Will insurance companies pay for Wegovy sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Wegovy, a revolutionary new weight-loss medication, has taken the world by storm, promising a new era of effective and accessible weight management. But the question on everyone’s mind is: will insurance companies cover the cost of this game-changing treatment?

This article delves into the intricate world of insurance coverage for Wegovy, exploring the factors that influence coverage decisions, the intricacies of pre-authorization processes, and the potential impact of individual state regulations. We’ll also shed light on alternative payment methods, strategies for negotiating coverage, and the role of advocacy organizations in supporting patients seeking access to this life-changing medication.

Wegovy and Insurance Coverage

Wegovy, a game-changer in the weight-loss world, is a powerful tool for those battling obesity. But like any fancy new gadget, it comes with a price tag. So, the burning question is: will your insurance cover it? Let’s break down the insurance landscape for Wegovy.

Insurance Coverage for Wegovy

Major insurance companies in the US are still figuring out how to handle Wegovy. Some insurers are covering it, while others are holding back. It’s a complex situation with many factors at play.

Factors Influencing Insurance Coverage

Insurance companies consider several factors when deciding whether to cover Wegovy.

- The patient’s medical history: Insurance companies may look at your medical history to see if you have conditions related to obesity, like diabetes or high blood pressure. If you have a history of these conditions, you might have a better chance of getting Wegovy covered.

- The patient’s Body Mass Index (BMI): Your BMI is a measure of your weight in relation to your height. Insurance companies often have specific BMI thresholds that must be met for Wegovy coverage. Generally, a BMI of 30 or higher qualifies for coverage, but this can vary.

- Previous weight-loss attempts: Insurance companies might want to see if you’ve tried other weight-loss methods, like diet and exercise, before considering Wegovy. They want to ensure that you’ve exhausted other options.

- Cost-effectiveness: Insurance companies weigh the potential cost savings of Wegovy against its cost. If Wegovy can help prevent or manage chronic conditions like diabetes, they may see it as a cost-effective treatment.

- Clinical trials and evidence: Insurance companies rely on the results of clinical trials and other research to determine the safety and effectiveness of Wegovy.

Criteria for Wegovy Approval

Insurance companies often have specific criteria that must be met for Wegovy coverage. These criteria may include:

- Diagnosis of obesity: You must be diagnosed with obesity by a healthcare professional.

- Failed previous weight-loss attempts: You may need to show that you’ve tried other weight-loss methods, like diet and exercise, without success.

- Commitment to lifestyle changes: Insurance companies may require you to commit to lifestyle changes, such as diet and exercise, along with taking Wegovy.

- Regular monitoring: You may need to undergo regular monitoring by a healthcare professional to ensure Wegovy is working effectively.

Pre-existing Conditions and Coverage

Certain pre-existing conditions or medical history may influence insurance coverage for Wegovy.

- Diabetes: If you have diabetes, insurance companies may be more likely to cover Wegovy because it can help manage blood sugar levels.

- High blood pressure: Wegovy can also help lower blood pressure, making it more likely to be covered by insurance for those with hypertension.

- Sleep apnea: Obesity is a common cause of sleep apnea, and Wegovy can help with weight loss, potentially improving sleep apnea symptoms.

- Heart disease: Wegovy can reduce the risk of heart disease, which may lead to increased insurance coverage.

Factors Affecting Wegovy Coverage

Getting Wegovy covered by insurance can be a bit of a rollercoaster ride. It’s not a simple yes or no situation, and a bunch of factors can influence your chances of getting it approved.

Pre-Authorization and Prior Authorization Processes

Pre-authorization and prior authorization processes are like gatekeepers for your Wegovy prescription. They’re procedures insurance companies use to determine if the drug is medically necessary and if it’s covered under your plan.

Pre-authorization is usually done before you even start taking Wegovy. It’s like a pre-approval process, where your doctor has to provide evidence that you meet the criteria for Wegovy.

Prior authorization happens after you’ve started taking Wegovy. It’s basically a review of your treatment to make sure it’s still working and that it’s still considered medically necessary.

These processes can be a bit of a hassle, but they’re important to ensure that insurance companies are covering treatments that are actually needed and effective.

State Regulations and Policies

Each state has its own set of rules about insurance coverage for prescription drugs. These regulations can impact whether or not Wegovy is covered in your state.

For example, some states may have specific requirements for pre-authorization or prior authorization, or they may have restrictions on the types of plans that cover Wegovy.

It’s important to check with your state’s insurance department to find out what the specific regulations are in your area.

Insurance Plan Coverage Differences

Different types of insurance plans, like HMOs and PPOs, have different coverage policies.

HMOs are generally more restrictive than PPOs when it comes to prescription drug coverage. This means that you might have a harder time getting Wegovy covered under an HMO plan.

PPOs typically have more flexibility in terms of coverage, but you might still have to jump through some hoops to get Wegovy approved.

It’s important to review your insurance plan’s formulary, which is a list of covered drugs. This will tell you if Wegovy is covered under your plan and what your out-of-pocket costs will be.

