Why would insurance company drop you – Why would insurance companies drop you? It’s a question that might send chills down your spine, especially if you rely on coverage for your health, car, or home. Think about it: you pay your premiums, you follow the rules, and then suddenly, you’re left high and dry. This isn’t a scene from a bad movie, it’s a reality for many folks who find themselves in a sticky situation with their insurance provider.

The truth is, there are a bunch of reasons why insurance companies might pull the plug on your policy. It could be something as simple as missing a payment, or it could be a more serious issue like fraud or breaking the terms of your contract. We’re diving into the world of insurance cancellations, exploring why they happen, what the consequences are, and how you can protect yourself from getting dropped.

Reasons for Insurance Cancellation

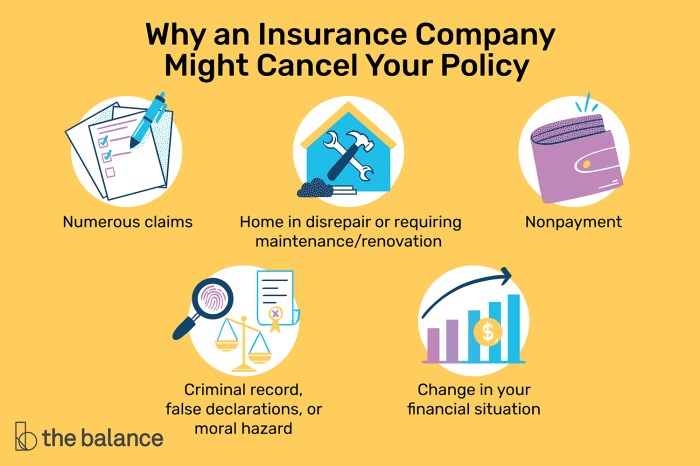

Insurance companies are in the business of managing risk, and they do this by carefully assessing the likelihood that a policyholder will file a claim. If a policyholder’s behavior or circumstances increase the risk of a claim, the insurance company may decide to cancel the policy.

Policy Violations

Insurance policies typically contain a list of specific actions or behaviors that could lead to cancellation. These violations are designed to protect the insurance company from excessive risk and to ensure that all policyholders are treated fairly.

- Failure to disclose material information: This includes omitting or misrepresenting information about your health, driving history, or property when applying for insurance. For example, failing to disclose a pre-existing medical condition when applying for health insurance could result in policy cancellation.

- Breach of contract: This could involve failing to pay premiums on time, making changes to your insured property without notifying the insurance company, or engaging in activities that are specifically prohibited by your policy. For instance, using your car for commercial purposes when your policy only covers personal use could lead to cancellation.

- Fraudulent claims: Filing a false or exaggerated claim to receive insurance benefits is a serious offense that can result in policy cancellation and potential legal consequences.

Fraudulent Activities, Why would insurance company drop you

Insurance fraud is a serious issue that costs insurance companies billions of dollars annually. It can take many forms, including:

- Staging accidents: This involves deliberately causing an accident to file a claim for insurance benefits. For example, staging a car accident to collect insurance money is a common form of fraud.

- Making false claims: This could involve claiming damages that never occurred or exaggerating the extent of your losses.

- Identity theft: Using someone else’s identity to obtain insurance or file a claim is a serious crime.

Non-Payment of Premiums

One of the most common reasons for insurance cancellation is failure to pay premiums on time. Most insurance policies have a grace period for late payments, but if premiums remain unpaid beyond that period, the policy may be canceled.

- Grace period: The grace period is the amount of time you have to make a late premium payment before your policy is canceled. The grace period varies depending on the type of insurance and the insurance company.

- Cancellation notice: If you fail to pay your premium within the grace period, the insurance company will typically send you a cancellation notice.

Cancellation Process for Different Types of Insurance

The cancellation process can vary depending on the type of insurance.

- Health insurance: Health insurance policies typically have a grace period for late premiums, but cancellation can occur if premiums remain unpaid.

- Auto insurance: Auto insurance policies may be canceled if you fail to pay premiums on time, are involved in multiple accidents, or have your license suspended.

