher premiums or even be denied coverage altogether. It’s important to shop around and compare quotes from different insurers.

Can I appeal the decision to drop my insurance?

Yes, you can appeal the decision, but it’s not always successful. You’ll need to provide strong evidence to support your case. It’s best to speak with an insurance attorney to explore your options.

What if I’m dropped because of a mistake on my part?

If you can prove that the reason for cancellation was a mistake on your part, you might be able to get your policy reinstated. You’ll need to provide documentation and evidence to support your claim.

What if I’m dropped for a reason that’s out of my control?

If you’re dropped for a reason that’s out of your control, such as a change in your risk profile, you might have limited options. However, you can still try to appeal the decision or find a new insurance company.