Cost-Sharing Mechanisms

Cost-sharing mechanisms, like copayments and deductibles, can significantly impact your out-of-pocket costs for Wegovy.

Copayments are fixed amounts you pay for each prescription, while deductibles are the amount you have to pay before your insurance starts covering your costs.

For example, if your copay for Wegovy is $100 and your deductible is $1,000, you’ll have to pay $1,100 out of pocket before your insurance starts covering the rest of the cost.

These costs can be a big burden, especially if you’re on a tight budget. It’s important to understand your insurance plan’s cost-sharing mechanisms and how they might affect your access to Wegovy.

Alternative Options for Wegovy Coverage: Will Insurance Companies Pay For Wegovy

So, you’re all set to jump on the Wegovy train and shed some pounds, but your insurance company is throwing you a curveball. Don’t sweat it! There are some sneaky plays you can make to get the coverage you need.

We’ll explore some alternative payment methods, like patient assistance programs and manufacturer coupons, and discuss how to negotiate with your insurance company. We’ll also dive into the process of appealing denials and introduce you to some awesome advocacy organizations that can lend a hand.

Patient Assistance Programs and Manufacturer Coupons

Patient assistance programs (PAPs) are lifesavers for folks who can’t afford their medications. These programs are often funded by pharmaceutical companies and offer financial assistance to eligible patients. They can help you cover the cost of Wegovy, either fully or partially, depending on the program. Manufacturer coupons are another great way to save money on Wegovy. These coupons are typically offered by the drug manufacturer and can be used to reduce the cost of your prescription at the pharmacy.

To find out if you qualify for a PAP or manufacturer coupon, you can check the pharmaceutical company’s website, contact the company directly, or talk to your doctor or pharmacist.

Negotiating with Insurance Companies

Sometimes, you gotta play hardball with your insurance company to get the coverage you deserve. You can try to negotiate with them by:

- Providing medical documentation: If your insurance company requires documentation, make sure to gather all the necessary medical records and reports to support your request for Wegovy coverage. This can include your doctor’s notes, lab results, and any other relevant information.

- Appealing the decision: If your initial request for coverage is denied, don’t give up! You have the right to appeal the decision. This usually involves submitting a formal request with additional documentation. Be sure to follow the insurance company’s specific procedures for appealing denials.

- Negotiating a co-pay: If your insurance company won’t cover Wegovy completely, try to negotiate a lower co-pay. You can explain your financial situation and ask if they can work with you to make the medication more affordable.

Appealing Insurance Denials, Will insurance companies pay for wegovy

If your insurance company throws you a denial, don’t get discouraged. You can fight back! Here’s the game plan:

- Understand the reason for denial: First things first, you gotta figure out why your insurance company denied your claim. This information is usually provided in the denial letter.

- Gather supporting documentation: Once you know the reason for denial, you can gather the necessary documentation to support your appeal. This may include medical records, doctor’s notes, and any other relevant information.

- Submit a formal appeal: Follow the insurance company’s specific procedures for submitting an appeal. Be sure to include all the necessary information and supporting documentation.

- Be persistent: If your first appeal is denied, don’t give up! You can appeal the decision again, or even file a complaint with your state’s insurance commissioner.

Advocacy Organizations

Sometimes, you need a little extra help navigating the insurance maze. That’s where advocacy organizations come in. These organizations can provide support and guidance to patients who are struggling to get the coverage they need. Here are a few examples:

- The American Diabetes Association: This organization offers resources and support to people with diabetes, including information on insurance coverage for diabetes medications.

- The National Health Council: This organization advocates for patients’ rights and access to healthcare. They provide information and resources on a variety of healthcare topics, including insurance coverage.

- The Patient Advocate Foundation: This organization provides free case management and advocacy services to patients who are facing healthcare challenges. They can help you navigate the insurance system and appeal denials.

Implications of Wegovy Coverage

The potential impact of Wegovy coverage on the healthcare system and patient access to weight-loss treatments is a hot topic. Think about it – if insurance companies start covering this drug, we could see a major shift in how we approach obesity.

Impact on Healthcare System and Patient Access

Insurance coverage for Wegovy could have a significant impact on the healthcare system and patient access to weight-loss treatments. Imagine a world where everyone has access to this powerful drug, a world where obesity rates start to drop. Here’s what we might see:

* Increased utilization of weight-loss treatments: With insurance coverage, more people would be able to afford Wegovy, leading to increased utilization of weight-loss treatments. This could put a strain on healthcare resources, as more people seek out consultations and monitoring.

* Potential reduction in obesity rates: A wider availability of effective weight-loss treatments like Wegovy could lead to a reduction in obesity rates. This would have a positive impact on the healthcare system, as obesity is linked to numerous chronic diseases, such as type 2 diabetes, heart disease, and certain cancers.

* Potential cost savings: While increased utilization might initially lead to higher healthcare costs, the long-term benefits of reduced obesity rates could potentially lead to cost savings in the long run. Think about it: less obesity means less diabetes, less heart disease, less need for expensive treatments.

* Increased awareness and access to weight-loss options: Insurance coverage for Wegovy could also raise awareness of the importance of weight management and increase access to other weight-loss options, such as lifestyle changes, counseling, and other medications. It’s a whole new approach to fighting the obesity epidemic.