- Home insurance: Home insurance policies can be canceled if you fail to pay premiums, make significant changes to your property without notifying the insurance company, or engage in activities that increase the risk of a claim.

Impact of Cancellation

Getting your insurance policy canceled can be a real bummer, like finding out your favorite band is breaking up. It’s not just about losing coverage; it’s about facing a whole new set of challenges. Think of it like being kicked out of your favorite bar – you’re not only left without a place to hang out, but you also have to find a new one, and it might not be as cool.

Difficulties Finding New Insurance Coverage

Being canceled by an insurance company can make finding new coverage a real pain. Imagine trying to get a loan with bad credit – it’s similar. Insurance companies see your cancellation as a red flag, making them hesitant to take you on. They might view you as a higher risk, so they might charge you more, make it harder to get approved, or even deny your application altogether. It’s like being stuck in a dating app purgatory, where everyone swipes left.

Preventing Cancellation

It’s a stressful situation when you’re facing the possibility of your insurance policy being canceled. But don’t worry, there are steps you can take to avoid that dreaded cancellation notice. Staying on top of your policy and being proactive can make a big difference.

Understanding Timely Premium Payments

Paying your premiums on time is the absolute foundation of keeping your insurance policy active. Think of it like this: your insurance company is basically saying, “Hey, we’re here to protect you, but we need you to keep your end of the bargain by paying your dues.” If you miss payments, you’re sending a signal that you’re not serious about the agreement, and they might decide to cut ties.

Maintaining Accurate Policy Information

Imagine this: you’ve moved to a new address, but you forgot to update your insurance policy. Now, if something happens, your insurance company might not even be able to find you! Keeping your contact information, address, and any other relevant details up-to-date is crucial. It ensures that you’re reachable and that your insurance company can properly assess your risks and provide coverage.

Seeking Professional Advice from an Insurance Broker

Sometimes, you just need a little expert help. Insurance brokers are like the superheroes of the insurance world. They know the ins and outs of the industry and can help you navigate the complexities of your policy. They can also provide valuable insights on how to prevent cancellation, find better coverage options, and even negotiate better rates.

Steps to Take When Facing Potential Cancellation

Think of this flowchart as your ultimate guide to dealing with a potential cancellation.

* Step 1: Understand the Reason. The first thing is to figure out why your insurance company is considering canceling your policy. Is it due to missed payments, changes in your circumstances, or something else?

* Step 2: Communicate with Your Insurance Company. Reach out to your insurance company immediately and explain your situation. Be upfront and honest about any challenges you’re facing.

* Step 3: Explore Solutions. Work with your insurance company to find solutions. Maybe you can set up a payment plan, provide additional documentation, or make changes to your policy.

* Step 4: Seek Professional Advice. If you’re struggling to find a solution on your own, consider reaching out to an insurance broker. They can provide valuable insights and guidance.

* Step 5: Appeal the Decision. If your insurance company still decides to cancel your policy, you might have the right to appeal their decision.

Summary: Why Would Insurance Company Drop You

So, you’ve learned the ins and outs of insurance cancellations, from the reasons why they happen to the potential consequences. The key takeaway is this: being proactive is your best defense. Stay on top of your payments, make sure your information is up-to-date, and don’t hesitate to reach out to your insurer or a broker if you have any questions. By taking these steps, you can keep your coverage secure and avoid the hassle and stress of being dropped.

FAQ

What happens if I can’t afford to pay my premium?

If you’re facing financial hardship, it’s crucial to contact your insurance company immediately. They might offer payment plans or other options to help you avoid cancellation.

Can I appeal a cancellation decision?

Yes, you can usually appeal a cancellation decision. However, you’ll need to provide strong evidence to support your case.

What if I’m dropped for a reason I don’t understand?

It’s essential to understand the reason for cancellation. If you’re unsure, contact your insurance company or a broker to clarify the situation.

Can I get insurance again after being dropped?

It can be more challenging to find insurance after being dropped, but it’s not impossible. You might need to pay higher premiums or look for specialized insurers.