Benefits and Drawbacks of Increased Coverage

There are potential benefits and drawbacks to increased insurance coverage for Wegovy.

Benefits

- Improved health outcomes: Increased access to Wegovy could lead to improved health outcomes for individuals struggling with obesity, reducing the risk of developing obesity-related diseases. Imagine a world where people can finally take control of their health.

- Reduced healthcare costs: As we mentioned before, the long-term benefits of reduced obesity rates could potentially lead to cost savings in the long run.

- Increased patient satisfaction: Individuals with insurance coverage for Wegovy might experience increased satisfaction with their healthcare, as they have access to effective treatments for their weight management goals.

Drawbacks

- Increased healthcare costs: Initially, the increased utilization of Wegovy could lead to higher healthcare costs, as more people are using the medication.

- Potential for misuse: There is a concern that increased coverage could lead to misuse of Wegovy, especially by individuals who may not need it for medical reasons.

- Potential for limited access to other weight-loss treatments: Increased focus on Wegovy could potentially limit access to other weight-loss treatments, such as lifestyle interventions and other medications.

Cost Comparison of Weight-Loss Treatments

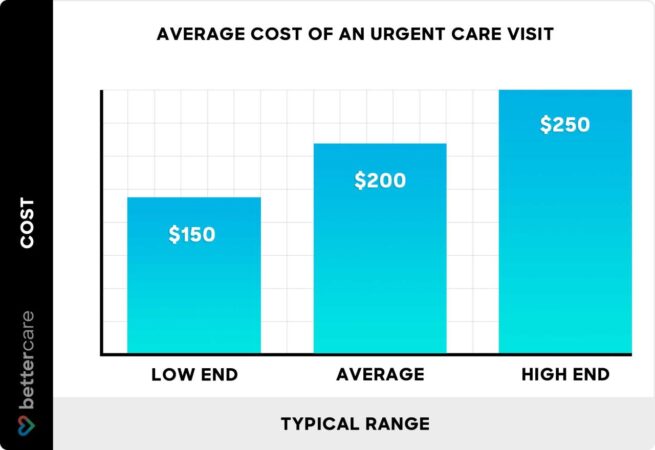

Here’s a table comparing the costs of Wegovy with other weight-loss treatments, including the impact of insurance coverage:

| Treatment | Cost (Without Insurance) | Cost (With Insurance) |

|—|—|—|

| Wegovy | $1,300 – $1,600 per month | $0 – $500 per month (depending on plan) |

| Saxenda | $1,000 – $1,300 per month | $0 – $400 per month (depending on plan) |

| Contrave | $300 – $400 per month | $0 – $200 per month (depending on plan) |

| Qsymia | $250 – $350 per month | $0 – $150 per month (depending on plan) |

| Lifestyle Changes | $0 – $100 per month | $0 – $100 per month |

Note: These are just estimated costs and can vary widely depending on the individual’s insurance plan, location, and other factors.

Impact of Wegovy Coverage on Obesity Prevalence

Here’s a visual representation of the potential impact of Wegovy coverage on the prevalence of obesity and related health conditions:

Image: A bar graph showing the prevalence of obesity over time, with one bar representing the prevalence without Wegovy coverage and another bar representing the prevalence with Wegovy coverage. The bar representing Wegovy coverage is significantly shorter than the bar representing no coverage, indicating a reduction in obesity prevalence. The graph could also include a separate line graph showing the prevalence of obesity-related health conditions, such as diabetes and heart disease, over time. This line graph would also show a decrease in the prevalence of these conditions with Wegovy coverage.

Description: The image illustrates the potential impact of Wegovy coverage on obesity prevalence. The bar graph shows a significant reduction in obesity prevalence with Wegovy coverage compared to no coverage. The line graph shows a corresponding decrease in the prevalence of obesity-related health conditions. This visual representation highlights the potential benefits of increased access to effective weight-loss treatments like Wegovy.

Last Point

Navigating the complex landscape of insurance coverage for Wegovy can feel like a maze, but understanding the key factors and exploring alternative options can empower patients to make informed decisions. Whether you’re a patient seeking coverage or a healthcare provider guiding your patients, this article provides a comprehensive guide to navigate the world of Wegovy and insurance.

Popular Questions

How much does Wegovy cost without insurance?

The cost of Wegovy without insurance can vary, but it’s generally considered expensive. The average monthly cost can range from $1,000 to $1,500, depending on the dosage and pharmacy.

What are the common reasons insurance companies deny Wegovy coverage?

Common reasons for denial include lack of pre-authorization, failure to meet specific criteria like BMI requirements, or pre-existing conditions that may be considered contraindications.

Is there a generic version of Wegovy available?

Currently, there is no generic version of Wegovy available. However, generic versions may become available in the future as the patent for Wegovy expires.

What are the potential side effects of Wegovy?

Common side effects of Wegovy include nausea, vomiting, diarrhea, constipation, and abdominal pain. Serious side effects are less common but can include pancreatitis, gallbladder problems, and thyroid problems.